Nuclear Power and ESG: Can They Play Together?

Nuclear power in particular can be a controversial and confusing topic with respect to ESG factors. Sustainalytics, a leading global ESG and corporate governance analytics firm, has joined Morningstar Research Services to present a comprehensive ESG analysis of nuclear power, including a look at carbon emissions intensity, waste management, operational management, public safety, worker safety, and regulatory oversight.

Climate Week’s Financing a Greener Future

The first half of 2020 saw $200bn in sustainable bonds issued globally with green bonds accounting for nearly half of that. As more companies commit to achieving net-zero emissions and as the world shifts to a low carbon economy, the CEO Investor Forum and Sustainalytics welcome industry experts to weigh in on the state of the sustainable finance market during this one-hour virtual event.

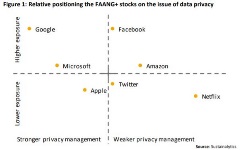

Managing data privacy risk: comparing the FAANG+ stocks

Collecting and processing personal data has become one of the most significant drivers of financial value in today’s economy. But as the upside of personal data grows, so too does the downside risk associated with data security, management and privacy.

Progress report on investor expectations and corporate benchmark in cocoa

GES has engaged the cocoa industry for many years to increase its effort in tackling the issue of child labour. As a part of its long-term engagement, GES published its second public report on the issue, including investor expectations and a corporate benchmark of leading cocoa and chocolate companies.

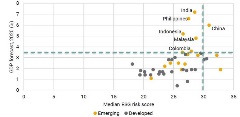

Emerging Markets Equities: Key Sources of ESG Risk

Based on our analysis, we find that investors in the FTSE Emerging Index are exposed to over 14 percent more unmanaged ESG risk than those in the FTSE Developed Index. The ESG risk gap between these indices is largest on the issue of data privacy and security. In addition, investors in select equity markets, such as China, may face a trade-off between chasing higher economic growth and mitigating portfolio ESG risk.

Mirova: Food Security - Closing the Food Gap

Solutions for closing the food gap are likely to come from both production innovations and changes in consumption trends: on the one hand, it is essential that we increase the supply of food, while on the other, there is real potential for a reduction in demand for certain commodities.

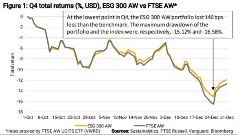

Beware of Bears: A Look Back at the Downswing of 2018

Overlaying Sustainalytics’ ESG Risk Ratings onto the FTSE AW Index, we found that 24 percent of the benchmark’s market cap was rated as having high to severe levels of ESG risk. In addition, over the course of Q4 2018 the negligible to low ESG risk companies outperformed the benchmark by 55 basis points. Our sample portfolio containing 300 best-in-class ESG performers would have returned 77 basis points more than the benchmark in Q4.

Water Stewardship Engagement

The Water Stewardship and Risk Engagement combines both scale and detail, and covers the food and beverage, mining and garment sectors, which are associated with a high level of water risk. This engagement links water policy and practices in these three sectors to the targets of Sustainable Development Goal 6 (to ensure the availability and sustainable management of water and sanitation for all)

ESG Transparency Poland (English Report)

Since 2012, GES together with the Polish Association of Listed Companies, a self-government organization of companies listed on the Warsaw Stock Exchange, has been involved in an educational project ESG analysis of companies in Poland aimed at increasing disclosure and transparency of reporting on non-financial indicators.

Combatting Child Labour: Investor expectations and corporate good practice

GES has engaged the cocoa industry for many years to increase its effort in tackling the issue of child labour. As a part of its long-term engagement, GES published its second public report on the issue, including investor expectations and a corporate benchmark of leading cocoa and chocolate companies.

Gaining Ground: Corporate Progress on the Ceres roadmap for Sustainability

This report, Gaining Ground: Corporate Progress on the Ceres Roadmap for Sustainability, evaluates how well 613 of the largest, publicly traded U.S. companies are integrating sustainability into their business systems and decision-making. The report— a collaboration between Ceres and Sustainalytics—assesses corporate progress across the four strategic areas first outlined in 2010 in the Ceres Roadmap for Sustainability: Governance, Stakeholder Engagement, Disclosure and Performance.

10 for 2018: ESG Risks on the Horizon

In 10 for 2018, we focus on the ESG issues we anticipate could pose significant risks for investors. The ESG issues in focus fall into four broad themes: water management, climate change, consumer protection and stakeholder governance. Learn more about the stories behind these issues below.

An investment firm that puts sustainability at the heart of the company

Econopolis combines financial analysis with its qualitative evaluation of management and macro-economic themes to construct a portfolio that it believes will be competitive and sustainable in the long term. Their qualitative approach to ESG presented them with two challenges: How can they measure their ESG performance against that of other leading responsible investors? And, how can they reassure clients that their approach is credible?

Perspectives on Modern Slavery (Australia)

An estimated 40 million people are currently oppressed by modern slavery and companies are under increasing pressure to manage this issue to mitigate operational disruptions as well as compliance and reputational risks. Sustainalytics, FSI and Suncorp tackle this issue on Sustainalytics’ Perspectives on Modern Slavery – Australia webinar.

.tmb-small.png?Culture=en&sfvrsn=2b2a9c60_2)

.tmb-small.jpg?Culture=en&sfvrsn=60d17804_2)

.tmb-small.png?Culture=en&sfvrsn=12e8d376_2)

f6f40ef6-31ad-42df-b35f-128241ea958e.tmb-small.png?Culture=en&sfvrsn=3c436c0f_2)