The Sustainable Finance Disclosure Regulation (SFDR) was adopted in 2019 to increase transparency on sustainability matters by financial market participants (FMPs), but recent months have seen challenges arise as it rolls out. Confusion among asset managers around what qualifies as a sustainable investment has led many to reclassify their funds from the SFDR’s highest sustainability classification, Article 9, to the less stringent category of Article 8. Now, with the June 30 deadline for the first entity-level Principal Adverse Impact (PAI) disclosures rapidly approaching, institutional investors may face further compliance complexities.

An analysis conducted by Morningstar Sustainalytics shows that there are still substantial gaps in data availability to meet the reporting requirements outlined in the SFDR. Relying solely on corporate disclosures will not be enough to meet these requirements. The European Commission allows, however, for the use of estimated and third-party data to fill these gaps. Although generally there is ample data for metrics that have been traditionally included in sustainability reporting, such as greenhouse gas emissions, there is still limited data for less commonly used metrics, such as emissions to water.

In this blog we take a closer look at trends in data availability and reporting across mandatory and voluntary PAIs, and how investors can address their data gaps.

Key Differences Between Mandatory and Voluntary PAI Disclosures

Under the SFDR, FMPs are obliged to report on the negative impacts of their investment decisions on sustainability factors. PAIs are the set of indicators that market participants must report on at the entity level, across all investment decisions of the FMP in a given year. There are currently no requirements under SFDR to report PAIs on product level.1 The SFDR distinguishes between two types of PAI disclosure: mandatory and voluntary.

Mandatory PAI disclosures require FMPs to report on a set of 18 environmental, social, and governance (ESG) indicators including greenhouse gas emissions, unadjusted gender pay gap, and controversial weapons.2 The indicators for mandatory PAI disclosures apply to all FMPs with more than 500 employees.

Voluntary PAI disclosures, on the other hand, require FMPs to select a minimum of two from a list of 46 indicators: one environment-related indicator and one social-related indicator.3

In analysing data availability across these corporate PAIs, we differentiated between three types of information:

- Reported data: Data and information reported first by issuers.

- Estimated data: Data generated by Sustainalytics’ estimation models.

- Sustainalytics’ third-party data: Sustainalytics’ data which includes data typically disclosed by an issuer only if there is a lawsuit on which it will have to report (e.g., United Nations Global Compact violations or other controversies).

The analysis is based on our February 2023 standard files and looked at approximately 12,000 issuers in the Sustainalytics universe.

Data Availability for PAIs: The Good, The Bad and the Limited

Our analysis shows that the data available for mandatory PAIs ranges from extremely limited to high. For example, less than 10% of issuers have reported data for gender pay gap and emissions to water (see Figure 1). Only 162 issuers disclosed relevant information regarding gender pay gaps, while 621 disclosed information related to emissions to water.

Figure 1. Issuers’ Data for Mandatory PAI Reporting

Source: Morningstar Sustainalytics. For informational purposes only.

Source: Morningstar Sustainalytics. For informational purposes only.

The gaps in reporting for mandatory PAIs are particularly notable. Our analysis revealed that that there was no single issuer with available data across all mandatory PAIs. Furthermore, only 44 issuers had relevant data that covered more than 90% of the mandatory indicators (see Figure 2).

Figure 2. Number of Companies Covering the Mandatory PAI Indicators

Source: Morningstar Sustainalytics. For informational purposes only.

