In this article, we define environmental, social and governance (ESG) materiality and highlight what investors need to know when considering the materiality of ESG issues in their investment portfolios. Investors are increasingly noting the importance of evaluating companies’ performance on material ESG factors. Understanding and assessing companies’ risks due to ESG issues is part of a holistic strategy and can complement an overall investment policy. The financial, business and reputational risks posed by ESG-related incidents such as repeated product quality control issues, effluents spills, or community opposition to projects, can present real business risks to companies and potentially affect investment outcomes.

Take recent quality and safety incidents at Boeing, which have put the company’s commercial airline unit in the spotlight. The issue of product governance, which focuses on how companies manage risks related to product quality, service safety, and responsible marketing, is a material issue across many sectors, particularly those producing consumer goods, vehicles and infrastructure. Poor management of material ESG issues like this can negatively impact share price, brand reputation and result in legal or regulatory issues. But what makes an ESG issue material to a company and how can investors determine whether companies are effectively managing the issues they are exposed to?

What is ESG Materiality?

Over the decades, the interpretation of what is considered material1 has expanded to include ESG-related factors. Many financial market participants have realized that for most issuers, ESG factors can impact company value and should be considered in their decision making. A common misconception is that ESG issues are strictly related to environmental issues like carbon emissions or social issues like the gender wage gap. However, the ESG factors affecting companies go far beyond and include areas such as child labor in supply chains or product quality and safety. As such, investors, regulators, and other stakeholders are increasingly demanding that issuers provide details on the ESG factors they’re exposed to and the actions they are taking to manage them.

To help evaluate the risks ESG issues may pose to an issuer, investors may leverage ESG ratings. Materiality is the foundation of Morningstar Sustainalytics’ ESG Risk Ratings methodology. To be considered material, an issue must have a potentially substantial impact on the economic value of a company and its financial risk-and-return profile from an investment perspective.2

For instance, for companies in the precious metals industry, risks and incidents related to emissions, effluents and waste, occupational health and safety, and community relations could have a negative impact on financial performance, business operations and stakeholders if not understood and managed adequately. Conversely, topics such as human capital or land use and biodiversity, though important, would be less material to companies within the sector. By implementing proper management policies and systems or finding opportunities to develop solutions in areas deemed most material, companies can potentially mitigate risks and enhance their financial performance.

Regulatory Momentum Behind ESG Disclosures

Climate and ESG-focused regulations and reporting standards are being implemented around the world, affecting both financial market participants and investors. Some regulations, like those related to the EU’s Sustainable Finance Action Plan or Fit for 55 Package, are being introduced to push economies toward environmental sustainability and lower emissions. Others, such as the U.K. Financial Conduct Authority’s Sustainability Disclosure Regulations or the U.S. Securities and Exchange Commission’s Names Rule are being introduced as a form of consumer protection to combat greenwashing among providers of investment products.

With the introduction of reporting frameworks such as the Task Force for Climate-Related Financial Disclosure, the International Sustainability Standards Board’s (ISSB) S1 and S2 standards or regulations such as the Corporate Sustainability Reporting Directive, global regulators are requiring both financial institutions and companies to provide more ESG and climate-related reporting and in greater detail.

Asset managers not only have to manage their own regulatory risks, but they must also assess how portfolio companies are responding to the incoming regulatory changes. Standards like the ISSB’s S1 and S2, are likely to be adopted by governments around the world, which will help to standardize what’s reported, and in turn will help investors meet their own obligations.

Table 1. Notable Sustainability-Related Regulations and Standards

| Applicable for Asset Managers | Applicable for Companies |

|

|

Source: Compiled by Morningstar Sustainalytics. For informational purposes only.

