Key Insights:

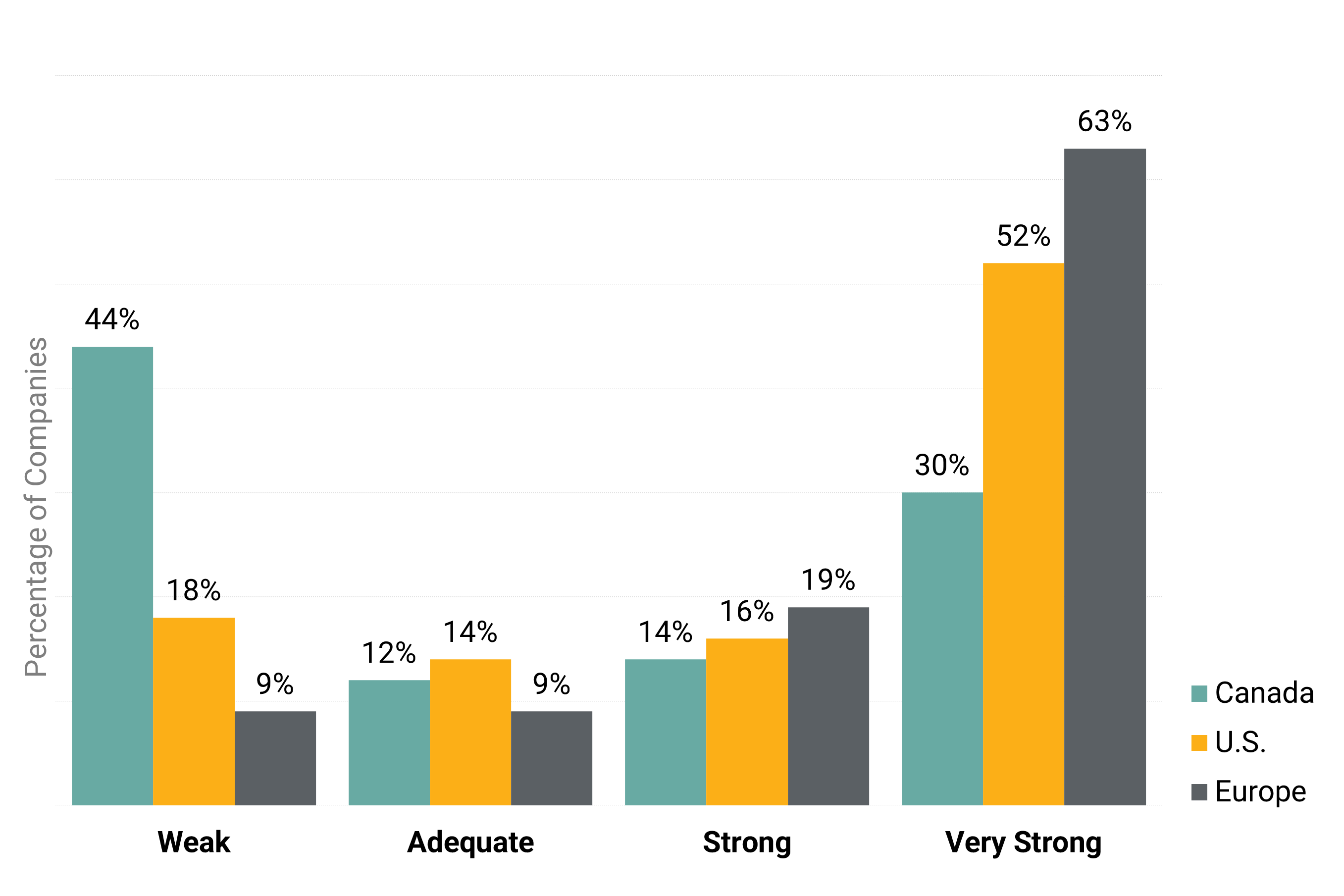

- Canadian O&G companies lag behind their peers in managing their GHG reduction programs. 44% of Canadian O&G companies have a weak GHG reduction program compared to only 18% and 9% of U.S. and EU based companies, respectively. 63% of EU O&G companies and 52% of U.S. companies have a very strong program, whereas only 30% Canadian O&G company GHG reduction programs have been rated as very strong.

