Sustainalytics Insight: Asset Managers, Proxy Voting & ESG - The Widening Gap

Asset manager support for environmental and social proposals saw a significant decline in the 2024 proxy season with particular challenges in US asset managers, according to a new report from Morningstar Sustainalytics. The special report, authored by Morningstar Sustainalytics Director of Stewardship Research & Policy Lindsey Stewart, CFA paints a clear picture of decline in asset managers support for significant US shareholder resolutions on environmental and social themes.

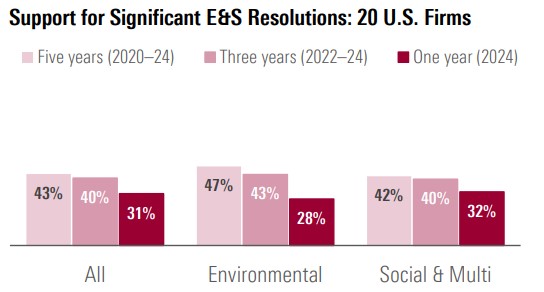

The shareholder voting data, as collected by the Morningstar proxy voting database and analyzed by Morningstar Sustainalytics stewardship research, showed that average support by 20 large US asset management firms for significant environmental and shareholder resolutions declined to 31% in 2024 from a high of 54% in 2021. The report also notably showed a widening gap between proxy voting trends in Europe, with votes by 15 European asset managers averaging 96% over the last five years, painting a stark contrast between the US and Europe.

Lindsey Stewart, CFA – Director of Stewardship Research & Policy, Morningstar Sustainalytics

“We are definitely seeing a widening gap – really a gulf to be honest – between asset manager support for environmental and social-related voting initiatives in the US versus Europe. While consistent support continues to exist for these initiatives in Europe and among US sustainable funds, we have seen a very consistent decline among major US headquartered asset managers in recent years with the potential to accelerate as we enter the 2025 proxy season.”

To speak in more detail with Lindsey, reach out to Tim Benedict at tim.benedict@morningstar.com or (203) 339-1912.

Media Contacts