While child labor remains a serious problem across industries and countries, it is only one part of the overall issues pertaining to children’s rights; companies and investors should recognize the scope and relevance of this topic.

Child welfare as a human rights issue is a key determinant for how the future shapes out. Due to unique vulnerabilities, children are often affected by events and business activities in ways that differ from adult experiences. The COVID-19 pandemic has caused disruptions to education, social interaction, and preventive healthcare. We have also seen elevated risks of abuse, precarious work, and domestic violence. Similarly, while the increasing financial hardship and inequality within and between countries have impacted all age groups, the effects on the physical, emotional, and psychological well-being of children have been profound in particular ways.[1] Yet, although the long-overdue ‘rise of the S’ on investors’ ESG agendas witnessed over the past year, children’s rights continue to be largely overlooked as a business-relevant ESG issue. To address this unintended inclination, Sustainalytics continues to collaborate with UNICEF to help develop guidance and tools to support the integration of children’s rights in investment activities.

UNICEF’s new tool for assessing companies’ child rights management

Sustainalytics has long been working on the topic of children’s rights in different forms, having identified this as a potential blind spot in ESG assessments and recognized the need for investors to receive more information about their role and the risks and impacts pertaining to children’s rights. In 2018, we joined forces with UNICEF and in 2019 published Investor Guidance on Integrating Children’s Rights into Investment Decision Making to facilitate a better understanding of the relevance of children’s rights for investment analyses.[2] UNICEF and Sustainalytics have subsequently jointly organized webinars and regional workshops to help investors interpret and implement the guidance.

As the most recent effort aiming to enable the related risks and opportunities to be incorporated in investment activities, UNICEF has developed the Integrating Children’s Rights Into ESG Assessment tool for investors to integrate children’s rights considerations into company assessments. The tool, launched on 2 April, builds on the 2019 Investor Guidance and is an important step to expanding the attention to children’s rights beyond child labor. In December 2020 and January 2021, Sustainalytics supported UNICEF in ensuring that the indicators within the tool capture measurable aspects of corporate reporting.

Below, we explore the tool’s relevance for investors through a brief data analysis using UNICEF’s initial framework[3] by highlighting several leading practices per industry, identifying strong and weak corporate reporting against various child-related indicators, and reflecting on the role of active ownership on material risks and opportunities.

Research methodology

UNICEF’s initial framework included 42 indicators on a range of issues varying from respect for children’s rights, child labor, family-friendly policies, and marketing to children, to name a few. Sustainalytics tested the indicators against the reporting of 15 companies to confirm that these are fit for purpose to ensure compatibility of the prevailing approaches.[4] Three companies were sampled from each of the industries most exposed to children’s rights violations: Personal & Household Goods, Food & Beverage, Technology, Travel & Leisure, and Basic Resources. The companies selected include strong and medium reporters, covering different degrees of alignment with international standards such as the UN Guiding Principles on Business and Human Rights, OECD Guidance on Responsible Business Conduct for International Investors, and Children’s Rights and Business principles. These standards were considered by UNICEF when developing this tool.

Data analysis insights

Chart 1 shows how companies are reporting by industry against children’s rights indicators. The Personal & Household Goods industry ranks first, which is expected considering that most of the leading practices are set by this and the Food & Beverage industry. In the benchmark sample, Adidas stands out through its commitment to uphold children’s rights as set out by the UN Convention on the Rights of the Child. The company promotes flexible working arrangements for workers with family responsibilities, recognizes the protection of minors as a material issue, and reports 100% retention rates in 2019 of employees who took parental leave.

The Food & Beverage industry places second with notable results from companies like Nestlé, which has a robust ‘global marketing to children’ policy that covers several media channels, sets strict audience thresholds, and commits to responsible representations of products for children. Furthermore, Nestlé participates in industry initiatives such as those carried out by the International Chamber of Commerce, the International Food and Beverage Alliance, and the Consumer Goods Forum. It is also a member of the EU Pledge.[5] According to the 2018 Access to Nutrition Global Index, companies that commit to pledges usually demonstrate significantly better performance on responsible marketing. [6]

