Following the COP28 United Nations Climate Change Conference, the world has largely agreed to transition away from fossil fuels. As the home of the fourth largest proven crude oil reserve in the world,1 Canadian oil producers have a key role to play in global decarbonization and will undoubtedly face challenges as the world moves further down the transition pathway. These companies could be uniquely positioned to decarbonize and avoid stranded assets by not only diversifying their business streams, but also by capitalizing on hydrocarbon uses beyond combustion.

Unconventional Oil in a Unique Environment

Alberta’s oil sands make up 94% of Canada’s oil reserves2 and approximately 10% of the world’s proven reserves.3 Northern Alberta offers expansive unconventional hydrocarbon resources of low-grade crude oil called bitumen. Bitumen is thick and viscous with a tar-like consistency, making it much more difficult to recover than traditional hydrocarbons elsewhere in the world. Because bitumen oil takes a lot of energy to mine and separate from the sand, oil sands extraction typically releases more greenhouse gases (GHGs) than other forms of oil production. Between 1990 and 2021, Canada’s GHG emissions from conventional oil production increased by 24%, while emissions from oil sands production increased by 463%, mainly driven by a rapid increase in production (see Figure 1).4 And in 2024, as oil sands producers plan to continue increasing production in anticipation of the completion of the Trans Mountain Expansion (TMX) pipeline,5 a recent study published in January warns that emissions from Canada’s oil sands are being vastly underreported.6

Figure 1. Oil and Gas Sector Greenhouse Gas Emissions in Canada, 1990 to 2021

Source: Environment and Climate Change Canada, www.canada.ca/environmental-indicators. For informational purposes only.

Apart from the unique attributes of its hydrocarbon resources, the oil sands present additional material environmental, social and governance (ESG) issues, such as community relations and biodiversity loss, that have the potential to impact the oil and gas producers operating there. The oil sands are located in Canada’s boreal forest, which is a unique ecosystem stretching 5,000 km across the country from coast to coast. In addition, many of the surface mining deposits in the oil sands flank the Athabasca River, an important waterway providing support for multiple Indigenous communities across Alberta and crucial habitats for endangered wildlife. Effectively preventing and managing environmental spills and releases from the oil sands operations is critical to preserving surrounding ecosystems and securing and maintaining a social license to operate.

Banking on Carbon Capture and Storage for Scope 1 and 2 Decarbonization

According to analysis conducted by the Global Carbon Capture and Storage (CCS) Institute,7 the Western Canadian Sedimentary Basin is one of the largest and most suitable basins for CCS globally. With this advantage, oil sands producers appear to be banking on CCS as the main method to decarbonize Alberta’s resource-rich economy.

Alberta’s six largest oil and gas producers formed Pathways Alliance, which aims to work with the Federal and Alberta governments to achieve net zero GHG emissions from oil sands operations by 2050. The alliance’s three-phase plan includes reducing current oil sands GHG emissions by approximately 22 megatonnes of CO2 emissions (scope 1 and 2) per year by 2030 and planned investments of CAD 24.5 billion (USD 18.1 billion) on CCS and other major emissions reduction projects and technologies.8

A CCS hub and transportation network proposed by Pathways Alliance would transport and store GHG emissions from over 20 smaller CCS facilities across the oil sands, with aims to sequester more than 10 megatonnes of carbon per year. With support from the Government of Alberta, the project is moving ahead with pore space (i.e., underground storage rights) being awarded to Pathways Alliance, and drilling tests and engineering work underway.

However, Pathways Alliance’s activity and the long-term success of the proposed CO2 hub is heavily contingent on fiscal frameworks — at both the provincial and federal levels — as well as results of a formal consultation with 25 Indigenous communities located around the proposed pore space and CO2 transportation line.

Additional Challenges to Lowering Oil Sands Emissions

Oil sands producers are relying heavily on CCS to meet their decarbonization targets. Adding to their net zero challenges is the fact that Alberta’s energy grid is mainly powered by natural gas.9 As the Alberta Utilities Commission instituted a moratorium on approving wind and solar power projects greater than one megawatt in August of 202310 and has since banned renewable power projects on prime agricultural land,11 producers now have limited short-term opportunities to replace fossil fuel power generation with renewable solutions, and therefore lower their scope 2 emissions sources.

A November 2023 report from the International Energy Agency warns against banking on CCS as the planet continues to warm. The report states oil and gas companies need to consider diversifying into clean energy rather than simply counting on carbon capture to help them maintain the status quo.12

With so much riding on the success of CCS in the oil sands, it’s important to consider if producers have additional risk mitigation strategies in place to successfully navigate through the low-carbon transition – especially in relation to their scope 3 emissions, which essentially remain unmanaged.

