Key Insights:

|

|

|

July 21, 2024, was the hottest day thus far in recorded history, with the average global temperature reaching 17.09 degrees Celsius.1 2024 marks the second consecutive year that average global temperatures have broken climate records. As temperatures rise, so too does the urgency to decarbonize the global economy. It’s why sustainable finance standard-setting bodies are becoming increasingly stringent on their decarbonization criteria. Anticipating the risks of further climate regulations, many investors are working to decarbonize their portfolios and reduce the impact of their investments on global warming.

Decarbonizing Portfolios Requires a Sector Differentiated Strategy

One practical approach to reaching this goal is to concentrate efforts on the sectors that are emitting the highest levels of greenhouse gases (GHG). This approach is supported by several sustainable finance standards, including the EU’s Sustainable Finance Disclosure Regulations (SFDR), the EU’s Paris-aligned (PAB) and climate transition (CTB) benchmarks, the latest European Securities Market Authority (ESMA) fund naming rules, the French socially responsible investment (SRI) label, and the Belgian Towards Sustainability label. These standards recommend excluding certain sectors from investments. For example, thermal coal and certain fossil fuels are completely excluded from PAB and CTB.

However, even with these sectors excluded from investments, plenty of carbon-intensive sectors remain, such as agriculture, manufacturing, construction, water supply and real estate, requiring ambitious carbon emissions reduction plans. For these sectors, companies and their investors will need to find other strategies to reduce emissions and align with the 1.5 degrees commitment of the Paris Agreement.

The March 2024 revision of the French SRI fund label, which has strict requirements for the funds that apply, set a new target for funds that include companies in high impact climate sectors, as defined by the SFDR (see Table 1).2 The revised regime requires that at least 15% of high impact climate sector companies should have a “credible climate transition plan” by 2026.3 The credibility of the plan should be evaluated based on the company’s current carbon reduction trend, the carbon emission reduction targets set, the resources it has committed, and the governance structure it has implemented.

Table 1. High Impact Climate Sectors According to the SFDR

|

|

|

|

|

|

|

|

|

Source: Annex 1 to Regulation (EC) No 1893/2006 of the European Parliament and of the Council.

Assessing Whether High Impact Climate Sectors are Prepared for the Low Carbon Transition

For this article we draw upon research from the Low Carbon Transition Ratings (LCTR) to assess the credibility of a company’s climate transition plan. The LCTR assesses companies’ transition plans and progress toward stated GHG reduction commitments by evaluating the quality and ambition of their GHG reduction targets, along with existing trends of carbon emissions and forward-looking investment plans.

Based on our global research universe, there are no companies with a credible climate transition strategy that is aligned with the Paris Agreement. This makes it rather difficult for investors seeking the SRI label for their funds to achieve the required 15% threshold of companies with credible climate transition plans.