ESG Issues Are Material Issues

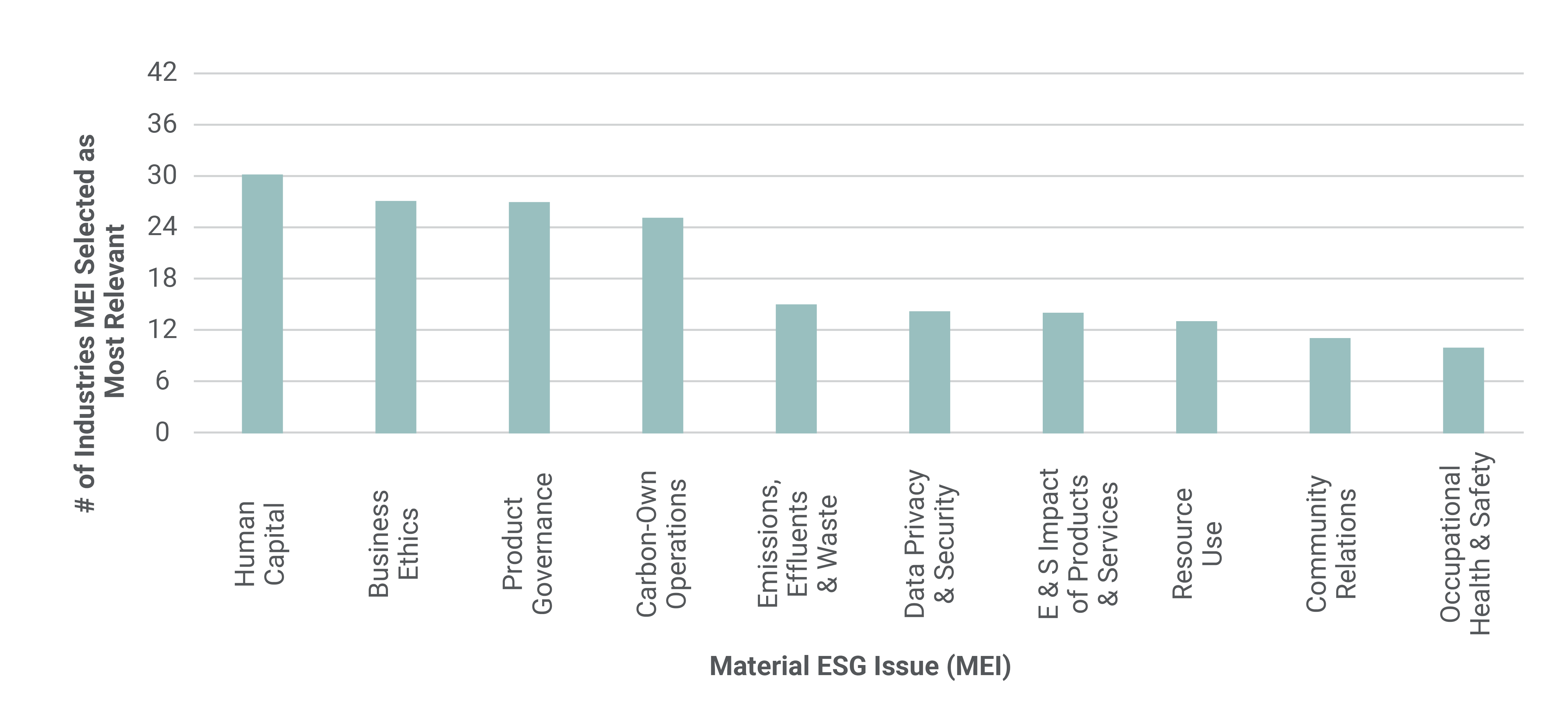

Every industry experiences risk from a variety of ESG factors. Some industries are more exposed to issues around carbon emissions, while others are more susceptible to matters related to business ethics or human capital. An analysis by Sustainalytics shows that four ESG issues emerged as being material for more than half of all industries in the ESG Risk Ratings universe3 4 – human capital, business ethics, product governance and direct carbon emissions (see Figure 1). Whether an ESG issue is material depends on several factors, including the industry and countries a company operates in, as well as its business model.

