In today's changing global ESG regulatory landscape, institutional investors need reliable, transparent data seamlessly integrated into their workflows for efficient investment management and reporting.

Morningstar Sustainalytics' EU Taxonomy Solution provides comprehensive data for regulatory reporting, investment analysis, and strategic decision-making. This dataset helps you comply with ESG regulations, improves portfolio monitoring, and supports the creation of green investment products.

The EU Taxonomy is a classification tool that determines whether an economic activity is environmentally sustainable. It helps investors, companies, and policymakers make informed decisions by identifying activities that contribute substantially to environmental objectives, aiding the transition to a more sustainable economy.

In March 2018, the European Commission launched a 10-point EU Action Plan to leverage financial markets in addressing sustainability challenges, particularly those related to climate change.

The EU Taxonomy Regulation, a key part of the plan, sets clear definitions for "sustainable" business activities to protect investors from greenwashing. It defines six environmental objectives:

- Climate change mitigation

- Climate change adaptation

- Sustainable use and protection of water and marine resources

- Transition to a circular economy, waste prevention and recycling

- Pollution prevention and control

- Protection and restoration of biodiversity and ecosystems

It also outlines four conditions that an eligible economic activity must meet to qualify as environmentally sustainable and thus be Taxonomy-aligned:

A Four-Step Guide

Identify if the company engages in activities that could make a Substantial Contribution to the EU Taxonomy’s objectives.

We gather reported data across all six Taxonomy objectives from company disclosures and estimate involvement for around 11,000 non-reporting companies in climate change mitigation and adaptation activities, based on Climate Delegated Act and EU’s NACE Classification system.

Example

Construction of new buildings is an eligible activity in the EU Taxonomy. A company involved in this can potentially contribute to climate change mitigation or adaptation, provided it meets the stringent technical screening criteria outlined in the Climate Delegated Act.

Evaluate if the activity meets the “greenness” criteria as set out by the Technical Screening Criteria.

We collect Substantial Contribution data reported by companies or use proxies to determine the percentage of the company’s eligible revenues, capex, and opex that meets the “greenness” criteria.

Example

A company involved in the construction of new buildings must assess whether it complies with the technical screening criteria to claim Taxonomy alignment. For non-reporters, Morningstar Sustainalytics determines if the company’s activity is “green”, leveraging our Sustainable Activities Involvement Research.

Ensure the activity adheres to the Do No Significant Harm (DNSH) criteria for each of the other five objectives. These criteria are determined separately for each activity in the Delegated Acts.

We collect DNSH data reported by companies. For companies that do not report on EU Taxonomy, Morningstar Sustainalytics assesses compliance with the DNSH criteria using our existing Controversy Research as a proxy, tagging environmental incidents to related activities.

Example

A company involved in the construction of new buildings must meet the DNSH criteria for the other five objectives. For instance, it must comply with specific water use criteria for water appliances installed in buildings (related to Sustainable Use and Protection of Water and Marine Resources).

Verify that the company adheres to the Minimum Safeguards (MS), ensuring responsible operation and avoidance of negative societal impacts.

We collect reported MS data in companies’ EU Taxonomy disclosures. For companies that do not report on EU Taxonomy, we assess compliance with the Minimum Safeguards criteria using our market leading Global Standards Screening research.

Example

A company involved in the construction of new buildings must assess whether it complies with the technical screening criteria to claim Taxonomy alignment. For non-reporters, Morningstar Sustainalytics determines if the company’s activity is “green”, leveraging our Sustainable Activities Involvement Research.

Timely and Precise Data CollectionCollection of reported data for companies covered by NFRD/CSRD and voluntary reporters, facilitating accurate regulatory reporting. | |

Regulatory Template-Based StructureA product structure that is based on regulatory templates ensuring access to all required data to fulfill requirements:

| |

Multi-level DataThree levels of data which include company, objective and activity level insights, allowing for more in-depth analysis and supporting entity level reporting needs. | |

Robust Quality Controls and Issuer Feedback ProcessEnabling investors to use the research with confidence for regulatory reporting purposes. | |

Granular ESG Estimates for 11,000+ CompaniesLeveraging data from Morningstar Sustainalytics’ market-leading ESG research products. | |

Portfolio Aggregation and Reporting ToolsOffering an end-to-end solution for regulatory reporting. |

Regulatory Reporting

Use EU Taxonomy data to report on Taxonomy alignment of all Article 8 and 9 funds and at entity level for NFRD/CSRD companies, ensuring compliance with regulatory requirements.