Chart 1

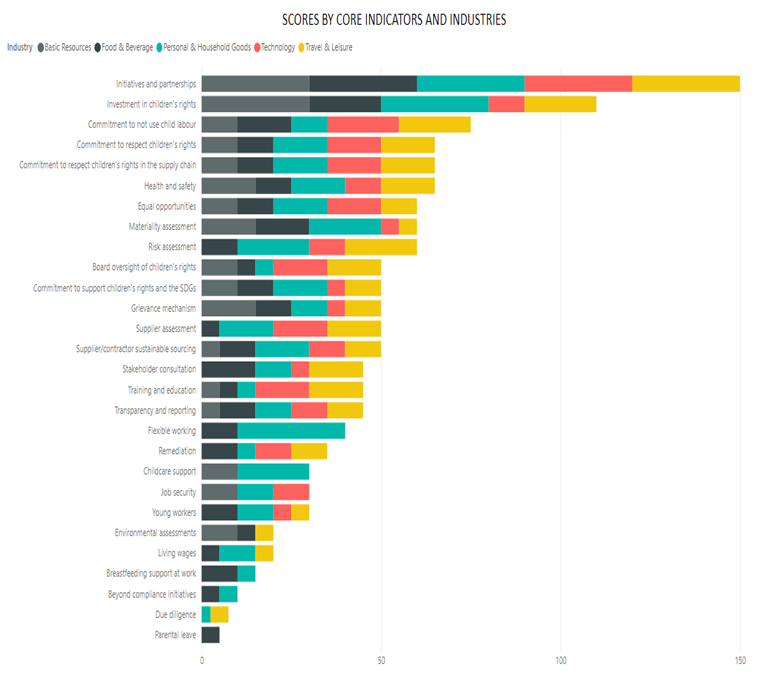

Chart 2 shows how companies are reporting by core indicators and industries. As expected, most companies score well against the “Initiatives and partnerships” indicator, which is considered a lower threshold one due to the commonness of reporting on collaborations with stakeholders such as NGOs on children’s rights. The same applies to the indicator ranked second that focuses on resources donated to social initiatives supporting children’s rights, which is also a widespread practice among companies in most industries. In sharp contrast, companies across industries perform poorly on the core indicators addressing due diligence and parental leave. On the due diligence indicator, only three companies partially scored points against the criteria because most have a process covering human rights without integrating children’s rights into existing assessments. In terms of parental leave, companies typically did not report on the duration and those that did disclose revealed that the leave was less than 14 weeks, for which no score was granted.

Chart 2

Paving the path for better disclosure and child rights management

It is telling that despite our sample set centering on industries with the most exposure to children’s rights issues and consisting of companies generally considered as having strong or medium disclosure, reporting on many child-related indicators is unequivocally lacking. While corporate disclosure does not always fully depict the companies’ actual measures, the results indicate that there may be significant gaps in company preparedness to mitigate risks and impacts relating to children’s rights. There is a similar disparity in identifying opportunities to benefit from products, services and policies aligning with the needs of children and their caregivers.

Disclosure typically evolves in response to increased demand. Investors can play an important role by engaging companies to better manage and report on their approach to children’s rights. Simply underlining the investor interest in this topic with relevant investees and enquiring about the potentially material implications can go a long way towards prompting companies to reflect on their child-related risks and impacts. Subject to improving company disclosure and standardization, the availability and quality of data will over time also enable a more informed assessment and comparison of companies within and across industries. UNICEF’s new tool can support active ownership advocating for more transparency. It provides a framework for evaluating companies’ preparedness and disclosure gaps relating to both overarching children’s rights risks and other indicators and risks that are more specific to certain business functions or industries. The indicators can also be used in company engagements as concrete examples of factors for companies to consider in improving their risk management profile.

Sustainalytics’ Bespoke Research team provides customized data collection and advisory services on children’s rights corporate reporting. Furthermore, encouraging better disclosure, particularly on the company’s most material ESG issues, is a fundamental element across Sustainalytics’ Engagement Services. We continue to collaborate with UNICEF to support investors in integrating children’s rights in investment analyses and engagement.

Sustainalytics’ Tytti Kaasinen, Director, Engagement Services, will present at the launch event for UNICEF’s new Integrating Children’s Rights Into ESG Assessment tool on 14 April at 9 a.m. EDT/3 p.m. CEST. Click here to register.

Sources:

[1] OHCHR. Child rights and the 2030 Agenda for Sustainable Development in the context of the COVID-19 pandemic. Accessed 30 March 2021, available at https://ohchr.org/Documents/Issues/Children/ChildRights_2030Agenda.pdf.

[2] Read more on the guidance and investor relevance in our previous blog post ‘Children’s rights – the smallest things can have the biggest impact’ at

[3] Following the development of the initial set of indicators the tool was shared with various stakeholders in a public consultation in February-March 2021 and based on feedback from Sustainalytics and others, UNICEF implemented some changes to the initial framework.

[4] Not an exhaustive list of companies.

[5] The EU Pledge is a voluntary initiative by leading companies to change food advertising to children.

[6] https://accesstonutrition.org/app/uploads/2020/02/GI_Global-Index_Full_Report_2018.pdf, p. 92

Recent Content

DEI Rollbacks: Impact on ESG Risk Ratings and Broader Implications for Investors

This article covers how not all reported rollbacks in diversity, equity, and inclusion (DEI) initiatives will have the same impact. Due to the relatively low weight of DEI in Sustainalytics’ ESG Risk Rating, we do not anticipate significant changes to overall ratings.

Industrial-Scale Decarbonization in the EU: Stewardship Field Notes From Germany, France and Spain

This article covers how Morningstar Sustainalytics’ Stewardship Team embarked on a field trip in November 2024 to learn how EU industry leaders are navigating the complex challenges of the energy transition.