In 2022, global tropical forest loss totaled 4.1 million hectares, a 10% increase compared to 2021.1 Driven by agricultural expansion to produce everyday products, deforestation threatens critical ecosystems that are vital for combating climate change, supporting livelihoods, and protecting biodiversity. Despite global commitments to halt deforestation by 2023, it is evident that further anti-deforestation efforts are needed.

The EU regulation on deforestation-free products (EUDR) creates more stringent due diligence requirements, ensuring that companies selling commodities in the EU can prove their products are deforestation-free. The implementation of the mandatory EUDR, which comes into effect in December 2024, marks an important step to tackle this decades-long issue and sets precedent for other jurisdictions to follow suit. However, with less than one year until large companies must comply, data from the ESG Risk Ratings shows that most companies are not yet prepared to meet the new requirements.

In this article we offer a deeper understanding of the EUDR, answering five key questions about who the EUDR applies to, how companies are meeting the requirements, and the risks non-compliance with the EUDR poses to both companies and investors.

Question One: What does the EUDR Cover and Who Is Affected?

The goal of the EUDR is to prevent global deforestation and the release of carbon emissions associated with the consumption and production of forest-risk commodities including cattle, wood, cocoa, soy, oil palm, coffee and rubber.2 It also covers several forest risk-derived products such as chocolate, palm and soybean oil, and furniture — common products across several consumer goods industries. Operators and traders who supply the relevant commodities or products in the EU must prove that products are deforestation and degradation-free, legally produced, and covered by a due diligence statement. The statement includes three main components:

- Traceability: Companies will be obliged to collect geographical coordinates of the plots of land where the commodities were produced, using techniques such as remotely sensed information or satellite imagery to verify geolocation.3 This step must happen before products are placed in market as part of a due diligence process.

- Risk assessments and mitigation measures: Using the traceability information, companies must carry out risk assessments of their operations. Furthermore, companies must introduce risk mitigation measures where relevant.4

- Public reporting: Companies are required to annually report on their due diligence systems and the steps taken to ensure compliance with the regulation.

Question Two: Are Companies Ready for Compliance With the EUDR?

