ESG Spotlight | Money laundering and tax evasion

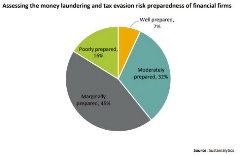

Policies to counteract money laundering and tax evasion activities have long been mandated by regulation, but a series of recent controversies, including Lux Leaks (2014), Panama Papers (2016) and Russian Laundromat (2017), has put banks’ programmes in these areas under unprecedented scrutiny.

Potential ESG Risks in the US Health Care Industry

The US health care industry is facing some uncertainty under the current administration. Recent news coverage focused primarily on the failed attempt to repeal the Affordable Care Act, but question marks related to deregulation and pricing remain. Investors will need to monitor developments closely to ensure they proactively manage emerging ESG risks.

Tobacco Mergers: Can You Buy the Brand but Leave the Health Liability?

Due to the success of anti-smoking campaigns and regulation, tobacco companies are increasingly struggling with a dwindling customer base. This has led to a wave of consolidation in an effort to maximize profits through industries of scale. As these behemoths gobble each other up and cigarette brands change hands, it leads investors to question what happens to the societal liabilities attached to them.

The Fearless Girl Beckons: Tracking Gender Diversity

The Fearless Girl stands in front of the Charging Bull, her hands on her waist, her stare strong and defiant. She challenges Wall Street’s bull, which has long symbolized strength and prosperity in a male-dominated corporate culture. She also is a poignant representation of the growing demand for greater gender diversity.

Palm Oil’s Evolving ESG Risk Profile: Can Issuers Cope?

The use of palm oil has become commonplace in packaged food and personal care products. This ubiquity is stimulating the rapid growth of the market. While this growth is creating several opportunities for investors, it is also exposing them to a growing number of ESG risks.

Waste Not, Want Not – Water Use in the Semiconductor Industry

This year’s theme for World Water Day is wastewater. It was aptly chosen given the United Nations’ prediction of a 55% increase in global water demand by 2050 (compared to 2000). To meet this demand, companies will need to manage (waste)water far more efficiently than they do today. The risk of failing to do so becomes concrete when you look at a water-intensive industry such as semiconductors.

#DeleteUber: The Changing Face of Consumer Boycotts?

In late January 2017, 200,000 Uber users deleted their accounts in just one week. Meanwhile, the company’s closest competitor, Lyft, surpassed Uber in the number of daily iOS downloads for the first time. This consumer action formed part of the #DeleteUber campaign on social media. Given the campaign’s impact, it is important to ask how it differs from more traditional consumer boycotts and what investors can learn from it.

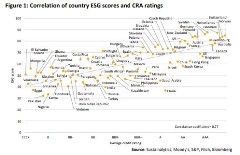

Can Country ESG Research Help You Identify Risks in Your Sovereign Bond Portfolio?

In recent years, we have seen a significant increase in the number of investors that integrate environmental, social and governance (ESG) considerations into their fixed income strategies. This is especially true when it comes to corporate bonds. The use of our Country Risk Research & Ratings in sovereign bond investments is however still comparatively new and clients often ask me how our research can support them.

10 for 2017: Investment Themes in a Changing World

In this year’s contribution to Sustainalytics’ 10 for series we present ten investment themes for investors to consider in 2017.For each theme, we describe the key drivers, identify companies with upside exposure and present a profile of a company that we consider to be particularly well-positioned in the market.

Why Responsible Investing is in our DNA

– Celebrating Sustainalytics’ 25th anniversary. This year Sustainalytics turns 25. It is an important event to celebrate, but, for me, the true value of such milestones lie in the fact that they give you pause to reflect. While Sustainalytics is a success story, it doesn’t mean we didn’t have some peaks and valleys. At any rate, I ask myself how we were able to create a company that has built responsible investing into its very DNA.

Real Estate Two Steps Forward, One Step Back

This report looks at the real estate sector, providing a in-depth analysis of the most material ESG issues it faces. The report leverages our ESG Ratings and Research combined with our Controversies Research to identify best practices, historical trends as well as the leaders and laggards in the sector.

Insurance Shedding light on new industry challenges

This report looks at the insurance sector, providing a in-depth analysis of the most material ESG issues it faces. . The report leverages our ESG Ratings and Research combined with our Controversies Research to identify best practices, historical trends as well as the leaders and laggards in the sector.

Precious Metals: Sustainability in a Rocky Environment

This report looks at the mining sector, providing a in-depth analysis of the most material ESG issues it faces. The report leverages our ESG Ratings and Research combined with our Controversies Research to identify best practices, historical trends as well as the leaders and laggards in the sector.

Household & Personal Products: Between Perception & Reality

This report looks at the Household & Personal Products sector, providing a in-depth analysis of the most material ESG issues it faces. The report leverages our ESG Ratings and Research combined with our Controversies Research to identify best practices, historical trends as well as the leaders and laggards in the sector.

Pharmaceuticals: Securing trust, Maintaining Profitability

This report looks at the pharmaceutical sector, providing a in-depth analysis of the most material ESG issues it faces. The report leverages our ESG Ratings and Research combined with our Controversies Research to identify best practices, historical trends as well as the leaders and laggards in the sector.

Aerospace & Defense Ready for Takeoff?

This report looks at the defense sector, providing a in-depth analysis of the most material ESG issues it faces. The report leverages our ESG Ratings and Research combined with our Controversies Research to identify best practices, historical trends as well as the leaders and laggards in the sector.

Utilities: The Great Transformation Begins

This report looks at the Utilities sector, providing a in-depth analysis of the most material ESG issues it faces. The report leverages our ESG Ratings and Research combined with our Controversies Research to identify best practices, historical trends as well as the leaders and laggards in the sector.

Banks – Like a Phoenix from the Ashes

This report looks at the Banking sector, providing a in-depth analysis of the most material ESG issues it faces. The report leverages our ESG Ratings and Research combined with our Controversies Research to identify best practices, historical trends as well as the leaders and laggards in the sector.