How a Top Credit Union Analyzed Its ESG Gaps and Set Its Sights on Leading in ESG

First West Credit Union (First West) is a financial co-operative based in British Columbia, Canada and the fifth largest credit union in the country. First West committed to providing financial solutions to its members through the lens of “triple-line profit capability” - balancing profitability with doing what’s right for its members and what’s right for its community teams. Download this Customer’s Story to learn more.

How Our ESG Solutions Can Benefit Your Credit Union

License your ESG Risk Rating for use in marketing material, promoting and drawing attention to your credit unions’ focus on sustainability.

Publish your ESG Risk Rating summary in sustainability or financial reports, communicating to members, investors and external stakeholders your credit unions’ awareness and management of ESG issues and risks.

Help your credit union attract and retain the best talent by demonstrating that your priorities go beyond just the bottom line.

Notification on events and controversies that can potentially affect your ESG Risk Rating and ranking within your industry.

Add credibility to your ESG story by leveraging a recognized third-party rating service.

Receive personalized support from a team of ESG experts who take a deep dive into your credit union’s ESG Risk Rating and its specific industry, identify gaps and facilitate better understanding of the research results.

Frequently Asked Questions About Sustainalytics’ ESG Solutions

We wanted to share some of the Frequently Asked Questions (FAQs) we’ve received from credit unions like yours about our research methodology, how the ESG Risk Rating is calculated, and our company feedback process. We hope these help you understand our ESG Risk Ratings. Have a look and see for yourself:

Related Insights and Resources

Landmark Rules Ask Companies to Grapple With Climate Risk Very Publicly

Ron Bundy hosts an interview with Gabriel Presler, Global Head of Enterprise Sustainability at Morningstar and Aron Szapiro, Morningstar’s Head of Retirement Studies and Public Policy, to discuss what the new SEC rule and other climate regulations mean.

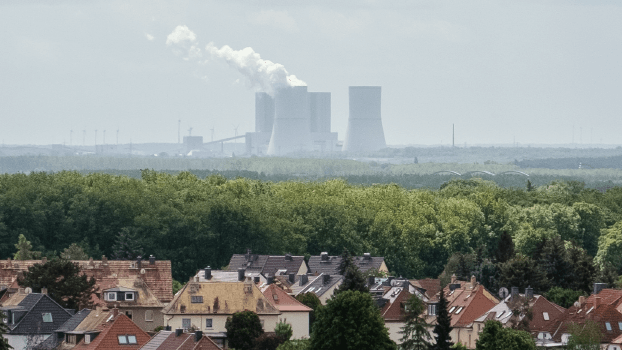

Reducing Emissions Through Sustainable Finance: A Guide for Companies in Carbon Intensive Industries

This corporate guide discusses the difficulties in measuring, reporting, and reducing GHG emissions in hard-to-abate sectors and provides key takeaways so that companies can take advantage of the opportunities sustainable finance offers.

Risk and Opportunity in Biodiversity: How Sustainable Finance Can Help

This article outlines how biodiversity loss poses material risks to business and how it connects to many other issues that companies can’t ignore. In addition, it covers how biodiversity conservation presents substantial economic opportunities, and how businesses can address and access these opportunities by issuing linked instruments that integrate biodiversity considerations.