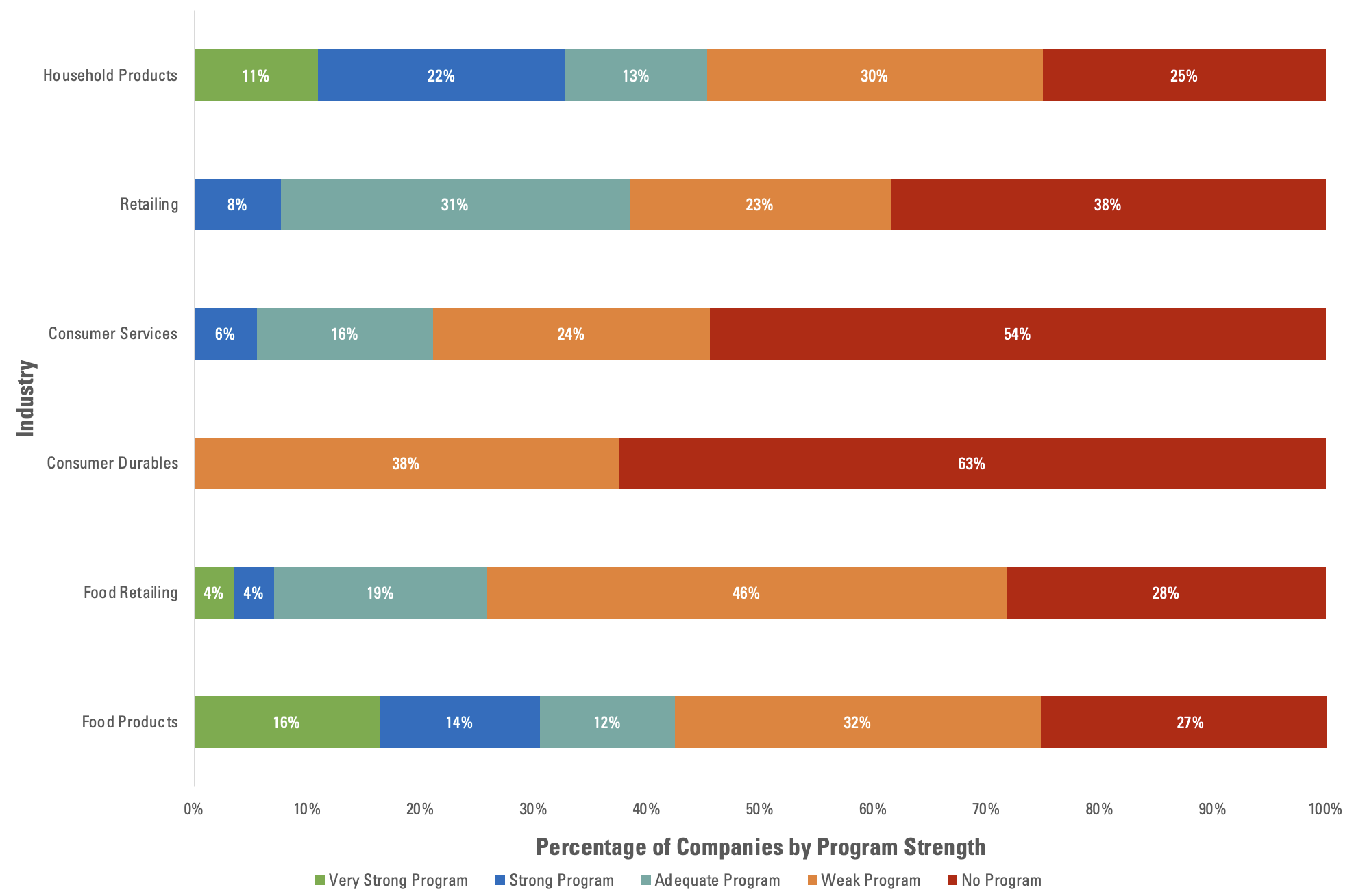

Using ESG Risk Ratings data, we analyzed the alignment of companies’ deforestation programs to the main EUDR requirements. Across relevant industries, 66% of companies have implemented some level of a deforestation program (see Figure 1). However, comprehensive management efforts are lacking, as only 20% of companies assessed have a strong or very strong program.

Figure 1. Performance of Companies' Deforestation Program by Industry

Even more concerning, most deforestation programs lack the proper traceability mechanisms necessary to comply with the EUDR requirements. Increased traceability and access to plot-level information can enable better decision making in supply chains to avoid forest loss.5 As seen in Figure 2, only 13% of companies have traceability programs in place that cover their own operations, as well as direct and third-party suppliers. Moreover, only 17% of these companies have sufficient monitoring of their anti-deforestation programs and only 8% have mechanisms for incident investigation and corrective action.

Figure 2. Percentage of Companies Meeting Select EUDR-Aligned Criteria Within Their Deforestation Program

Compared to 2023, when we reported on the initial EUDR proposal, there has been no change in companies’ performance on these criteria. Based on available disclosure, and with only a few months until its application, companies remain far from prepared for the more stringent requirements the mandatory EUDR brings. Specific improvement areas include the following:

Many Companies Lack Full Traceability to Plantation Level

When it comes to commodities such as palm oil and soy, many companies only report mill-level traceability data. While mill-level traceability is an important intermediary step to achieving full traceability, the EUDR requires that companies trace commodities back to their origin and provide plantation-level GPS information. This also means companies must map their full supply chains, including indirect suppliers which are often difficult to locate.

Commodity Coverage is Often Insufficient

Many companies, especially those in the food products sector, produce or trade several different forest-risk commodities or products. Often, companies lack comprehensive reporting on all commodities and focus traceability predominantly on one commodity. Companies will need to ensure that they can provide deforestation due diligence across all relevant supply chains. This will create added complexity for companies sourcing several different relevant commodities, as traceability approaches will differ.6

The Role of Certification Schemes

Recognized deforestation prevention certification schemes, such as the Roundtable on Sustainable Palm Oil (RSPO) and Rainforest Alliance, are important mechanisms to facilitate the traceability and transparency of agricultural production processes. However, certifications alone cannot prove compliance with the EUDR. Many of the certifications do not fully align with the EUDR requirements and therefore cannot ensure legal compliance.7 Instead, certifications can be used to support the data collection process, but companies will need to have internal deforestation traceability and monitoring systems in place to ensure compliance.

Question Three: What Risks Does the EUDR Bring to Companies and Investors?

