The Impact and Cost of Air Pollution: U.S. Petroleum Refineries

Investors can examine to what extent petroleum refiners manage their Non-GHG Air Emissions and assess the quality of a company's programs to reduce air pollutants. For instance, examining all the petroleum refiners assessed by Sustainalytics, we observe that only 3% have a strong program to manage non-greenhouse gas emissions.

Bringing Investors and Companies Together to Accelerate Human Rights Progress

Human rights issues have been rising on the responsible investment agenda in recent years. The COVID-19 pandemic and the Black Lives Matter movement have provoked even more pointed discourse on the topic. The European Union’s current efforts to introduce rules to hold companies accountable for social and environmental risks in their supply chains further accelerate that ascent. This wave of legal requirements and normative expectations is impacting financial markets worldwide, with responsible business regulations already in place or quickly becoming valid.

Recent market trends put engagement and voting front and centre for responsible investors

From a market perspective, engagement and voting on governance issues have been used as levers for influence for a long time. On the other hand, environmental and social issues were historically addressed from a values-based perspective or primarily for fact-finding purposes. Today, many responsible investors leverage corporate dialogue as a tool to influence and drive meaningful change and impact

North American Material Risk Engagement Trends: ESG Reporting Frameworks, Emission Reduction Targets and Beyond

There are many factors that rating agencies consider within its overall assessment. For example, ESG rating companies tend to look for at least three years of ESG metrics to determine company trends and long-term ESG targets, goals, and strategies to manage and reduce ESG risks at least five years ahead. Read on to learn about how Sustainalytics' Material Risk Engagement program promotes and protects long-term value by engaging with high-risk companies on financially-material ESG issues. (A North American Snapshot)

EU Taxonomy Developments and the EU’s Renewed Sustainable Finance Strategy

On July 6th, the European Commission published its Strategy for Financing the Transition to a Sustainable Economy, the successor of the EU’s Sustainable Finance Action Plan, which launched in 2018. The strategy focuses on transforming the financial system and financing transition plans, building on the 2018 Action Plan, which centered on developing the EU Taxonomy, putting in place disclosure regimes, and developing tools for the market to develop sustainable investment solutions and prevent greenwashing.

The Mutual Influence of Investors and Government

On issues from voting rights to climate change, the relationship between investors, companies, and governments has never been more dynamic. This has spurred a lively discussion about the impact and appropriate role of these actors in addressing systemic environmental and social issues. An increasingly cited view is that commitments made by businesses and investors are often superficial, and at best, can provide only incremental progress towards addressing the problems we face. Some go further to suggest that sustainable investing has done more harm than good, with the notion that these efforts have provided a false sense of progress and have delayed meaningful government action. This is a worthwhile debate, but my experience over the last eight years in the sustainable investing space has given me a very different perspective.

Banks Embrace Corporate Culture as Change Agent

Corporate culture is not automatically positive, and elements of a company’s culture may provide certain benefits or disadvantages to a firm’s competitiveness. When acknowledged, corporate culture can be used as a tool to drive better business outcomes and manage conduct and compliance risk. Our discussions with companies show that corporate culture can have a dominant effect and influence behaviour over and beyond stated company policies and programs.

Deforestation and Biodiversity Loss Highlight the Need for a Better Normal

The world is aching for a return to normality after a year (and still counting) of news bulletins being dominated by the COVID-19 pandemic; Earth Day 2021 should serve as a stark reminder that we cannot go back to business-as-usual. We must address the vast environmental challenges facing humanity, such as climate change, loss of biodiversity, extreme weather and issues related to water.

Personal Products and the New Ethics of Product Naming

Over recent years, personal product (PP) companies have faced an increasing demand for more inclusive product governance – from formulations to labels – and marketing that reflects the diversity of consumers. To grow sustainably within their communities and stay relevant for their target customers, such companies need to create value for society proactively. Some of the major players in this industry have already started paving the way for others.

Lessons Learned from 926 Engagement Meetings in Emerging Markets

When Sustainalytics (GES[1]) initiated the Emerging Markets (EM) Engagement program as a pilot project in 2009, the scale, scope and impact were undetermined factors. Based on the successful execution of the program methodology in the African and Middle Eastern regions during the pilot stage, the full program launched in 2010 to cover all major emerging markets. After the project close in July 2020, the program accounts for 926 meetings with companies in emerging markets.

Death and Taxes are the Only Constants - But Not for Everyone

Major global companies such Google, Amazon, Facebook and Apple (known as “GAFA”) have come to dominate not just the tech industry but increasingly global commerce as well. The OECD estimates that companies like these avoid USD 100-240 billion in taxes annually, representing roughly 4-10% of global corporate income tax revenues. Attention paid to corporate taxation has also risen sharply in recent years, with increasingly heated debates on what constitutes “companies paying their fair share.”

Business Ethics and Economic Downturn - A Closer Look at China

In October 2019, China posted its lowest quarterly GDP growth rate (6.0%) in 30 years. While the country’s trade war with the US might have added to the economic headwind, the economic results are in line with a decade of cooling down following years of double-digital growth.

Tax Transparency in Australia

As Benjamin Franklin once said, “in this world nothing can be said to be certain, except death and taxes.” He was referring to the world in 1789. In today’s world, death remains a certainty. Taxes on the other hand, are less certain as companies, accountants and lawyers have found ways to reduce tax obligations.

Whistleblower Protections in Europe: Considerations for Investors

All organizations have hidden vulnerabilities. Whistleblowing exposes fraud and other financial crimes, thereby giving society an opportunity to act against misbehaviour. Globally, whistleblowers have helped save lives, recover billions of dollars, and protect the environment and local communities.

Auditor Independence: Lessons from KPMG South Africa & Other Scandals

A good reputation is arguably one of an audit firm’s most valuable assets. But when auditor independence is compromised, it can have very negative consequences for the relevant stakeholders and, in extreme cases, it can even undermine the public’s trust in a country’s financial system. Recent controversies at Tesco and BT Group, involving PricewaterhouseCoopers (PwC), have led to the unprecedented termination of important business relationships going back three decades. KPMG South Africa’ involvement in a political corruption scandal is also proving to have even more far-reaching implications, which risks impacting KPMG’s international operations. In this blog post, I will delve into these controversies and highlight the mechanisms that can help to preserve auditor independence and maintain a strong reputation.

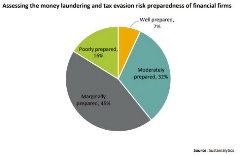

ESG Spotlight | Money laundering and tax evasion

Policies to counteract money laundering and tax evasion activities have long been mandated by regulation, but a series of recent controversies, including Lux Leaks (2014), Panama Papers (2016) and Russian Laundromat (2017), has put banks’ programmes in these areas under unprecedented scrutiny.

.tmb-thumbnl_rc.jpg?Culture=en&sfvrsn=f9fcdf85_1)

.tmb-thumbnl_rc.png?Culture=en&sfvrsn=ce56d6ce_2)