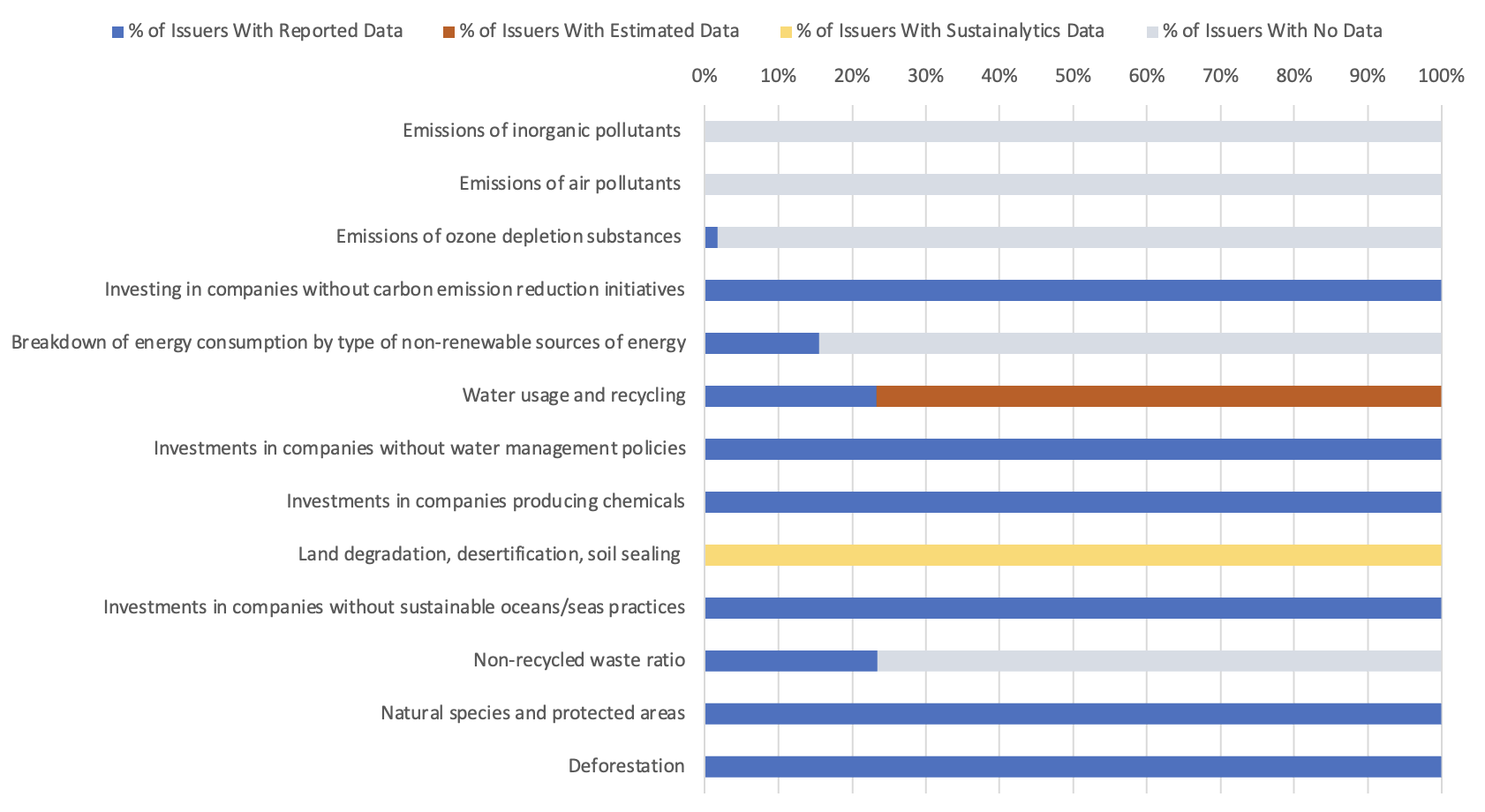

Source: Morningstar Sustainalytics. For informational purposes only.Although data availability across voluntary PAIs is slightly better, data gaps still remain. Three of the four emissions-related voluntary PAIs have a very low level of reported data. Just nine issuers had disclosed information regarding emissions to air pollutants, while only 12 issuers met the transparency provisions for emissions of inorganic pollutants (see Figure 3).

When estimated data and Sustainalytics’ third-party data are included in the analysis, however, data availability improves across some indicators. The scale of data availability for water usage and recycling, for example, is significantly improved with the inclusion of estimated data (see Figure 3).4

Figure 3. Issuers' Voluntary PAI Reporting – Environmental Indicators

Source: Morningstar Sustainalytics. For informational purposes only.