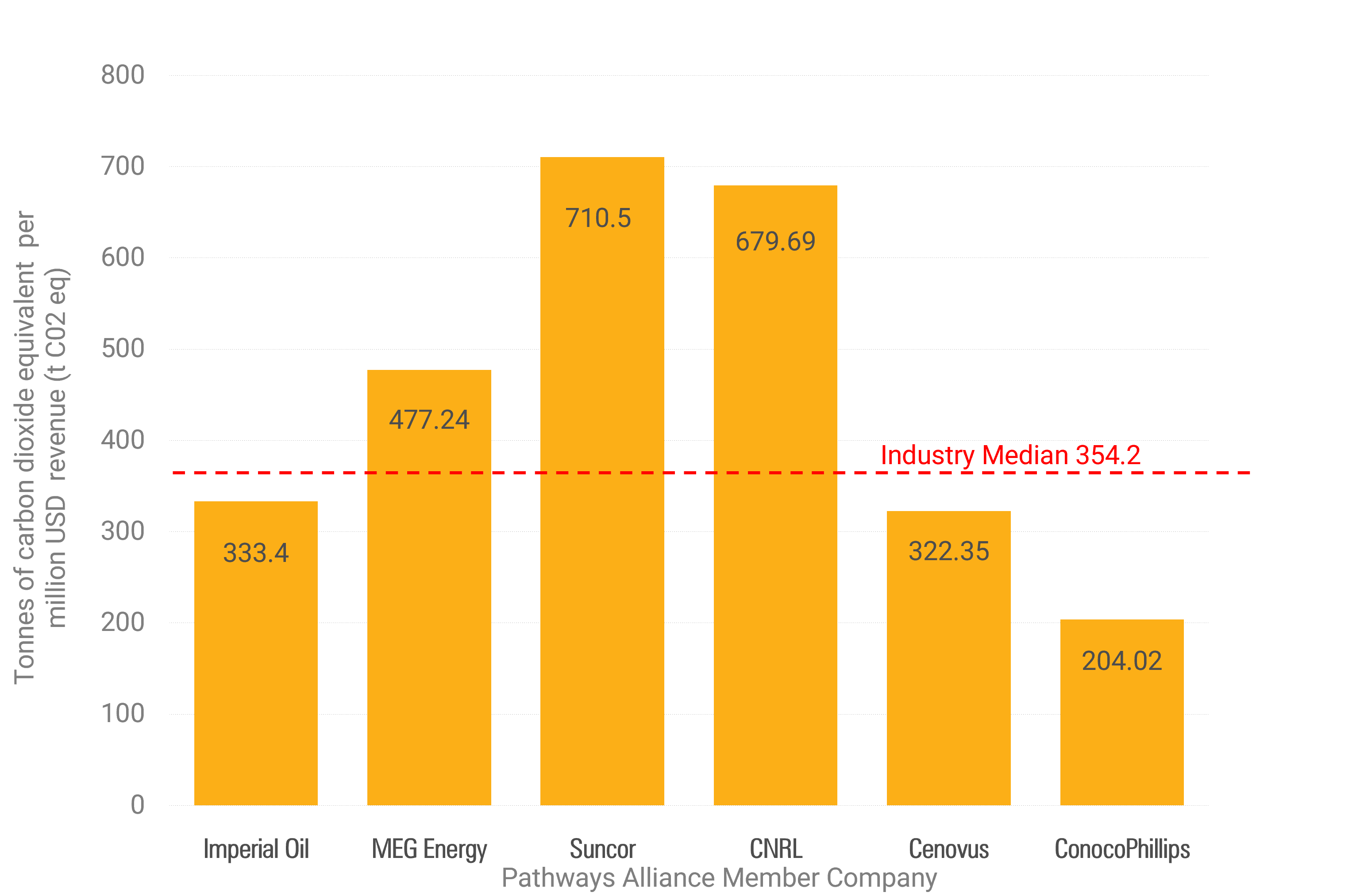

- Pathways Alliance formed in 2021 as a consortium of Canada’s six largest oil sands producers. The carbon intensity of half of this consortium's companies is well above the median for the oil and gas industry, and two others are just under the median.

