With ESG reporting frameworks frequently on the minds of investors, we are often asked which framework companies should consider – Global Reporting Initiative (GRI), Sustainability Accounting Standards Board (SASB), or Task Force on Climate Related Financial Disclosures (TCFD). Most importantly, companies would benefit most from a framework that addresses material ESG issues that are meaningful and relevant for the organizations’ goals. Of relevance, rating agencies for example tend to look for at least three years of ESG metrics to determine company trends and long-term ESG targets, goals, and strategies to manage and reduce ESG risks at least five years ahead.

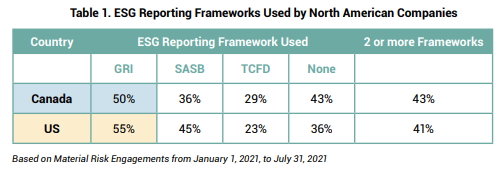

A best practice is to provide disclosure in ESG reporting framework data charts. GRI addresses a broad ESG data set, is principle-based and is beneficial to all stakeholders. GRI is currently the most used ESG reporting framework in North America (see Table 1). SASB standards are industry-specific and focus on financially material issues on the sustainability topics that matter most to investors. TCFD is gaining momentum with investors since it focuses on climate-related risks and can demonstrate how a company is prepared for climate change impacts, such as floods, drought, and earthquakes. TCFD, while a valuable addition to measuring ESG in this context, has a narrower focus and should not be used as a substitute for SASB or GRI. As of July 31, 2021, from the 14 Canadian and 22 American companies engaged in 2021, the majority use GRI as an ESG reporting framework. On average, 42% of these North American companies use two or more ESG frameworks for reporting (see the breakdown in Table 1).

ESG Target Trends, Net-Zero Carbon Emissions and Beyond

Long-term ESG targets are recommended for material ESG issues. To do this, a company must determine the materiality of ESG issues and analyze at least one year of baseline performance data from operations. Examples of ESG targets, preferably in five-year increments, are reductions in CO2, NOx and SOx emissions, withdrawn, consumed and discharged water, and solid, hazardous and effluent wastes. Furthermore, it is important for companies to have a CAPEX commitment to initiatives to achieve these reduction targets and demonstrate progress year over year, while it is also suggested that companies disclose ESG performance metrics for at least three consecutive years. Not to forget, there must be clear governance and senior management responsibility of ESG risk management to increase commitment and accountability.

Carbon as a Material Risk

Out of all the material ESG risks discussed with North American companies, investors have shown the most interest in carbon emission reduction plans, especially net-zero carbon emission goals, as demonstrated by their attendance at engagement meetings focusing on this topic. Investors are asking for company plans to reduce revenue from coal, e.g. less than 5%, for net-zero or science-based targets. Companies’ responses to these requests can result in being included in an investment universe or remaining excluded. Investors are also asking for TCFD reporting. Activity in the market signaling similar pressure are the Net Zero Asset Management signatories, representing USD $32 trillion in AUM. These signatories are dedicated to supporting investing aligned with net-zero emissions by 2050 or sooner.1 The majority of Canadian companies engaged in 2021 as of July 31 do not have ESG targets. However, in the United States, there is a 50/50 split between companies with and without ESG targets (see Table 2). From this analysis, ESG framework reporting does not uncover if companies in the United States and Canada have ESG targets, as illustrated in Graph 3.

Transition Initiatives

Governments are also setting carbon emission reduction targets. The Canadian government has set targets to reduce emissions by 40-45% by 2030 and to achieve net-zero emissions by 2050 using a 2005 baseline. A carbon charge on fuels will increase to CND $170 per tonne in 2030.2 There are federal incentives companies can use to achieve carbon emission reductions from electrification or hydrogen blending. Oil and gas companies in Alberta plan to work with the federal and provincial government to achieve net-zero greenhouse gas emissions from oil sands operations by 2050 as part of the Oil Sands Net Zero initiative.3 In the United States, President Biden has proposed a target of zero-emission vehicles to reach 50% of sales in the U.S. by 2030, and a target to reduce economywide greenhouse gas emissions by 50-52% in 2030. This is backed by plans for billions of dollars in clean energy and sustainable infrastructure investments.4 The U.S Department of Energy recently announced funding of USD $52.5 million to projects that advance clean hydrogen technologies. Companies are asked during engagements how these government targets and incentives are being integrated into company strategies. Examples of greenhouse gas emission reduction initiatives that have been observed in engaged North American companies to meet net zero targets are:

- Renewable natural gas5 (RNG) substitutions in existing infrastructure since it is interchangeable with fossil natural gas.

