Key Insights

|

|

|

|

By 2050, 68% of the world's population will live in urban centres, adding 2.2 billion new urban residents compared to 2021. It’s a shift that will significantly increase the consumption of construction materials.1 This creates pressure on access to some raw materials that are essential for construction. And it raises concerns about the potential environmental damage caused by their mining. Additionally, it intensifies pressure on the industry's decarbonization efforts. Emissions from the chemical processing of cement alone makes up 4% of global emissions, the highest after coal, oil, and gas.2

In light of these challenges, Morningstar Sustainalytics has added Raw Materials Use as a new material ESG issue (MEI) to the construction materials industry as part of enhancements to our ESG Risk Ratings. This MEI focuses on the efficient and effective use of a company's raw materials (excluding energy and water), particularly those that can have a major impact on the low carbon transition.

This article identifies key risk drivers to help investors gain deeper insights on industry trends. It also highlights management measures taken by individual companies to manage the scarcity, regulatory, and carbon transition risks stemming from their raw materials use.

Scarcity and Mining Risks in the Construction Materials Industry

The construction materials industry relies on raw materials like limestone, sand, stone, brick, and gypsum. In particular, the specific type of sand suitable for concrete and aggregates poses risks related to supply disruption due to increasing demands, scarcity, and unsustainable mining practices. Conflicts are present in some of its mining locations, such as in India and parts of Africa.3 Finding new solutions outside the sand value chain could be part of the solution, including replacing sand with crushed rock, recycled aggregates, and other materials.4

Pressure on governments to regulate sand mining and find alternatives is growing, which in turn could pose regulatory risks to the industry in the future.5 Additionally, sand mining can affect the sediment needed for protection against storms and flooding, leading to erosion. Similarly to limestone mining, this can threaten biodiversity around mining locations.6 Due to this environmental damage, companies could face fines, penalties, and restrictions on their mining rights for violating environmental regulations and zoning laws.

Alternative Raw Materials and the Road to Decarbonization

Concrete – the second most used resource globally after water7 – is responsible for 7% of the world’s emissions. This is largely due to cement, its binding element.8 As the industry faces increasing pressure to decarbonize, the Global Cement and Concrete Association (GCCA)9 and cement associations around the world10 have set roadmaps to reach carbon neutrality. Recent regulations such as the EU's Green Deal Industrial Plan (2023), the U.S. Inflation Reduction Act (2022), and China's Carbon Peak Implementation Plan for Building Materials Industry11 are also expected to advance decarbonization efforts.

This calls for rethinking the type and volume of raw materials used. For example, traditional cement production process relies on large amounts of clinker, which is produced through the calcination process of limestone and is a significant source of carbon emissions. To address this, the cement industry is integrating alternative raw materials into the clinker production process. Additionally, the use of supplementary cementitious materials (SCMs) is being promoted to substitute clinker, thereby reducing the clinker-to-cement ratio.12

Examples of SCMs include the by-products of other industrial processes such as fly ash, or materials recycled from waste such as bricks, roof tiles, and concrete.13 The GCCA estimates that the use of SCMs could be responsible for 9% of the industry’s CO2 reductions needed to reach net zero by 2050.14

Assessing the Preparedness of Companies Via Management Indicators

Morningstar Sustainalytics assesses the companies’ preparedness to manage these risks through various management indicators. The eco-design indicator assesses the inclusion of environmental criteria in the research and development stage of products, while the end-of-life product stewardship program indicator assesses the final stage, such as the packaging and final environmental impact.

The Raw Materials MEI also includes indicators focused on the use of recycled materials as shown in Table 1.

Table 1. Summary of Raw Materials MEI Indicators for Use of Recycled Materials

| Indicator | Description |

|---|---|

| Recycled Materials Program | Assesses initiatives to use recycled/reused materials as input. |

| Recycled Materials Use | Evaluates the actual percentage of recycled/reused materials. |

| Recycled Material Use Commitment | Assesses the strength and credibility of the company's commitment to using recycled materials. |

| Raw Material Innovation Program | Examines research and development and innovation efforts to substitute critical raw materials. |

Source: Morningstar Sustainalytics. For informational purposes only.

The MEI also includes general environmental indicators, such as environment management system (EMS), EMS certification, and environmental policy.