- While all companies must be careful with their statements to avoid greenwashing risks, they should not fear or refuse to publicly disclose climate-related information. This practice is called greenhushing. Instead, companies should engage in real climate actions, avoid generic disclosures, seek third-party verification, and communicate transparently.

As the climate crisis continues to accelerate, governments, corporations, and investors are under increasing pressure to ensure transparency around decarbonization strategies. This article covers the interplay and actions of stakeholder responses to growing concerns of greenwashing risks with Canada’s oil and gas (O&G) sector.

Greenwashing is the practice of conveying false, misleading, or unsupported information about the environmental or climate benefits of an organization’s product, service, activity, or brand. Between 2022 and 2023, the number of alleged greenwashing incidents worldwide increased by 21.1%, with alleged greenwashing cases in Europe rising by 26.1% for the same period.1 Data out of the EU indicates 40% of green claims have no supporting evidence and 53% of claims are misleading, vague, or unfounded.2 In Canada, climate-related greenwashing incidents in the banking and financial services sectors increased by 70% in 2023, mainly due to their financing of projects and activities within the fossil fuel and O&G sectors.3

O&G Sector Response: Misalignment With Canada’s Climate Goals

As part of the Paris Agreement on climate change, Canada committed to reduce its greenhouse gas (GHG) emissions by at least 40%-45% below 2005 levels by 2030 and achieve net zero by 2050. However, Canada saw only a 7.1% reduction in GHG emissions from 2005 to 2022.4 While sectors like electricity and heavy industry showed declines, others like O&G and agriculture continued to produce increases in GHG emissions.5

From 1990 to 2022, Canada’s O&G sector saw an 83% increase in emissions. In 2022, the sector was the largest GHG emitter in Canada – accounting for 31% of total emissions for the country.6 This data underscores the importance of targeted efforts across the sector to decarbonize, in line with the country’s climate commitments.

Pathways Alliance (Pathways) formed in 2021 as a consortium of Canada’s six largest oil sands producers: Canadian Natural Resources Limited (CNRL), Cenovus Energy, ConocoPhillips Canada, Imperial Oil, MEG Energy, and Suncor Energy. Collectively, these companies operate about 95% of Canada’s oil sands production and are responsible for approximately 2.7 million barrels per day of oil production;7 roughly 63% of Canada’s total.8 Pathways advertised a goal to achieve net zero GHG emissions from oil sands operations by 20509 as part of its efforts to help Canada meet its climate targets. In its sweeping advertising campaign, Pathways stated that it is, “making clear strides toward net zero” and that it will, “help our country achieve a sustainable future.”10

According to Morningstar Sustainalytics’ ESG Risk Rating, 44% of Canadian O&G companies have a weak GHG reduction program compared to only 18% and 9% of U.S. and EU based companies respectively (Figure 1). Additionally, 63% of EU O&G companies and 52% of U.S. companies have a very strong program, whereas only 30% Canadian O&G company GHG reduction programs have been rated as very strong.

Figure 1. Comparison of Greenhouse Gas Reduction Programs in the Oil and Gas Sectors in Canada, U.S. and Europe

Source: Morningstar Sustainalytics. For information purposes only.

Note: Data analyzed for 43 Canadian, 63 U.S. and 54 European O&G producers’ GHG reduction programs.