Investment Strategy Definition

Incorporate EU Taxonomy considerations into investment strategy definitions to align with the intentions, objectives and preferences of end investors.

Investment Selection and Construction

Once the investment objective is set, incorporate Taxonomy considerations during the investment selection and product construction process to ensure exposure is aligned with intention.

Portfolio Monitoring and Reporting

Integrate Taxonomy data into portfolio and risk management processes to ensure ongoing exposure aligns with initially defined thresholds.

Active Ownership

Engage directly with portfolio companies to ensure certain factors align with the Taxonomy.

Sustainability Preference Consideration

Use Taxonomy insights to consider client’s ‘sustainability preferences’ as part of “suitability assessment” in financial advice.

Index Creation

Develop benchmarks with ESG factors, such as Taxonomy alignment, for passive investment products.

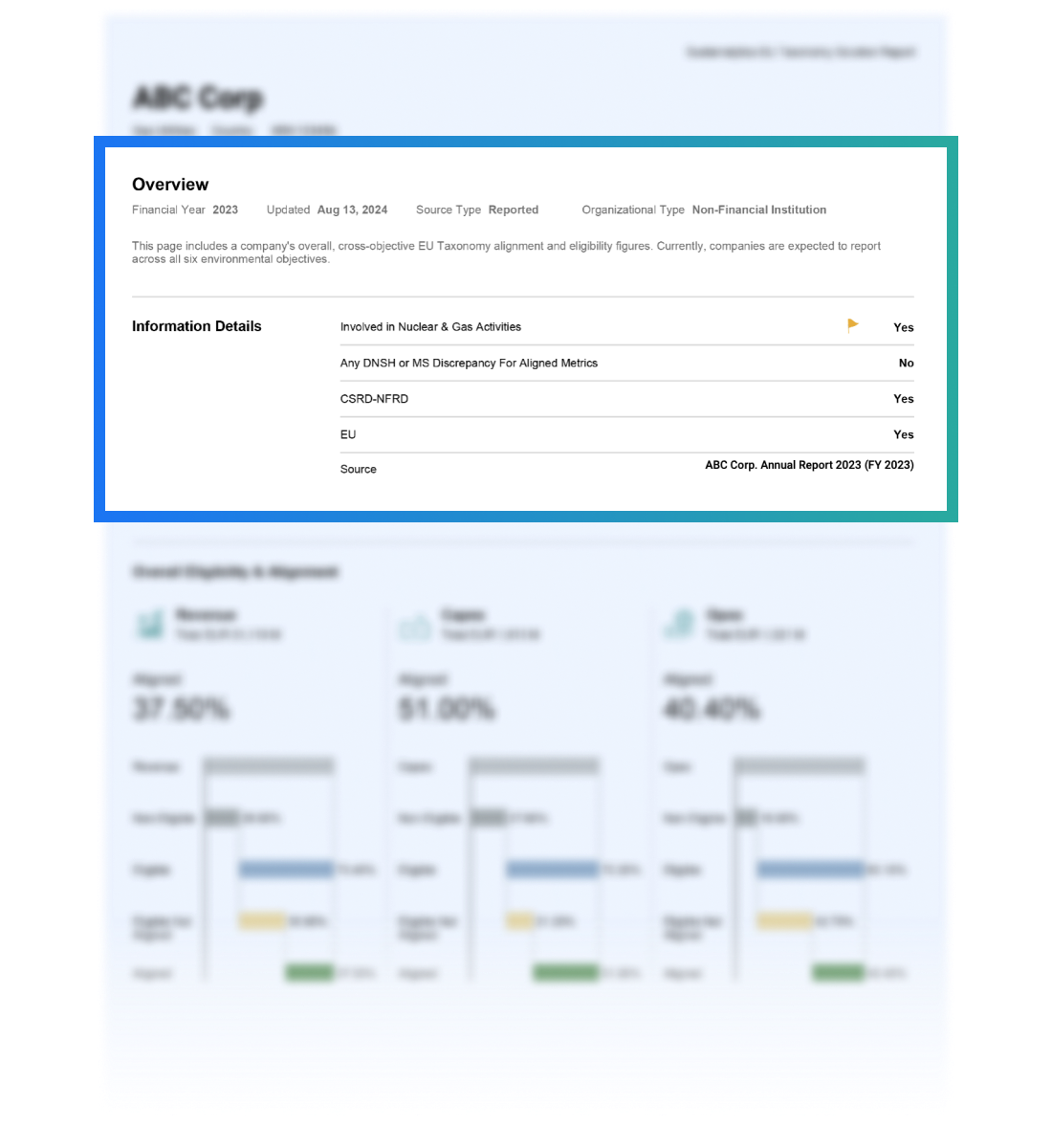

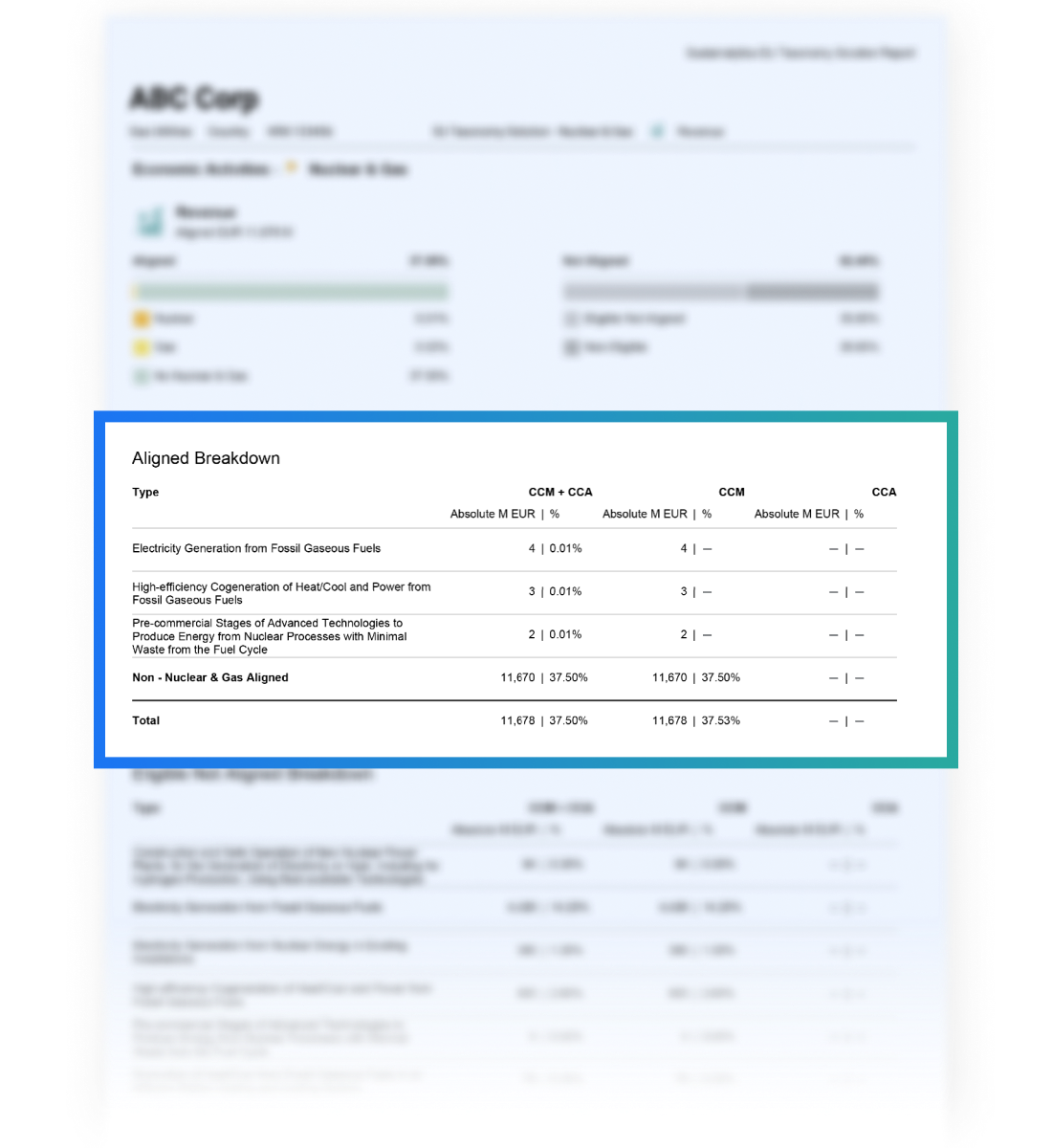

Company details, including the CSRD-NFRD flag.