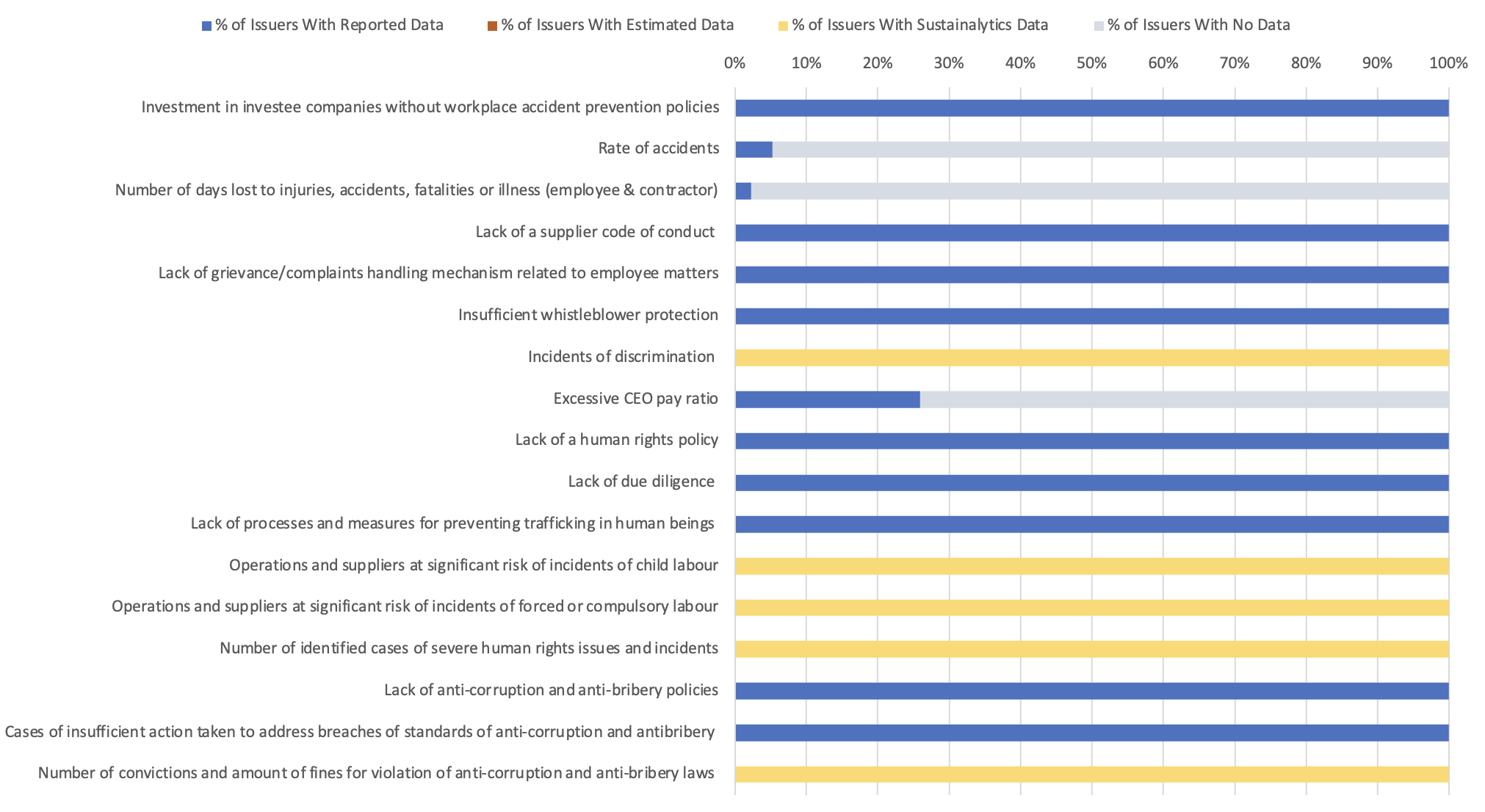

For social-related voluntary PAIs, data availability is much less challenging. These indicators have good levels of data availability in general and are further bolstered with the inclusion of Sustainalytics’ third-party data (see Figure 4).

