10 for 2020: Creating Impact Through Thematic Investing

The UN Sustainable Development Goals (SDGs) are playing an increasingly important role in shaping the sustainability roadmaps of investors, governments and civil society groups. In Sustainalytics’ thematic research report, 10 for 2020: Creating Impact Through Thematic Investing, we present investors with ten ESG investment themes that can positively contribute to advancing the SDGs.

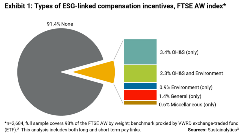

The State of Pay: Executive Remuneration & ESG Metrics

With investors increasingly incorporating ESG considerations into their investment decisions, many are looking into how corporate leadership may be incentivized to pursue an ESG agenda. This report offers insights to global equity investors considering pay-links as a topic for corporate engagement.

ESG Transparency Poland (Polish Report)

Since 2012, GES together with the Polish Association of Listed Companies, a self-government organization of companies listed on the Warsaw Stock Exchange, has been involved in an educational project ESG analysis of companies in Poland aimed at increasing disclosure and transparency of reporting on non-financial indicators.

Investor Guidance on Integrating Children’s Rights into Investment Decision Making

Sustainalytics in collaboration with UNICEF, The United Nations Children’s Fund, has published a new report titled, Investor Guidance on Integrating Children’s Rights into Investment Decision-Making. The guidance offers investors a practical toolkit on how to incorporate children’s rights into investment analysis and engagement activities.

Sustainalytics’ CEO Michael Jantzi Featured in Clean50 Webcast Series

We are excited to share that Sustainalytic’s CEO Michael Jantzi, participated in a clean finance podcast hosted by Canada Clean50 as part of their #CleanReset initiative. In the company of fellow leading clean finance experts, the dialogue is an insightful overview of how Canada’s current position on ESG regulation may impact financial sustainability for large Canadian corporations.

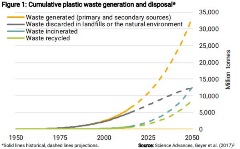

Sustainalytics' Feeding the Future Engagement

Food production is a leading contributor to global GHG emissions, deforestation, water stress and biodiversity loss, and the sector is increasingly under scrutiny to mitigate its environmental footprint. A failure to manage related impacts and adapt to changing consumer trends could result in material business risks or missing out on opportunities. Land and forest investments could become stranded assets. Sustainalytics will also provide a preview of its new thematic engagement, Feeding the Future.

Access to Nutrition Index 2016

Since the launch of the first Index, recognition of the human and economic consequences of poor nutrition has increased. Globally one in three people are now either undernourished, overweight or obese. Over the last 35 years obesity has more than doubled and has now reached epidemic proportions. Over the next 10 years, malnutrition is set to continue to increase.

The ESG Risk Ratings: Moving Up the Innovation Curve

To provide our clients with a better understanding of the ESG Risk Ratings, we published a series of white papers, the first of which presents a brief history of responsible investment and covers the motivations for developing a next generation ESG rating.

Progress report on investor expectations and corporate benchmark in cocoa

GES has engaged the cocoa industry for many years to increase its effort in tackling the issue of child labour. As a part of its long-term engagement, GES published its second public report on the issue, including investor expectations and a corporate benchmark of leading cocoa and chocolate companies.

Mirova: Food Security - Closing the Food Gap

Solutions for closing the food gap are likely to come from both production innovations and changes in consumption trends: on the one hand, it is essential that we increase the supply of food, while on the other, there is real potential for a reduction in demand for certain commodities.

Finding your path in the upcoming ESG regulations

Finding your path in the upcoming ESG regulations: A spotlight on EU Taxonomy and Disclosures The Taxonomy is a classification framework, part of the EU Sustainable Finance Action Plan, designed to determine whether an economic activity is environmentally sustainable.

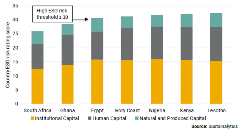

New Frontiers: African Sovereign Debt and ESG Risk

In New Frontiers: African Sovereign Debt and ESG Risk, we leverage our Country Risk Ratings to analyze ESG risk among African countries. Our findings show country-level ESG risk and average sovereign credit ratings exhibit a strong positive correlation.

The Budding Cannabis Industry: A first look at ESG Considerations

While investors are being drawn to the cannabis industry by the lure of an expanding market and profit potential, uncertainties around regulations, scalability and potential stock price corrections remain. Underexplored ESG risks could also present material concerns for management teams and investors entering the industry.

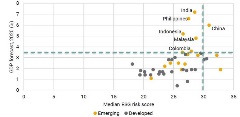

Emerging Markets Equities: Key Sources of ESG Risk

Based on our analysis, we find that investors in the FTSE Emerging Index are exposed to over 14 percent more unmanaged ESG risk than those in the FTSE Developed Index. The ESG risk gap between these indices is largest on the issue of data privacy and security. In addition, investors in select equity markets, such as China, may face a trade-off between chasing higher economic growth and mitigating portfolio ESG risk.

.tmb-small.png?Culture=en&sfvrsn=22076ca_2)

.tmb-small.png?Culture=en&sfvrsn=2b2a9c60_2)