Recently, the European Supervisory Authorities (ESAs) published a list of questions to the EU Commission to clarify further some key aspects of the Sustainable Finance Disclosure Regulation (SFDR), part of the EU’s package of measures around sustainable finance. The questions seek clarification on the definition of “sustainable investments” and how to interpret it, products with carbon emissions reduction objectives, and the meaning of “to consider” in the stipulations on principal adverse impact, among others. Regulators asking questions about topics central to the EU Action Plan show that more work needs to happen to make this ambitious, first-of-a-kind sustainable finance legislation workable for the market and supervisors and more useful for end investors. This article uses data from Morningstar and Sustainalytics to review the implications of this unclarity by looking at current market practices.

The concepts touched on by the European Security Market Authority (ESMA) are key for SFDR, the broader set of EU Action Plan regulations, and the MiFID II amendments on ESG and sustainability preferences that took effect in August. These amendments require an advisor to consider a client’s sustainability preferences when providing investment advice.1 These requirements hinge on some of the key concepts mentioned earlier: sustainable investments, Taxonomy alignment, and principal adverse impact. However, much is still unclear or unfinished. The recently published ESMA guidelines on MiFID II don’t offer guidance on how financial advisors can address any resulting unclarity in their advice to clients.

What is causing investor confusion?

A Morningstar report about SFDR Article 8 and Article 9 demonstrates the need for further clarity and guidance. It highlights the confusion around rules and definitions as the market starts to comply with the regulations in force. Asset manager data provided in the new European ESG Template (EET) is still patchy (see Figure 1). However, we can draw some initial conclusions: Taxonomy disclosures so far are very conservative and mostly 0%, whereas planned proportions of sustainable investments vary widely even in Article 9 products and appear to be much less conservative. We will discuss these findings and others in the next section.

Figure 1: Coverage of Key EET Data Points for the Surveyed Article 8 and Article 9 Funds

Principal Adverse Impact (PAI) Considerations

The chart above shows that 43% of those surveyed do consider PAIs. Given the questions posed by the ESAs to the European Commission on what it means “to consider principal adverse impact,” how exactly are different financial market participants doing this? The ESAs found in their July 2022 annual review that practices indeed vary and that there is room for improvement.