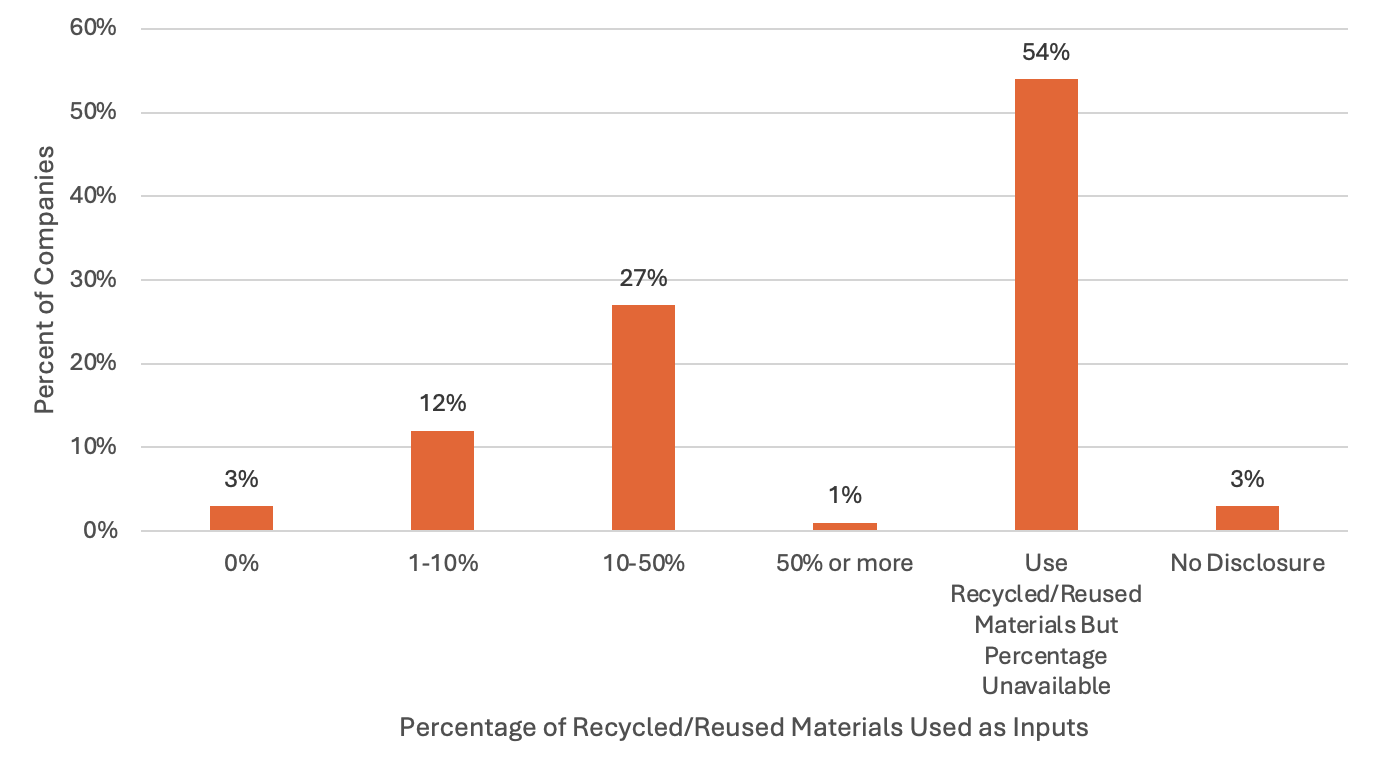

As Figure 1 illustrates, approximately 94% of companies in the construction materials industry evaluated by Sustainalytics report using recycled/reused materials to some extent. However, only 28% of these companies report using more than 10% recycled/reused materials as inputs. Notably, 54% do not disclose the percentage of such materials out of their total input materials. Leveraging solutions such as integrating fly ash, furnace slag, and other waste by-products from industrial processes is steadily becoming an industry trend.

Figure 1. Distribution of Companies in the Construction Materials Industry Based on the Percentage of Recycled/Reused Materials They Use as Input

Source: Morningstar Sustainalytics. For informational purposes only.

Source: Morningstar Sustainalytics. For informational purposes only.