A Civil Response: NGOs and Climate Litigation

A 2023 global climate litigation report revealed that between July 2020 and December 2022, 630 climate change lawsuits were filed across the world – with Canada having the sixth highest number of climate-related actions filed during this period.11 These actions comprised a range of claims against a variety of corporate issuers, as well as several cases against governments. Furthermore, a recent study determined that 89% of Canadian companies surveyed believe ESG litigation is an emerging risk, but only about 14% of respondents had ESG compliance programs modeling best practices.12

A current application by the nongovernmental organization (NGO) Greenpeace Canada to the Canadian Competition Bureau13 alleges that the claims made by Pathways of, “actively reducing emissions and helping Canada achieve its climate targets,” are false and misleading for the following reasons:

- They fail to incorporate the lifecycle of the product,

- They represent that they have and are following a transparent and concrete plan for reducing emissions and/or achieving net zero while they are continuing to expand production,

- They are based on untenable and not established assumptions about future technologies, and

- They give the impression that the Pathways Alliance is a climate leader and that their actions will clear pollution when they are not taking actions that do so.

Greenpeace Canada has asked the Competition Bureau to have Pathways remove all the representations about reducing emissions, achieving net zero, cleaning air, and combatting climate change as well as issue a public retraction of these statements and pay a fine that is the greater of CAD 10 million (USD 7.3 million) or 3% of worldwide gross revenues to organizations for the rehabilitation and cleanup of oil sands production. The complaint was submitted in March of 2023 and the Competition Bureau has yet to make a determination.

Government Response: Introduction of Anti-Greenwashing Rules

In June 2024, amendments were made to Canada’s Competition Act as part of Bill C-59.14 The Competition Act makes it illegal for companies to market or promote goods or services based on unfounded or misleading claims. Companies making misrepresentations to the public through deceptive marketing practices are subject to orders and administrative penalties.

Canada's latest competition law amendments create new rules for businesses' environment-related messages or representations and aim to combat greenwashing by requiring companies to provide evidence to back up their environmental claims. New conditions specific to environmental claims require that representation of a product’s environmental benefits must be based on an adequate and proper test. They also require that representation of the environmental benefits of a business or business activity be based on adequate and proper substantiation, in line with internationally recognized methodology. These new amendments apply to any business or individual that is marketing products, services, or any business interests.

Examples of greenwashing risk exposure aligned with the amendments include product claims of environmental benefit, such as low-carbon fuel labelled with sustainability information, and social claims such as those aligned with diversity, equity, and inclusion (DEI) efforts. Environmental claims at the business level must also be substantiated by an internationally recognized methodology, which includes net zero and carbon-neutral claims.

However, the current Competition Act legislation doesn’t define what constitutes an internationally recognized methodology for backing up claims about a business or business activity. Additional guidance from the Competition Bureau is required to provide clarity on what is considered acceptable, and the bureau is speeding the development of this guidance, while opening a feedback forum for related comments or suggestions.

Immediately following the passing of Bill C-59, Pathways replaced its website, social media, and other public communications content with a notice.15 The notice stated that the consortium remained committed to its work and reducing environmental impacts from oil sands production, but that the changes to the Competition Act create significant uncertainty for Canadian companies that want to communicate publicly about the work they are doing to improve their environmental performance.16 Five of the six Pathways consortium companies have also removed all or most ESG and climate-related content from their websites (with U.S.-based ConocoPhillips being the one company who did not).

An Investor Response: Shedding Light With ESG Research, Data and Stewardship

All six Pathways consortium companies are engaged with the Sustainalytics Material Risk Engagement Stewardship program, which is an engagement overlay to the Sustainalytics’ ESG Risk Ratings. Investors can use Sustainalytics’ risk research and stewardship services to uncover ESG data and information about Pathways consortium companies that is no longer available on their websites.

For example, investors can use the ESG Risk Ratings data to help discern how a company compares to its peers in terms of carbon intensity. Figure 2 demonstrates the carbon intensity of Pathways consortium companies compared to the industry median. We can see that half of the consortium companies are well above the industry median and two others are just under the median. The only company representing a significantly lower intensity than the industry median is U.S.-based ConocoPhillips (all other consortium companies are headquartered in Canada).