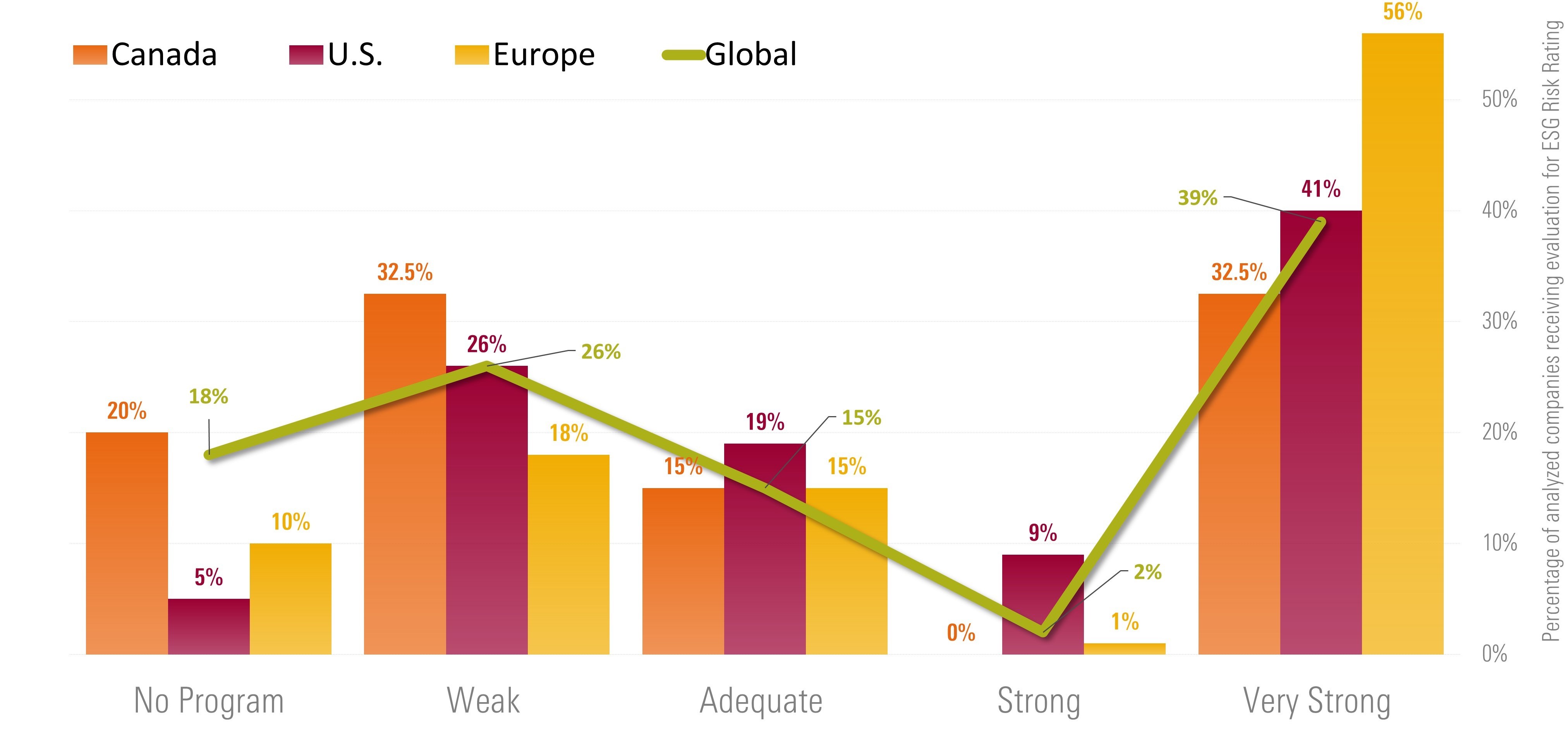

Figure 2 below demonstrates the strength of GHG risk management programs for Canadian oil and gas producers as compared to their global peers. Canada is lagging behind U.S. and European producers, but is more closely aligned to global management levels.

Figure 2. Evaluation of Oil and Gas Producers' Greenhouse Gas Risk Management Programs

Source: Morningstar Sustainalytics. For informational purposes only.

Note: The data for this analysis was retrieved on December 21, 2023, from Sustainalytics Risk Rating Universe. Analysis of oil and gas sector companies includes 40 Canadian companies, 57 U.S. companies, 72 EU companies, and 244 global companies.

