Our enhanced approach goes beyond labels to deliver clear, comparable insights into the expected contributions of your investments, enabling you to mitigate the risks of greenwashing and meet evolving transparency demands. By partnering with Morningstar Sustainalytics, you can attract capital, build trust, and lead the way in a rapidly evolving, impact-driven market.

Our nuanced assessment goes beyond superficial labels so you can be confident about your impact narrative and position your framework as a credible leader in the sustainable finance space. Assessment from a trusted partner can help you meet evolving transparency demands, mitigate the risk of greenwashing, and attract the capital necessary to drive long-term sustainability.

Sustainability Contribution SignalOffering granular insights on real-world impact potential with a science-based approach. | |

4-Level SystemCombines environmental and social contribution with avoidance of harm criteria, providing a structured and transparent approach that helps mitigate greenwashing concerns. | |

Recognition of Transition Plans and CommitmentsAssessment of short-term measures and long-term commitment to a credible transition pathway. | |

Context Aware AssessmentRecognizing companies operating in hard-to-abate sectors and their unique challenges. | |

Impact Over LabelsWe offer a deep look at a framework’s intended contributions, whether environmental or social, across a comprehensive range of projects and activities. | |

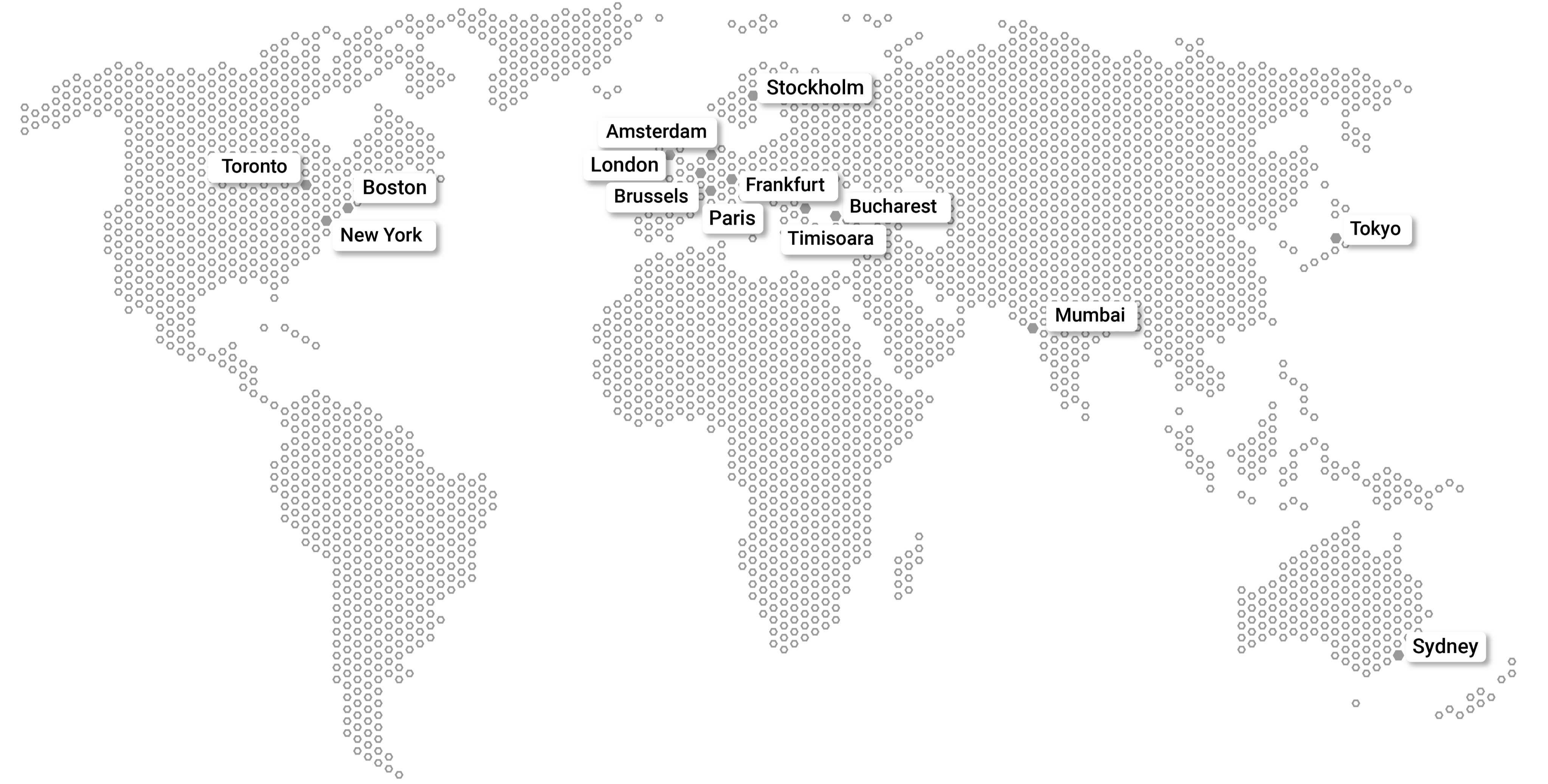

Research Team That Understands Your ContextOur research analysts are experienced in all aspects of sustainable fixed income and the regional context in which you operate. | |

Quality of EngagementOur iterative process goes above and beyond a simple tick-box exercise. |

Gain Recognition for Your Transition Journey

Trusted by Investors and Issuers

Attract a Wide Range of Investors

Mitigate Greenwashing Concerns

Build Confidence Beyond Labels

Benefit From Our Deep Understanding of Responsible Investors

Connect With Our Experts

Climate Bond Verification

Leading companies are assessing climate risks and mitigation roles. Climate bonds finance projects aligned with the Paris Agreement. As an approved external reviewer, Sustainalytics has completed more climate bond verifications than any other external reviewer in the market for 2020.

Pre-issuance verification

Ensure projects and assets meet sector eligibility criteria and internal controls manage bond proceeds.

Post-issuance verification

Provide issuers with a report on compliance with the Climate Bonds Standard's post-issuance requirements.

Ongoing Verification

Issuers must report annually on their bond to comply with the Climate Bonds Standard's certification requirements.

EU Taxonomy

Sustainalytics allows issuers to include an assessment in their second-party Opinion that aligns their bond or loan framework with the EU Taxonomy. This addition assures the market and investors of compliance with the EU's six environmental objectives, enhancing confidence during issuance.

Sustainalytics’ assessment considers the following general requirements for a bond framework’s alignment with the EU taxonomy:

Why Sustainalytics?

A Single Market Standard

Consistent approach to ESG assessments across the investment spectrum.

Award-Winning Research and Data

Firm recognized as Best ESG Research and Data Provider by Environmental Finance and Investment Week.

End-to-End ESG Solutions

ESG products and services that serve the entire investment value chain.

30 Years of ESG Expertise

800+ ESG research analysts across our global offices.

A Leading SPO Provider

As recognized by Environmental Finance and the Climate Bonds Initiative.