Auditor Independence: Lessons from KPMG South Africa & Other Scandals

A good reputation is arguably one of an audit firm’s most valuable assets. But when auditor independence is compromised, it can have very negative consequences for the relevant stakeholders and, in extreme cases, it can even undermine the public’s trust in a country’s financial system. Recent controversies at Tesco and BT Group, involving PricewaterhouseCoopers (PwC), have led to the unprecedented termination of important business relationships going back three decades. KPMG South Africa’ involvement in a political corruption scandal is also proving to have even more far-reaching implications, which risks impacting KPMG’s international operations. In this blog post, I will delve into these controversies and highlight the mechanisms that can help to preserve auditor independence and maintain a strong reputation.

<UPDATE> P&G vs Trian Partners - the Largest Proxy Fight in History

Preliminary results show that Nelson Peltz lost his proxy contest against P&G. At the conclusion of the AGM, the company announced the election to the board of all 11 of its nominees. Peltz is not yet admitting defeat, stating that the vote results are” too close to call” (within a 1% margin), and has called for P&G to appoint him on the board regardless the vote count. Following the news, P&G’s stock price dropped by 2.7% to USD 89.86, closing, however, at USD 91.62.

From Guidance to Compliance: What does New York’s Cybersecurity Regulation Mean?

New York State’s new cybersecurity regulation for financial institutions is meant to help safeguard companies and the industry against cybersecurity threats. It goes beyond many other regulations by, among other things, making some of the guidance and recommended best practices mandatory. Cybersecurity is already considered a material ESG risk for the financial services industry, but with the new regulation this risk is compounded with regulatory concerns.

Whole Risk, Whole Opportunity: The ESG implications of Amazon’s Whole Foods Acquisition

Amazon’s expansionism has brought it into multicategory retailing, consumer electronics, cloud computing, logistics and media production. Now, with its recent USD 13.7bn acquisition of Whole Foods Market, it strides into brick-and-mortar grocery retailing. As Amazon expands in all directions, so does the frontier of its ESG risks and opportunities. How do grocery stores fit into Amazon’s customer-obsessed technocracy? And how will it use the Whole Foods brand, built on a foundation of upmarket ethical consumerism?

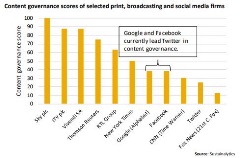

Fox Sky Takeover: Why Content Governance Matters

The power of media companies to shape societal dialogue and act as gatekeepers of content is coming under increased scrutiny. This is starting to impact the industry as demonstrated in the challenges American media giant Twenty-First Century Fox (Fox) is facing in its proposed GBP 11.7 billion (USD 15 billion) takeover of UK broadcaster Sky plc.

Will the Consolidation in the Chemical Industry change its ESG Risk Profile?

When the stock market closes today, the DowDuPont merger will officially be finalized and the new entity will start trading under the ticker DWDP (as of September first). This is the most recent – and certainly one of the most significant – mergers in an industry that has seen unprecedented consolidation. But what are the social and environmental ramifications of this consolidation and does it risk changing the industry’s ESG risk profile?

Uber’s ESG Risks—is the new CEO up to the Challenge?

Uber, the ride hailing company, recently appointed Dara Khosrowshahi as CEO. His appointment comes in the wake of intensifying criticism of the company. Uber is accused of having a hostile workplace culture, mistreating its drivers and using software tools to evade regulators. What are the root causes of these issues, which Khosrowshahi will need to address if he wants to get the company back on track?

Wall Street Banks Face Mounting Shareholder Pressure to Address Gender Pay Gap

Gender diversity and equality are increasingly coming under the spotlight on Wall Street (see also The Fearless Girl Beckons). The 2017 proxy season was no different. Activist investors, such as Arjuna Capital and Pax World Management, actively targeted Wall Street banks, encouraging them to tackle the gender pay gap.

What will the TCFD mean for Oil and Gas Producers?

Building on the momentum created by the “Aiming for A” resolutions and the Paris Agreement, the Task Force on Climate-related Financial Disclosures (TCFD) published its recommendations for disclosing climate-related risks in June. How will these new guidelines affect the oil and gas industry and can investors leverage them in their engagement efforts?

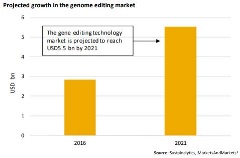

What ESG Issues will Investors Face as the Electric Vehicle Market Gears up?

On 2 July 2017, Elon Musk tweeted that the first Model 3 would be delivered by the end of the month and that Tesla plans to ramp up production to 20,000 units by December. The announcement is a strong indication that the electric vehicles (EVs) revolution may be approaching faster than expected, driven by a favorable combination of political, technological and market trends. This is certainly a positive development, however, even in the world of clean tech, environmental, social and governance (ESG) issues abound. Companies and investors alike will need to manage related risks carefully.

Are Subprime Auto Loans the Next Bubble?

Through the course of our research, we’ve seen a significant increase in media coverage surrounding the U.S. auto loan market. Headlines highlight an increase in delinquency and default rates, a prevalence of deep subprime auto loans, lower vehicle deliveries and higher inventories. Reminiscent of the financial crisis, many investors are asking whether this is the next bubble and what they can do to manage related ESG risks.

Sizing up the US withdrawal from the Paris Agreement

President Trump’s announcement last week that he will pull the US out of the Paris Agreement is unlikely to have any meaningful impact on clean energy transition. This is because the global pivot to renewable energy is increasingly being driven by economic fundamentals, not policy (an argument we made in our deep dive of the Paris Agreement in January 2016).

WannaCry: A Cybersecurity Wake Up Call

The recent Wanna, also called WannaCry, ransomware attack once again highlighted the importance of cybersecurity and protecting online data and systems. In our 10 for 2017 report, we argue that such attacks are likely to increase in frequency and intensity making it prudent for investors to integrate cybersecurity risk management into their investment decision making processes. Understanding these risks is crucial since most companies provide poor visibility into their ability to proactively manage such threats.

Dieselgate: Opening a New Era for the Auto Industry?

On 23 May 2017, German prosecutors raided Daimler AG’s offices in Stuttgart as part of their investigation into alleged emissions fraud. The company’s shares have since tumbled 4.3 percent. Daimler’s experience is the latest reminder that investing in clean technologies is money better spent than paying penalties for non-compliance in an increasingly stringent regulatory environment.