Sustainalytics is the world’s largest provider of second-party opinions (SPOs), having successfully completed over a 1000 projects for green, social, sustainability and KPI-linked bonds and loans for issuers and their underwriters. 1

Sustainalytics’ SPO service has won multiple awards and continues to be an industry leader. Our first SPO published in 2014 was for a sustainability bond framework, followed by our first Green Bond SPO and Social Bond SPO in early 2015.

Since then, the sustainable bond market continue to experienced explosive growth. The Green, social, sustainability and sustainability-linked bond market crossed reached the $1.03 Trillion mark in 2021 (over 69% higher than 2020). Expert predict the market to reach $1.5 trillion in 2022. 2 Of which sustainability-linked bond issuance, is forecast to more than double to $200 billion in 2022 according to environmental finance.

Organizations are leveraging sustainable finance instruments to fund related projects, meet their own sustainability targets, and advance their corporate sustainability profiles.

Set your sustainability-linked bond apart with a second-party opinion from Sustainalytics.

A New Milestone: Sustainalytics 1000th Second-Party Opinion

By the Numbers

5 Reasons Why You Need a Sustainalytics SPO for Your sustainability-linked bond

Independent reviews have become market best practice with approximately two-thirds of issuers using SPOs to provide investors with assurance that use of proceeds are credible and impactful 3. Knowing that your sustainability-linked bond framework is aligned to market expectations has become a critical part of issuing a bond.

Meet Market Expectations

An SPO assesses the alignment of the bond’s framework with recognized International Capital Market Association’s (ICMA) Principles.

Gain Investors’ Confidence

A Sustainalytics SPO provides additional assurance on the credibility of the issuer and the issuance. With over 30 years of experience, Sustainalytics’ award-winning data and research is trusted by investors worldwide.

Enhance Awareness of Environmental or Social Issues

Our second-party opinion service will help clearly highlight key aspects of your thematic bond and sustainability strategy to investors and other stakeholders.

Diversify Issuer Investor Base

The demand for thematic bonds is high and green, social and sustainability bonds tend to be oversubscribed. Unlike providers who limit their opinions to niche products or geographic areas, Sustainalytics’ 400+ global analysts have depth of experience on diverse use of proceeds categories.

Assess the Use of Proceeds

An SPO assesses the impact of projects to be financed with the green, social, or sustainable bond’s proceeds—giving your company and investors confidence that your projects are moving the needle on climate action.

Published Projects

Recent examples of sustainable bond reports: Telus, Koninklijke Ahold Delhaize, and Government of Chile..

Explore some of our 1000+ published opinions for bonds issued by leading multinational corporations to financial institutions, non-profits, and governments.

Bridge the Gap Between Corporate Sustainability and Finance

The ever-changing sustainable finance landscape can seem overwhelming for companies and issuers as financial markets increasingly allocate growing amounts of capital to finance climate change mitigation and the transition a low carbon economy. Read insights on recent progress made by organizations bridging the gap between sustainability and finance and gain a better understanding of key sustainable finance concepts.

What’s Next?