- Renewable energy generation or purchases to replace coal generation, e.g., powering facilities with 100% renewable electricity by 2030.

- Electrification of vehicle fleets and of industrial processes/equipment.

- Green(er) product manufacturing, where less harmful chemicals, less energy, and/or less water is used, and less waste is produced in product manufacturing processes.

- Investment in clean hydrogen opportunities and technologies.

Financial Mechanisms to Achieve ESG Targets

Aside from the provided example of company reporting and other highlighted transition initiatives, there are also increasingly available and awarded financial mechanisms to achieve ESG targets. For example, banks are providing a means to support ESG initiatives via sustainability bonds, green bonds, sustainability-linked bonds, social bonds, climate bonds, blue bonds, SDG bonds, etc. Scotiabank recently announced the issuance of a USD $1 billion sustainability bond, the largest to date in Canada, to finance green and social projects.6 The bank’s sustainability bond framework received a second-party opinion from Sustainalytics. In terms of market growth here, according to the Climate Bonds Initiative’s March 2021 report (Sustainable Debt: North America State of the Market), the North American sustainable debt market reached a cumulative USD 311 billion at the end of Q1 2021, with almost 6,000 instruments issued under green, social and sustainability (GSS) labels since 2011. In the last five years (2016-2020), the North American GSS market grew by an average of 76% year-on-year and for the first three months of 2021 by 10%. While these are encouraging numbers, given that the US is the largest single country source of cumulative GSS debt globally (Canada ranked 10th), further strong growth and accountability is needed to enable the transition and further grow impact.

Investors are increasingly expecting companies to provide long-term ESG targets for material ESG issues. Based on engagement dialogues in the North American market, our analysis show that there is clear room for improvement. Investors and companies together should continue work towards advancements in utility and set clear expectations of best practices. For the remainder of 2021, we will continue to focus efforts on suggested actions such as:

- Clear governance and senior management responsibility of ESG risk management.

- Three consecutive years of ESG metrics for material ESG issues, including how ESG materiality is defined.

- ESG long-term targets in five-year increments as well as disclosed progress year over year.

- Dedicated capex for initiatives to reach net zero targets and other ESG targets.

- TCFD reporting in addition to either GRI or SASB ESG framework reporting.

- Assessment and implementation of lower emission opportunities by partnering with other organizations or through government incentives.

Connect with our stewardship experts to discover what's on the horizon for Sustainalytics' Material Risk Engagement.

.png?Status=Master&sfvrsn=d51ed96e_1)

Sources:

1. BlackRock, Vanguard Among New Net Zero Asset Management Signatories, ESG Today, by Mark Segal, Mar 29, 2021, https://www.esgtoday.com/blackrock-vanguard-among-new-net-zero-asset-management-signatories/?utm_source=rss&utm_medium=rss&utm_campaign=blackrock-vanguard-among-new-net-zero-asset-management-signatories

2. Government of Canada, A Healthy Environment and a Healthy Economy, March 2021, https://www.canada.ca/en/environment-climate-change/news/2020/12/a-healthy-environment-and-a-healthy-economy.html

3. Major Oil Sands Players Seek to Neutralize Industry’s Climate Impact, ESG Today, by Mark Segal, Jun 9, 2021, https://www.esgtoday.com/major-oil-sands-players-seek-to-neutralize-industrys-climate-impact/?utm_source=rss&utm_medium=rss&utm_campaign=major-oil-sands-players-seek-to-neutralize-industrys-climate-impact

4. Biden Targets Zero Emission Vehicles to Reach 50% of Sales by 2030, ESG Today, by Mark Segal, Aug 5, 2021, https://www.esgtoday.com/biden-targets-zero-emission-vehicles-to-reach-50-of-sales-by-2030/?utm_source=rss&utm_medium=rss&utm_campaign=biden-targets-zero-emission-vehicles-to-reach-50-of-sales-by-2030

5. RNG is made from landfill waste, animal manure, wastewater, food waste, other organic feedstocks.

6. Scotiabank Issues $1 Billion Sustainability Bond, the Largest to Date in Canada, ESG Today, by Emanuela Kerencheva, Aug 4, 2021, https://www.esgtoday.com/scotiabank-issues-1-billion-sustainability-bond-in-largest-offering-to-date-in-canada/?utm_source=rss&utm_medium=rss&utm_campaign=scotiabank-issues-1-billion-sustainability-bond-in-largest-offering-to-date-in-canada