Figure 1. 10 Most Relevant ESG Issues in Sustainalytics' ESG Universe

Source: Morningstar Sustainalytics. For informational purposes only.

Source: Morningstar Sustainalytics. For informational purposes only.

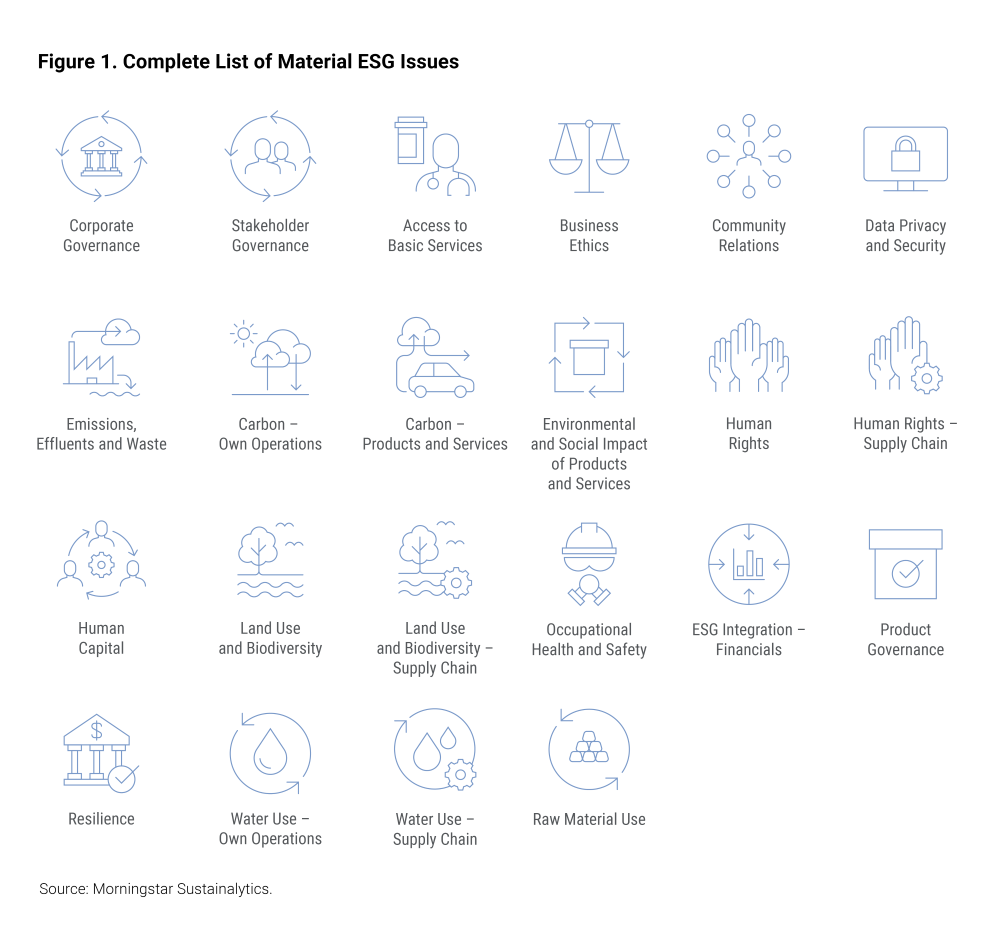

In assessing companies’ ESG Risk Ratings, Sustainalytics evaluates companies’ exposure to, and management of, a set of material ESG issues, which are those likely to have an effect on the enterprise value of companies (see Figure 2 for the full list). From regulatory penalties and reputational damage to environmental harm to lower financial performance, the negative outcomes of poorly managed material ESG issues can be detrimental to companies and investors.

