Responsibility for corporate environmental, social, and governance (ESG) programs increasingly belongs to corporate social responsibility (CSR) and sustainability teams, according to The Morningstar Sustainalytics Corporate ESG Survey Report 2022. The survey asked 556 CSR and sustainability professionals around the world (168 from the Americas) about the challenges they’re facing and how they’re dealing with them.

In this supplement, we share additional findings from the survey on how CSR and sustainability teams in the Americas are managing ESG programs and how their responses on key ESG topics compare to the world.

Click here to download the Americas supplement.

We looked at two other regions in this supplement series: Europe, the Middle East, and Africa (EMEA), and Asia-Pacific (APAC). Click here to find them.

Once you’ve reviewed this supplement, click here to download the full Corporate ESG Survey Report 2022: CSR and Sustainability in Transition for global insights about peer practices and the future directions of corporate ESG programs.

Recent Content

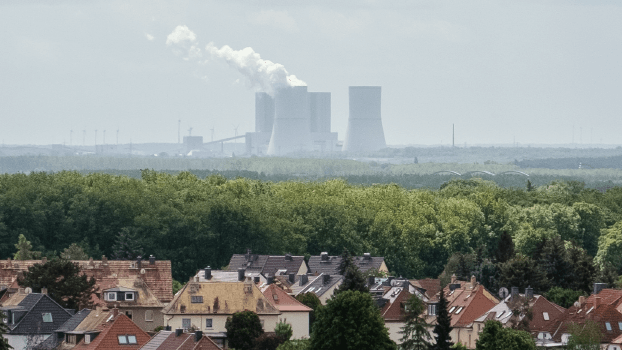

Reducing Emissions Through Sustainable Finance: A Guide for Companies in Carbon Intensive Industries

This corporate guide discusses the difficulties in measuring, reporting, and reducing GHG emissions in hard-to-abate sectors and provides key takeaways so that companies can take advantage of the opportunities sustainable finance offers.

Meeting Investor Expectations Through Corporate ESG Reporting, Planning and AGMs

Investors are increasingly influenced by ESG ratings and companies’ approaches to managing ESG risk. While an annual general meeting (AGM) is an ideal opportunity to communicate company plans around managing these risks, ESG reporting goes beyond an AGM or proxy season. Investors want investing to align with values, but are also looking at risk exposure and management.