Alternative Opportunities to Align With the Low Carbon Transition

In the longer term, there may be other opportunities for oil sands producers to lower their emissions. For instance, Phase 2 (2031 – 2040) of Pathways Alliance’s net zero plan includes investment in more research and development for alternative power sources. This includes potentially using hydrogen, more electrification, and small modular reactors.13 And already in early 2024, an agreement has been reached between an Alberta power producer and one of North America’s most diverse electricity generators to jointly assess the development and deployment of grid-scale small modular reactors to advance nuclear power generation in Alberta and create net zero power solutions.14

Another step oil and gas producers are taking in response to climate-related transition risks is diversifying their product portfolios to include sustainable or lower-carbon fuels and alternative streams of business. We are seeing this already with producers investing in technologies such as renewable diesel, sustainable aviation fuel, and hydrogen production.

In fact, Alberta is now Canada’s hydrogen leader with plans for a world-class hub in Edmonton.15 The province also offers opportunities in the global critical minerals race, with the opening of Alberta’s first lithium extraction pilot project. Alberta is home to one of the world’s largest lithium deposits and until recently there has been little interest in developing this deposit.16 However, lithium is now a key focus of the Canadian government’s CAD 3.8 billion (USD 2.8 billion) eight-year critical minerals strategy, which aims to increase domestic extraction and production.17 A Calgary-based junior resource company has developed a technology to extract naturally occurring lithium from oil field brines, and local producers are partnering with, and investing in, such companies to provide technical and development support.18