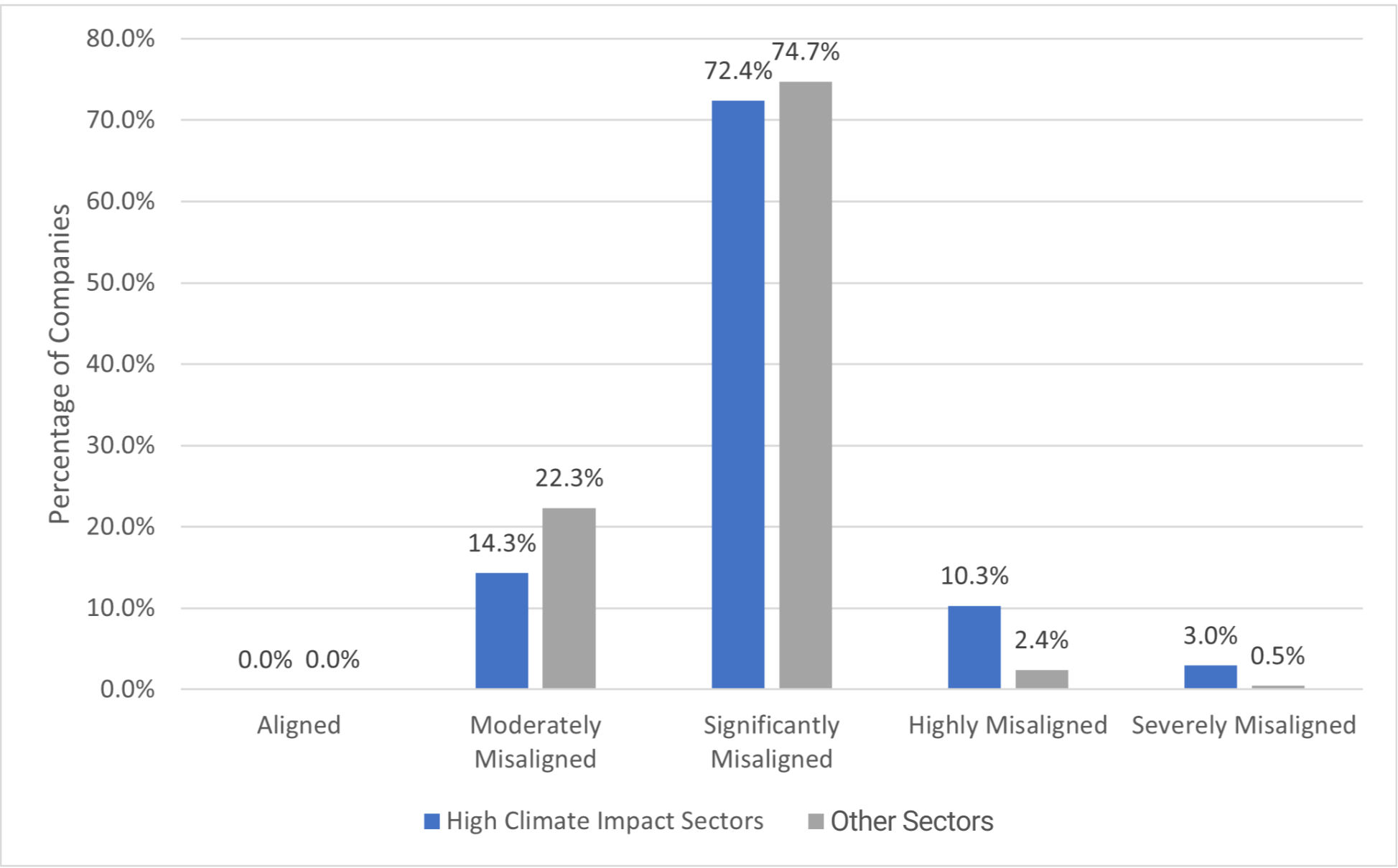

Although most companies in our research universe are misaligned, we do find important differences in the quality of their climate transition plans. In Figure 1 we see that though 14.3% of companies fall under the moderately misaligned category, this is still better than those companies that are significantly (72.4%), highly (10.3%) or severely misaligned (3%).

Figure 1. Distribution of Companies Across LCTR Alignment Categories: High Impact Climate Sectors vs. Other Sectors

Source: Morningstar Sustainalytics.

Note 1: Based on the 9,956 companies researched as part of Sustainalytics’ research universe on the July 2, 2024.

Note 2: Other Sectors refers to all sectors in the LCTR universe not captured under the High Impact Climate Sectors as identified in Table 1.

While companies in high impact climate sectors have a greater degree of misalignment with the Paris Agreement compared to other sectors, the difference is small. None of the companies in the high climate impact sectors are considered aligned and 13.3% are considered highly or severely misaligned (compared to only 2.9% of companies in other sectors).