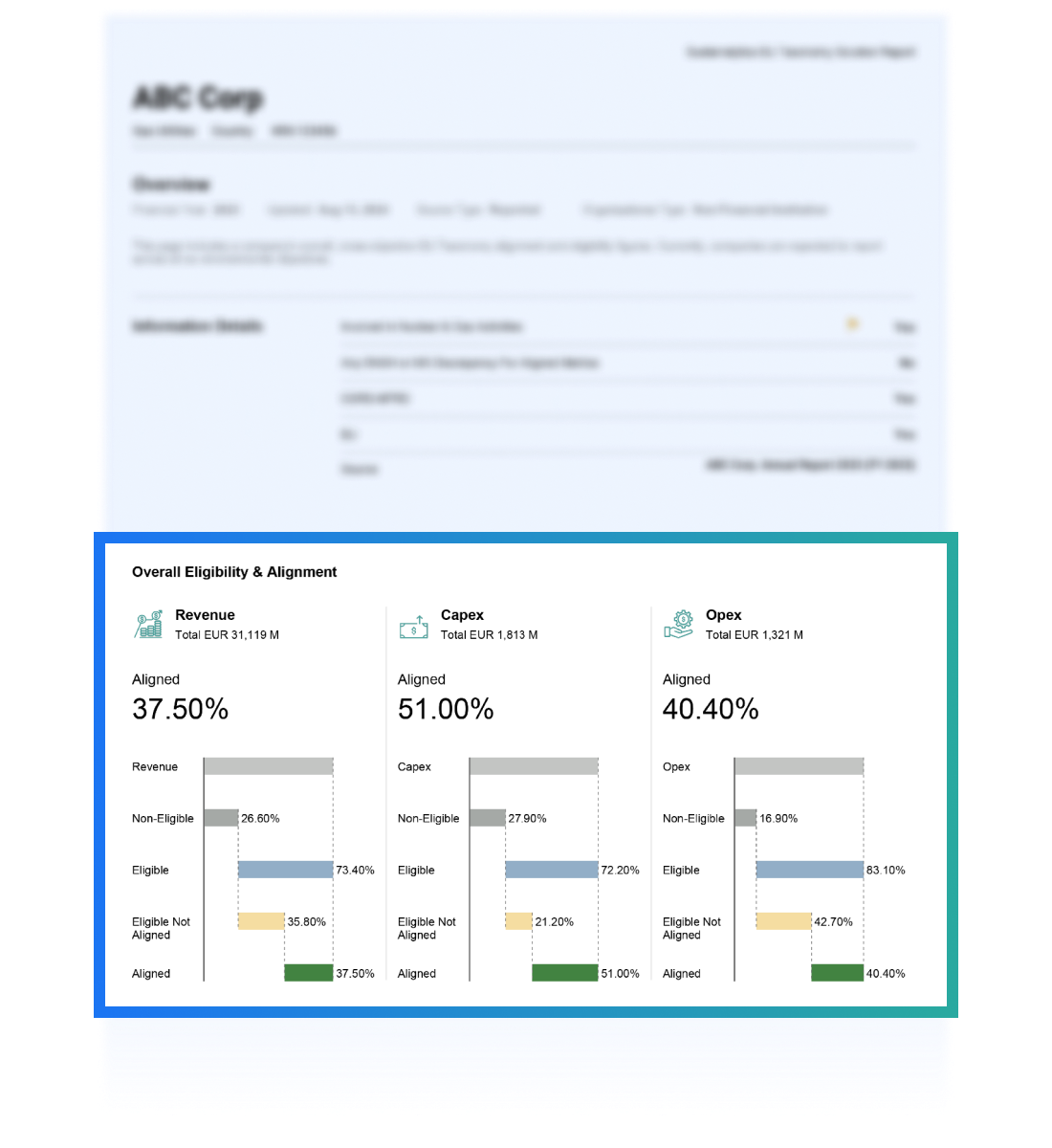

A company’s alignment and eligibility for revenue, capex and opex across all six objectives.

