In March 2018, the European Commission launched a 10-point EU Action Plan to leverage financial markets in addressing sustainability challenges, particularly those related to climate change.

Three main objectives underpin the EU Sustainable Finance Action Plan:

Reorient capital flows towards sustainable investment to achieve sustainable growth.

Manage financial risks stemming from climate change, environmental degradation, and social issues.

Foster transparency and long-termism in financial and economic activity.

Financial market participants are driven to comply against a set of criteria fostering transparency and a common language for what is “sustainable” when creating sustainable investments.

Morningstar Sustainalytics has developed a holistic solution designed to help you:

Meet all your regulatory requirements with robust, reliable data.

Streamline your compliance process with advanced reporting tools.

Easily embed data within existing workflows, ensuring consistent and reliable data for regulatory reporting needs.

Our solution is built on the foundation of robust methodologies that underpin all our ESG research, including our EU Taxonomy Solution and Principal Adverse Impact (PAIs) Data Solution. This high-quality data is then integrated into a wide variety of tools and capabilities, allowing you to seamlessly manage and report in line with your regulatory obligations.

Sustainalytics’ Corporate Sustainability Reporting Directive (CSRD) Aligned Data is designed to empower issuers with an unparalleled level of insight and compliance readiness. Built upon a deep foundation of data, our CSRD Aligned Data offers quantitative and qualitative insights aligned with over 600 criteria from the European Sustainability Reporting Standards (ESRS) covering approximately 25,000 companies. Leverage the most comprehensive data available to comply with evolving regulatory standards, assess materiality, and simplify your CSRD reporting requirements.

Morningstar Sustainalytics delivers a robust dataset that includes reported and estimated data across three key performance indicators (revenues, capex, opex) and six objectives. It assists investors in complying with the latest ESG regulations, enhances portfolio monitoring, and supports the development of credible green investment products.

Morningstar Sustainalytics helps investors integrate Principal Adverse Impacts (PAIs) into their investment strategies. This solution supports the fulfillment of SFDR reporting obligations and complements a broad suite of research products, aiding in the management of ESG risks and reduction of negative stakeholder impacts.

Morningstar Sustainalytics’ dedicated dataset helps index providers and investors comply with the mandatory reporting obligations under the EU Benchmarks Regulation, as well as screen companies against the exclusion criteria set for EU Climate Benchmarks (PABs and CTBs), as required by the ESMA Fund Naming Rules. We also offer sustainable investing index solutions through Morningstar Indexes, ensuring alignment with EU Benchmark Regulation.

Morningstar Sustainalytics’ ESMA Fund Naming Rules Solution provides investors with data covering all the exclusion criteria set for both Paris-Aligned Benchmarks (PABs) and Climate Transition Benchmarks (CTBs), as well as capabilities to screen portfolios on their adherence to the rules. Based on a conservative approach to methodology, our solution enables investors to customize exclusions to ensure alignment with regulatory expectations.

Morningstar Sustainalytics assists financial market participants in identifying sustainable investments. We provide investors with a combination of suggested data and screening capabilities that enable them to customize inputs and thresholds based on Contribution, Do No Significant Harm, and Good Governance, thereby incorporating their own views into investment decisions.

Discover more about our solutions suite

Morningstar Sustainalytics enables investors to aggregate data at portfolio level and generate reports for fund or entity level disclosures using our EU Taxonomy and PAI datasets. Our best-in-class capabilities enable investors access to end-to-end regulatory support and help them incorporate EU Taxonomy criteria and PAI insights, as well as manage their ESG risks.

Gain Insights around global ESG regulatory initiatives, directives and frameworks through our Regulatory hub.

ESMA Fund Naming Guidelines: Early Insights Into Rebranding Activity and Portfolio Impact

This article looks at how the universe of open-end and exchange-traded funds in scope of the ESMA fund naming guidelines has changed since their introduction in May 2024, through analysis of rebranding activity and assessed the impact of the requirements.

Why Sustainalytics?

A Single Market Standard

Consistent approach to ESG assessments across the investment spectrum.

Award-Winning Research and Data

Firm recognized as Best ESG Research and Data Provider by Environmental Finance and Investment Week.

