Sustainalytics’ Global Access, our investor platform containing most of our core research and data products, is now available to our corporate clients.

Corporate sustainability professionals can access the ESG Risk, Climate, Impact, and Compliance research viewed by over 1,100 institutional investors globally.

Screen business partners on sustainability criteria, monitor ESG incidents, improve your competitive positioning, and prepare for regulatory requirements.

Latest Insights

Sustainable Investing Trends to Watch in 2026

Eyes on Asia: How the Region Is Advancing on Human Rights Due Diligence

Controversial Weapons: Reassessing the Red Lines

I already have an account

I want to learn more

Key Features

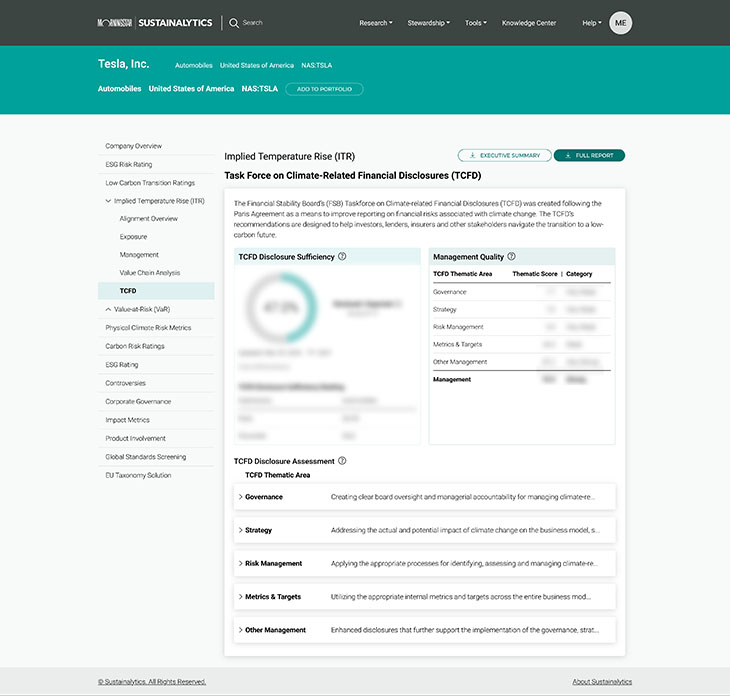

Granular sustainability data on individual companies

Quick search: Immediately access research on any company that is part of our main research universe

Event Alerts: Obtain Automated alerts with the latest scores and updates on Controversies and underlying incidents

Detailed company reports: Zoom in on an individual company to get detailed insights on their ESG performance and disclosures

Screen Companies and Generate Reports

Data extraction

Extract Excel reports on selected companies to perform further data analysis and modeling

Screening tool

Screen companies on various ESG criteria and monitor ESG incidents

Industry reports

Download industry reports for detailed insights and stats on your industry's sustainability performance

Our Global ESG Research Universe, at your fingertips

Comprehensive research

Choose among ESG risk, climate, compliance, or impact data for a comprehensive sustainability analysis

16,500+ companies

Find ESG frontrunners, business partners, peers, clients, and suppliers in our main research universe

Why Sustainalytics?

A Single Market Standard

Consistent approach to ESG assessments across the investment spectrum.

Award-Winning Research and Data

Firm recognized as Best ESG Research and Data Provider by Environmental Finance and Investment Week.

End-to-End ESG Solutions

ESG products and services that serve the entire investment value chain.

30 Years of ESG Expertise

800+ ESG research analysts across our global offices.

A Leading SPO Provider

As recognized by Environmental Finance and the Climate Bonds Initiative.

Related Insights and Resources

Related Products

Top-Rated Companies

The Top-Rated ESG Badge is awarded on an annual basis to companies who excel at managing their ESG Risk Ratings.

ESG Risk Rating License

Sustainalytics’ ESG Risk Ratings License allows companies to use the ESG Risk Rating and reports for various internal and/or external corporate purposes.

ESG Risk Ratings

Morningstar Sustainalytics' ESG Risk Ratings offer industry-leading research and detailed data on more than 13,000 companies, supported by 20 material ESG issues.