Figure 2 highlights some notable solutions for using recycled and reused materials. Notably, while the use of fly ash and furnace slag is expected to decrease over time due to the phasing out of coal plants, the use of calcined clay, limestone, and natural pozzolanas as supplementary cementitious materials is expected to increase.15 Other companies are also experimenting with new construction materials such as timber, which could be an eco-friendly option, provided that it is sustainably harvested.

Figure 2. Company Examples of Notable Recycled/Reused Materials Solutions

Source: Morningstar Sustainalytics. For informational purposes only.

While the industry is making progress towards leveraging recycled and reused materials, much work remains to be done. The International Energy Agency, for example, notes that along with a projected increase in demand for construction materials, especially cement, the clinker-to-cement ratios has increased annually since 2015, reaching 71% as of 2022.16

The recent enhancement to our ESG Risk Ratings, which adds Raw Materials Use as a new MEI to the construction materials industry, will offer investors deeper insights into these industry trends. It also provides valuable assessments into the best management practices companies are adopting to address the scarcity, regulatory, and carbon transition risks stemming from their raw materials use.

References

- United Nations Human Settlements Programme (UN-Habitat), “World Cities Report 2022: Envisaging the Future of Cities,” UN-Habitat, 2022, https://unhabitat.org/sites/default/files/2022/06/wcr_2022.pdf

- Global Carbon Atlas, "World Territorial Emissions," Global Carbon Atlas, 2022, accessed May 22, 2024, https://globalcarbonatlas.org/emissions/carbon-emissions/

- Ajit Niranjan, "The World Is Running Out of Sand," Deutsche Welle, March 15, 2021, accessed July 4, 2024, https://www.dw.com/en/the-world-is-running-out-of-sand/a-56821076

- United Nations Environment Programme (UNEP), "Sand and Sustainability: 10 Strategic Recommendations to Avert a Crisis," April 26, 2022, accessed July 4, 2024, https://www.unep.org/resources/report/sand-and-sustainability-10-strategic-recommendations-avert-crisis.

- Kate Whiting and Madeleine North, "Global Sand Mining Is Impacting the Environment," World Economic Forum, September 2023, accessed July 4, 2024, https://www.weforum.org/agenda/2023/09/global-sand-mining-demand-impacting-environment/

- Ibid.

- Zach Winn, "Cleaning Up One of the World's Most Commonly Used Substances," MIT Office of Sustainability, 2023, accessed May 22, 2024, https://sustainability.mit.edu/article/cleaning-one-worlds-most-commonly-used-substances

- Global Cement and Concrete Association, "GCCA 2050 Net Zero Roadmap Accelerator Program," Global Cement and Concrete Association, accessed May 22, 2024, https://gccassociation.org/netzeroaccelerator/

- Global Concrete and Cement Association, "Concrete Future: The GCCA 2050 Cement and Concrete Industry Roadmap for Net Zero Concrete," accessed May 22, 2024, https://gccassociation.org/concretefuture/

- CEMBUREAU, "2050 Carbon Neutrality Roadmap," CEMBUREAU, 2020, accessed May 22, 2024, https://cembureau.eu/library/reports/2050-carbon-neutrality-roadmap/

- International Energy Agency, "Cement," International Energy Agency, accessed May 22, 2024, https://www.iea.org/energy-system/industry/cement

- CEMBUREAU, "2050 Ambitions & The Role of Secondary Materials," CEMBUREAU, accessed May 22, 2024, https://cembureau.eu/media/4wgdiraw/230123-cembureau-alternative-raw-materials-leaflet.pdf

- Ibid.

- The Global Concrete and Cement Association, "The GCCA 2050 Cement and Concrete Industry Roadmap for Net Zero Concrete," The Global Concrete and Cement Association, 2021, accessed May 22, 2024, https://gccassociation.org/concretefuture/wp-content/uploads/2021/10/GCCA-Concrete-Future-Roadmap-Overview.pdf

- CEMBUREAU, "Clinker Substitution in the Cement Industry," 2024, accessed May 22, 2024, https://cembureau.eu/media/f1gjfv0z/240305-cembureau-position-faq-clinker-substitution.pdf

- International Energy Agency. "Cement". Accessed: May 22, 2024. https://www.iea.org/energy-system/industry/cement