Key Insights:

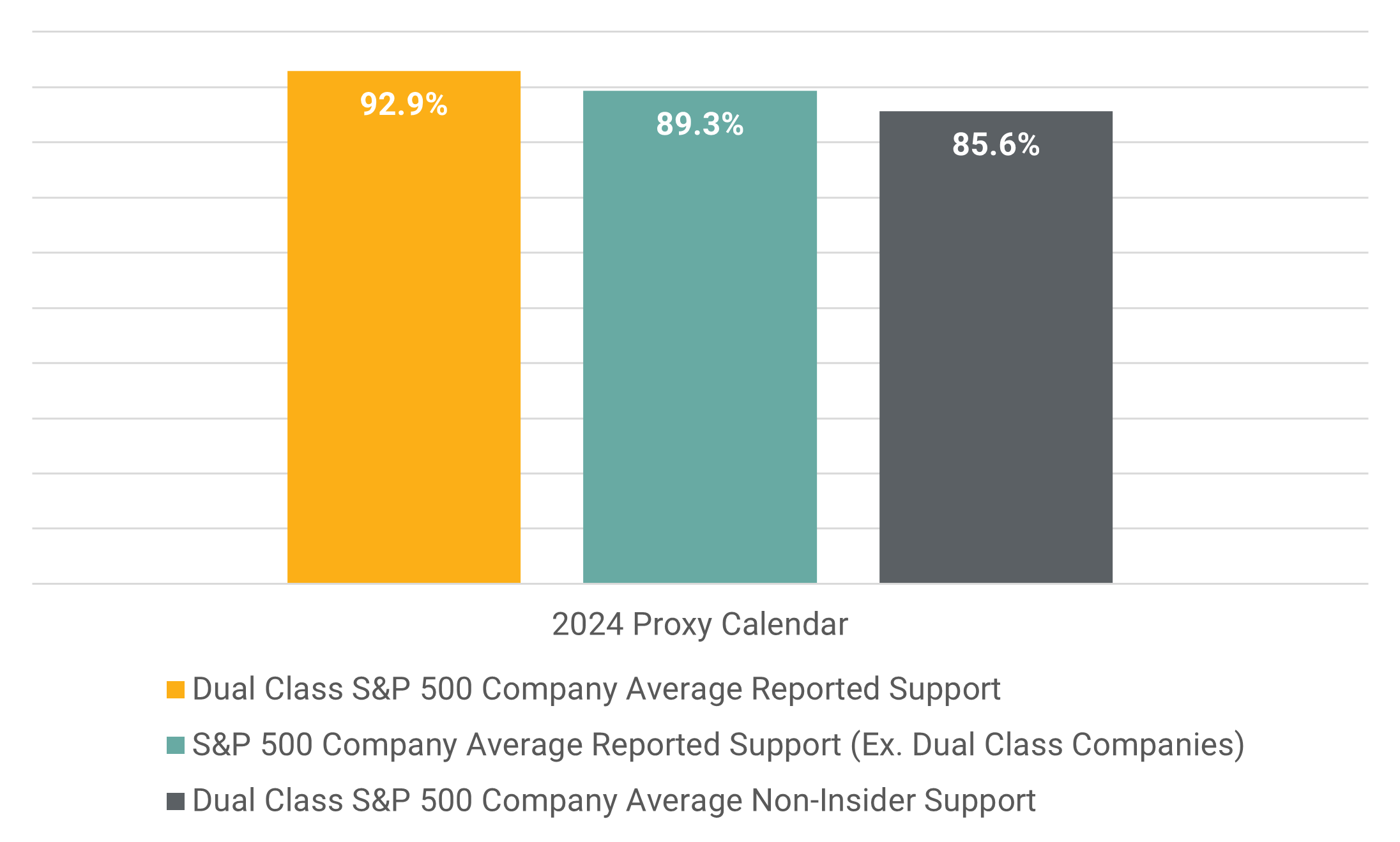

- While dual class companies reported an average 92.9% approval for pay packages across the 2024 proxy calendar, adjusted figures accounting for insider influence brought minority shareholder support down to 85.6% — effectively double the reported shareholder opposition.

- Minority shareholders appear to be more opposed to executive pay practices at dual class companies than at companies with a single vote capital structure, where average support across S&P 500 companies was 89.3% in the 2024 proxy calendar.

- Shareholder resolutions at companies with dual class structures faced a significant impact from insiders, effectively swaying votes by an estimated 19 percentage points across 47 proposals.