Figure 4. Issuers' Voluntary PAI Reporting – Social Indicators

Source: Morningstar Sustainalytics. For informational purposes only.

What PAI Data Gaps Mean for Financial Market Participants

As seen in our analysis, disclosure by corporate issuers across PAI indicators remains mixed, even as the first deadline for entity-level PAI reporting looms large. Indicators that have been traditionally included in sustainability reporting, such as board diversity or human rights, have ample data to report. However, issuers still face challenges in reporting on less common metrics.

To address these data shortages, regulation stipulates that FMPs should use "best effort" strategies to fill gaps, such as resorting to external data providers or experts, or making “reasonable assumptions." FMPs will be required to address such gaps in a narrative disclosure, as they cannot exclude investments from PAI calculations due to a lack of data.5

The reporting landscape is, however, expected to improve with the implementation of the Corporate Sustainability Reporting Directive (CSRD), which will apply gradually starting in 2024. Under the directive, around 50,000 companies will be required to report on sustainability issues. The reporting by issuers will be done based on the European Sustainability Reporting Standards (ESRS) across a series of environmental, employee-related, human rights, or anti-corruption and bribery matters.6

While currently only one non-financial company in Sustainalytics’ universe has included PAI disclosures in its sustainability report, we may see other industrial companies attempt this kind of reporting, even before the CSRD is in place. Pressure and questions from investors will drive companies to provide the data.

The Road Ahead for PAI Disclosures

With the implementation of the CSRD, and an increase in sustainability reporting across the market, data availability limitations are expected to diminish. Along with other key EU regulations, alignment with the CSRD will be critical for the smooth functioning of the sustainable finance regulatory framework.

The European Supervisory Authorities consulted on SFDR broadly in April 2023, and the consultation paper included suggestions for finetuning existing definitions as well as the suggestion to add four mandatory social PAIs and nine opt-in indicators. It is likely that regulators will continue to refine existing PAIs and introduce new ones, highlighting the need for ongoing monitoring and adaptation within the market.

Need Help Closing Data Gaps in Your PAI Disclosures?

Sustainalytics can help close certain data gaps through the development of estimation models.7 Get in touch with our team to learn more.

References

1. Under MiFID II sustainability rules, financial advisors must ask their clients for their sustainability preferences in relation to PAIs. This means that many fund managers have been compelled to report PAIs on financial products as well.

2. European Insurance and Occupational Pensions Authority. 2022. Principal adverse impact and product templates for the Sustainable Finance Disclosure Regulation. July 26,2022. https://www.eiopa.europa.eu/publications/principal-adverse-impact-and-product-templates-sustainable-finance-disclosure-regulation_en

3. European Commission. 2022. Commission Delegated Regulation (EU) of 6.4.2022. June 4, 2022. https://ec.europa.eu/finance/docs/level-2-measures/C_2022_1931_1_EN_ACT_part1_v6%20(1).pdf

4. Note that due to their limited research universe, the two ‘minimum fit’ voluntary PAIs in our offering were not included in the analysis (8. Exposure to areas of high water stress, and 11. Investments in companies without sustainable land/agriculture practices).

5. European Securities and Markets Authority. 2022. Questions and answers on the SFDR Delegated Regulation. November 17, 2022. https://www.esma.europa.eu/sites/default/files/library/jc_2022_62_jc_sfdr_qas.pdf

6. European Commission. Corporate Sustainability Reporting. Accessed May 9, 2023. https://finance.ec.europa.eu/capital-markets-union-and-financial-markets/company-reporting-and-auditing/company-reporting/corporate-sustainability-reporting_en

7. Only for metrics that are suitable for estimation models according to the criteria of our methodologies.