Figure 2. Pathways Alliance Member Company Carbon Emissions Intensity vs. Industry Median

Source: Morningstar Sustainalytics. For information purposes only.

Notes: Data sourced from the most recent Sustainalytics ESG Risk Rating for each company as of August 15, 2024. Carbon intensity is assessed using publicly reported emissions data and is calculated as the sum of scope 1 and scope 2 emissions for the current baseline year, expressed in tonnes of carbon dioxide equivalent (t C02 eq) per million U.S. dollars of revenue for the same baseline year. Performance is determined based on the positioning of a company’s calculated intensity figure relative to the median intensity of its industry group. By using disclosed emissions and company revenue, the assessment is comparable across companies. Industry median is for 2022. Carbon intensity is calculated across different assets while oil sands assets drive carbon intensity up.

In connection with ESG Risk Ratings data for the Pathways consortium company GHG reduction program indicators, Table 1 shows that although four out of six consortium companies are rated to have a very strong GHG reduction program, only CNRL is rated as having a GHG reduction target and strategy that includes adoption of key mitigation technologies and demonstration of how decarbonization initiatives are closing the gap between current emissions performance and targeted emissions reductions. On the other hand, Suncor, Imperial Oil and ConocoPhillips' ESG Risk Ratings indicate there has not been past disclosure by the companies to satisfy these indicators.

Table 1. Pathways Alliance Member Company GHG Reduction Program Ratings and Indicators

Source: Morningstar Sustainalytics. For information purposes only.

Notes: Data sourced from the most recent ESG Risk Ratings for each company as of August 15, 2024. The GHG Reduction Program indicator assesses a company's programs and initiatives to reduce and manage the release of GHG emissions within its operational boundary, including improvements in energy efficiency and process changes, as well as the strength of targets (i.e., alignment with strong decarbonization pathways), given the current need to decarbonize at an accelerated rate.

Overall, Sustainalytics’ ESG Risk Rating data demonstrates that, in general, Canadian O&G companies are lagging U.S. and EU peers in consideration of their GHG emissions intensity levels and strategic reduction programs.

Transparency is the New Objectivity

Sustainalytics’ Stewardship team engages these companies with intent to influence improved management of climate-related risks, along with additionally identified ESG risk management gaps. However, our analysis shows that only a few of the Pathways consortium companies are responding well to our requests to engage on behalf of investors. See Table 2.

Table 2. Summary of Pathways Alliance Response to Engagement

Source: Morningstar Sustainalytics. For information purposes only.

MEG Energy and Imperial Oil stand out positively with their response and progress performance whereas the others are on or nearing low-performance due to their lack of response to our requests for engagement.

During discussions with two Pathways consortium companies about their reactions to Bill C-59, they said that, “most member companies are taking a conservative approach until more clarity is provided around the adequate and proper substantiation in line with internationally recognized methodology” and that “we can proceed with engagement dialogue but cannot speak about quantifiable numbers for decarbonization at this time.”17

While all companies must be careful with their statements to avoid greenwashing risks, they should not fear or refuse to publicly disclose climate-related information. This practice is called greenhushing.18 Instead, companies should engage in real climate actions, avoid generic disclosures, seek third-party verification, and communicate transparently. By mitigating greenwashing risk, companies will also reduce the litigation, regulatory, and reputational risks they could face from greenwashing allegations. As such, it’s crucial that boards of directors and senior management understand and mitigate greenwashing and greenhushing risks, and that investors are empowered with tools and knowledge to make informed decisions.

The best way to clear the air is have it all out in the open.