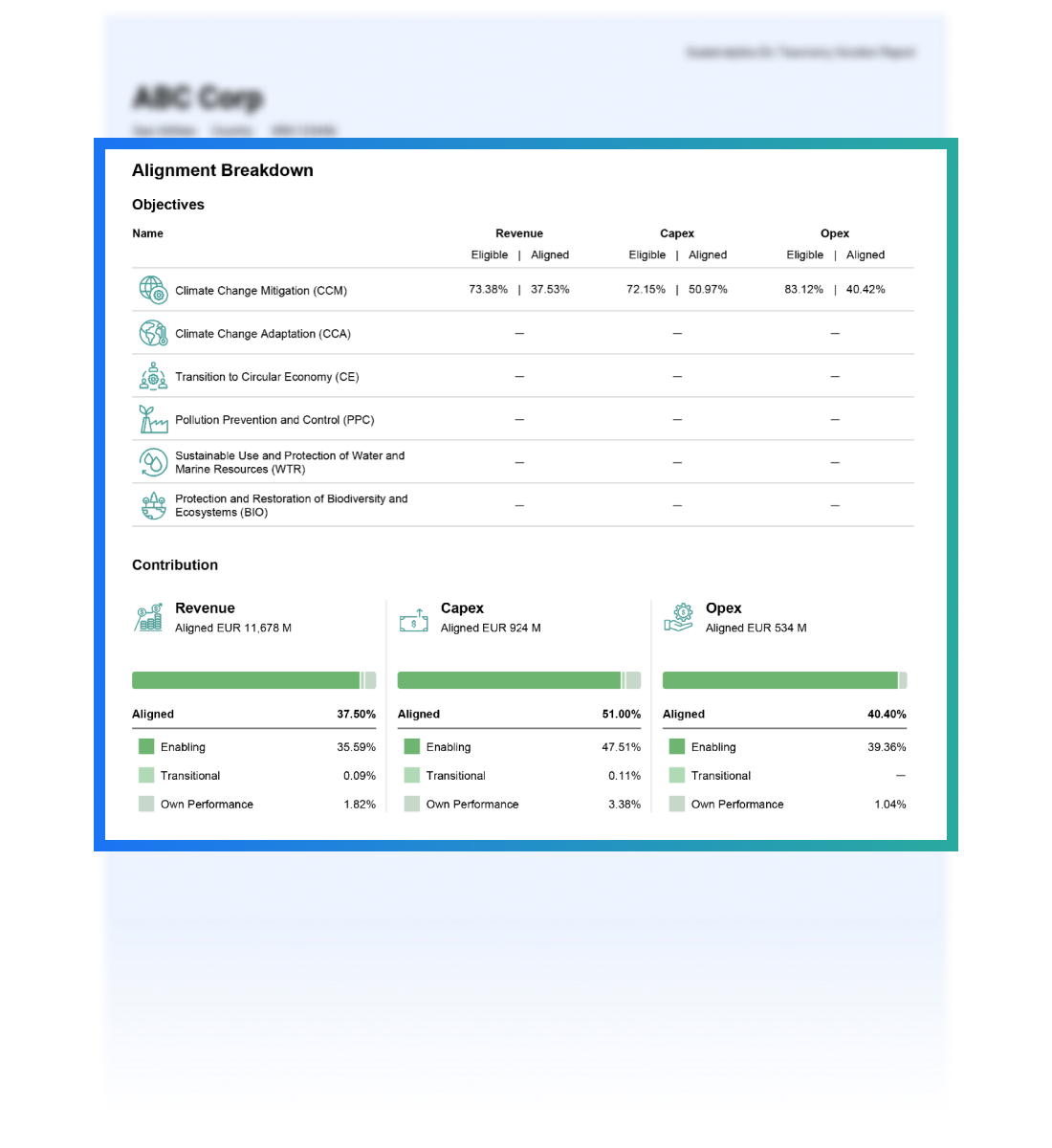

A company’s Taxonomy alignment breakdown is shown per objective. Breakdowns for Substantial Contribution type and Nuclear and Gas involvement are provided, in line with regulatory templates.