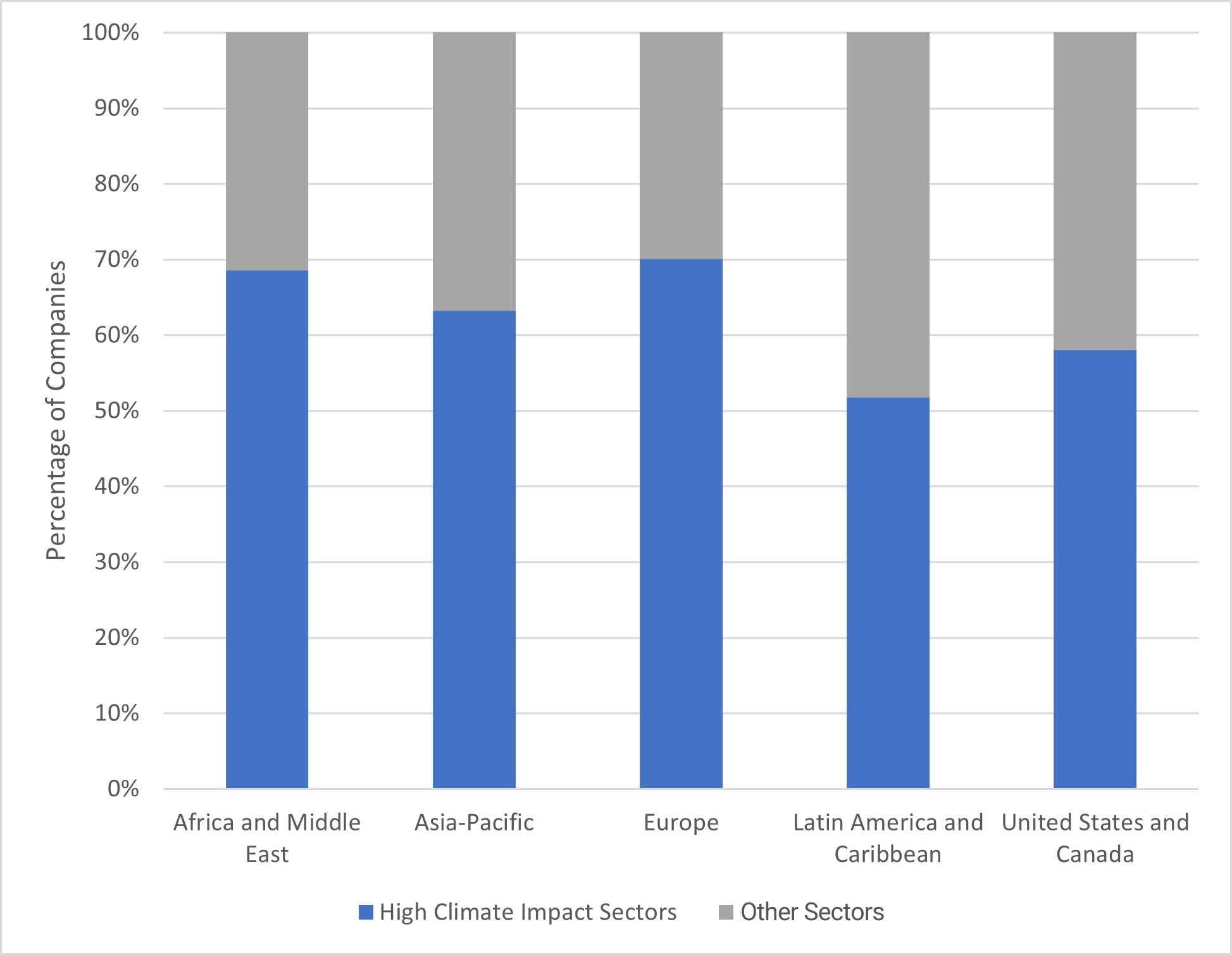

This finding is concerning, given that companies in high impact climate sectors make up more than 60% of the global economy. As shown in Figure 2, in Europe, high impact climate sector companies make up about 70% of the total market capitalization.4 In the United States and Canada, less than 60% of the economy falls in the high impact climate sector category, likely because of the large presence of the financial sector, as well as software and internet services companies from the technology sector. Latin America and the Caribbean also have a large focus on financial sector companies, though its sample size is smaller than other regions.

Figure 2. Percentage of High Impact Climate Sectors vs. Other Sectors Across Regions

Source: Morningstar Sustainalytics.

Note: Dataset covers the 9,956 companies in Sustainalytics’ coverage universe.

Championing Credible Climate Transition Plans via Company Engagement

For funds with the French SRI label, managers face a clear challenge. How can they reach the target of having 15% of companies with a credible climate strategy by 2026 given the high proportion of companies that are misaligned to a 1.5 degree scenario? If these investors are serious about the target, one way to reach the threshold is to strengthen their engagement efforts with these high impact climate sector companies in their portfolios. Without engagement, investors will have difficulty finding enough companies with credible transition plans to invest in. As a result, investment firms unable to significantly improve their climate strategies will be at risk of losing the SRI label for their funds.

