The highly anticipated final report by the TEG (Technical Expert Group) on the EU Taxonomy was published in early March, followed by a stakeholder information session. You can read our blog post on last fall’s developments here.

The report’s recommendations will form the basis of the European Commission’s decisions regarding its framework for green investments and the adoption of related legislation. Sustainalytics is preparing to support clients with respect to the EU Taxonomy as well as other related EU action items. In this article, we will provide an overview of the latest developments as well as a list of important Action-Plan-related dates.

The final TEG report

The Taxonomy regulation will require financial market participants offering products with sustainability or ESG objectives in the EU to disclose the product’s percentage of Taxonomy-alignment and which of the six environmental objectives of the Taxonomy it pursues. The final TEG report outlines criteria for climate change mitigation (one of the six objectives) and thresholds for 70 sectors, which together are responsible for around 93% of Europe’s greenhouse gas emissions. The criteria for buildings, forestry and manufacturing activities have been revised since the June 2019 report; however, criteria in most other areas have not significantly changed. Nuclear energy is not included in the Taxonomy, although the TEG recommends further work on the topic. Solid fossil fuels are still excluded as are unabated natural gas and waste-to-energy.

New to the report are criteria on climate change adaptation (the second objective) and an expansion of the minimum safeguards to encompass the OECD Guidelines for Multinational Enterprises and the UN Guiding Principles on Business and Human Rights. Also, the TEG recommends a future version of the Taxonomy include social objectives (not to be confused with social safeguards), as well as a ‘brown’ taxonomy – a list of activities that do significant harm to climate objectives. The Taxonomy regulation has already been amended to allow for these future developments.

Another new element is the inclusion of four design principles for taxonomy development. This is intended to encourage standardization across jurisdictions that develop their own taxonomies and to “enable mutual recognition and support market understanding.” In order to encourage dialogue and coordination where appropriate, the EU has convened an International Platform on Sustainable Finance.

‘Potential alignment’, user guidance and company reporting

The lack of available data from market participants to determine Taxonomy alignment has been widely discussed and clearly acknowledged by the TEG. To address this data gap, the TEG proposes including a “potential Taxonomy alignment” reporting category. For example, in a case where all technical thresholds and social safeguards are met and the do-no-significant-harm criteria (DNSH) can be reasonably assumed to be met but not factually demonstrated, the activity would fall in the “potentially aligned” category.

In addition, the report includes extensive user guidance and walks the reader through the necessary steps to calculate Taxonomy alignment for non-disclosing companies. This is a helpful way to bring the Taxonomy down to a very practical level. Similarly, the report explains what a due diligence process should look like to assess whether technical screening criteria, DNSH criteria and social safeguards have been met. While this information is useful, such an extensive exercise is likely to be costly, particularly for investors with large portfolios of holdings that include non-disclosing companies.

A regulation that will alleviate this burden for investors was announced in December and is clearer following the publication of the TEG report: companies that fall within the scope of the Non-Financial Reporting Directive (NFRD) will need to disclose Taxonomy alignment (the NFRD covers about 6,000 companies across the EU). This means companies must go through all the required steps, from determining economic activities in which they are involved, to assessing whether the technical screening criteria are met for each activity, to assessing compliance with DNSH criteria and social safeguards. Those working in corporate sustainability reporting teams will have their work cut out for them.

Other Action Plan developments

While the Taxonomy is a major pillar of the EU’s Action Plan on sustainable finance, other items are also set to make a significant impact. For example, related to item 9 of the Action Plan (strengthen corporate sustainability disclosure) and to the company disclosure requirements discussed above, the EU has launched a public consultation to determine the other sustainability issues on which companies covered by the NFRD should disclose.

Furthermore, the amended regulation on climate-related benchmarks and benchmarks’ ESG disclosures will come into effect on April 30th. Providers of indexes with ESG objectives will need to disclose on a substantial number of ESG factors in their benchmarks’ statements and methodologies, although the details need to be adopted into law. Minimum technical standards for “Climate Transition” and “Paris-aligned” Benchmarks also still need to be formally adopted.

Regarding green bonds, the TEG published final recommendations for an EU Green Bond Standard (GBS) on the same day as the final Taxonomy report, however their regulatory status will not be confirmed until the third quarter of this year. The recommendations haven’t changed much compared to the June 2019 version, but the GBS report does now include a guide on usability.

How Sustainalytics can help

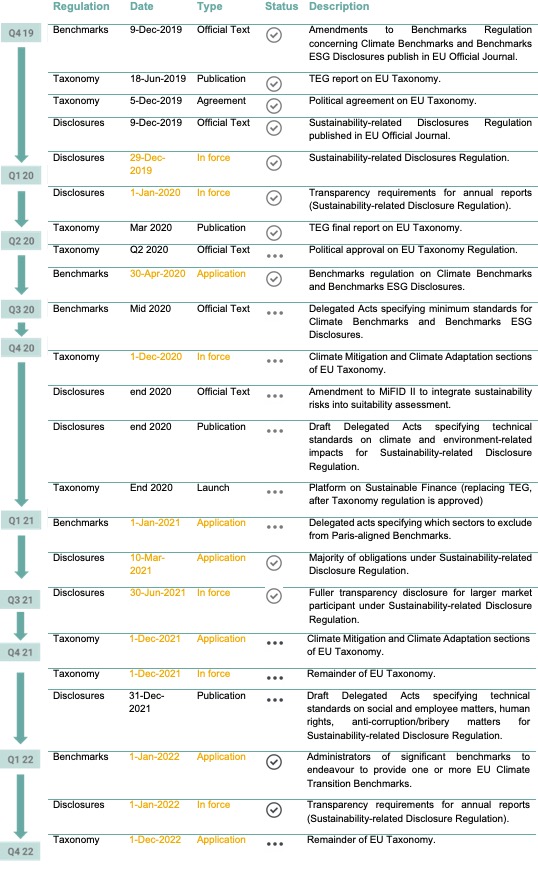

The items described above are by no means an exhaustive list of current developments. With so many actions and regulatory changes, each in a different phase of development and legal adoption, and with many interlinkages, it is easy to lose track. Covering the topics most relevant to our clients, we have compiled a timeline with dates as they are currently known (see below).

Sustainalytics aims to support its clients in meeting regulatory requirements related to the EU Action Plan in line with the timelines set out in those regulations. We will be launching an EU Benchmarks Mapping in April to facilitate index clients in dealing with the upcoming regulatory changes affecting climate benchmarks and disclosures. With respect to the EU Taxonomy, we are in the process of mapping the latest TEG recommendations against our research. We believe our research is well placed to support clients, and we will be further developing it in line with the requirements and regulation timelines.

Sustainalytics is also developing a new offering for green bond issuers which will assess the degree of compliance of their green bond use-of-proceeds criteria with the requirements of the EU Taxonomy.

To understand how Sustainalytics’ current product suite can support you in meeting the various EU requirements, be sure to reach out to your client advisor to receive our Guidance Pack on the EU Action Plan or contact us.

Recent Content

DEI Rollbacks: Impact on ESG Risk Ratings and Broader Implications for Investors

This article covers how not all reported rollbacks in diversity, equity, and inclusion (DEI) initiatives will have the same impact. Due to the relatively low weight of DEI in Sustainalytics’ ESG Risk Rating, we do not anticipate significant changes to overall ratings.

Industrial-Scale Decarbonization in the EU: Stewardship Field Notes From Germany, France and Spain

This article covers how Morningstar Sustainalytics’ Stewardship Team embarked on a field trip in November 2024 to learn how EU industry leaders are navigating the complex challenges of the energy transition.