Want to save time on the manual tasks associated with portfolio monitoring and reporting? Our screening services can help streamline your ESG screening, reporting, and compliance processes—freeing up time so you can focus on value-added tasks. Our deep ESG data and regulatory expertise can help you ensure portfolios remain aligned with evolving sustainability policies and frameworks.

Benefit from seamless integration, customizable data feeds, and reports tailored to your specific ESG mandate, strategy, and industry frameworks.

Our ESG screening service empowers asset managers, asset owners, and wealth managers to efficiently execute ESG mandates, ensure compliance with industry frameworks, and streamline portfolio monitoring—without the manual burden.

Our expert-driven service and hands-on support helps you leverage ESG data into meaningful action with ease and precision.

Manage Vast Datasets with Ease

Our knowledgeable experts will translate your investment screening needs into streamlined reports that provide access to deep data for a broad universe of coverage.

Save Time on Manual Tasks

Offload the manual work of portfolio screening and monitoring and spend more time on value-added tasks.

Comply with ESMA Guidance

Leverage norms, compliance, or regulatory based screening data to meet compliance needs, with our team of experts on hand to map data to key reporting frameworks.

Navigate Multiple Datasets

For those looking to leverage multiple Sustainalytics data feeds, our screening services can help you create and report on custom screening thresholds.

Scale your Reporting

The batch screening capability facilitates production and delivery of screenings for a selected list of portfolios.

Quality Assurance on all ReportsOur team of dedicated data consultants review each report for quality and accuracy. | |

Customizable CriteriaWith a variety of screening options and available data points, you can define ESG screening criteria that meets your and your client’s individualized needs. | |

Best in Class Client TeamsOur expertise allows us to provide consultative setup to ensure you find the right data set to meet client mandates and needs. | |

Flexible Delivery OptionsAutomated, on-time delivery via FTP or email. | |

Continuous ServiceNeed to make a change to screening criteria? Our team can make adjustments to reporting and screens based on evolving needs at any point in time. |

Screening Service

Outsource manual ESG screening and receive clear, customized reports aligned with your investment criteria.

Custom Data Feed

Build bespoke data feeds that seamlessly integrate into internal systems, enabling informed decision-making.

Regulatory Mapping

Stay ahead of compliance requirements by mapping portfolios to common industry frameworks such as ESMA.

Portfolio investment lists

Execute your ESG mandate by outsourcing manual checks of your portfolio's alignment.

Our Experts Are Ready to Help You

Why Sustainalytics?

A Single Market Standard

Consistent approach to ESG assessments across the investment spectrum.

Award-Winning Research and Data

Firm recognized as Best ESG Research and Data Provider by Environmental Finance and Investment Week.

End-to-End ESG Solutions

ESG products and services that serve the entire investment value chain.

30 Years of ESG Expertise

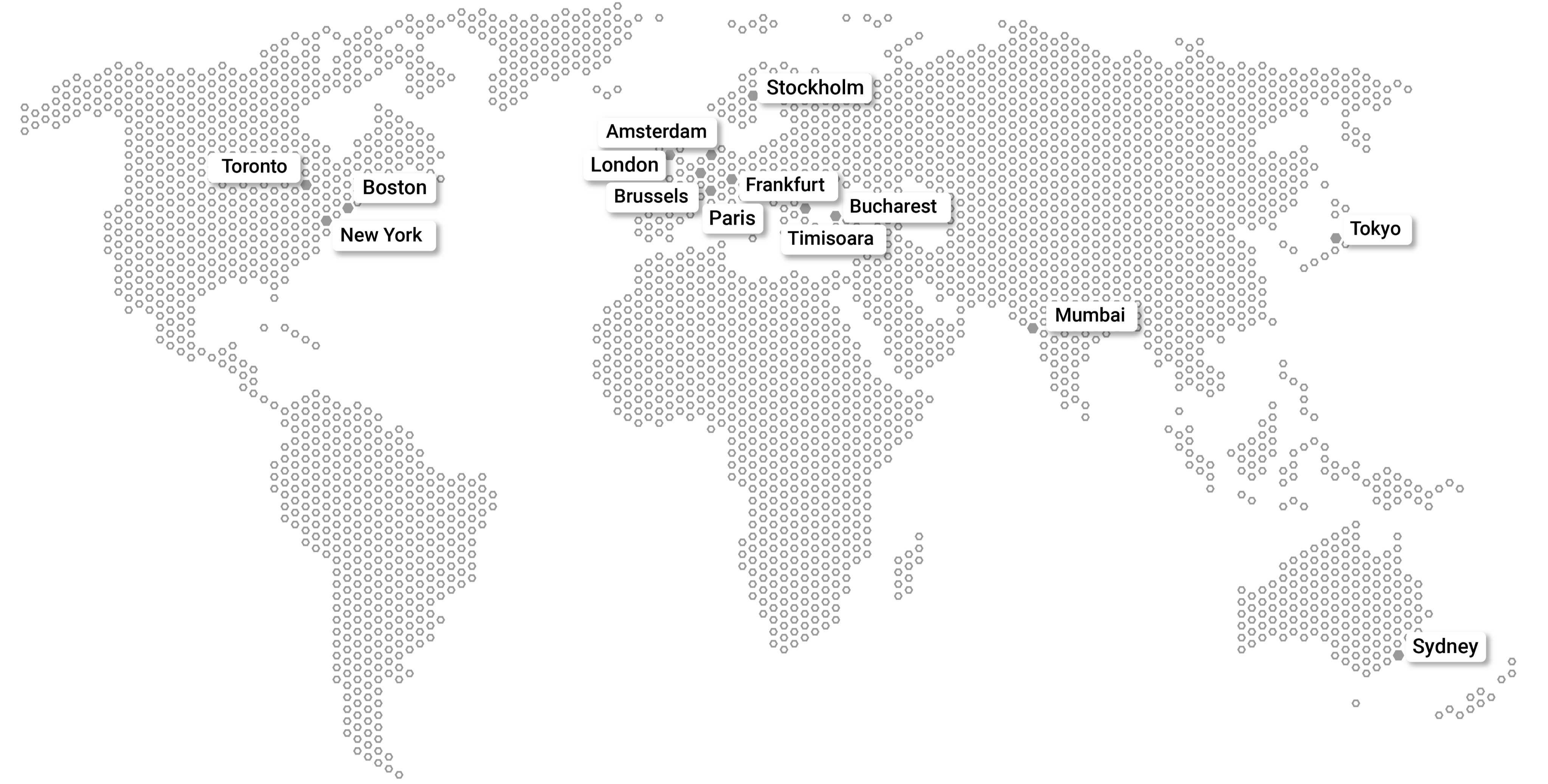

800+ ESG research analysts across our global offices.

A Leading SPO Provider

As recognized by Environmental Finance and the Climate Bonds Initiative.