Sustainalytics Insight: Shareholder Democracy and the Challenge of Dual Class Share Structures

Unequal share class structures, where companies have multiple share classes with differing voting rights, are a threat to fair proxy voting and can distort corporate governance, according to a new report from Morningstar Sustainalytics. The special report, authored by Morningstar Sustainalytics Stewardship Team members Ignacio Giner, Matteo Felleca and Jackie Cook, shines a light on the issues that can arise when company voting structures aren’t aligned with the economic interest of the entire shareholder base.

“Multi-class structures can distort key governance signals, limiting the influence of minority shareholders on issues ranging from executive compensation to environmental, social, and governance (ESG) resolutions,” said Cook, director of stewardship, product strategy and development. “Systemic risks may also arise as a growing number of companies, particularly in the tech sector, adopt this share structure at their initial public offering.”

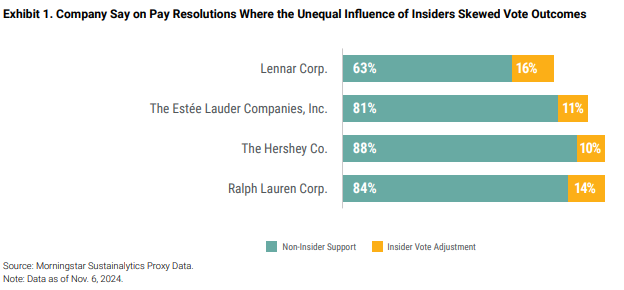

The report highlights “say on pay” ballot proposals as one area where unequal voting rights have limited shareholders’ ability to make their voice heard. For example, at Lennar Corp, Executive Chairman and Co-Chief Executive Officer Stuart Miller has voting rights over 65.6% of Class B stocks, which carries 10 votes per share as compared to one vote per share of the more widely held Class A stock.

“Across the market, entrenched insider control may lead to poor governance practices and impede the ability of shareholders to enact reform. We believe that better reporting of the votes – disaggregating those cast by insider holders of super voting shares from those cast by minority shareholders – would support shareholder democracy and strengthen good governance in markets increasingly shaped by differential voting rights.”

To speak in more detail with the report’s authors, reach out to Tim Benedict at tim.benedict@morningstar.com or (203) 339-1912.

Media Contacts

%0A&_biz_n=1&rnd=606059&cdn_o=a&_biz_z=1746528320375)