A country’s demographics has a strong influence on long-term social trends, including the development of ESG issues. With millennials becoming the dominant cohort among the workforce and consumers, we are witnessing the social transformations that come with a new generation. Although occurring globally, these transformations are particularly dramatic in China, due to the contrasting social environments experienced by China’s millennials and their parents.

In this article, we discuss the characteristics of China’s millennial generation and their impact on the development of some ESG issues in China. Leveraging Sustainalytics’ ESG Risk Ratings, we analyze the preparedness of Chinese companies for these impacts. We find that in general Chinese companies are not well prepared for the ESG issues emerging with the rise of China’s millennials.

A very different generation

Since the beginning of its reformation and opening up in 1979, China has experienced four decades of rapid social restructuring and high-speed economic growth. These changes have resulted in radical disparities between Chinese youth and older generations. While their parents went through hardships including the national famine in the 1960s, the chaos of the Cultural Revolution, and the scarcity of the planning economy, China’s millennials were born into a world that was far more prosperous and open, and seemed to be on the rise forever.

At the risk of overgeneralization, media coverage suggests that in contrast to older generations, China’s millennials appear to share the following characteristics:

- Growing up in prosperity, China’s millennials have a higher expectation of the quality of the products and services they receive. They want authentic goods at reasonable prices instead of fake products at extremely low prices. Moreover, younger generations are more aware of their rights as consumers.

- Compared to their parents, China’s millennials are more aware of social and environmental issues and care more about the impact of their actions on society. A survey of 1,000 active, US-based individual investors by Morgan Stanley in 2017 showed that 86 per cent of millennials are interested in sustainable investment.[i] This is one of several surveys globally that has found similar results. Although we have not seen analogous surveys targeting China’s millennial investors, the overall trend is likely to be the same, although potentially in earlier stages. We expect the demand and interest for sustainable investment in China will grown as millennials control an increasingly larger part of social wealth.

- Just like in the other parts of the world, China’s millennials are digital natives. For many of them, the Internet has become an integral part of their lives. Young generations treasure their virtual properties and identities online as much as they treasure their wealth in the real world. For them, online privacy is as important as privacy in real world. As a result, the stereotype of “Chinese people being willing to exchange privacy for convenience” seems increasingly frayed.

Rapid development and an increase in the standard of living will inevitably lead to an increased awareness of social responsibility, which has a positive impact across all ESG issues. However, based on the common characteristics described above, we consider three Material ESG Issues (MEIs) from our ESG Risk Rating framework as most relevant to the rise of China’s millennials: Product Governance; ESG Integration – Financials; and Data Privacy and Security.

Are Chinese companies well prepared for emerging ESG issues?

Product Governance

Product Governance focuses on how companies manage their responsibilities vis-à-vis clients, including the quality and safety of their products and services, marketing practices, fair billing and post-sales responsibility.

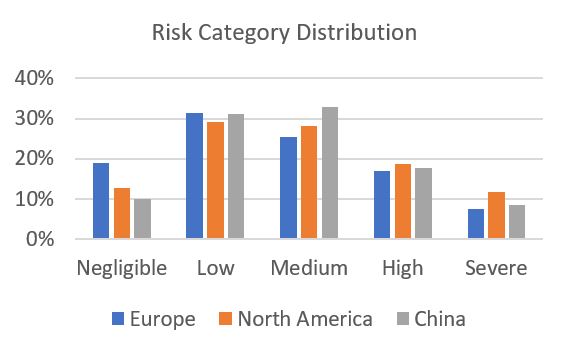

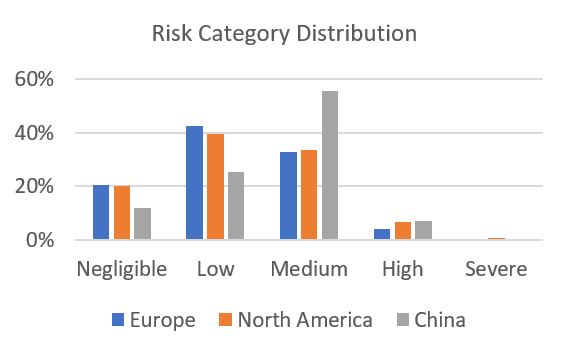

Figure 1. Performance comparison on Product Governance

Source: Sustainalytics ESG Risk Ratings Click image to enlarge

According to our assessment, the risk category distribution for Product Governance is similar for companies across Europe, North America and China, with most rated as having a low or medium level of risk. However, the average management score of Chinese companies on this issue is significantly lower than their European and North American peers.[ii]

While most Chinese companies have reported some initiatives to improve customer satisfaction through promoting customer experience and product quality, some other important aspects of robust Product Governance are often neglected. For example, Chinese financial companies generally do not disclose adequate programs on responsible product offerings to avoid predatory sales and minimize risks to clients. Most Chinese media companies also lack formal policies and programs on media and advertising ethics.

ESG Integration – Financials

The ESG Integration – Financials MEI focuses on the consideration of ESG criteria in business activities by financial institutions, which is either driven by financial downside risk concerns or by the recognition of business opportunities.

