Getting an edge in a competitive marketplace could mean the difference between reaching the summit or being middle of the pack. Having a leg up with respect to ESG performance could propel your company to the top of your industry.

Now, imagine being able to peek at your competition’s ESG Risk Rating and compare exposure and management scores as well as analyze their material ESG issues. Sustainalytics Competitive Insights will allow you to benchmark your ESG risk performance against your peers to know where your company stands and where it can improve.

Quickly compare yourself to your industry peers.

Latest Insights

ESG in Conversation: Financing the Future

Webinar Replay: Enhanced Assessment Framework for UoP SPOs

ESG in Conversation: Shining a Light on Shareholder Rights

Key Benefits and Features

Platform Access

Available in the Sustainalytics’ Issuer Gateway platform as soon as the peers are locked.

Real Time updates

Real time display of the Competitive Insights report once peers have been selected including real time ESG Risk Rating updates of your own rating and the one from peers.

Overall ESG Risk Rating comparison

The ESG Comparison includes industry ranking for each competitor selected.

Visual Representation of the results

Exposure and Management Comparison including scatterplot showing relative peer performance.

Downloadable 20 peer reports

Deep dive into competitors’ ratings by getting access to 20 peer reports, downloadable through Sustainalytics’ Issuer Gateway.

Report Insights

Highlevel explanation of each of the Comparisons available in the report including definitions of each risk.

ESG Risk Rating Comparison of your company and the peers selected including industry and subindustry ranking..

Comparison of company’s level of exposure to ESG issues and the actions taken by a company to manage relevant ESG risks. Includes a visual representation of your company’s risk compared to the selected peers.

In depth comparison and definition of each Material ESG Issue; including Corporate Governance, Data Privacy and Security, Resilience, Product Governance, Human Capital, Business Ethics, and ESG Integration – financials.

Why Sustainalytics?

A Single Market Standard

Consistent approach to ESG assessments across the investment spectrum.

Award-Winning Research and Data

Firm recognized as Best ESG Research and Data Provider by Environmental Finance and Investment Week.

End-to-End ESG Solutions

ESG products and services that serve the entire investment value chain.

30 Years of ESG Expertise

800+ ESG research analysts across our global offices.

A Leading SPO Provider

As recognized by Environmental Finance and the Climate Bonds Initiative.

Related Insights and Resources

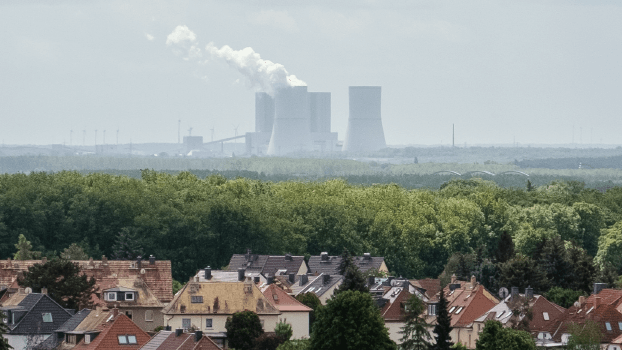

Reducing Emissions Through Sustainable Finance: A Guide for Companies in Carbon Intensive Industries

This corporate guide discusses the difficulties in measuring, reporting, and reducing GHG emissions in hard-to-abate sectors and provides key takeaways so that companies can take advantage of the opportunities sustainable finance offers.

Risk and Opportunity in Biodiversity: How Sustainable Finance Can Help

This article outlines how biodiversity loss poses material risks to business and how it connects to many other issues that companies can’t ignore. In addition, it covers how biodiversity conservation presents substantial economic opportunities, and how businesses can address and access these opportunities by issuing linked instruments that integrate biodiversity considerations.

Today’s Sustainable Bond Market: Boosting Confidence in Sustainable Bond Issuances

In this article, we examine the kinds of sustainable bonds offered in the market, some of the key regulations being developed in different markets and the current initiatives to improve the quality and credibility of issuances.

Related Products

Peer Performance Insights

Compare your performance to industry peers to drive ESG performance improvements.

Learn More

ESG Risk Rating License

Sustainalytics’ ESG Risk Ratings License allows companies to use the ESG Risk Rating and reports for various internal and/or external corporate purposes.

ESG Risk Ratings

Morningstar Sustainalytics' ESG Risk Ratings offer industry-leading research and detailed data on more than 13,000 companies, supported by 20 material ESG issues.

Learn More