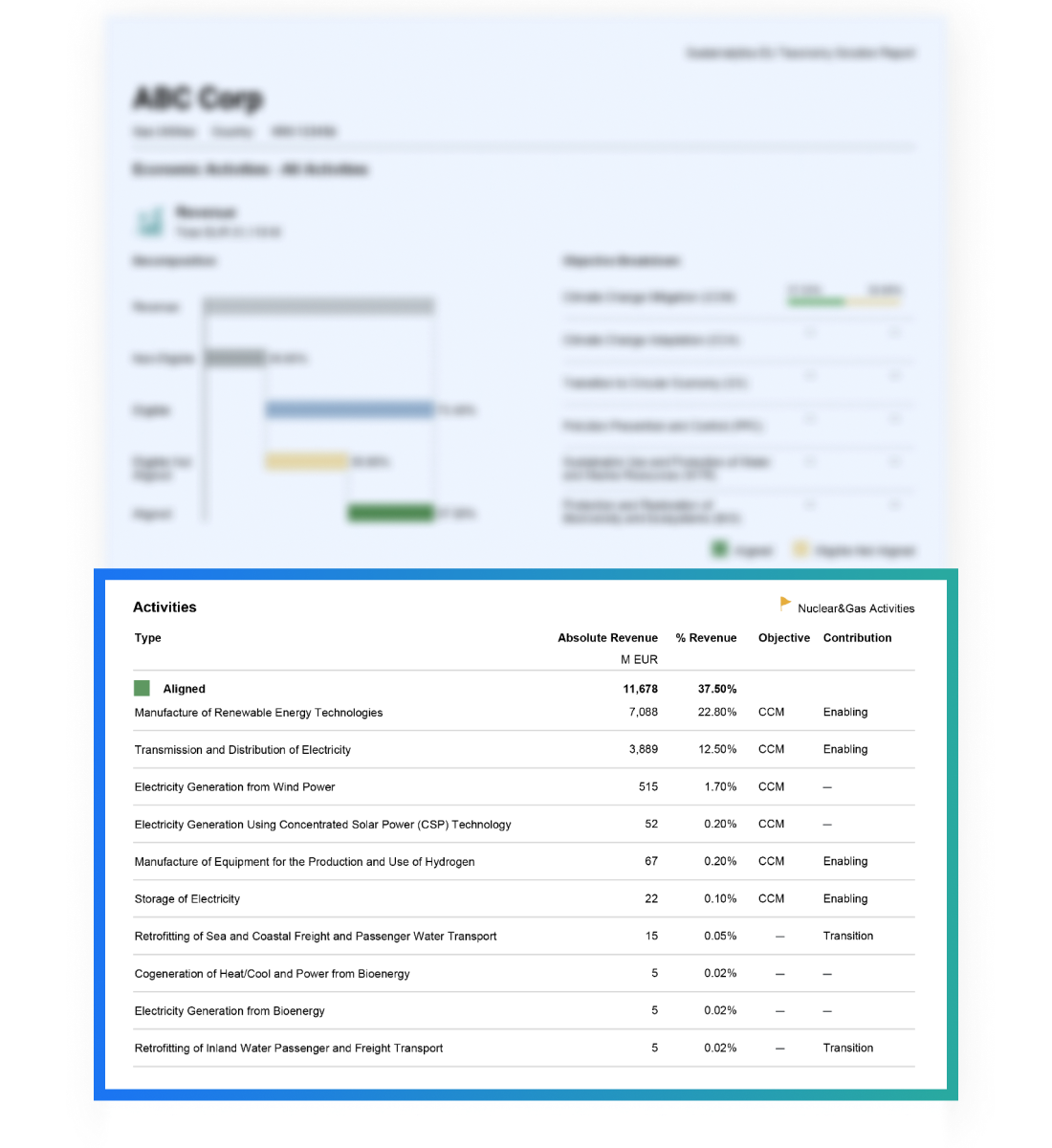

Detailed activity level information is provided, indicating the amount and percentage of eligible and aligned revenues, capex and opex per activity. Our design is fully aligned with regulatory templates to optimize user experience.

| EU Sustainable Finance Action Plan Solutions SuiteLearn More ❯ |

| SFDR PAI Data SolutionLearn More ❯ |

A Single Market Standard

Consistent approach to ESG assessments across the investment spectrum.

Award-Winning Research and Data

Firm recognized as Best ESG Research and Data Provider by Environmental Finance and Investment Week.

End-to-End ESG Solutions

ESG products and services that serve the entire investment value chain.

30 Years of ESG Expertise

800+ ESG research analysts across our global offices.

A Leading SPO Provider

As recognized by Environmental Finance and the Climate Bonds Initiative.