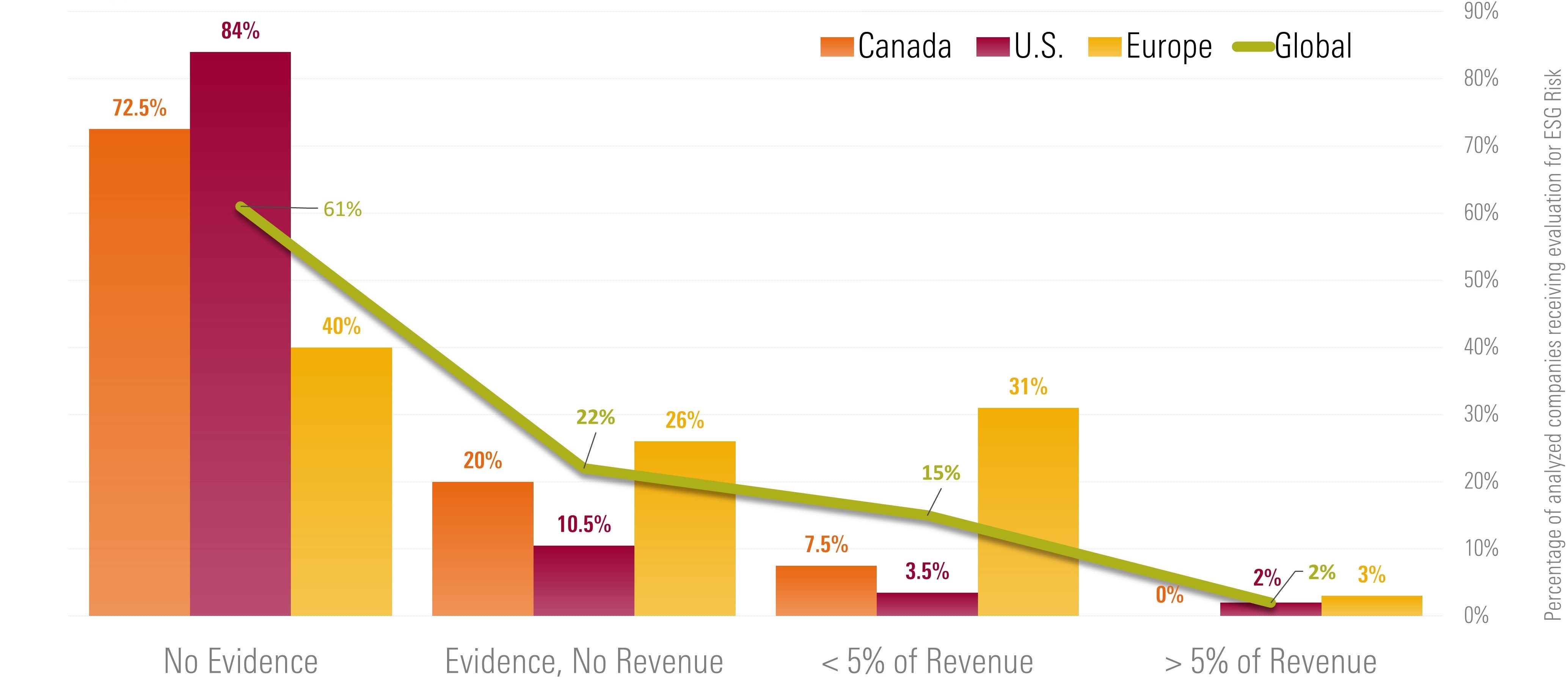

Figure 3 shows that some Canadian oil and gas producers are ahead of U.S. producers when it comes to introducing sustainable products and services and generating revenues from them. However, both Canadian and U.S. companies are not diversifying their product portfolios with the same rigor as their European or global peers.

Figure 3. Oil and Gas Producers' Revenues From Sustainable Products and Services

Source: Morningstar Sustainalytics.

Note: The data for this analysis was retrieved on December 21, 2023, from Sustainalytics Risk Rating Universe. Analysis of oil and gas sector companies includes 40 Canadian companies, 57 U.S. companies, 73 EU companies, and 244 global companies.

The Next Frontier: Bitumen Beyond Combustion

Despite its dirty reputation, Canada’s unconventional bitumen oil also presents some diversification opportunities for oil sands producers. Where light crude oil is primarily made into fuel, heavy bitumen oil has many potential uses beyond burning it.

Alberta Innovates19 has developed a strategy called Bitumen Beyond Combustion (BBC), believing that the Alberta oil sands could contribute to achieving net zero emissions goals if this resource was used to create valued products and not just combustible fuels. The BBC strategy calls for a greater portion of bitumen production to be diverted away from fuel production and dedicated to the manufacture of high-value materials, such as asphalt binders or carbon fibre. In doing so, the carbon from the bitumen would remain trapped within the products and not released into the atmosphere.20

Analysis by Alberta Innovates shows that BBC can create more economic value and reduce GHG emissions, with potential total annual revenue exceeding CAD 100 billion (USD 73.9 billion) per year by 2050.21 A recent study has also shown that oil sands production would have to drop by as much as 90% for Alberta to achieve net zero emissions by 2050 in the absence of a BBC strategy. However, if BBC was implemented, bitumen production could be maintained or even increased in net zero by 2050 scenarios.22

Nevertheless, significant investment and policy support would be required to turn the bitumen beyond combustion vision into reality.

Drawing the Line

Participating nations in COP28 have come to a final agreement that calls for the orderly transition away from fossil fuels. As investors consider their options within the oil and gas sector, it’s important to understand the unique risks and opportunities specific to where and how producers operate. Although the pathway to decarbonize the Canadian oil sands via what could be one of the world’s leading CCS hubs seems promising, producers could be in for a bumpy ride on their net zero journey if they don't consider alternative and innovative opportunities to diversify away from fossil fuel combustion.

References

- OPEC. 2022. "World Energy Statistics: 2022 World Oil Proved Reserves.” Oil Sands Magazine. https://www.oilsandsmagazine.com/energy-statistics/world#reserves.

- Oil Sands Magazine. 2023. “Oh, Canada! A Fresh Look AT Global Oil Rankings Post-Covid.” July 14, 2023. https://www.oilsandsmagazine.com/news/2023/7/14/canada-global-rankings-trade-production-supply-post-covid.

- Government of Canada. 2019. “Canada has the third-largest proven oil reserve in the world, most of which is in the oil sands.” https://natural-resources.canada.ca/our-natural-resources/energy-sources-distribution/fossil-fuels/crude-oil/oil-resources/18085.

- Environment and Climate Change Canada. 2023. “Greenhouse Gas Emissions. Canadian Environmental Sustainability Indicators.” Canada. https://www.canada.ca/content/dam/eccc/documents/pdf/cesindicators/ghg-emissions/2023/greenhouse-gas-emissions-en.pdf.

- Paraskova T. 2024. “Canada's Oil Sands Set for Expansion as Pipeline Nears Completion.” Oilprice.com. January 6, 2024. https://oilprice.com/Energy/Crude-Oil/Canadas-Oil-Sands-Set-for-Expansion-as-Pipeline-Nears-Completion.html.

- He, M. et al. 2024. “Total organic carbon measurements reveal major gaps in petrochemical emissions reporting.” Science. Vol. 383, Issue 6681. https://www.science.org/doi/10.1126/science.adj6233#editor-abstract.

