The world is aching for a return to normality after a year (and still counting) of news bulletins being dominated by the COVID-19 pandemic; Earth Day 2021 should serve as a stark reminder that we cannot go back to business-as-usual. We must address the vast environmental challenges facing humanity, such as climate change, loss of biodiversity, extreme weather and issues related to water.

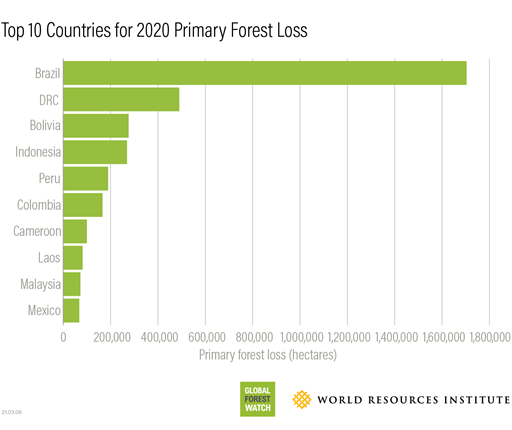

Issues related to land use and biodiversity, deforestation in particular, have become increasingly prominent over the past few years—exacerbated by reports of widespread and destructive wildfires taking place in Indonesia and Brazil. Reports highlight the scale of deforestation and the implications of biodiversity loss on global ecosystems and the global food system that affect increasing global populations. According to the Food and Agriculture Organization of the United Nations (FAO), since 1990, 178 million hectares of forest have been lost, which is roughly the size of Libya.[1] The Intergovernmental Science-Policy Platform on Biodiversity and Ecosystem Services (IPBES) reported in 2019 noted that the rate of species extinction is accelerating alarmingly, which will have severe consequences on the global economy, food security, and health.[2] According to findings by Global Forest Watch, primary rainforest destruction increased 12% in 2020 compared to 2019. Primary forest loss in 2020 was by far the greatest in Brazil. Primary forest loss in Brazil increased by 25% in 2020 compared to 2019, with the majority of the primary forest loss taking place in the Amazon.[3]

Source: Global Forest Watch, World Resources Institute (https://blog.globalforestwatch.org/data-and-research/global-tree-cover-loss-data-2020/)

Moreover, deforestation can lead to more infectious diseases in humans, such as the Nipah and Lassa viruses.[4] Deforestation and biodiversity loss have also been linked to the COVID-19 pandemic, severely impacting people’s lives around the world. [5]

Companies, consumers, investors, and regulators seem are also increasingly taking note of issues related to land use and biodiversity, and the impact and risks involved. In February 2021, in a 600-page report commissioned by the Treasury of the United Kingdom, Prof Sir Partha Dasgupta stated that a new way of accounting GDP is needed, one that includes the depletion of resources, to prevent the collapse of global ecosystems that the world depends on.[6] Companies have become more aware of how these issues can impact their business and are more closely scrutinizing their supply chains regarding deforestation and biodiversity loss, for example, satellite monitoring.

Meanwhile, consumers are slowly waking up to this issue and are pressuring companies and governments to act, for example, by demanding deforestation-free products. Investors are becoming more aware of the long-term related risks, such as decreased agricultural yields due to depleted soils, regulatory risks, stranded assets, supply chain disruptions and reputational fallout. Finally, governments in the coming year(s) are expected to put forward regulations that will address deforestation in relation to imported commodities. For example, the United Kingdom has proposed a law requiring companies to demonstrate that their products and supply lines are free from illegal deforestation[7], with the European Union expected to draft similar regulation in the future. In terms of commodities responsible for the bulk of forest replacement, seven agricultural commodities stand out; cattle, oil palm, soy, cocoa, rubber, coffee and plantation wood fiber. Between 2001 and 2015, land use for cattle pastures accounted for 41.5 million hectares of deforestation, followed by oil palm (10.5 million hectares) and soy (8.2 million hectares).[8]

There is much variance in the degree to which companies are managing issues related to deforestation and biodiversity. One company that stands out for its strong policies and programs related to tackling deforestation in its supply chain is Swiss chocolate manufacturer Barry Callebaut. The company sources no less than a fourth of global cacao production. Its Forever Chocolate strategy launched in 2016, has set 2025 targets to achieve 100% sustainable ingredients for all its products. Barry issued a deforestation policy in 2020, showcasing its commitments to address the issue, and published a heat map providing an overview of the ingredients linked with deforestation and their origins.

Investors can also influence companies through active ownership. Via efforts of a Sustainalytics Material Risk Engagement in 2020, Sime Darby Plantations improved its ESG Risk Ratings score, moving into the top 40% of its industry. Along with other palm oil producers, the company has committed to the Sustainable Palm Oil Manifesto, which sets higher standards for growers, traders, end-users, and other stakeholders, in addition to the Roundtable for Sustainable Palm Oil Principles and Criteria.

With the ongoing growth in ESG investing, it is expected that interest and awareness regarding issues of deforestation and biodiversity will continue to increase among investors. And rightly so, given the reports on the decline of the Earth’s biodiversity and forests and the knock-on effects, this will have on the global economy, food system, and climate. Shareholders can play a role in stimulating better management of deforestation and biodiversity issues, for instance, by engaging and voting, or through divesting from companies that are responsible for the destruction of forests and biodiversity. Whereas some investors have already realized its importance, many have yet to adjust strategies addressing the risks associated with deforestation and biodiversity. [9] Like the companies exposed to these issues, either through their operations or supply chains, investors need to be aware of these considerations and adjust accordingly.

Sources:

[4] https://www.nationalgeographic.com/science/2019/11/deforestation-leading-to-more-infectious-diseases-in-humans/

[6] https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/962785/The_Economics_of_Biodiversity_The_Dasgupta_Review_Full_Report.pdf

Recent Content

DEI Rollbacks: Impact on ESG Risk Ratings and Broader Implications for Investors

This article covers how not all reported rollbacks in diversity, equity, and inclusion (DEI) initiatives will have the same impact. Due to the relatively low weight of DEI in Sustainalytics’ ESG Risk Rating, we do not anticipate significant changes to overall ratings.

Industrial-Scale Decarbonization in the EU: Stewardship Field Notes From Germany, France and Spain

This article covers how Morningstar Sustainalytics’ Stewardship Team embarked on a field trip in November 2024 to learn how EU industry leaders are navigating the complex challenges of the energy transition.