- Better reporting of the votes, disaggregating those cast by insider holders of super voting shares from those cast by minority shareholders, would strengthen accountability of management to the broad shareholder base.

The principle of one share, one vote1 is fundamental to shareholder democracy. It ensures that voting power proportionally aligns with a shareholder’s economic interest. Dual class share structures with differential voting rights violate this principle.

Our 2024 post-proxy season analysis shows that, for companies with differential share voting rights, reported vote results often deviate significantly from estimated broad market shareholder sentiment on resolutions that shape important aspects of corporate governance. Dual class structures can distort key governance signals, limiting the influence of minority shareholders on issues ranging from executive compensation to environmental, social, and governance (ESG) resolutions. As a growing number of companies, particularly in the tech sector, adopt this capital structure at IPO, systemic risks may arise.

As a minimum safeguard, we propose that companies should be required to disclose their vote outcomes by share class to better represent the market signal conveyed via proxy voting and ward off weaker market-wide governance practices.2

The Rise of Dual Class Share Structures

Dual class share structures typically take the form of two classes of shares, where one class, usually held by founders, founding families with board representation, and company insiders, carries superior voting rights. These rights often allow them to override decisions by the broader shareholder base. Proponents argue that this arrangement shields management from market pressures, supporting long-term strategic decision-making, especially during critical growth stages. However, critics highlight concerns over governance, warning that disproportionate insider voting power can reduce management accountability, allowing insiders to ignore broader shareholder interests.

Recent IPOs in the US, particularly in the tech sector, have increasingly favored dual class structures, prompting investor groups like the Council of Institutional Investors (CII)3 and the Investor Coalition for Equal Voting Rights (ICEV)4 to call for superior voting rights to expire within five to seven years post-IPO, to reestablish voting equity.

Dual Class Structures Skew Outcomes on Pay Approval

Across the largest 500 companies in the US, 483 offered shareholders an advisory vote on their company’s executive compensation practices for the preceding fiscal year, also known as say on pay. Fifteen of these say on pay votes were at companies with dual class share structures. Shareholders’ say on pay votes are a measure of shareholder confidence in the board’s oversight. A vote to approve the board’s compensation report and the pay awarded to the CEO and other senior C-suite executives in the previous fiscal year has become an annual fixture on proxy ballots since mandated by the Dodd-Frank post-financial crisis reform legislation in 2010.5 For S&P 500 companies with dual class share structures, we found a substantial gap between reported and adjusted say-on-pay support.

