On July 31, 2025, the European Financial Reporting Advisory Group (EFRAG) published revised and simplified Exposure Drafts of the European Sustainability Reporting Standards (ESRS). Initially published by the European Commission in July 2023, the ESRS are criteria for implementing the Corporate Sustainability Reporting Directive (CSRD). These standards are meant to help investors and other stakeholders evaluate the sustainability performance of companies as part of the European Green Deal, the EU’s set of policy initiatives aimed at a regional green transition and climate neutrality by 2050.1

This article delves into the elements of the standards, their focus on impact, and the timeline for their rollout. It also explores what the impact of richer and more accessible sustainability information from issuers could mean for investors and the broader sustainable finance market.

About the CSRD and Its Standards

The CSRD, which came into force in January 2023, is a directive from the commission which strengthens the rules around corporate reporting of environmental and social information. Expanding on the Non-Financial Reporting Directive (NFRD), CSRD applies to a broader set of companies, including non-listed entities and small to medium-sized enterprises.

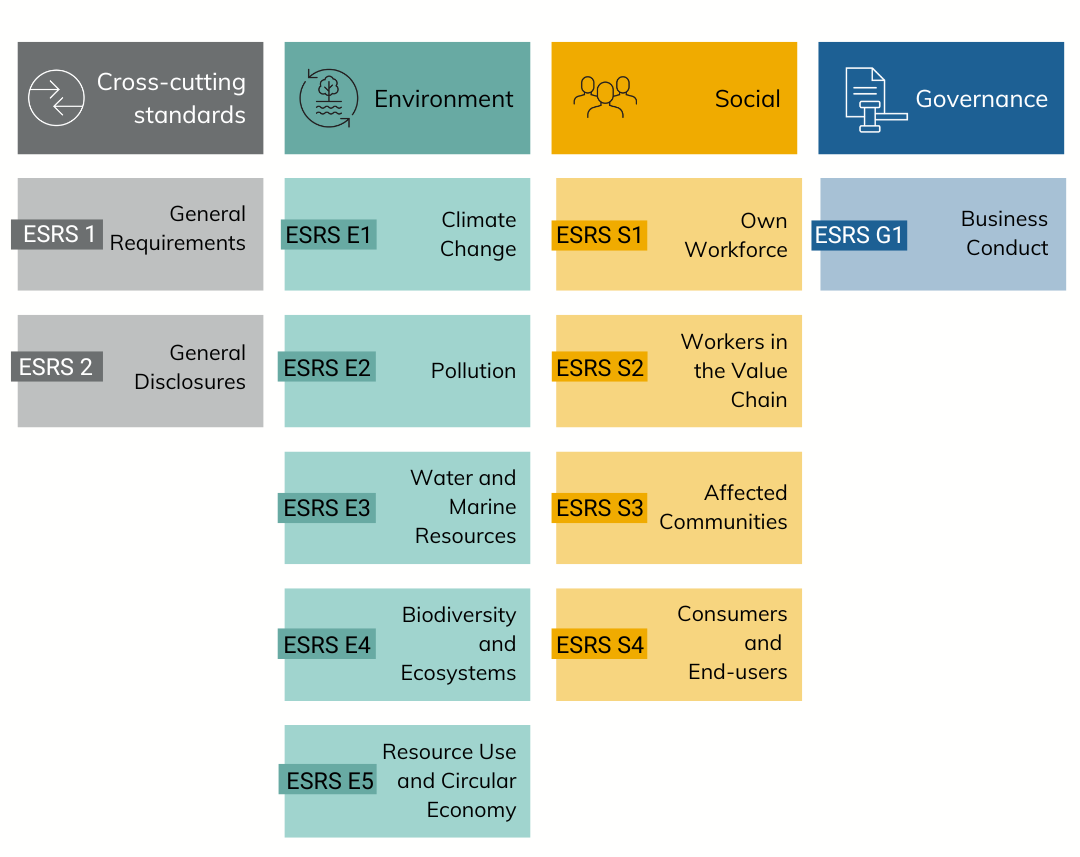

Companies subject to the CSRD have to report according to the ESRS. The ESRS outlines the quantitative and qualitative information issuers operating in the EU need to disclose across a wide range of environmental, social and governance (ESG) topics, as summarized in Table 1. Under the ESRS, the information companies disclose is subject to a double materiality assessment, which refers to the risks that material external environmental and societal issues pose to an issuer’s financial performance (financial materiality), as well as the impact an issuer’s operations and products have on society and the environment (impact materiality).

Table 1. Overview of the Current European Sustainability Reporting Standards

Source: European Sustainability Reporting Standards. For informational purposes only.

The Exposure Drafts published in July 2025 would make small changes to the topics presented in Table 1. For example, if adopted as proposed, ESRS E3 would be narrowed to “Water.”

