Regulatory Standards and COVID-19: Is Oil and Gas Being Given a Hall Pass on ESG?

Globally, oil and gas companies are weathering a storm like no other in their history. Although volatility seems to have settled somewhat since the early months of 2020 (when the Russia-Saudi Arabia oil price war experienced its most heated moments yet), cost-cutting and debt borrowing continues to plague the industry as the vast majority of COVID-19 related restrictions remain in place worldwide.

The Race to Net Zero: Decarbonization Commitments in the Oil & Gas Industry

Recent reports concerning record decreases in global greenhouse gas (GHG) emissions due to the COVID-19 pandemic have spurred hope for a “green shift” in our global economy, post-pandemic. The importance of this shift cannot be understated, given that capital investments made within the next five-to-ten years will determine the world’s carbon pathway to 2050 and beyond.

Airlines Post-COVID-19: The Challenges to a Climate-Friendly Recovery

Planes grounded, borders closed and passengers staying at home: the past months haven’t been easy for the airline industry. COVID-19 has led to the deepest crisis ever in the history of the sector.[i] Airlines are in dire need of cash to recover, while at the same time the industry is also expected to adapt and prepare itself for the more critical crisis ahead that is climate change. Despite the slowdown of air travel, long term prospects of mitigating carbon footprint of the industry are not clear. Carbon commitments supported by comprehensive programs are in place, nonetheless, our research suggests that existing measures may not be sufficient to curve down emissions and mitigate climate change.

Tackling the Climate Crisis: Mobilizing the Transition

As we mark the 50th Anniversary of Earth Day, we highlight the need for a collective effort in order to combat the impacts of climate change. In this blog, we explore the important role that investors play in mobilizing the transition to reduce emissions and how sustainable solutions can support this.

Mexican companies remain dedicated as government backtracks on climate commitments

Since taking office in December 2018, Mexico’s president Andres Manuel Lopez-Obrador, often referred to as AMLO, has not inspired much hope among investors in the country’s energy sector. The first six months of his presidency has confirmed investor concerns that the privatizing of the energy industry would be rolled back under AMLO, who has made energy sovereignty a cornerstone of his administration’s agenda. The contracts issued under the 2013 energy reforms have been placed under review and the energy auctions for oil, natural gas and renewables projects that were scheduled for 2018 were cancelled. The energy auctions scheme was introduced in 2015 as a key measure to achieve Mexico’s energy reduction commitments of 30 per cent and 35 per cent by 2021 and 2024, respectively.

Sustainalytics’ Carbon Risk Rating: Platypus Asset Management Live Test

Climate change is at the centre of public debate: from school strikes around the world to a recent landmark court ruling blocking a new coal mine in Australia on climate grounds. It is also increasingly becoming an investment risk and investors are looking to understand how this risk can affect their portfolios.

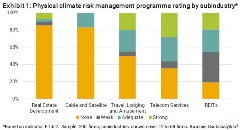

Preparing for the Storm: Extreme Weather Events and the Chemicals Industry

In 2017, extreme weather events (i.e., hurricanes and flooding) resulted in USD 344 million in economic losses, globally.[i] Chemical companies are particularly exposed to this risk due to their concentration of assets in regions prone to extreme weather events, such as the Gulf Coast region of the United States. This region is home to several refining and petrochemical plants, and to more than half of the country’s downstream chemical production.[ii] With growing investor concern about the physical impacts of climate change and extreme weather events, we examine chemical companies’ preparedness to face this material issue. We also take a closer look at Arkema as a case study.

Risk Exposure in a Changing Climate: The Story of PG&E

The destructive California wildfires in November 2018 once again focused investor attention on climate-change related risks. PG&E, the largest utility in the United States, has stated the fires were very likely caused by its equipment. The company has since announced it will file for bankruptcy protection at the end of January in what is being called the highest profile climate-change bankruptcy to date. The company’s expected liabilities from the devastating wildfires in 2017 and 2018 are estimated at over USD 30 billion and the company’s share price has dropped by over 90% since before the 2017 fire. It is currently unclear what would happen in the event of PG&E filing for bankruptcy protection, but state legislators have mentioned the possibility of breaking up the utility, selling off assets, or converting it to a publicly-owned company.

Energy and Climate Policy in Australia: Out of Touch and Out of Time?

Just before the leadership spill two weeks ago, Australia’s former prime minister Malcolm Turnbull discarded the carbon emissions reduction target contained in the National Energy Guarantee (NEG). The proposed legislation was aimed at reforming the country’s electricity market and addressing the “energy trilemma” of ensuring emissions reduction, grid reliability and power price affordability.

Beyond footprinting: How can investors manage carbon risks in their portfolio?

Institutional investors are facing increased pressure from customers, regulators and civil society to become more responsive to the threat of climate change. Over the last few years, there have been several developments that encourage investors to integrate risks associated with climate change into their decision-making (see timeline below). In addition to the impact of their investment, they need to address the effect climate change will have on their investment. This will manifest in both physical risk – through floods, draughts, extreme weather events, etc. – and carbon risk (also referred to as transition risk).

Transition Risk for Oil & Gas Companies: Addressing the Disclosure Gap

As the world transitions towards a low-carbon economy, investors are increasingly interested in how oil and gas companies plan to address related risks. Most companies in the industry recognize that their business is exposed to risks related to carbon regulations, decreasing demand for its products, or increasing costs related to the implementation of emission reduction technologies. However, when it comes to addressing these risks, disclosure is limited (as we noted in our July 2017 blog post on the Task Force for Climate-Related Financial Disclosures [TCFD]). Oil and gas companies will have to increase and improve their disclosure if they want to convince investors of the viability of their business model in a carbon-constrained world.

What will the TCFD mean for Oil and Gas Producers?

Building on the momentum created by the “Aiming for A” resolutions and the Paris Agreement, the Task Force on Climate-related Financial Disclosures (TCFD) published its recommendations for disclosing climate-related risks in June. How will these new guidelines affect the oil and gas industry and can investors leverage them in their engagement efforts?

Sizing up the US withdrawal from the Paris Agreement

President Trump’s announcement last week that he will pull the US out of the Paris Agreement is unlikely to have any meaningful impact on clean energy transition. This is because the global pivot to renewable energy is increasingly being driven by economic fundamentals, not policy (an argument we made in our deep dive of the Paris Agreement in January 2016).

.tmb-thumbnl_rc.png?Culture=en&sfvrsn=c0620b0d_2)