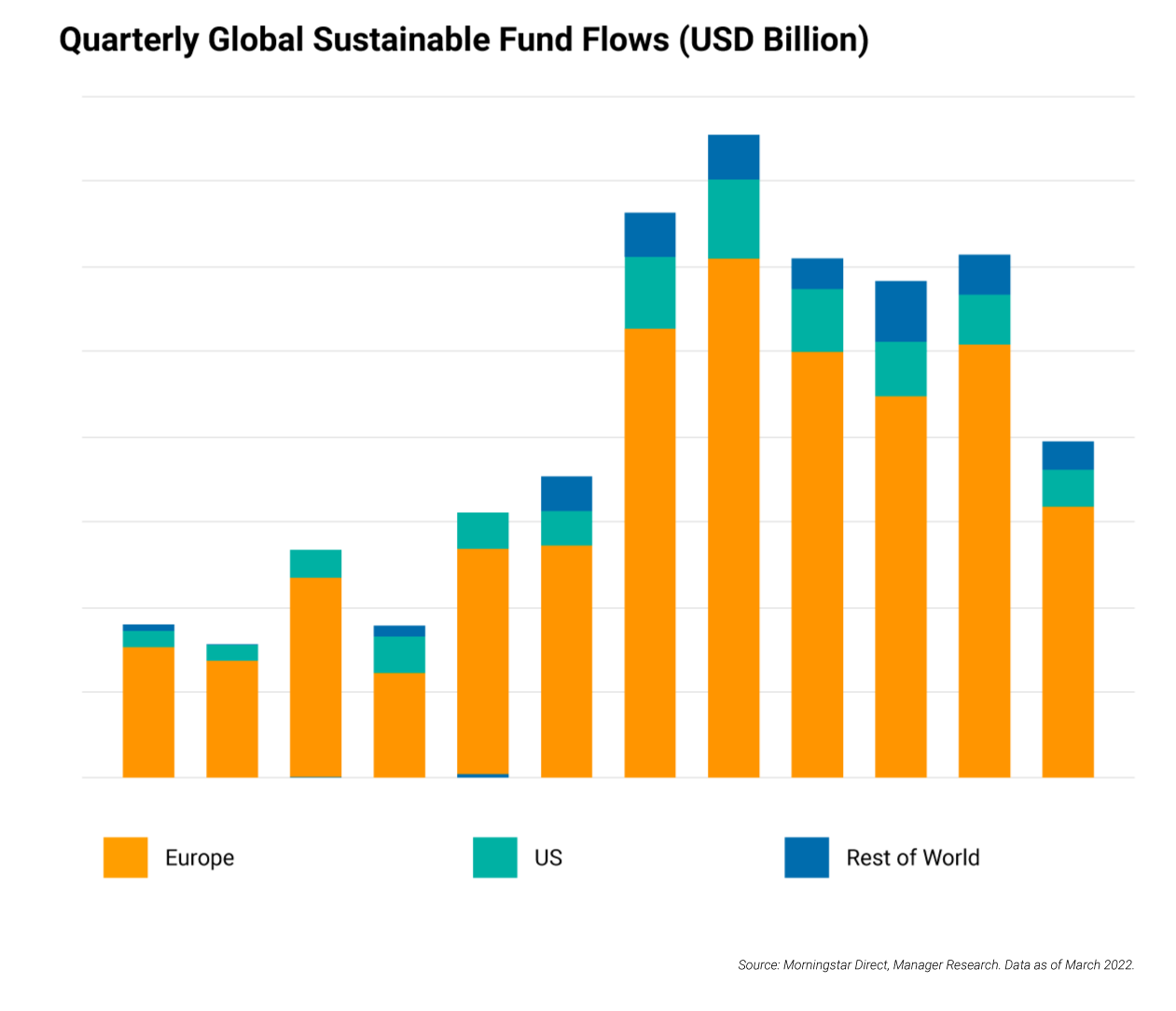

The sustainable finance market has demonstrated its resilience and staying power through an unprecedented socio-economic upheaval.

While green bonds continue to lead in terms of total number and volume of deals, we’ve observed a proportional decrease relative to other financial instruments. Notably, the share of Sustainalytics SPOs dedicated to green bonds dropped from 58% to 48% of our total opinions delivered from 2020 to 2021. This trend speaks primarily to the rise in sustainability-linked instruments. That said, in the wake of COP26, we’ve observed increased financing related to net-zero commitments from sovereign and corporate issuers. The regulatory environment continues to evolve, most notably by way of the EU Sustainable Finance Action Plan, whose regulatory measures for financial institutions and corporates will be far-reaching beyond European borders.

Learn more about our Second-Party Opinion Services and contact us to get started.

Join Our Weekly Second-Party Opinion Update

Subscribe to receive weekly updates from Sustainalytics’ recently published opinion projects and services.

.png?sfvrsn=a278e6b2_1)