Since the publication of the European Commission’s new sustainable finance strategy, the reports on further Taxonomy developments, and the final rules on Taxonomy reporting for corporates and financial undertakings, two further developments have been announced. On July 9th, the European Supervisory Authorities (ESAs) announced a six-month delay in the implementation of the level 2 regulation, or regulatory technical standards, of the EU Sustainable Finance Disclosure Regulation (SFDR). Then, on July 26th, the EU Commission published a long-awaited Q&A on the interpretation of key elements of the Sustainable Finance Disclosure Regulation (SFDR). These new developments will leave many of us with a lot of poolside or bedside reading during the holidays as the Commission and the regulators break for summer. In this blog, we look at the delay of the level 2 regulation, some aspects of the Q&A, and the ongoing confusion and divergence around SFDR. We pay special attention to the potential impact of the Principle Adverse Impact indicators, an element of SFDR.

Delay to Level 2 Regulation

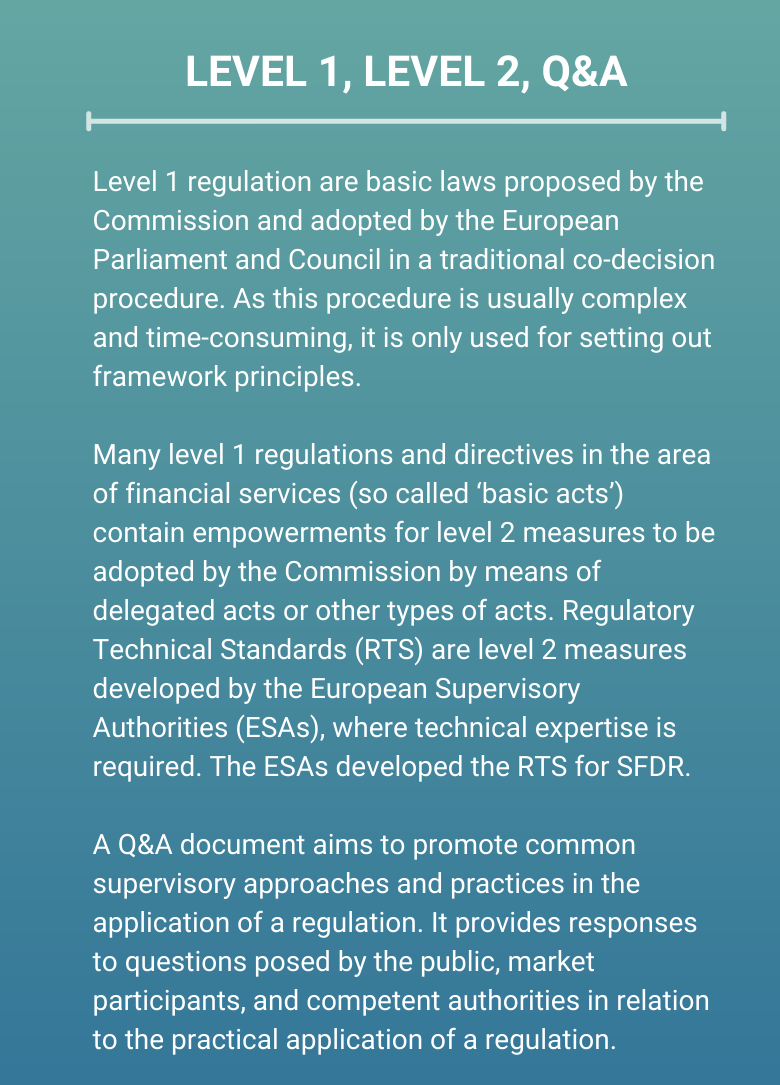

The SFDR level 1 regulation was adopted in November 2019 and took effect in March 2021. The level 2 regulation (see breakout - click image to enlarge) was delayed initially by a year and the delay was recently extended another six months to June 2022. Usually, the two levels of regulation go hand in hand and take effect at the same time, however, the Commission and the regulators acknowledged that financial market participants needed more time to prepare for this landmark regulation. They decoupled the level 2 timelines from level 1 to avoid the complicated political process of reopening the level 1 regulation. Thus, the level 2 rules for prospectuses, annual reporting, and website reporting are delayed until mid-2022, while the level 1 regulation is already in force. Although prolonging the period of ambiguity around interpretation of the regulation, the delay offers more time to prepare for next steps.