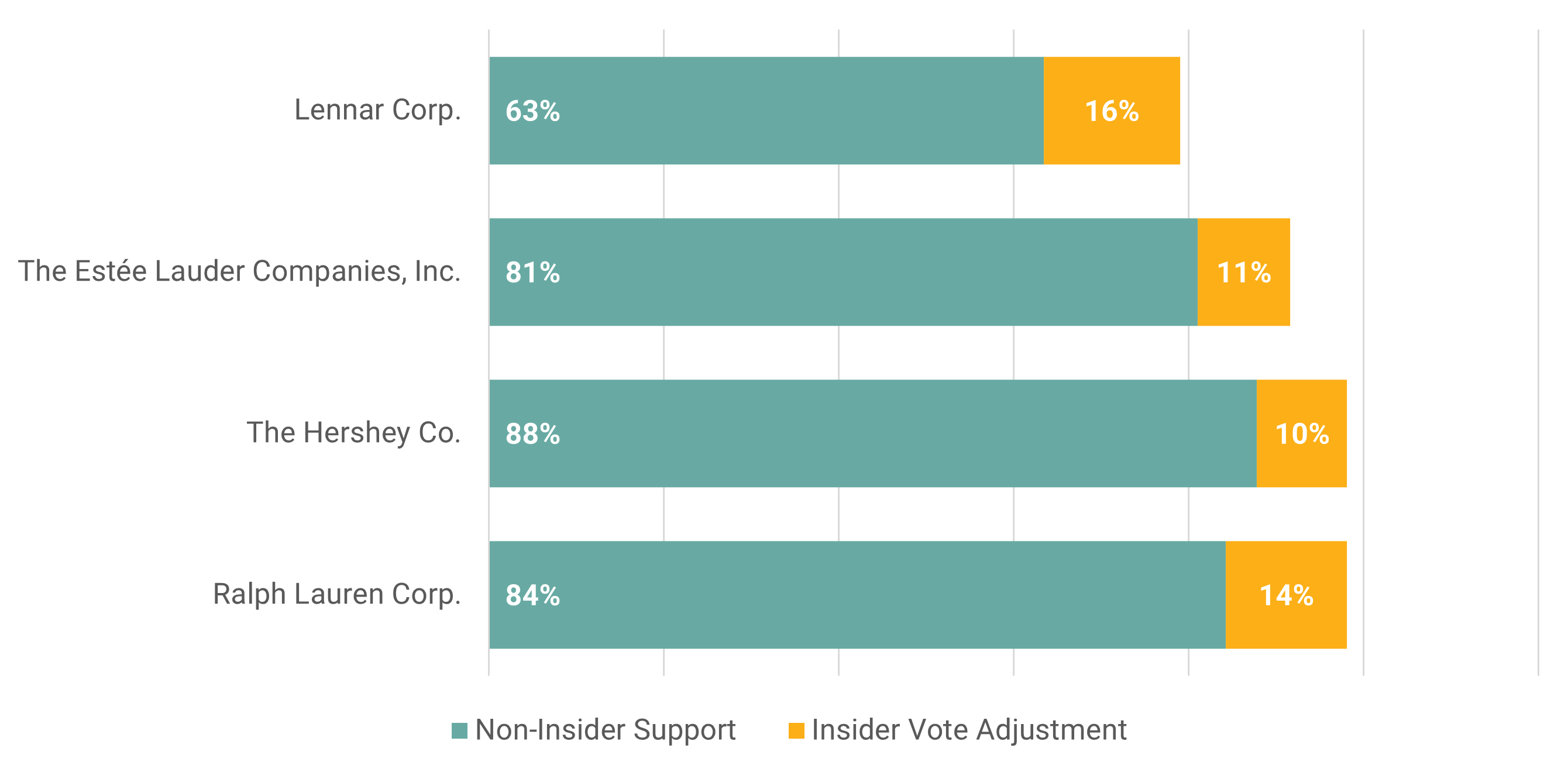

We identified at least four companies with dual class share structures where non-insider (adjusted) voting support appears to be at least 10 percentage points lower than the vote outcome reported by companies (Figure 1).

Figure 1. Company Say on Pay Resolutions Where the Unequal Influence of Insiders Skewed Vote Outcomes

Source: Morningstar Sustainalytics Proxy Data.

Note: Data as of Nov. 6, 2024.

While dual class companies reported an average 92.9% approval for pay packages across the 2024 proxy calendar, adjusted figures accounting for insider influence brought minority shareholder support down to 85.6% — effectively double the reported shareholder opposition.

Another important finding is that minority shareholders appear to be more opposed to executive pay practices at dual class companies than at companies with a single vote capital structure, where average support across S&P 500 companies was 89.3% in the 2024 proxy calendar (Figure 2).

Figure 2. Comparison of Say on Pay Support at Dual Class Companies Versus Single Share Class Companies

Source: Morningstar Sustainalytics Proxy Data.

Note: Data as of Nov. 6, 2024.

This divergence underscores how unequal voting rights can mask broader shareholder discontent on executive pay practices, a key area of governance attracting growing investor scrutiny.

