Sustainalytics Insight: What is Biodiversity Risk & Why Does it Matter for Investors?

With the 16th Conference of the Parties (COP 16) kicking off this week in Colombia, it’s a great time to revisit the material risks that biodiversity loss may present for global investors.

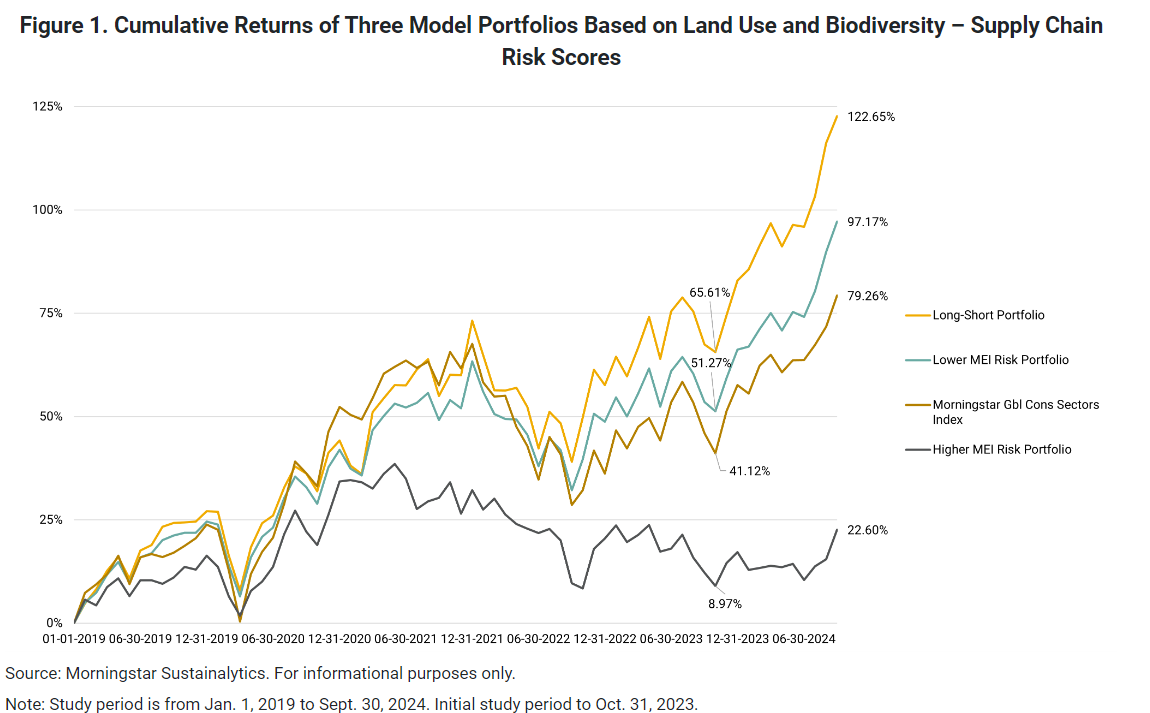

According to Morningstar Sustainalytics, investing in companies facing high levels of biodiversity risk could have a material effect on long-term portfolio performance. The global ESG research, ratings and data provider uses hypothetical portfolios using its material ESG issue (MEI) data from its ESG Risk Ratings to illustrate this important point.

In a new study, Morningstar Sustainalytics ESG Research Associate Director Martin Vezer, PhD, revisits the model portfolio analysis he introduced earlier this year, finding that a portfolio investing in stocks with lower MEI risk scores on Land Use and Biodiversity – Supply Chain would have performed better than a portfolio with higher exposure to biodiversity risks between 2019 and 2023. In addition, a similar long-short portfolio going long on stocks with lower biodiversity risk and short on stocks with higher biodiversity risk performed the best over this same time period.

Martin Vezer, ESG Research Associate Director, Morningstar Sustainalytics, said:

“Investors have grown increasingly interested in addressing portfolio risks linked to biodiversity loss, which can stem from holding stocks in companies involved in land use changes. Such activities have led to operational and supply chain disruptions, reputational damage and systemic risks. This analysis can serve as a starting point for assessing company performance relative to their ability to address ESG-related issues. Our research can help investors better understand how these factors may affect global equity portfolios.”

To speak in more detail with Martin, reach out to Tim Benedict at tim.benedict@morningstar.com or (203) 339-1912.

Media Contacts