Reporting on Principal Adverse Impact indicators (PAIs) is also part of the level 2 regulation. [i] We assume that this reporting, which is due in June 2023, is also impacted by this delay, however, it is not yet clear exactly how. Despite the shifting timelines, we believe that the market momentum around PAIs will not diminish and that PAIs may have a significant impact on stock selection and portfolio construction by fund managers keen to have “good” PAI scores (see second breakout).

(click image to enlarge)

SFDR Q&A by EU Regulators

The Q&A published by the EU Commission addresses seven questions raised by the ESAs, most of them of a fairly technical/legal nature. One of the questions is about how to interpret the term “promoting” under Article 8, the article in SFDR that lays down disclosure requirements for “light green” products with environmental or social characteristics.[ii] This question is worth highlighting given the level of concern around the divergence in how fund managers classify their funds, as also described in this Morningstar article:

- “Integration per se of sustainability risks […] is not sufficient for Article 8 to apply”. The Q&A seems to reinforce the consensus in the market that ESG integration[iii] alone is not sufficient to be considered an Article 8 product.

- The term “promotion” seems to be a broad notion, including “direct or indirect claims, information reporting, disclosures as well as an impression that investments pursued by the financial product also consider environmental and social characteristics in terms of investment policies, goals, targets, or objectives or a general ambition in, […]” with an extensive list of potential materials and places where these claims/reporting/disclosures/impression could be made. In other words, Article 8 really is a catch-all category. It even covers products that mention in their materials exclusions that are required by law, such as controversial weapons for instance. This goes against market consensus which is that basic exclusions should not be sufficient to be categorized as Article 8.

The broadness of Article 8 highlights the discrepancy between the regulators’ objective and market uses. With Article 8 regulators aim to cast a wide enough net to ensure transparency about sustainability claims for as many funds as possible. However, the market views Article 8 and Article 9 more as labels or stamps of approval and is not happy that products with the bare minimum in ESG considerations fall into the same Article 8 bucket as products more advanced environmental and social strategies. Some fear it increases rather than decreases the risk of greenwashing.

While the Q&A answers some questions, several outstanding issues remain, meaning ambiguity and divergence in the interpretation of SFDR rules will persist for some time. The EU established a landmark regulation with SFDR. However, the complexity of the regulation and the interdependencies with other regulations combined with ongoing uncertainty and ambiguity around timelines and technical standards place a significant burden on financial market participants and those aiming to support the industry in complying with the various rules.

Contact us to learn more about Sustainalytics' SFDR Solutions or download the brochure.

Notes:

[i] Principles Adverse Impact indicators are the predefined list of ESG indicators and metrics (such as carbon emissions, wastewater emissions, social violations, etc.) that are considered to always have a negative impact.

[ii] “Article 9” products are so-called “dark-green” products with mainly sustainable investments. “Article 6” products are all other types of products without environmental and social characteristics or sustainable investments. The article numbers refer to the articles in the level 1 text of the SFDR.

[iii] The UNPRI defines ESG integration as “the explicit and systematic inclusion of ESG issues in investment analysis and investment decisions”.

Recent Content

DEI Rollbacks: Impact on ESG Risk Ratings and Broader Implications for Investors

This article covers how not all reported rollbacks in diversity, equity, and inclusion (DEI) initiatives will have the same impact. Due to the relatively low weight of DEI in Sustainalytics’ ESG Risk Rating, we do not anticipate significant changes to overall ratings.

Industrial-Scale Decarbonization in the EU: Stewardship Field Notes From Germany, France and Spain

This article covers how Morningstar Sustainalytics’ Stewardship Team embarked on a field trip in November 2024 to learn how EU industry leaders are navigating the complex challenges of the energy transition.