Pipelines play a critical role in the U.S. energy infrastructure transporting natural gas, crude oil, natural gas liquids, petroleum, and petrochemical products. While these pipelines are essential in supporting the U.S economy, investors are increasingly

scrutinizing pipeline operators' long-term economic profitability and sustainability practices. A closer look into the status of pipelines reveals a particular issue that investors need to consider.

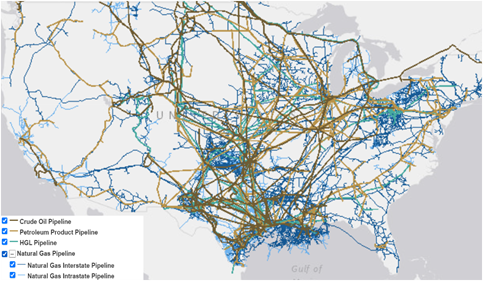

There are an estimated 2.8 million miles of pipelines in the U.S. that carry trillions of cubic feet of natural gas and hundreds of billions of tons of liquid petroleum products each year.

The pipelines vary in size and function and are typically classified as follows:

Gathering lines: Move crude oil and natural gas from wells to storage or processing facilities within production areas.

Transmission lines: Transport large quantities of crude oil or natural gas over long distances to refining, processing, or storage facilities.

Distribution lines: Deliver natural gas to final customers in various industries, homes, and businesses.

Most pipelines are buried underground in the U.S., except for a few built above ground, and many are unaware of the vast network of oil and gas pipelines because they are well concealed from the public.

Source: U.S. Energy Information Administration

Source: U.S. Energy Information Administration

Aging Pipelines

Although oil and gas pipelines play an integral role in the U.S. energy infrastructure — as oil and gas supply 65% of the country’s energy consumption—more than half of them are at least 50 years old. Many miles of the pipelines were built before 1960 (some before the 1940s) and are still in use today. Specifically, 32% of gas distribution lines, 54% of gas transmission lines, and 43% of pipelines that carry hazardous liquids (including crude oil and refined petroleum products) were installed before 1970.

Source: U.S. Energy Information Administration

Source: U.S. Energy Information Administration

Pipelines’ exposure to safety incidents

Pipelines are not immune to accidents. From failing welds to extreme weather events to construction workers hitting pipes with their equipment, there are many reasons why pipeline accidents occur. Over the past two decades, oil and gas pipelines in the U.S faced over 5,700 significant incidents*, causing 256 fatalities and 1,142 injuries. Gas distribution, gas transmission, and hazardous liquids pipeline incidents accounted for 25%, 24%, and 48% of the total significant incidents, respectively. However, gas distribution pipeline incidents caused over 70% of the fatalities and injuries recorded during this period.

Source: PHMSA

*Significant Incidents are:

1. Fatality or injury requiring in-patient hospitalization

2. $50,000 or more in total costs, measured in 1984 dollars

3. Highly volatile liquid releases of 5 barrels or more or other liquid releases of 50 barrels or more

4. Liquid releases resulting in an unintentional fire or explosion.

Considering that corrosion causes nearly 20% of all pipeline incidents, the aging pipelines are of particular concern. Older pipelines' exposure to health and safety risks,

as well as environmental risks resulting from leaks and spills, will likely increase.

Helping investors identify companies involved in incidents

Sustainalytics' Controversy Research uses a qualitative assessment approach to monitor, screen, and analyze companies involved in negative controversies, including those associated with quality and safety and the environmental and social impact of products. Through this research, investors can better understand the risks that pipeline operators face, the impact of their operations on the environment and society, and how they respond to and manage controversies.

Looking ahead

In the upcoming years, the aging pipelines in the U.S could have very real consequences. As a result of deterioration, they may create supply disruptions due to maintenance shutdowns, increasing further environmental and safety concerns. The U.S Congress passed a law in 2020 (PIPES Act of 2020) that directs the Pipeline and Hazardous Materials Safety Administration (PHMSA) to take numerous regulatory actions related to pipeline safety. This includes ensuring safety considerations are met for gathering lines and strengthening requirements for gas distribution networks. The PIPES Act of 2020 will likely bring change to the industry. Still, investors need to continue assessing how pipeline operators manage safety and environmental risks and identify companies involved in controversies to gauge their performance. As new challenges relating to cybersecurity and the physical impact of climate change become increasingly important, governance over pipelines increases in tandem.

Sources:

1. (PHMSA), Pipeline and Hazardous Materials Safety Administration. Pipeline and Hazardous Materials Safety Administration. Pipeline and Hazardous Materials Safety Administration. [Online] [Cited: 06 17, 2021.] https://www.phmsa.dot.gov/.

2. Alliance, FracTracker. [Online] [Cited: 06 17, 2021.] https://www.fractracker.org/2016/06/introduction-oil-gas-pipelines/.

3. PHMSA. Miles by Decade. [Online] [Cited: 06 17, 2021.] https://portal.phmsa.dot.gov/analytics/saw.dll?Dashboard.

4. —. Significant Incidents . [Online] [Cited: 06 17, 2021.] https://portal.phmsa.dot.gov/analytics/saw.dll?Portalpages&PortalPath=%2Fshared%2FPDM%20Public%20Website%2F_portal%2FSC%20Incident%20Trend&Page=Significant.

5. —. Fact Sheet: Corrosion. [Online] [Cited: 06 17, 2021.] https://primis.phmsa.dot.gov/comm/FactSheets/FSCorrosion.htm.

Recent Content

DEI Rollbacks: Impact on ESG Risk Ratings and Broader Implications for Investors

This article covers how not all reported rollbacks in diversity, equity, and inclusion (DEI) initiatives will have the same impact. Due to the relatively low weight of DEI in Sustainalytics’ ESG Risk Rating, we do not anticipate significant changes to overall ratings.

Industrial-Scale Decarbonization in the EU: Stewardship Field Notes From Germany, France and Spain

This article covers how Morningstar Sustainalytics’ Stewardship Team embarked on a field trip in November 2024 to learn how EU industry leaders are navigating the complex challenges of the energy transition.