Companies reporting under the CSRD are required to provide limited assurance2 of compliance with the reporting obligations of CSRD (and ESRS), as well as with EU Taxonomy Regulation disclosures. The first wave of companies subject to CSRD reporting came into effect in 2024, with subsequent waves being delayed as part of the "stop-the-clock" directive. The commission originally estimated that the new directive and standards would impact 50,000 companies, but ongoing changes via the Omnibus I simplification package may reduce the number of companies brought into scope.

By broadening the scope of topics covered compared to NFRD, introducing a limited assurance regime, and making extra-financial information readily available and easily accessible via the European Single Access point,3 CSRD should largely improve the quality, quantity, and availability of sustainability-related information for investors. It will support investors’ capacity to manage and mitigate sustainability risks and impacts as per regulatory and/or contractual requirements, and to build products aligned with the preferences of their end clients. On the flip side, these standards also mean that many investment firms will themselves be required to disclose information according to CSRD.

Impact Materiality: The Heart of CSRD and Its Standards

While the recent Exposure Drafts indicate some changes to ESRS are forthcoming, the core emphasis on double materiality remains. The standards clearly state that “the object of sustainability reporting…is to present fairly the undertaking’s material impacts on people and environment, as well as the material sustainability risks and opportunities in relation to environmental, social and governance topics.”4 The assessment of impact materiality should focus on both the positive and negative impacts of business activities and consider the severity of these impacts on a broad range of stakeholders (not only investors) and across the value chain, both upstream and/or downstream.

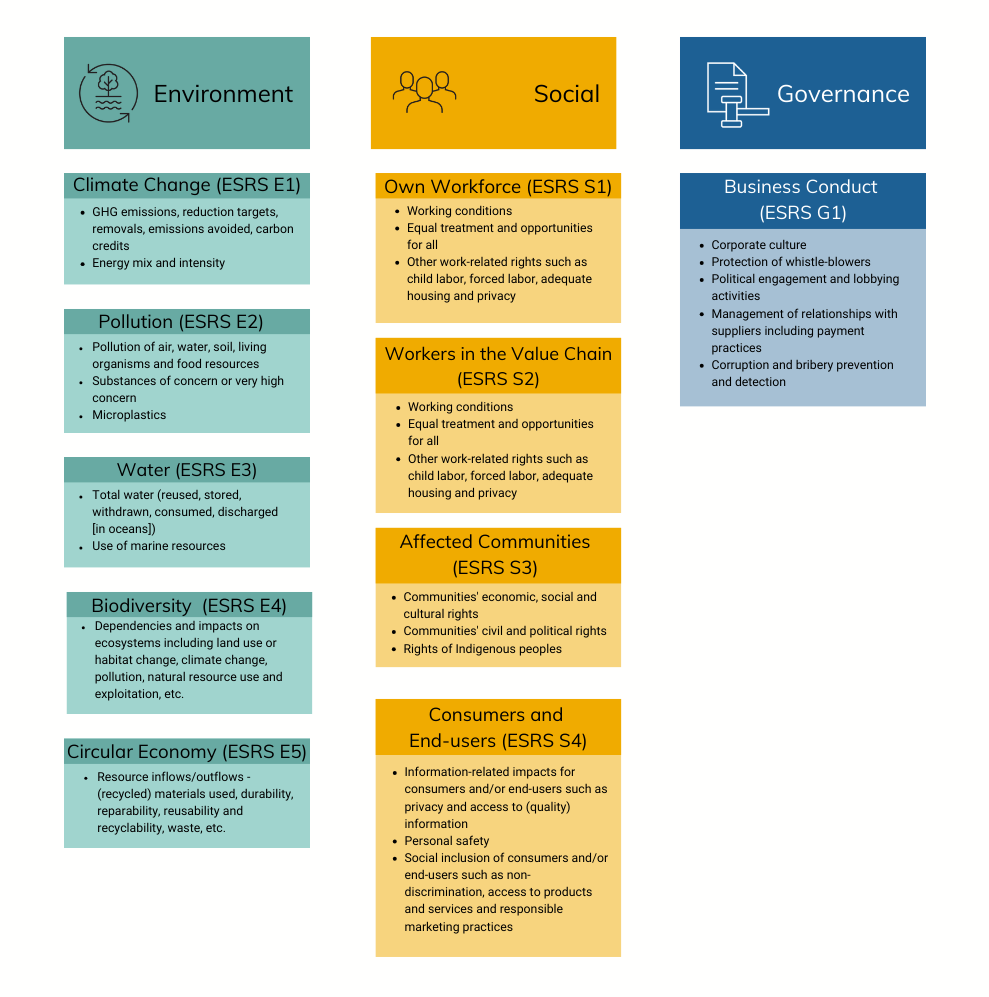

All the ESG standards shown in Table 2, and related data points, are subject to a double materiality assessment, including scope 1, 2, and 3 greenhouse gas (GHG) emissions. However, it’s worth noting that if a company concludes that climate change is not a material topic, it must provide a detailed explanation of the conclusions of its materiality assessment. It’s also important to note that some of the data points in Table 2 would be affected by the changes proposed in the July 2025 Exposure Drafts. For example, use of marine resources would not be covered under ESRS E3.

