The Russia-Ukraine conflict has wide-ranging implications on the automotive industry. For one, this puts more pressure on a sector that was already constrained by the disrupted supply chains, brought about by pandemic-induced congestions and shortages. Additionally, the surge in fuel price is already affecting customers, although it may accelerate the adoption of electric vehicles (EVs) as a side effect. However, the scarcity of minerals, which are necessary for semiconductor manufacturing, may further exacerbate the chip shortage that has afflicted the automotive industry since 2020.

Supply chain disruptions and rising commodity prices create roadblocks for EV transition

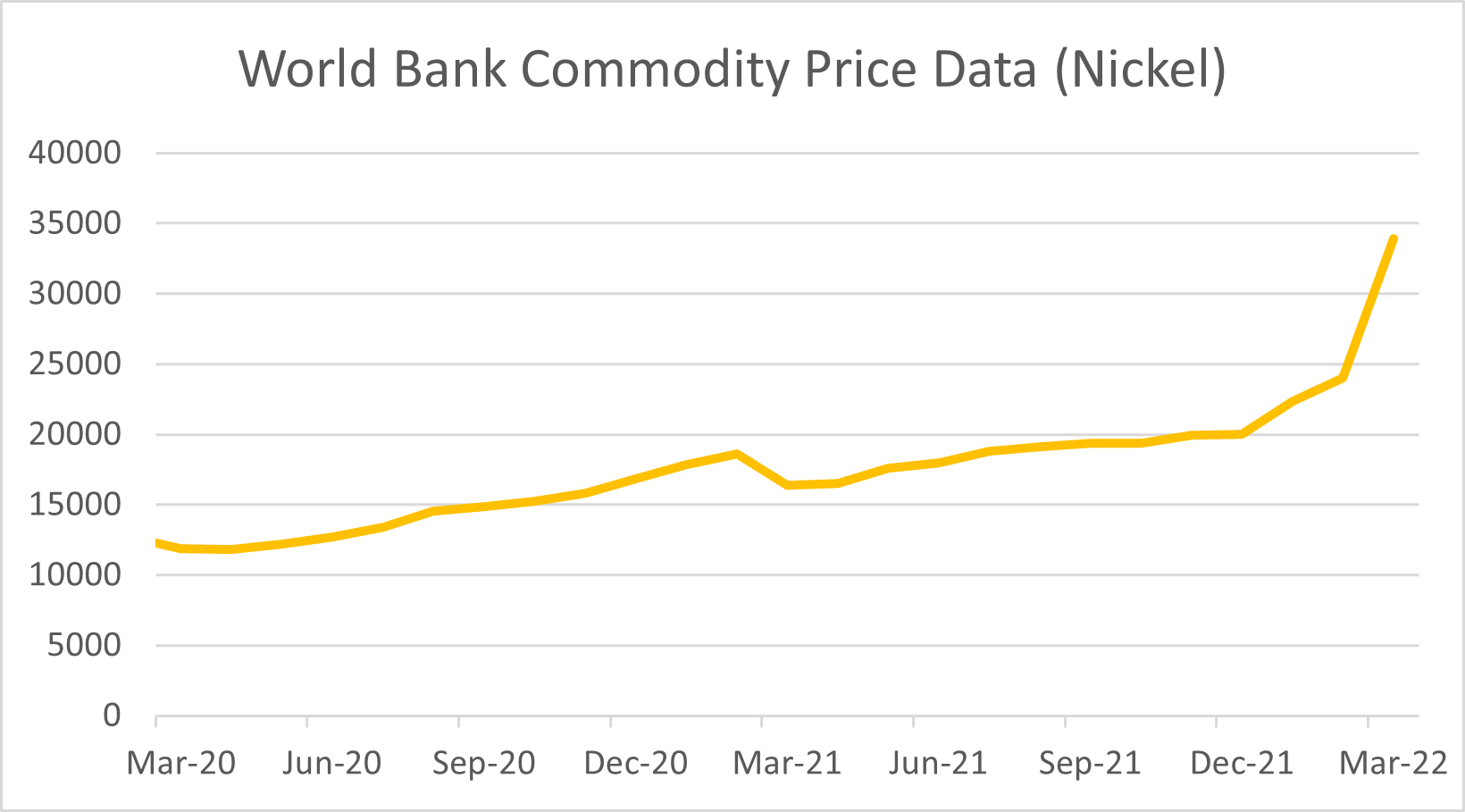

The supply of minerals, crucial to the advancement of the vehicle electrification effort, has been disrupted as a direct effect of the Russian invasion of Ukraine. In particular, the early-March 30% increase in the price of nickel1 (see Exhibit 1), which is an essential component of cathodes in lithium batteries, is likely to make EV production a more difficult task for automakers as Russia accounts for 7% of the global nickel supply.

Exhibit 1

Source: The World Bank, World Bank Commodity Price Data (The Pink Sheet) April 2022, https://www.worldbank.org/en/research/commodity-markets

In addition to global nickel supply, Russia represents around 45% of the global production of palladium, a metal necessary in semiconductor manufacturing. Furthermore, both Ukraine and Russia are producers of neon gas, used in lasers that are equally necessary in semiconductor production.2 A disrupted supply of these resources is likely to exacerbate the pandemic-induced chip shortage that is already straining the global vehicle production.

