Gaining Ground: Corporate Progress on the Ceres roadmap for Sustainability

This report, Gaining Ground: Corporate Progress on the Ceres Roadmap for Sustainability, evaluates how well 613 of the largest, publicly traded U.S. companies are integrating sustainability into their business systems and decision-making. The report— a collaboration between Ceres and Sustainalytics—assesses corporate progress across the four strategic areas first outlined in 2010 in the Ceres Roadmap for Sustainability: Governance, Stakeholder Engagement, Disclosure and Performance.

Combatting Child Labour: Investor expectations and corporate good practice

GES has engaged the cocoa industry for many years to increase its effort in tackling the issue of child labour. As a part of its long-term engagement, GES published its second public report on the issue, including investor expectations and a corporate benchmark of leading cocoa and chocolate companies.

ESG Transparency Poland (English Report)

Since 2012, GES together with the Polish Association of Listed Companies, a self-government organization of companies listed on the Warsaw Stock Exchange, has been involved in an educational project ESG analysis of companies in Poland aimed at increasing disclosure and transparency of reporting on non-financial indicators.

Sustainable Banking Insights

An increasing number of financial institutions integrate sustainability considerations such as environment, social and governance factors into their investment decisions and product development. Increased customer awareness, regulations, and growing evidence of the long-term benefits of considering sustainability in investment decisions has led to a significant growth in the sustainable finance field.

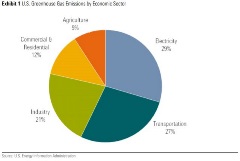

Nuclear Power and ESG: Can They Play Together?

Nuclear power in particular can be a controversial and confusing topic with respect to ESG factors. Sustainalytics, a leading global ESG and corporate governance analytics firm, has joined Morningstar Research Services to present a comprehensive ESG analysis of nuclear power, including a look at carbon emissions intensity, waste management, operational management, public safety, worker safety, and regulatory oversight.

Climate Week’s Financing a Greener Future

The first half of 2020 saw $200bn in sustainable bonds issued globally with green bonds accounting for nearly half of that. As more companies commit to achieving net-zero emissions and as the world shifts to a low carbon economy, the CEO Investor Forum and Sustainalytics welcome industry experts to weigh in on the state of the sustainable finance market during this one-hour virtual event.

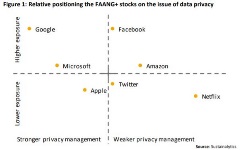

Managing data privacy risk: comparing the FAANG+ stocks

Collecting and processing personal data has become one of the most significant drivers of financial value in today’s economy. But as the upside of personal data grows, so too does the downside risk associated with data security, management and privacy.

Taking responsibility through the consideration of ESG factors and Global Compact Principles

Placing its clients’ interests centre stage, ABN AMRO understands the importance of delivering optimum service and offering transparent and simple products, while remaining at the forefront of technological developments and innovative solutions for client convenience. As part of its fiduciary duty and as a bank that commits to the United Nations-supported Principles for Responsible Investment, ABN AMRO has a detailed plan for ESG integration, engagement and sustainable investing.

Tomorrow's Board

The world is changing faster than it ever has. As a result, companies are facing increasingly complex and numerous challenges. They need to adapt faster, and in this process, the board has a crucial role to play. A new vision of the board is needed to help start a process today that will result in them being better prepared for tomorrow’s challenges.

Preparing for a sustainable future through ESG investment and engagement

ING Wholesale Banking (WB) is the commercial banking business of ING Bank N.V. Using a forward-looking financing approach that incorporates environmental, social and governance (ESG) considerations, ING WB provides banking services for large, multinational corporate clients, banks, insurance companies and other institutional investors.

Investor’s Guidance on Children’s Rights Integration

To establish how, and to what extent, investors are considering children’s rights in their policies and practices, GES also worked with the Global Child Forum, a Swedish not-for-profit foundation, to survey asset owner PRI signatories in 2014, 2015 and 2017.

Shipbreaking: Clean Shipping in Deep Water

Cleaner shipping has been a trending topic particularly since the International Maritime Organization (IMO) declared that 2020 will mark the “beginning of a decade of action and delivery” for the shipping industry.[i] A key approach to cleaner shipping is for companies to renew their fleet with more environmental-friendly vessels. However, this approach triggers an obsolescence of older vessels and increases shipbreaking activity. In Sustainalytics’ 10 for 2020 report, we mention the issue of shipping practices with large environmental impacts including shipbreaking practices which we will explore more in depth in this article.

Chilean Aquaculture: Expansion into Troubled Waters?

In November 2019, as part of the Sustainable Seafood Engagement, Sustainalytics visited Chile to learn more about the country’s rapidly growing aquaculture industry. Commercial salmon farming has developed quickly in Chile over the past two decades, and today the country is the second largest producer of seafood in the world. Although salmon is not a native species to Chile, the climate in the southern part of the country (zones 10 and 11) offers excellent conditions for farming activities. Farmed salmon now represents the country’s second largest export and the industry provides thousands of jobs for people living in some of Chile’s most remote communities.[i] Despite this economic success story, the industry also faces environmental and social challenges which may cause investor risk. These risks may become more pronounced in the future, as the sector now looks to expand deeper into biodiversity hotspots.

Infographic - Creating Impact Through Thematic Investing

In this year’s edition of our 10 for series, we put an environmental, social and governance (ESG) lens on 10 investment themes that may offer investors an opportunity to create a positive social and environmental impact through the equity market. The trends we identify are driven by corporate initiatives to scale new technologies, improve social conditions, conserve ecosystems and mitigate climate change.

f6f40ef6-31ad-42df-b35f-128241ea958e.tmb-small.png?Culture=en&sfvrsn=3c436c0f_2)

.tmb-thumbnl_rc.png?Culture=en&sfvrsn=72dd1885_2)