Table 2. Select Topics Currently Covered Under the European Sustainability Reporting Standards

Source: European Sustainability Reporting Standards. For informational purposes only.

Investors were hoping the CSRD data points that companies are required to disclose would align with their own impact reporting obligations under the Sustainable Finance Disclosure Regulation (SFDR). While the CSRD data points capture the inputs to the principal adverse impact (PAI) indicators from SFDR, there is a misalignment between the two. Reporting on certain PAI indicators is mandated by SFDR, while the matching CSRD data points are only required when a company determines the data point is material under the double materiality standard. To alleviate implementation challenges, the ESRS requires issuers to explicitly mention when the data point in question is not material, which allows investors to assume that the investee company does not contribute to the corresponding indicator of principal adverse impacts in the context of their own SFDR disclosures. The European Commission is expected to propose revisions to SFDR in the fourth quarter of 2025, which could potentially include addressing this misalignment.

Phasing In of ESRS and Some Exceptions

The application of the ESRS regulation will take place in four stages. The timing of some stages changed with the “stop-the-clock” directive, and the Omnibus I package may yet change these thresholds.

- Phase 1: From January 1, 2024, for large public-interest companies (with over 500 employees) already subject to the existing NFRD, with reports due in 2025.

- Phase 2: From January 1, 2027, for large companies (with more than 250 employees and/or EUR 50 million in turnover and/or EUR 25 million in total assets) that are not presently subject to the NFRD, with reports due in 2028.

- Phase 3: From January 1, 2028, for listed small (with more than 50 employees and/or EUR 10 million in net turnover and/or EUR 5 million in total assets) and medium enterprises (less than 250 employees and/or less than EUR 50 million in net turnover and/or less than EUR 25 million in total assets) and other undertakings, with reports due in 2029. These companies can also opt-out of reporting for up to two years.

- Phase 4: From January 1, 2028, for non-EU companies with substantial activity in the EU (defined as those companies with a turnover of more than EUR 150 million in the EU and that have either a branch in the EU with a net turnover exceeding EUR 40 million or a subsidiary that is a large company), with reports due in 2029.

It is important to note the ESRS include additional exceptions to further support companies reporting to the standards. In the first year that a company applies the standards, those with fewer than 750 employees may omit scope 3 GHG emissions data and the disclosure requirements specified in the standard on own workforce (ESRS S1). In the first two years, companies with fewer than 750 employees can omit the disclosure requirements on biodiversity (ESRS E4), value-chain workers (S2), affected communities (S3), and consumers and end-users (S4).

In the first three years that they apply the standards, all companies may omit the following information: anticipated financial effects related to environmental issues (climate, pollution, water, biodiversity, and resource use). Certain data points related to their own workforce (social protection, persons with disabilities, work-related ill-health, and work-life balance) may also be omitted in the first reporting year.

Discover How We Can Help

To support investors and issuers in meeting their new reporting obligations, Morningstar Sustainalytics offers a suite of products. Visit the pages linked below or get in touch to learn more.

- Impact solutions to support impact materiality assessment.

- ESG Risk Ratings to support financial materiality assessment.

- Climate solutions including our Low-Carbon Transition Rating to support reporting of environmental data points.

*updated November 7, 2023 with additional details on how ESRS will be phased in.

*updated January 26, 2024 with corrections to details of Phase 3 of the ESRS roll out.

*updated August 27, 2025 with new information. Original article written by Arthur Carabia.

References

- The European Green Deal is a package of policy initiatives which aims to set the EU on the path to a green transition, with the ultimate goal of reaching climate neutrality by 2050. Read more at: https://www.consilium.europa.eu/en/policies/green-deal/#:~:text=The%20European%20Green%20Deal%20is%20a%20package%20of%20policy%20initiatives,a%20modern%20and%20competitive%20economy.

- According to Accountancy Europe: “Assurance level relates to the work effort… In a limited assurance engagement, practitioners obtain less assurance on the quality of the information because of less or different work undertaken than in a reasonable assurance engagement where they conduct more and deeper work. In both cases, the practitioner needs to sufficiently understand the company to assess the risk of material misstatement. It is about assessing the risk for the information to be sufficiently incorrect that it may impact the economic decisions of the information users.” For more details see “Sustainability Assurance Under CSRD: Key Matters to Respond to the Upcoming CSRD Requirements.”

- European Single Access Point offers access to public financial and sustainability-related information about EU companies and EU investment products. To learn more visit: https://www.europarl.europa.eu/legislative-train/theme-an-economy-that-works-for-people/file-european-single-access-point.

- EFRAG. 2025. Exposure Draft ESRS 1 General Requirements. July 31, 2025. https://www.efrag.org/sites/default/files/media/document/2025-07/Amended_ESRS_Exposure_Draft_July_2025_ESRS_1.pdf.