- The Global CCS Institute evaluates sedimentary basins worldwide to assess their suitability for CCS. For more information visit: https://www.globalccsinstitute.com/.

- Pathways Alliance. 2023. “Pathways Alliance advances key oil sands CO2 emissions reduction activities.” https://www.newswire.ca/news-releases/pathways-alliance-advances-key-oil-sands-co2-emissions-reduction-activities-860332032.html.

- Canada Energy Regulator. 2023. “Provincial and Territorial Energy Profiles – Alberta.” https://www.cer-rec.gc.ca/en/data-analysis/energy-markets/provincial-territorial-energy-profiles/provincial-territorial-energy-profiles-alberta.html.

- Government of Alberta. 2023. “Backgrounder: AUC pause and inquiry.” https://www.alberta.ca/external/news/2023-08-02-auc-pause-backgrounder.pdf.

- Ljunggren, D. 2023. “Alberta to ban some renewable energy projects, greens say move is 'uncertainty bomb'.” Reuters. February 28, 2024. https://www.reuters.com/world/americas/canadas-alberta-set-ban-renewables-projects-prime-land-report-2024-02-28/.

- International Energy Agency. 2023. “Oil and gas industry faces moment of truth – and opportunity to adapt – as clean energy transitions advance.” https://www.iea.org/news/oil-and-gas-industry-faces-moment-of-truth-and-opportunity-to-adapt-as-clean-energy-transitions-advance.

- Pathways Alliance. 2023. “Net Zero Initiative: A three-phased approach to meeting our net zero goal.” https://pathwaysalliance.ca/net-zero-initiative/planned-phases.

- Ontario Power Generation. 2024. “Capital Power and OPG partner to advance new nuclear in Alberta.” https://www.opg.com/releases/capital-power-and-opg-partner-to-advance-new-nuclear-in-alberta/.

- Air Products. “Canada Net-zero Hydrogen Energy Complex.” https://www.airproducts.com/energy-transition/canada-net-zero-hydrogen-energy-complex.

- Stephenson, A. 2023. “Alberta enters global critical minerals race with opening of first lithium extraction pilot project.” Financial Post. September 7, 2023. https://financialpost.com/commodities/mining/alberta-critical-minerals-lithium-extraction-pilot-project.

- Stephenson, A. 2023. “Alberta lithium fields lure investment from South Korea's Posco Holdings.” CBC News. November 8, 2023. https://www.cbc.ca/news/canada/calgary/alberta-lithium-posco-holdings-south-korea-1.7022738#:~:text=Lithium%20is%20now%20a%20key%20focus%20of%20the,resources%20such%20as%20cobalt%2C%20copper%2C%20titanium%20and%20zinc.

- Stephenson, A. 2022. “Imperial Oil signs deal with E3 Lithium to advance pilot project.” BNN Bloomberg. June 23, 2022. https://www.bnnbloomberg.ca/imperial-oil-signs-deal-with-e3-lithium-to-advance-pilot-project-1.1782884#:~:text=The%20agreement%20will%20see%20Imperial%20invest%20%246.35%20million,batteries%20used%20in%20electric%20vehicles%29%20from%20oilfield%20brines.

- Alberta Innovates drives research and innovation by providing funding, services, and expertise to post-secondary researchers, entrepreneurs, and industry. For more information visit: https://albertainnovates.ca/.

- Zhou, J., Bomben, P., Gray, M., Helfenbaum, B., Liu, S., and Kerr, M. 2023. “BITUMEN BEYOND COMBUSTION.” Alberta Innovates. https://albertainnovates.ca/wp-content/uploads/2023/11/AI-BBC-WHITE-PAPER-Nov-2023.pdf.

- Ibid.

- Navius Research. 2023. “Bitumen Beyond Combustion in a Net Zero Alberta.” November 7, 2023. Prepared for Alberta Innovates. https://www.naviusresearch.com/wp-content/uploads/2023/11/BBC-memo-2023-11-07-updated-figure.pdf.

Recent Content

DEI Rollbacks: Impact on ESG Risk Ratings and Broader Implications for Investors

This article covers how not all reported rollbacks in diversity, equity, and inclusion (DEI) initiatives will have the same impact. Due to the relatively low weight of DEI in Sustainalytics’ ESG Risk Rating, we do not anticipate significant changes to overall ratings.

Industrial-Scale Decarbonization in the EU: Stewardship Field Notes From Germany, France and Spain

This article covers how Morningstar Sustainalytics’ Stewardship Team embarked on a field trip in November 2024 to learn how EU industry leaders are navigating the complex challenges of the energy transition.