Achieving real-world positive outcomes through direct, intensive engagement with companies is not guaranteed. Although many fund managers employ engagement strategies, to really move a company in a more positive direction requires extensive resources. Even the collaborative engagement association Climate Action 100+ admitted that an overwhelming majority of companies targeted by their efforts were failing to meet expectations on the just transition.5,6 Therefore, investors need to be precise in where they focus their engagement efforts to see meaningful progress among portfolio companies.

The Opportunity: Engaging With Sectors Already on the Right Track

For investors with limited engagement resources, focusing on companies within the moderately misaligned (14.3%) and significantly misaligned (72.4%) categories could be an effective approach to achieving the SRI label’s 15% threshold (see Figure 1 above). Companies in these categories likely need less effort to become aligned to a 1.5 degree scenario than those in the highly misaligned and severely misaligned categories. Companies in the highly and severely misaligned categories will inevitably need to be addressed to create impact, but for these companies to be considered aligned will likely require more than a year of engagement.

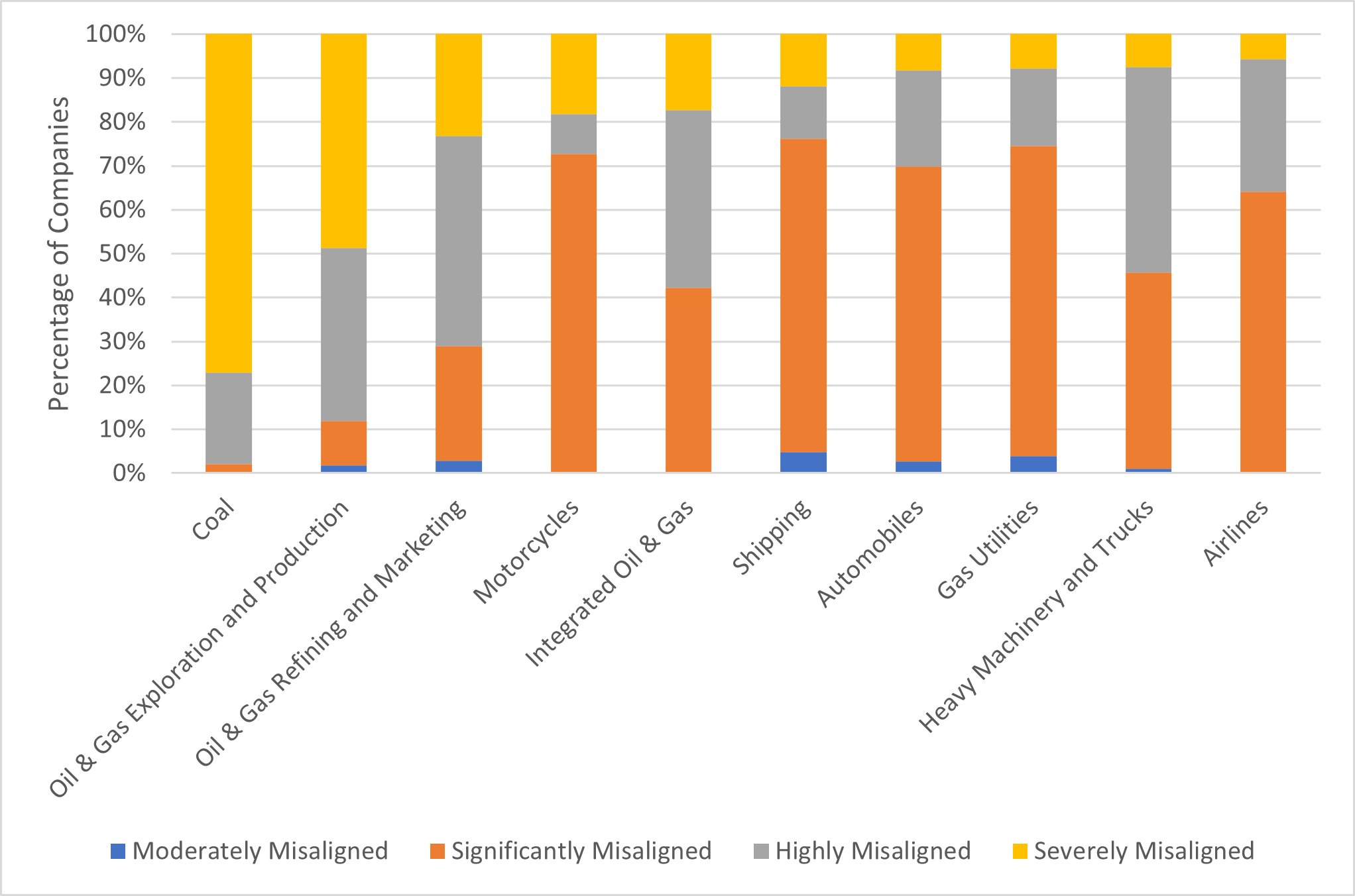

When zooming in on the specific sectors within the high impact climate category, we note that the sectors with the lowest proportion of highly and severely misaligned companies include the textiles, luxury apparel, real estate development, and precious metals mining sectors (see Figure 3). On the other hand, the sectors that have a larger share of companies that are severely misaligned and will require more effort to bring into alignment with the Paris Agreement include coal, oil and gas, motorcycles, shipping and automobiles (see Figure 4). Coal companies and some oil and gas producers will likely already be screened out by responsible investment policies.

Figure 3. Percentage of High Impact Climate Sector Companies Within LCTR’s Moderately Misaligned Category

Source: Morningstar Sustainalytics.

Note 1: Dataset covers the 9,956 companies in Sustainalytics’ coverage universe.

Note 2: Tobacco companies would be phased out under most responsible investment standards and engaging this sector towards more alignment would therefore be irrelevant, except for the few companies that are investing substantially to transition to an alternative sector.

Figure 4. Percentage of High Impact Climate Sector Companies Within LCTR’s Severely Misaligned Category

Source: Morningstar Sustainalytics.

Note: Dataset covers the 9,956 companies in Sustainalytics’ coverage universe.