Identifying Sustainable Investments Under the Regulation Remains Inconsistent

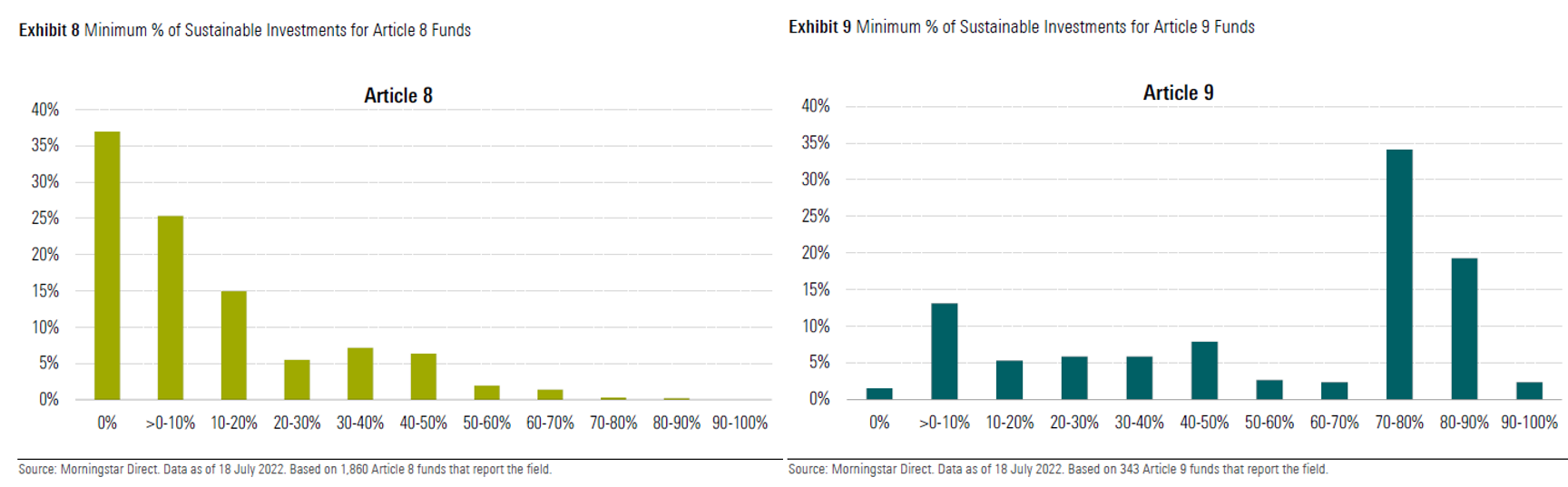

The data further shows that a significant proportion of fund managers state a minimum proportion of sustainable investments for Article 8 and 9 products, even though there is no clear definition2 in SFDR, and different approaches can already be identified in the market. Some may consider an issuer fully sustainable if they have a certain minimum involvement percentage in sustainable economic activities; others may consider an issuer sustainable for a certain involvement percentage (similar to the Taxonomy approach, where a company can be x% aligned). This situation leads to low comparability and makes it difficult for advisors searching for suitable financial products for clients wishing to make sustainable investments. Advisors are supposed to compare different financial products, for instance by ranking, as suggested by ESMA in their guidelines, when advising clients. But how can investors rank sustainable investment products that have different methodologies?

Article 9 products, which according to this ESA guidance, should only make sustainable investments, can be seen in the graph below to have widely differing percentages, from just over 0% to as high as 100%. This shows that some Article 9 products risk having to downgrade to Article 8 to avoid being accused of greenwashing.

Figure 2: Minimum Percentage of Sustainable Investments

Different Approaches for EU Taxonomy Alignment

Now, despite the lack of definition, market players appear much more comfortable reporting minimum sustainable investment percentages than disclosing Taxonomy alignment percentages (though recognizing that the number of fund managers providing data on this in the EET is small). Given the lack of clarity around the use of estimates, ‘equivalent information',3 and pending guidance, most fund managers opt to report 0% Taxonomy-aligned planned investments, as seen in Figure 3. Though Taxonomy alignment in the broader economy can be expected to be low (low single digits), most funds are reporting 0%, including those with environmental or climate objectives. One can discern that the Taxonomy may not be an effective tool to drive capital flows in its current state. The alignment the industry craves may be a few years away as we wait on greater uptake of reported data and enhanced clarity around the use of estimates.

Figure 3: Distribution of Article 8 and Article 9 (Combined) Based on

Minimum or Planned Investments Sustainable Taxonomy Aligned

Morningstar Sustainalytics’ estimated Taxonomy alignment data shows anecdotally that even funds with potentially significant alignment percentages are opting to be conservative (even when their planned sustainable investment proportions are substantial).

Figure 4: Example of Comparing Fund Percentage of Revenue to Minimum or Planned Sustainable Investments

Source: Sustainalytics Taxonomy Solution estimated data and Morningstar Direct.

Our data set also shows that prohibiting the use of estimates, even for non-EU issuers not in the scope of regulation that would require their own reporting on Taxonomy figures, would significantly reduce the Taxonomy alignment of funds with a global range. The table below shows that most companies with alignment are estimated to be in non-EU regions―placing them out of scope by only being allowed to use reported data. Many non-EU issuers might not report on Taxonomy figures, which would significantly reduce the applicability of this important tool for sustainable finance.

Figure 5: Companies with Aligned Revenues

Source: Sustainalytics Taxonomy Solution estimated data

Much work remains towards achieving the sustainable finance goals of the EU Action Plan regulations. It remains to be seen what can be achieved in this turbulent last stretch of the EU Commission’s current mandate and whether the next Commission, coming in 2024, will be as committed to sustainable finance as the current one has been to date.

Discover how Investors work with Morningstar Sustainalytics’ for EU Action Plan Compliance

Morningstar Sustainalytics aims to support investors with data and solutions covering the EU Action Plan requirements. Combinations of data points can be used to identify a sustainable investment as defined under the SFDR.

An SFDR Sustainable Investments Mapping file is available for clients to select their own inputs and thresholds for Contribution, Do No Significant Harm and Good Governance to ensure that their views and interpretations of these components can be integrated.

Combined with our industry-leading EU Taxonomy and SFDR PAI Solutions, Morningstar Sustainalytics offers a holistic regulatory approach to provide investors with comprehensive and consistent data needed to fill out regulatory templates such as the SFDR Annexes, the European ESG Template (EET), and the MiFID II requirements surrounding sustainability preferences as they come into force. Get in touch with our Client Advisory team to review your individual strategy and objectives.

Notes:

1. A key missing link in this chain that is the upcoming Corporate Sustainability Reporting Directive, that would establish mandatory sustainability disclosures for corporates.

2. The definition of Sustainable Investments in Article 2(17) is: ‘sustainable investment’ means an investment in an economic activity that contributes to an environmental objective […], or an investment in an economic activity that contributes to a social objective […], provided that such investments do not significantly harm any of those objectives and that the investee companies follow good governance practices, in particular with respect to sound management structures, employee relations, remuneration of staff and tax compliance.

3. The term 'equivalent information’ was used by ESAs in a supervisory statement from March 2022, but for which there is no definition yet.