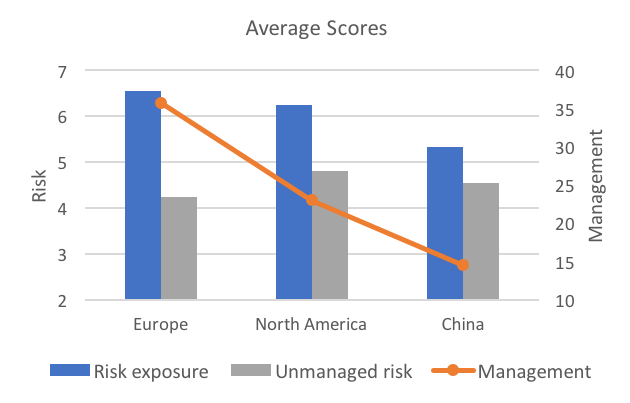

Figure 2. Performance comparison on ESG Integration

Source: Sustainalytics ESG Risk Ratings Click image to enlarge

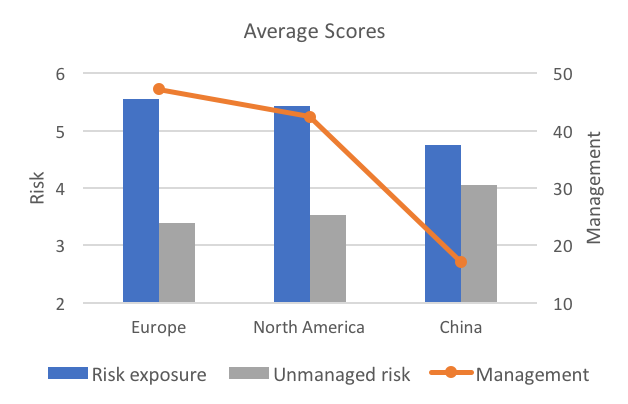

Overall and not surprisingly, Chinese companies’ Risk Rating on ESG Integration is higher than European and North American companies, mainly due to a weaker average management score.

In China, ESG Integration is at a very early stage. Companies generally see responsible investment as a broad public commitment, rather than a rigorous process of evaluation and screening, or as an effective tool to manage financial risk. Furthermore, poor corporate ESG disclosure results in insufficient data on ESG performance, making it difficult for Chinese financial companies to adopt a more sophisticated ESG integration approach.

Data Privacy and Security

Data Privacy and Security focuses on data governance practices, including how companies collect, use, manage and protect data.

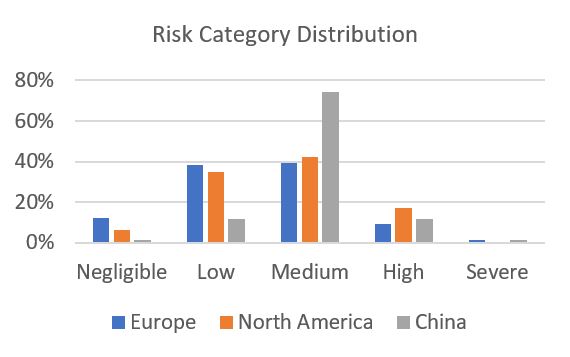

Figure 3. Performance comparison on Data Privacy and Security

Source: Sustainalytics ESG Risk Ratings Click image to enlarge

Like the ESG Integration MEI, on average Chinese companies’ Risk Rating on Data Privacy and Security is higher than European and North American peers, due to much weaker management.

Most Chinese companies do not publicly disclose a formal privacy policy. When they do, the content of their policies is more akin to a disclaimer, rather than serious commitments. Also, most Chinese technology, media and telecommunication companies lack initiatives to ensure that data sharing with governments, as part of legally mandated requests for information, follows due process and is as transparent as possible.

Conclusion

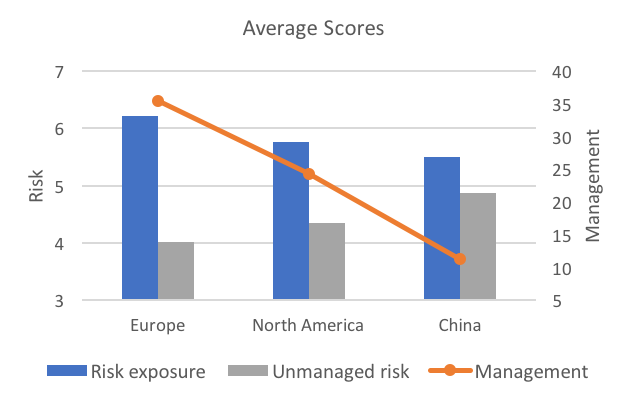

Our research suggests that there are significant gaps in Chinese companies’ management of the emerging ESG issues we have identified as important to Chinese millennials. Thus, even with lower risk exposure scores, Chinese companies’ unmanaged risk on these issues is higher.

On average we found Chinese companies’ risk exposure on the three MEIs to be lower due to relatively weaker regulatory requirements and lower public awareness. However, with the rise of China’s millennials we expect awareness of consumer rights, sustainable finance and data privacy in China to also grow. Product Governance, ESG Integration – Financials and Data Privacy and Security, among other ESG issues, will become increasingly material for Chinese companies. (To reflect the changing risk profile, Sustainalytics’ would also raise the risk exposure score for Chinese companies on these issues.) If not addressed, these management gaps could bring higher ESG risks for Chinese companies.

To bring awareness to these important emerging ESG issues, investors and business partners of Chinese companies may want to engage in a dialogue with their counterparts as part of due diligence and ongoing relationship monitoring.

Sources and Notes:

[ii] The ESG Risk Ratings’ emphasis on materiality requires the assessment of two dimensions: ESG risk exposure and ESG risk management. Exposure reflects the extent to which a company is exposed to material ESG risks. Management can be considered as a set of company commitments and actions that demonstrate how the company approaches and handles ESG issues.