Unequal Voting May Keep Important Issues Off Companies’ Proxy Ballots

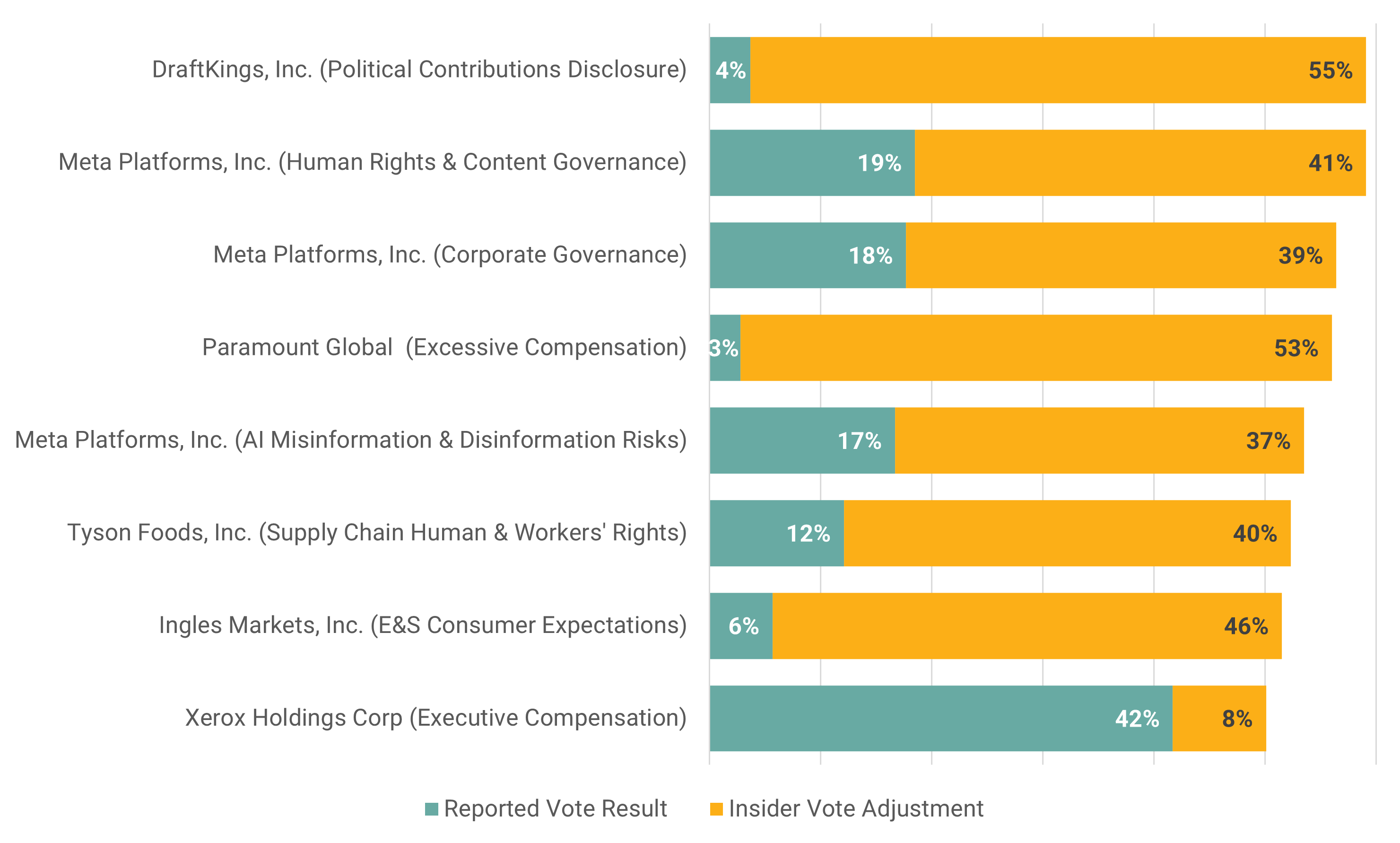

Dual class share structures reduced minority shareholder influence on issues like environmental disclosures and supply chain worker treatment. Our data shows that shareholder resolutions at companies with dual class structures faced a significant impact from insiders, effectively swaying votes by an estimated 19 percentage points across 47 proposals.6 In Figure 3 below, we identified eight resolutions that might have received majority support had it not been for insider control.

Figure 3. Resolutions That Would Likely Have Passed After Adjusting for Unequal Voting Rights

Source: Morningstar Sustainalytics Proxy Data.

Note: Data as of Nov. 6, 2024

One extreme example is Paramount Global, which limits voting rights exclusively to Class A shares, predominantly held by the Redstone family at the time of the company’s annual shareholder meeting in June 2024. On the ballot was a proposal for improved AI oversight, voted on at the company’s annual shareholder meeting. The proposal garnered less than 5% of reported support. However, without insider influence, we estimate the resolution would have received closer to 49% support from minority shareholders, which is more in line with the 34% average support across 13 similar resolutions voted at other US companies in the 2024 proxy season.

When Polled, Minority Shareholders Overwhelmingly Opt for One Share, One Vote Arrangements

In the 2024 proxy season, five shareholder resolutions came to vote asking companies to collapse dual class ownership structures. Of these, four would likely have passed with majority non-insider shareholder support. Where this resolution was voted at UPS, the resolution failed to earn majority support. In this case, the company does not have a typical dual class structure.

Table 1. Resolutions Requesting a One Share, One Vote Share Structure Voted in 2024 Proxy Season

| Company | Reported Support | Adjusted Support |

|---|---|---|

| Alphabet | 31.33% | 77.47% |

| Ford Motor Co. | 38.30% | 86.40% |

| Lions Gate Entertainment Corp.7 | 62.18% | 62.18% |

| Meta Platforms, Inc. | 26.28% | 88.83% |

| United Parcel Service, Inc.8 | 36.47% | 36.80% |

Source: Morningstar Sustainalytics Proxy Data.

Note: Data as of Nov. 6, 2024.

