On March 19, 2023, UBS announced its intention to acquire its fellow bank Credit Suisse for US$3.2 billion.[i] Long-time rivals, the two companies are likely to become one entity. Much of the attention has therefore been on the financial drivers and outcomes of the deal.

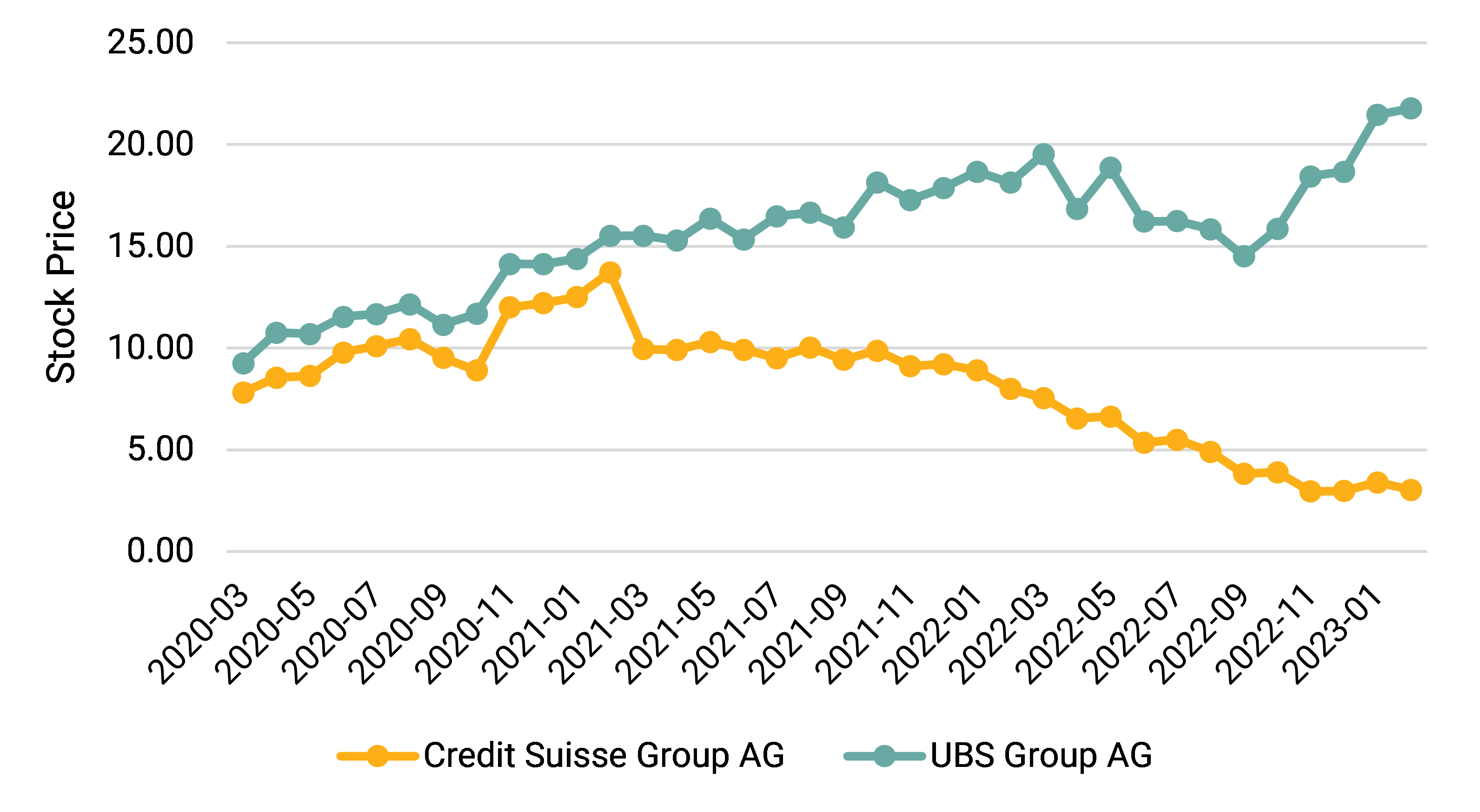

Anecdotal evidence suggests that acquisitions are one way to remove market inefficiencies, and therefore, acquirers are likely to be in a better financial position than their targets. The UBS-Credit Suisse case seems to fall under this category. Exhibit 1 shows that Credit Suisse’s market cap has lost 62% of its value over the last three years. Much of this drop started in March 2021 with the collapse of Achegos and Greensill. By contrast, UBS has been enjoying a good performance; its stock price has risen by 135% over the same period of time.

Alignment of ESG Risk and Financial Performance in Diverging Corporate Journeys

From a strategic standpoint, the two banks have parted ways because each has invested in different segments and made opposite choices over time. For instance, UBS has privileged growth and specialization of its activities and has developed over the years better risk management systems and corporate culture. The result represents stark differences in financial outcomes, with UBS taking the lead over Credit Suisse.

Exhibit 1: Stock Prices (in US$): UBS vs. Credit Suisse

Source: Morningstar Direct

Amid growing interest in the financial impacts of the merger, less attention has been paid to the ESG aspects. How have the two companies been performing on the ESG side? The short answer is that the situation on the ESG front is not much different from the financial one.

Exhibit 2 shows that UBS and Credit Suisse had comparable ESG RR scores in March 2020, yet the gap has widened considerably. The ESG Risk Ratings score of Credit Suisse decreased in 2020 and 2021 but started to increase in 2022 to reach 29.9. Between 2020 and 2023, its risk category ranged between “high” and “medium” risk, to presently stand at “high” as of March 28, 2023. Meanwhile, the ESG Risk Rating for UBS has improved significantly over the same period, as highlighted by a decrease in risk score from 34.4 to 19.9. Its risk category has therefore improved from “high” to “low.”

