Over the past decade, the world has made progress in reducing the gender gap in education, health, economic resources and political participation.1 Some countries, however, are still lagging—including Japan.

While Japan is placed as one of the most developed economies in the world (ranking 3rd in GDP2), the country ranks 120th out of 156 countries in the World Economic Forum’s 2021 gender gap rankings. It is the lowest-ranked among G7 countries and the third lowest rank in the East Asia and Pacific region (Table 1). One of the factors leading to this low ranking is its poor performance in economic participation and opportunity due to a “low share of women in senior roles (14.7%), even though 72% of Japanese women are in the labour force.”

Gender Equality Schemes and Challenges in the Japanese Workforce

Since putting the Act on Ensuring Equal Opportunities for and Treatment of Men and Women in Employment into practice in 1985, Japan has launched multiple regulations and schemes that promote equal opportunities and women’s participation and advancement in the workplace. One main government scheme is the Fifth Basic Plan for Gender Equality. It sets targets for companies to achieve by 2025 regarding women’s representation across the workforce to expand women’s participation in decision-making processes.3 These targets for the private sector include: 30% women’s representation at the section chief level (18.9% in 2019); 18% at the director level (11.4% in 2019); and 12% at the department manager level (6.9% in 2019). Additionally, there is a target to increase women’s representation at executive levels (including directors, auditors, executive officers, executive managing officers and officers equivalent to them) at listed companies to 12% by 2022.

In Japan, the share of women in senior and middle management positions in 2019 was only 14.5%. Looking at other G7 countries, the share is typically close to or above 30% (40.7% in the United States, 36.8% in the United Kingdom, 35.1% in Canada, 34.6% in France, 29.4% in Germany and 23.3% in Italy).4 This demonstrates that Japan’s 2025 targets are behind even the current status in most other G7 countries and may not be ambitious enough. However, Japan failed to meet its most recent target to increase the percentage of women in leadership positions in all areas of society to at least 30% by 2020 (set in 2003). This lack of development indicates the real difficulties Japan is experiencing in expanding women’s representation in leadership.

Board Diversity in Japanese Companies in the Material Risk Engagement Program

From the investor perspective, diversity is a material issue. It creates a more dynamic and innovative work environment, ensures that the company better reflects the customer base and societal demographics, and provides a bigger talent pool for recruitment. Business tends to be more successful with strong diversity performance.

Sustainalytics’ Material Risk Engagement (MRE) program typically flags a lack of diversity as a management gap, and we encourage engaged companies to develop initiatives that promote women’s advancement. While there should be gender diversity across the workforce, a company’s commitment to diversity must come from the top, including the board level,

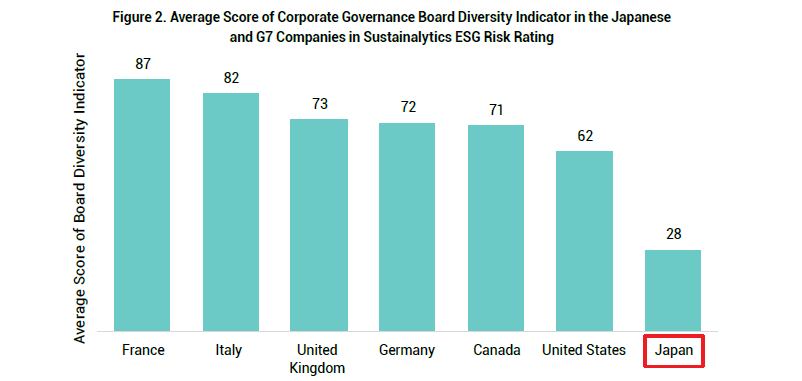

Sustainalytics’ ESG Risk Ratings solution has a specific indicator that evaluates gender diversity, including at the the board level. When we benchmark companies in the MRE target group (which focuses on companies in the High or Severe Risk category) we can see much less board diversity within Japanese companies (Figure 2).

Source: Sustainalytics

Engagement on Gender Diversity with Japanese Companies

Sustainalytics’ risk management-focused engagement currently targets approximately 50 Japanese companies, mostly large cap names in industries such as chemicals, machinery, utilities, transport, conglomerates, and oil & gas. When looking at our Risk Rating for these Japanese companies, all are exposed to high corporate governance risk, 61% are assessed to have weak management of this material ESG issue, and 31% have average management. Looking further at our board diversity indicator, 89% of these Japanese companies have a Weak or Average score (50 or below in Figure 3).

Source: Sustainalytics

Source: Sustainalytics

Our engagements are focused on programmes and targets to increase the percentage of women on the board, executive management, and senior positions. Among the companies Sustainalytics has begun engagement dialogues with, 83% answered that they have a target to increase the percentage of female employees in senior positions. Comparatively, 17% have a target for executive management, and none have a target for the board (Figure 4).

Interestingly, among those who answered they have a target for female employees in senior positions (83%), only 13% have a target for executive management, and none of them have a target for the board. Moreover, among those who answered that they have a target for the executive management (17%), a third does not have a target for female employees in senior positions. Six percent of the companies in the research answered they have no targets for board, executive management, or senior positions. Pushing the companies about the lack of targets, the typical response is that the companies are aware of the demand from society to promote more women in leadership, but people should be recruited and promoted due to knowledge and experience and not because of gender.

Through our MRE engagements, Sustainalytics promotes that companies must increase the number of women in leadership positions, especially on the board. We engage with target companies to encourage the development of policies, targets, and plans, and we encourage them to develop internal candidates and ensure recruitment practices that aim for diversity. These actions improve corporate governance and overall ESG initiatives and mitigate relevant risks, including the lack of emerging top-level talent.

Closing the gender gap in Japan will take some time, but it is important for the prosperity of Japanese companies and the country. We will continue engaging on this topic to ensure top-level awareness and a commitment to change.

Sources:

[1] United Nations, “Goal 5: Achieve gender equality and empower all women and girls”, (2021), at: https://www.un.org/sustainabledevelopment/gender-equality/

[2] The World Bank Group, “Gross domestic product 2020”, (2021), at: https://databank.worldbank.org/data/download/GDP.pdf

[3] Cabinet Office, Government of Japan, “The Fifth Basic Plan for Gender Equality (Overview)”, (2021), at: https://www.gender.go.jp/english_contents/about_danjo/whitepaper/pdf/5th_bpg.pdf

[4] International Labour Office, “Women in managerial and leadership positions in the G20”, (2021), at: https://www.ilo.org/wcmsp5/groups/public/---dgreports/---ddg_p/documents/publication/wcms_762098.pdf