Companies engaged in deforestation have come under significant and increasing scrutiny regarding the social and environmental costs of forest degradation. Sustainalytics’ Controversy Research database has tracked 1,639 incidents related to deforestation between February 2014 and February 2024, 91% of which occurred at the supply chain level.8

Companies linked to deforestation in their own operations and supply chains face reputational and business risks. One example is packaged food company JBS SA, which is a major supplier of Brazilian beef, among other commodities, to European food retailers. In recent years, the company has faced numerous allegations of deforestation in the Amazon. In December 2023, the New York Times reported on a lawsuit against JBS SA filed by the Brazilian state of Rondônia, over its illegal purchasing of cattle raised in protected areas.9

Apart from the legal risk and associated financial losses, JBS has lost buyers over deforestation concerns, whereas related media coverage exacerbates the risk for reputational damage. JBS’s competitor, Marfrig Global Foods SA, which derived 10% of its 2022 revenue from the European market,10 has faced similar deforestation allegations and associated risks. In 2022 the company lost a USD200 million loan package from the Inter-American Development Bank Group amid deforestation concerns in the Amazon.11 In September 2023, Nestle SA announced that it had dropped Marfrig as a supplier due to allegations of illegal land acquisition from Indigenous peoples.12

The EUDR Brings New Financial Risks

While the financial risks associated with deforestation have been minimal up until now, the EUDR is set to impose additional costs and operational consequences. Companies failing to comply with the requirements face possible penalties, including fines up to 4% of the company’s EU revenue, confiscation of revenues gained from the concerned products, and temporary prohibition of placing relevant commodities on the market.13 Compliance checks will be carried out periodically, with a large focus on companies sourcing relevant commodities from high-risk regions, such as Brazil, Indonesia and Malaysia, where much of the forest loss occurred in 2022.14 As such, investors should pay specific attention to businesses sourcing relevant commodities from high-risk regions and ensure that companies are equipped with adequate due diligence mechanisms.

Question Four: How Can Companies Prepare for Implementation of the EUDR?

When the regulation comes into effect, companies should already have the relevant mechanisms in place to satisfy the EUDR requirements. Based on available evidence, Sustainalytics’ ESG Risk Rating data shows that most companies are far off track to meet the mandatory due diligence component of the new law. However, some companies seem to be paving the path for their peers.

Agricultural company IOI Corp. shares in its 2023 sustainability report that it has communicated the EUDR requirements to its suppliers.15 It is reportedly also working to strengthen its traceability to plantations and ensure assurance for the export of its palm oil products into the EU market. Other companies such as food retailer Schwarz Group and cocoa and chocolate manufacturer Barry Callebaut disclose plans to expand the scope of their deforestation programs to ensure compliance.16 In turn, Unilever announced in March 2022 that it is piloting a blockchain technology to better track and trace its palm oil supply chain.17

Question Five: What’s Next for EUDR Compliance?

In the months leading up to the implementation of the EUDR, companies and investors should prepare for the potential legal and financial risks that the new regulation could bring. Investors can use a combination of ESG Risk Ratings data and controversies research to engage with companies on their alignment with the requirements and identify potential gaps.

Particular attention should be given to the strength and scope of companies’ traceability and monitoring programs, as these are essential to ensure that companies can meet the due diligence requirements across all relevant supply chains. With forest loss on the rise since 2022, the EUDR comes at a critical time to help accelerate action on anti-deforestation measures. In line with the EU’s action, the United Kingdom18 and the United States19 are both in the process of introducing more stringent deforestation due diligence laws. While the increase in regulation poses challenges, it also creates opportunities for effective collaboration between companies, governments, investors, and smallholders to increase traceability capabilities and prevent global forest loss.

References

- Weisse, M., Goldman, E., and Carter, S. “Forest Pulse: The Latest on the World’s Forests.” Accessed: April 2, 2024. World Resources Institute. (n.d.) https://research.wri.org/gfr/latest-analysis-deforestation-trends.