For fund managers applying the SRI label criteria, focusing engagement on companies within the semiconductor design and manufacturing, luxury apparel and REITs industries would enable them to move more of their investments toward credible transition plans by 2026. As seen in Figure 5 below, these are the high impact climate sectors with the highest proportion of their market capitalization within the moderately or significantly misaligned categories — meaning that they are closer to becoming fully aligned to a 1.5 degree scenario. Engagement with companies in other high impact climate sectors is also encouraged, but focusing on those more likely to successfully meet the requirement could avert the immediate risk of losing the SRI fund label.

Figure 5. High Impact Climate Sectors With the Most Market Capitalization in the Moderately and Significantly Misaligned Categories

Source: Morningstar Sustainalytics.

Note: Dataset covers the 9,956 companies in Sustainalytics’ coverage universe.

Morningstar Sustainalytics’ Net Zero Transition Engagement Program supports progress toward investor-led decarbonization targets through direct and constructive dialogue with companies across the sectors that have the most climate impact. Collaborating through the Net Zero Engagement Program could help investors to achieve positive results with companies, making them investible for funds applying the SRI label.

References

- Fritz, A. 2024. “The planet just saw its hottest day on record.” July 23, 2024. CNN. https://www.cnn.com/2024/07/23/climate/hottest-day-global-record/index.html.

- Per Annex 1 point 9 in SFDR, ‘high impact climate sectors’ means the sectors listed in Sections A to H and Section L of Annex 1 to Regulation (EC) No 1893/2006 of the European Parliament and of the Council. The sectors listed are agriculture, forestry and fishing; mining and quarrying; manufacturing; electricity, gas, steam and air conditioning supply; water supply; sewerage, waste management and remediation activities; construction; wholesale and retail trade; repair of motor vehicles and motorcycles; transportation and storage; and real estate activities. See https://eur-lex.europa.eu/eli/reg_del/2022/1288/oj for full details.

- Label ISR (English translation). 2024. Label Standards. March 1, 2024. https://www.lelabelisr.fr/wp-content/uploads/EN_Referentiel-Label-ISR-mars24-1.pdf.

- Based on Morningstar Sustainalytics’ research universe of 9,956 companies.

- Webb, D. 2023. “CA100+ companies show ‘poor performance’ on Just Transition.” October 18, 2023. https://www.responsible-investor.com/ca100-companies-show-poor-performance-on-just-transition/.

- Climate Action 100+. 2023. Climate Action 100+ 2023 Net-zero Company Benchmark 2.0 2023 Results. October 2023. https://www.climateaction100.org/wp-content/uploads/2023/10/2023-Key-Findings.pdf.