The four largest asset managers – BlackRock, Vanguard, State Street and Fidelity – each embed support for the principle of one share, one vote in their proxy voting guidance. For instance, Vanguard highlights that the “alignment of voting and economic interests is a foundation of good governance.”9 Except for BlackRock, which opposed the resolution at UPS, the four asset manager giants unanimously cast their votes in support of shareholder proposals listed in Table 1.

Disaggregated Voting Disclosure Would Strengthen Accountability

Looking ahead, while investor groups are likely to intensify their push for voting equity, regulators and exchanges are moving towards a more relaxed approach to dual class structures for smaller, earlier stage listed companies. In October 2024, the European Council formally adopted a directive on multiple vote share structures which will allow smaller companies to list multiple share classes on EU financial markets open to trading SME shares.10

The results of our research underscore the ways in which dual class share structures can obscure the true level of broad market shareholder proxy voting support, or opposition, thereby diluting minority shareholder voice on important governance and sustainability issues. We find that reported vote outcomes overstate shareholder support for senior executive compensation arrangements and frequently understate support for shareholder resolutions.

Given the important role of advisory shareholder voting in shaping corporate governance practices, we believe companies with dual class share structures should be required to disclose proxy voting results disaggregated by share class. Voting transparency would support shareholder democracy in markets increasingly shaped by differential voting rights.

By focusing on the impact of dual class share structures on vote outcomes, we aim to highlight the continued relevance and value placed by shareholders on the proxy voting process as a market-wide poll of shareholder sentiment on material matters. Across the market, entrenched insider control may lead to poor governance practices and impede the ability of shareholders to enact reform. We believe that better reporting of the votes, disaggregating those cast by insider holders of super voting shares from those cast by minority shareholders, would strengthen accountability of management to the broad shareholder base.

To learn more about dual class shares and shareholder democracy, download the full report here or by clicking the image below.

References

- This article is a condensed and slightly modified version of our original report. Giner, I.G., Felleca, M., & Cook, J. 2025. “Shareholder Democracy and the Challenge of Dual Class Share Structures: How Unequal Voting Rights Influence Proxy Voting Outcomes and Corporate Governance.” Morningstar Sustainalytics. Jan. 23, 2025. https://connect.sustainalytics.com/shareholder-democracy-and-the-challenge-of-dual-class-share-structures.

- This paper extends Cook, J. 2021. “Accounting for Insider Influence in the Proxy Process.” Morningstar. https://www.morningstar.com/sustainable-investing/accounting-insider-influence-proxy-process.

- Council of Institutional Investors. “Dual-Class Stock.” Nov. 11, 2024. https://www.cii.org/dualclass_stock.

- Investor Coalition for Equal Voting Rights. 2023. “Investor Statement on Unequal Voting Rights.” https://cdn-suk-railpencom-live-001.azureedge.net/media/media/xtupqlv3/icev-2023-investor-statement-undermining-the-shareholder-voice.pdf.

- United States Congress. 2010. H.R.4173 - Dodd-Frank Wall Street Reform and Consumer Protection Act. https://www.congress.gov/bill/111th-congress/house-bill/4173/text.

- Not counting resolutions filed by so-called ‘anti-ESG’ groups.

- The board made no recommendation, and therefore we did not discount insider voting influence from this outcome.

- While UPS has two classes of shares, the superior voting class is widely held and does not have a significant impact on vote outcomes.

- Vanguard. “Proxy Voting Policy for U.S. Portfolio Companies.” 2022. https://corporate.vanguard.com/content/dam/corp/advocate/investment-stewardship/pdf/policies-and-reports/US_Proxy_Voting.pdf.

- Council of the EU. “SME financing: Council adopts the multiple-vote share structures directive.” Oct. 8, 2024. https://www.consilium.europa.eu/en/press/press-releases/2024/10/08/sme-financing-council-adopts-the-multiple-vote-share-structures-directive/.

Recent Content

DEI Rollbacks: Impact on ESG Risk Ratings and Broader Implications for Investors

This article covers how not all reported rollbacks in diversity, equity, and inclusion (DEI) initiatives will have the same impact. Due to the relatively low weight of DEI in Sustainalytics’ ESG Risk Rating, we do not anticipate significant changes to overall ratings.

Industrial-Scale Decarbonization in the EU: Stewardship Field Notes From Germany, France and Spain

This article covers how Morningstar Sustainalytics’ Stewardship Team embarked on a field trip in November 2024 to learn how EU industry leaders are navigating the complex challenges of the energy transition.