End-to-End ESG Solutions

ESG products and services that serve the entire investment value chain.

30 Years of ESG Expertise

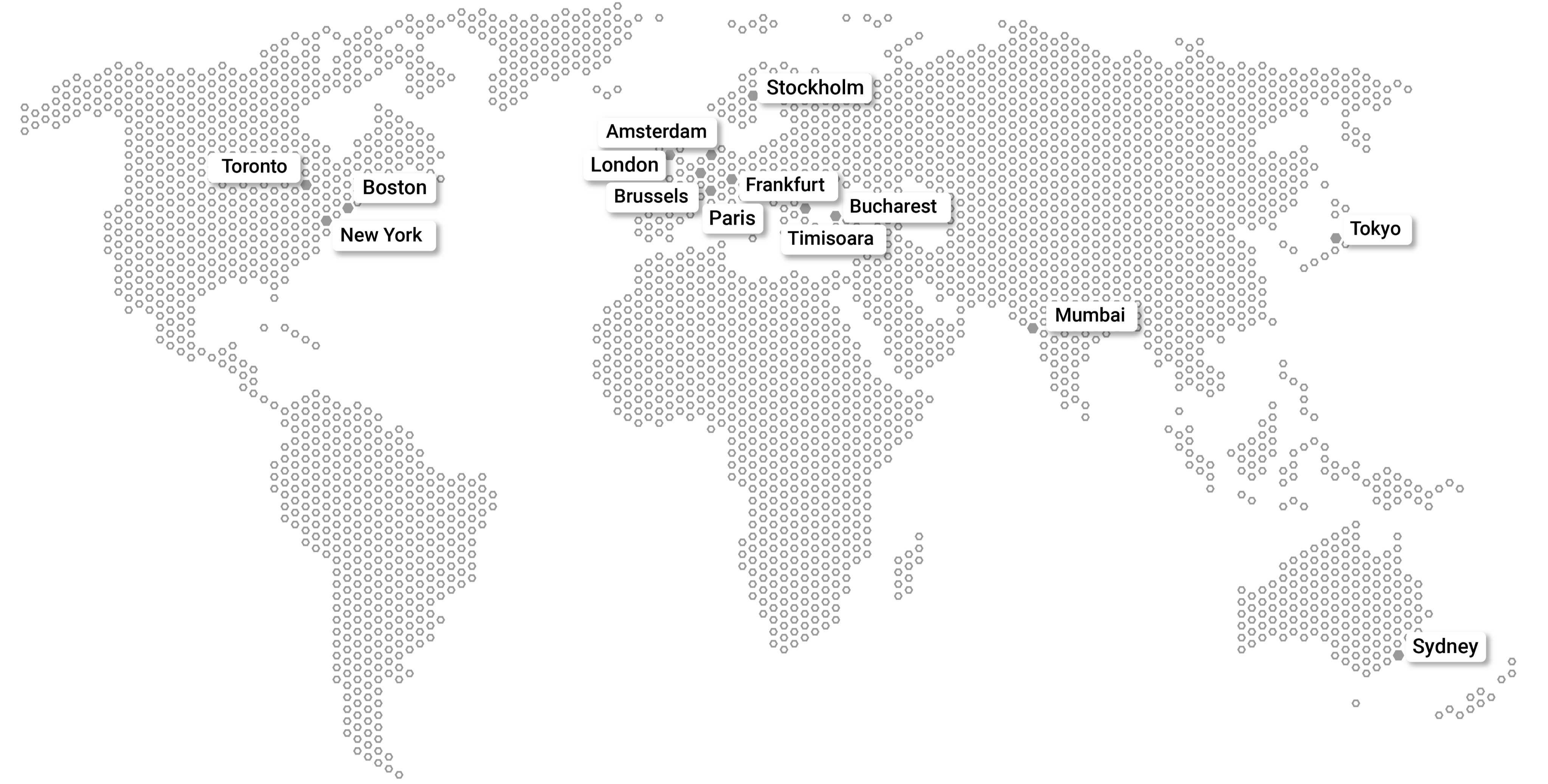

800+ ESG research analysts across our global offices.

A Leading SPO Provider

As recognized by Environmental Finance and the Climate Bonds Initiative.