For instance, Boeing’s quality and safety management issues with its commercial airplanes led to hundreds of millions of dollars in regulatory penalties,5 a decay in passenger trust6 and contributed to a decline in share value.7 At mining company Glencore, incidents related to business ethics issues led to an investigation of the company and a guilty plea to bribing foreign officials. A U.S. judge ordered Glencore to pay a USD 700 million penalty in 2023.8

Figure 2. Complete List of Material ESG Issues

Source: Morningstar Sustainalytics. For informational purposes only.

Source: Morningstar Sustainalytics. For informational purposes only.

Understanding ESG Materiality and Related Risks

Incorporating ESG considerations into portfolio management is a necessary practice for today’s investor. To do so effectively, investors must understand and account for the risks and opportunities that may arise based on portfolio companies’ management of material ESG issues. So, what should investors consider when evaluating the ESG issues that are material to a company’s financial outcomes?

Materiality Assessment

Not every ESG factor is material to every company. While topics related to human capital, like labor relations or employee diversity, would be material for companies across most industries, issues such as the management of emissions, effluents and waste would be material for only certain industries. Tools like SASB’s Materiality Finder and Materiality Map can help companies, and their investors, identify and prioritize their most relevant ESG issues.

ESG Risk Ratings

ESG ratings firms evaluate the investment risks ESG issues may pose to companies. Sustainalytics’ ESG Risk Ratings provide both a relative and absolute assessment of a company’s exposure to industry-specific material ESG risks and its management of those risks. Some investors look at the overall ESG rating, which is calculated based on the company’s exposure and management scores across several indicators. A more nuanced approach involves evaluating the company’s management score on specific issues.

Controversies and Incidents

Controversies related to a particular ESG issue or set of issues can also be a strong indication of the quality of a company’s relevant management systems and policies. For instance, does the company have the relevant policies and implementation processes in place to effectively address potential community opposition to its projects? Controversy reports provide investors with a company’s historical controversy assessment, offering insight into how it has addressed ESG-related incidents over time. Analysis of company controversies can also complement evaluations of ESG risk and help to better understand a company’s ESG risk exposure.

Country of Operation

A country’s long-term prosperity impacts both its ability to service its debt as well as the ability of companies operating there to flourish. Understanding the risk profile of the countries in which companies operate, such as their access to and management of natural, human and institutional wealth,9 can also enhance understanding of potential risk exposure. Investors can use country-focused research, such as the Country Risk Ratings, to supplement traditional sovereign bond- and macro-economic analyses.

Climate Risks

For investors and companies, climate change presents risks in several areas. The risks posed by government policies, such as more stringent emissions standards,10 and changing consumer preferences in the transition to a low carbon economy will produce risks that most companies are not prepared for.11 Companies not adequately prepared for the climate transition could also see their value put at risk.12 Risks posed by the physical impacts of climate change, such as flooding or extreme heat, also threaten business operations, assets and surrounding infrastructure.13 Although companies may have stated climate transition and emission reduction goals, it is important to consider not only what companies say they will do to counteract related risks, but how well that are following through to enact changes effectively.

ESG Risks Present Real Business Risks

Taking a holistic view of a company’s investment risk profile requires considering the materiality of ESG factors. To meet client and market demands for sustainable investments, and to comply with relevant regulations and reporting standards, investors should understand the materiality of ESG and climate factors as well as the risks they pose and opportunities they can present. To gain a better understanding of material ESG issues, along with industry and company-level insights into potential risks and opportunities, investors can partner with ESG data and ratings specialists.

Contact our team to discuss how Sustainalytics can help you better understand the material ESG risks in your portfolio. If you’re interested in learning more, explore our other content on the materiality of ESG factors:

- Fundamentals of ESG Materiality: An Overview for Investors – Report

- ESG Risk Ratings: Distilling for Enhanced Performance and Downside Risk – Report | Webinar

- Single, Double or Dynamic? An Exploration of Materiality in ESG Investments – Webinar

References

- CFA Institute. 2014. “Standards of Practice Guidance: Standard II(A) Material Nonpublic Information.” https://www.cfainstitute.org/en/ethics-standards/ethics/code-of-ethics-standards-of-conduct-guidance/standards-of-practice-II-A.