Several aspects have contributed to these results. One is that UBS has fared much better than Credit Suisse on the environmental and governance dimensions. For example, the Governance Risk Score of Credit Suisse increased from 16.0 in March 2020 to reach 16.6 in February 2023. Meanwhile, the UBS Governance Risk score has improved from 15.7 to 10.0 over the same period. As of February 2023, the Environmental Risk score of Credit Suisse is slightly higher than that of UBS. On the social side, it is a tie for most of the considered period; the difference has become noticeable only from November 2022 onward. In addition, Credit Suisse was involved in high-risk controversies related to business ethics and corporate governance incidents. These incidents include improper risk management of Archegos,[ii] tax evasion probes,[iii] and PricewaterhouseCoopers, which audited its financial statement for 2022, issuing “an adverse opinion.”[iv] By March 2023, the controversy rating for Credit Suisse stands at Category 5 for corporate governance and Category 4 for business ethics.

Exhibit 2 ESG Risk Scores: UBS vs. Credit Suisse

Source: Morningstar Sustainalytics

Following the ESG Risk Trajectory for a New Entity

As highlighted by many financial analysts, the acquisition might bring several financial challenges to UBS. On the positive side, there might be opportunities for diversification, economies of scale, synergies, and better positioning in the Swiss market and globally. On the flip side, Credit Suisse may require heavy investments and a significant overhaul to become profitable again.

On the ESG front, given the significant differences in ESG risk ratings between the two companies, the challenges may also be equally important. For UBS, taking over a company with a poorer ESG record may hurt its own ESG performance. We are interested in seeing which trajectory the ESG Risk Ratings score of the newly created entity will follow in the future.

Acknowledgements: The authors would like to thank their Morningstar Sustainalytics colleagues who helped in the preparation of this analysis. Feedback on the findings and insights was provided by Theodora Batoudaki, Hendrik Garz, Sercan Soylu, and Claudia Volk.

References

[i] https://www.ubs.com/global/en/media/display-page-ndp/en-20230319-tree.html