Telecom Network Outages, the ESG Risks of a Connected World

The telecom industry is exposed to several Material ESG Issues, including Data Privacy and Security, Business Ethics, Human Capital and Product Governance. Product Governance issues in the telecom industry include service quality, maintaining reliable, high-speed networks, and responding to customer billing concerns.

ESG Risks Affecting Data Centers: Why Water Resource Use Matters to Investors

Data centers play a critical role for many technology and telecom companies and for their supporting servers, digital storage equipment and network infrastructure for data processing and storage. Data centers require high volumes of water directly for cooling purposes and indirectly, through electricity generation. Morningstar Sustainalytics’ recent activation of the Resource Use Material ESG Issue (MEI) within its ESG Risk Ratings recognizes water risks of data centers.

Russia, ESG Risks in Energy, and Corporate Citizenship

As the unprecedented situation in Ukraine continues to unfold, Russia’s energy industry has remained remarkably untouched by the waves of sanctions currently being deployed against the country, despite being arguably its most important sector. While the European Union and its allies have been cautious to avoid disrupting energy flows (unlike how sanctions are currently disrupting the flow of capital), international oil companies are responding to the crisis in their own capacity.

The Sustainability Conundrum of Living Income in Agriculture

Living Income is a crucial consideration among leading companies across some sectors and their supplier companies throughout the agricultural and food supply chain. Companies that manage ESG risk in their supply chains, making targeted investments to improve their resilience, are better positioned to build investor confidence.

Bringing Investors and Companies Together to Accelerate Human Rights Progress

Human rights issues have been rising on the responsible investment agenda in recent years. The COVID-19 pandemic and the Black Lives Matter movement have provoked even more pointed discourse on the topic. The European Union’s current efforts to introduce rules to hold companies accountable for social and environmental risks in their supply chains further accelerate that ascent. This wave of legal requirements and normative expectations is impacting financial markets worldwide, with responsible business regulations already in place or quickly becoming valid.

Impact of Climate Change and Extreme Weather on Essential Services

Utilities have found themselves in the literal and metaphorical eye of the storm over the last year as hurricanes, floods and wildfires of increasing frequency and strength have wreaked damage on their assets. In late August, Storm Ida made landfall in Louisiana, USA and devastated the power grid lines. Entergy, the utility operating in Louisiana, supplying most of New Orleans, restored 90% of the supply only by mid-September, with 87,000 customers still without power.

The circular way forward could be the key to reducing food waste

Indications that a food crisis is imminent are clear. Fundamental changes in the global food system are required to address these challenges. This decade is a watershed moment for urgent efforts to close the loop, and companies and investors can play a pivotal role. Despite being closely connected to issues such as climate change and basic human rights, food waste has attracted comparatively less attention from companies, investors, and other stakeholders.

Recent market trends put engagement and voting front and centre for responsible investors

From a market perspective, engagement and voting on governance issues have been used as levers for influence for a long time. On the other hand, environmental and social issues were historically addressed from a values-based perspective or primarily for fact-finding purposes. Today, many responsible investors leverage corporate dialogue as a tool to influence and drive meaningful change and impact

North American Material Risk Engagement Trends: ESG Reporting Frameworks, Emission Reduction Targets and Beyond

There are many factors that rating agencies consider within its overall assessment. For example, ESG rating companies tend to look for at least three years of ESG metrics to determine company trends and long-term ESG targets, goals, and strategies to manage and reduce ESG risks at least five years ahead. Read on to learn about how Sustainalytics' Material Risk Engagement program promotes and protects long-term value by engaging with high-risk companies on financially-material ESG issues. (A North American Snapshot)

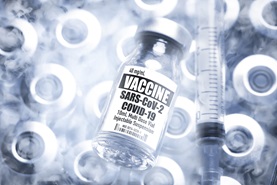

ESG Investors Consider Socioeconomic Impacts of COVID-19 in the Construction Industry

The construction industry can have a reputation for workforce insensitivity and is highly vulnerable to economic and social variabilities. The ESG Impacts of COVID-19 drive companies to adapt to significant challenges related to the demand for construction services. This construction sector research snapshot highlights relevant social issues that corporations face due to ripple effects from the pandemic using Sustainalytics’ ESG Risk Ratings and Controversies Research.

ESG Risk Exposure from COVID-19 Vaccine Transportation and Distribution

As mass vaccination against the coronavirus started, a key challenge has been to keep millions of doses of vaccines at the right temperature. An increase in temperature inside a truck or aircraft, by half a degree, for half an hour, would reportedly result in a 'defrosted' vaccine which has then to be discarded.

Royal Dutch Shell Court Order Shifts Paradigm for Corporate ESG Accountability

On 26 May 2021, the Court of The Hague orders Royal Dutch Shell (RDS) to reduce CO2 emissions to a net 45% by the end of 2030 compared to 2019 through the Group Policy of the Shell Group. The order of a national (Dutch) court demands that a global company (RDS) fulfills its obligations under the Paris Climate Agreement, although RDS was not a party in that agreement, and there is no legal equivalent in The Netherlands. What are the broader consequences of this order, also globally and for other companies and potentially also other jurisdictions?

Unwritten Risks – The True Costs of Mispriced Climate Change

Research shows that Property & Casualty insurance underwriters are not accurately pricing climate risks, and US government policy and program decisions are proving to be unsustainable. In our most recent blog, Justin Cheng talks about the resulting premium pricing corrections in the wake of intensifying extreme weather events. With this trend, a significant number of US homeowners are unable to obtain property insurance while taxpayers take on the increased cost of climate risk.

10 for 2021: Investing in the Circular Economy

This report aims to support investors interested in gauging environmental, social and governance (ESG) risks and opportunities in the global food value chain. We survey key subindustries – from agrochemicals, agriculture and aquaculture to packaged food, food retail and restaurants – in search of solutions that may support the principles of the circular economy (CE). These principles include minimizing waste and pollution, extending the use-phase of products and ecosystem regeneration. Some of the key insights found in the report are:

How Climate Gentrification is Increasing Real Estate Costs and Socio-economic Disparities

Climate gentrification is an emerging concept describing how land with greater resiliency against intensifying physical impacts of climate change becomes more desirable and valuable.[1] It catalyzes fast and visible socio-economic transformation in communities.