References

- Fagan, P., Hickman, V. 2024. “EU: ESAs unveil their findings on greenwashing – calls for improved market practice on sustainability-related claims.” Linklaters. August 1, 2024. https://sustainablefutures.linklaters.com/post/102j99o/eu-esas-unveil-their-findings-on-greenwashing-calls-for-improved-market-practi

- European Commission. 2024. “Green Claims.” https://environment.ec.europa.eu/topics/circular-economy/green-claims_en

- ESG Investing. 2023. “Research shows increased greenwashing risk.” August 1, 2024. https://www.esginvesting.co.uk/2023/10/research-shows-increased-greenwashing-risk/

- Environment and Climate Change Canada. 2024. National Inventory Report 1990-2022: Greenhouse Gas Sources and Sinks in Canada. Greenhouse gas emissions, Canada, 1990 to 2022. https://www.canada.ca/en/environment-climate-change/services/environmental-indicators/greenhouse-gas-emissions.html

- Environment and Climate Change Canada. 2024. National Inventory Report 1990-2022: Greenhouse Gas Sources and Sinks in Canada. Greenhouse gas emissions by economic sector, Canada, 1990 to 2022. https://www.canada.ca/en/environment-climate-change/services/environmental-indicators/greenhouse-gas-emissions.html

- Environment and Climate Change Canada. 2024. National Inventory Report 1990-2022: Greenhouse Gas Sources and Sinks in Canada. Oil and gas sector greenhouse gas emissions, Canada, 1990 to 2022. https://www.canada.ca/en/environment-climate-change/services/environmental-indicators/greenhouse-gas-emissions.html#oil-gas

- Figure calculated from data at: Canadian Association of Petroleum Producers website. “Canada oil and natural gas production.” www.capp.ca/economy/canadas-oil-and-natural-gas-production. CAPP shows Alberta oil sands production as 2.84 million bpd in 2021. 95% of 2.84 million = 2.69 million.

- Figure calculated from data at: Statistics Canada. Table 25-10-0063-01 Supply and disposition of crude oil and equivalent. https://www150.statcan.gc.ca/t1/tbl1/en/tv.action?pid=2510006301. The Stats. Can. monthly crude production figures for 2021 (Jan-Dec) total 1,567,801,950 barrels. Therefore, Canada’s barrels per day figure is: 4,295,347.81 (from 1,567,801,950 / 365). Finally then, Pathways roughly 2,690,000 bpd = about 63% of Canada’s bpd.

- Pathways Alliance. 2023. “Clear the air.” Mar 4, 2023. https://pathwaysalliance.ca/cleartheair/

- Pathways Alliance. 2023. “Clear the air.” Mar 4, 2023. https://pathwaysalliance.ca/cleartheair/

- UN Environment Programme. 2023. “Global Climate Litigation Report 2023 Status Review.” Resources | UNEP. https://www.unep.org/resources/report/global-climate-litigation-report-2023-status-review

- Macnab, A. 2024. Canadian Lawyer Magazine. “ESG-related legal risk is on the rise, says KPMG's Conor Chell.” Aug. 1, 2024. https://www.canadianlawyermag.com/practice-areas/esg/esg-related-legal-risk-is-on-the-rise-says-kpmgs-conor-chell/385378

- Climatecasechart.com. 2024. “Greenpeace Canada v. Pathways Alliance.” Aug. 1, 2024. https://climatecasechart.com/non-us-case/greenpeace-canada-v-pathways-alliance/

- Parliament of Canada. 2024. “Bill C-59 (Royal Assent) June 20, 2024.” https://www.parl.ca/DocumentViewer/en/44-1/bill/C-59/royal-assent

- Scace, M. 2024. “Pathways Alliance revives website with slimmed-down version.” Calgary Herald. Aug. 1, 2024. https://calgaryherald.com/business/energy/pathways-alliance-revives-website-after-bill-c-59

- Pathways Alliance. 2024. “Canada’s Competition Act amendments.” https://pathwaysalliance.ca/home-page/canadas-competition-act-amendments/

- This information was acquired via Sustainalytics telephone correspondence with two Pathways Alliance member company representatives as part of the Sustainalytics Material Risk Engagement stewardship product activities.

- Fisher, R., Hodge, M., Beals, B. 2024. “Greenwashing, greenhushing and greenwishing: Don’t fall victim to these ESG reporting traps.” KPMG. https://kpmg.com/us/en/media/news/greenwashing-esg-traps-2023.html