- Morningstar Sustainalytics. 2022. “Understanding Materiality: Lessons from Industries With High ESG Risk.” https://connect.sustainalytics.com/scs-ebook-understanding-esg-materiality-for-corporations.

- Pop, O., Toni, L. 2023. “The State of ESG Risk: Three Takeaways From our Annual Industry Reports.” November 28, 2023. https://www.sustainalytics.com/esg-research/resource/investors-esg-blog/the-state-of-esg-risk-across-industries--three-key-takeaways-from-our-annual-industry-reports.

- Based on analysis from 2019 to 2023. The assessed universe comprises public companies in the comprehensive framework. The approximate number of companies included each year is as follows: 2019 - 4,000 companies, 2020 - 4,000 companies, 2021 - 4,300 companies, 2022 - 4,500 companies, 2023 - 4,500 companies.

- The Associated Press. “Boeing Pays $200 Million to Settle SEC Charges over 737 Max Safety Claims.” NBC News. September 22, 2022. https://www.nbcnews.com/news/us-news/boeing-pays-200-million-settle-sec-charges-737-max-safety-claims-rcna49076.

- Fleck, A. 2024. “Trust in Boeing Plummets After Safety Incidents.” Statista. March 18, 2024. https://www.statista.com/chart/31928/net-trust-among-us-familiar-with-boeing-brand/.

- Owens, N. 2024. “After Earnings, Is Boeing Stock a Buy, a Sell, or Fairly Valued?” April 30, 2024. Morningstar.com. https://www.morningstar.com/stocks/after-earnings-is-boeing-stock-buy-sell-or-fairly-valued-4.

- Cohen, L. 2023. “Glencore Sentenced to Pay $700 Million in US after Bribery Guilty Plea.” Reuters. February 28, 2023. https://www.reuters.com/legal/glencore-sentenced-pay-700-mln-us-after-bribery-guilty-plea-2023-02-28/.

- Natural and produced capital includes renewable, non-renewable and produced capital refereeing to the stock of renewable natural resources (e.g., forests), non-renewable natural resources (e.g., fossil fuels) and produced capital (e.g., infrastructure) that provide inputs into (or in the case of produced capital, are produced through) economic activity. Human capital refers to the stock of knowledge and skills among economic participants. Institutional capital refers to the social and institutional infrastructure that enables the productive functioning of a society and economy. For more details see Morningstar Sustainalytics Country Risk Ratings Methodology.

- Heijkants, E. 2023. “Policy Response to Climate Change: The EU’s Fit for 55 Package and Its Implications for Companies and Investors.” July 17, 2023. https://www.sustainalytics.com/esg-research/resource/investors-esg-blog/policy-responses-to-climate-change-eu-fit-for-55-implications-for-companies-and-investors.

- Joshi, P. 2024. “Beyond 1.5 Degrees: What the LCTR Tells Us About Companies Managing Their Climate Risk.” March 11, 2024. https://www.sustainalytics.com/esg-research/resource/investors-esg-blog/beyond-1.5-degrees--what-the-lctr-tells-us-about-companies-managing-their-climate-risk.

- Osborne-Saponja, A., Feldman, J. 2024. “Value At Risk: Quantifying the Impacts of a Low Carbon Transition.” April 30, 2024. https://www.sustainalytics.com/landing-pages/value-at-risk--quantifying-the-impacts-of-a-low-carbon-transition.

- White, A. 2023. “Capturing the Direct and Indirect Risks of Physical Climate Change in Investment Portfolios.” May 8, 2023. https://www.sustainalytics.com/esg-research/resource/investors-esg-blog/capturing-the-direct-and-indirect-risks-of-physical-climate-change-in-investment-portfolios.