To alleviate the financial impact caused by the chip shortage, many automakers have been prioritizing chip allocation to the production of high-end models with higher margins; as this strategy has been relatively effective, OEMs are likely to prolong this strategy in the mid-term should the chip shortage endure or intensify, which in turn may impact production and access to more affordable models for customers with lower incomes and consequently reshape the mobility landscape. Also, in the context of a prolonged chip shortage, prioritizing the production of pricier EV models may prevent a fair allocation of existing governmental EV subsidies, if mid-range customers are deterred from EVs because of rising prices and consequently reconvert to cheaper internal combustion engine (ICE) models that are already available in the market. According to our data, 29% of the automakers (that we cover) generate over 5% of revenue from sustainable vehicles, while 20% of companies generate less than 5%. This is measured by Sustainalytics through the Sustainable Products & Services indicator, which is part of the Carbon - Products and Services Material ESG Issue (MEI) within the ESG Risk Ratings, (see Exhibit 2). Nonetheless, the soaring fuel costs due to inflation and dependence on Russian energy can present both to the sector as well as governments with a momentum to accelerate the transition to EVs, should they capitalize on a shifting customer demand.

Exhibit 2

Source: Sustainable Products & Services, part of Carbon - Products and Services MEI, Sustainalytics Data

Conflict continues to affect the supply of auto parts from Ukraine, while most operations in Russia have halted

The discontinued supply of auto parts originally manufactured in Ukraine have caused operational disruptions in the production of some vehicles, especially in Europe, and delaying the launch of some new models. Automakers in Europe have been faced with a shortage of cable wire harnesses, which are a critical component in the manufacturing of cars. Around 7% of wire harnesses supplied to European OEMs are produced in Ukraine;3 the disruption in supply from those factories and bottlenecks, related to shipping the wire harnesses across borders, has led some carmakers to suspend production at some of their plants.4 Several German automakers, such as WV and BMW, are facing difficulties to find immediate solutions. Manufacturing wire harnesses is highly dependent on skilled manual labor and on the unique car model requirements, making it difficult to relocate or even duplicate production in other facilities in the short-term.5 Additionally, mid- and long-term production solutions could also imply mitigative shifts in car production to other regions, such as America and Asia,6 which have comprehensive supply chain networks,3 but will likely pose additional financial challenges. In the meantime, we expect these carmakers to continue capitalizing on the supply coming from Ukraine, albeit on a limited basis, while at the same time halting or delaying production for some vehicles. This is the case particularly for premium or luxury models that depend on car-specific wire harnesses currently manufactured in Ukraine.

As far as the automobile production in Russia is concerned, the effect of sanctions, including strained inventories and supply chains, difficulties in payments processing and reputational risks associated with operating in the country has forced almost all OEMs to interrupt their operations in Russia. This includes Renault, which is one of the most exposed automakers to the Russian market (around 10% of 2021 revenue), mainly through its subsidiary AvtoVaz. Renault, which left Russia after mounting public pressure (including from the Ukrainian government and also after it had initially planned not to leave),7 has followed the suit of Aston Martin, BMW, Ford, GM, Honda, Hyundai, Jaguar Land Rover, Mercedes Benz, Nissan, Stellantis, Toyota, Volvo Cars and VW.

Get in touch with our Client Advisory team for any questions regarding how your investments may be affected by these risks.

Sources:

[1] The World Bank, World Bank Commodity Price Data (The Pink Sheet) April 2022, at https://www.worldbank.org/en/research/commodity-markets

[2] Automotive Logistics (2022), “Russia’s invasion of Ukraine is a long-term risk for the automotive supply chain”, at https://www.automotivelogistics.media/insight/russias-invasion-of-ukraine-is-a-long-term-risk-for-the-automotive-supply-chain/42809.article

[3] CNBC (2022), “Why Russia’s Invasion Of Ukraine Has Sent Automakers Scrambling”, at https://www.youtube.com/watch?v=BZd8g1s8Fno&list=WL&index=800

[4] Financial Times (2022), “Europe’s car plants halted by lack of low-cost Ukrainian component”, at https://www.ft.com/content/1d0522d0-5bb2-4c49-8978-6fb99fec7e24

[5] Reuters (2022), “Ukraine invasion hampers wire harness supplies for carmakers”, at https://www.reuters.com/business/autos-transportation/ukraine-invasion-hurts-flow-wire-harnesses-carmakers-2022-03-02/

[6] Volkswagen AG (2022), Corporate Website: Annual Media Conference Speeches 2022, at https://www.volkswagenag.com/presence/investorrelation/publications/presentations/2022/03/20220315_VWAG_JPK22_MediaConference_Speeches.pdf

[7] Financial Times (2022), “Renault suspends Russia business and looks at options for AvtoVaz stake”, at https://www.ft.com/content/1e87cfc9-08da-4fd4-9378-6c6cf16da5f7