- European Commission. “Regulation on Deforestation-Free Products.” Accessed: April 2, 2024. https://environment.ec.europa.eu/topics/forests/deforestation/regulation-deforestation-free-products_en

- European Commission. “Traceability.” Accessed: April 2, 2024. https://green-business.ec.europa.eu/deforestation-regulation-implementation/traceability_en

- EUR-Lex. “Regulation (EU) 2023/1115 of the European Parliament and of the Council of 31 May 2023 on the making available on the Union market and the export from the Union of certain commodities and products associated with deforestation and forest degradation and repealing Regulation (EU) No 995/2010.” June 9, 2023. https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX%3A32023R1115&qid=1687867231461

- Fripp, E., et al. “Traceability and Transparency in Supply Chains for Agricultural and Forest Commodities: A Review of Success Factors and Enabling Conditions To Improve Resource Use and Reduce Forest Loss.” October, 2023. Washington, DC: World Resources Institute. https://files.wri.org/d8/s3fs-public/2023-10/traceability-transparency-supply-chains.pdf?VersionId=3HZoYFHW6eQ7CZ7DEDurlJoeJRzg9gsK

- Ibid.

- Roundtable on Sustainable Palm Oil. “Gap Analysis Between RSPO P&C and EUDR.” April 26, 2023. https://rspo.org/gap-analysis-between-rspo-pc-and-eudr/

- The data for this analysis was retrieved on Feb. 12, 2024 from Sustainalytics’ Ratings+ Universe and includes 365 companies from the following industries: Household Products, Retailing, Consumer Services, Consumer Durables, Food Retailing and Food Products.

- Andreoni, Manuela. “Brazilian State Seeks Millions in Environmental Damages from Giant Meatpacker.” December 20, 2023. The New York Times. https://www.nytimes.com/2023/12/20/climate/amazon-deforestation-jbs.html#:~:text=The%20Brazilian%20authorities%20are%20seeking%20millions%20of%20dollars,on%20illegally%20deforested%20lands%20in%20the%20Amazon%20rainforest.

- Marfrig Global Foods. Sustainability Report. April 27, 2023. https://api.mziq.com/mzfilemanager/v2/d/b8180300-b881-4e6c-b970-12ad72a86ec8/26cd39c8-c617-c0b2-0918-8c473ca7bce7?origin=2

- Brice, Jessica. "Big Beef Loan Scrapped Amid Uproar over Amazon Deforestation." February 23, 2022. Bloomberg. https://www.bloomberg.com/news/articles/2022-02-23/big-beef-loan-shelved-amid-uproar-over-amazon-deforestation

- Murray, Grace. "Nestle Drops Supplier Linked to Indigenous Land Invasions." September 12, 2023. The Bureau of Investigative Journalism. https://www.thebureauinvestigates.com/stories/2023-09-12/nestle-drops-supplier-linked-to-indigenous-land-invasions/

- EUR-Lex. “Regulation (EU) 2023/1115 of the European Parliament and of the Council of 31 May 2023 on the making available on the Union market and the export from the Union of certain commodities and products associated with deforestation and forest degradation and repealing Regulation (EU) No 995/2010.” June 9, 2023. https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX%3A32023R1115&qid=1687867231461

- Weisse, M., Goldman, E., and Carter, S. “Forest Pulse: The Latest on the World’s Forests.” Accessed: April 2, 2024. World Resources Institute. (n.d.) https://research.wri.org/gfr/latest-analysis-deforestation-trends

- IOI Group. “Sustainability Report: Driving Nature Positive Impacts.” September, 2023. https://www.ioigroup.com/integrated-report/sr/2023/sustainability-report_2023.pdf

- Shwarz Group. "Be Part of Our Sustainable Future: Progress Report for the 2022 fiscal Year for the Companies of Schwarz Group.” November 24, 2023. https://gruppe.schwarz/en/asset/download/10719/file/ProgressReport_FY22.pdf?version=2

- Unilever. "SAP, Unilever Pilot Blockchain Technology Supporting Deforestation-Free Palm Oil." March 21, 2022. https://www.unilever.com/news/press-and-media/press-releases/2022/sap-unilever-pilot-blockchain-technology-supporting-deforestationfree-palm-oil/

- UK Parliament. "The UK’s Contribution to Tackling Global Deforestation – Report Summary". January 4, 2024. https://publications.parliament.uk/pa/cm5804/cmselect/cmenvaud/405/summary.html

- Canby, Kerstin. “Progress of bipartisan policy to tackle global deforestation: The FOREST Act has been reintroduced to the US Senate and House of Representatives.” December 6, 2023. Forest Trends. Progress on bipartisan policy to tackle global deforestation: The FOREST Act has been reintroduced to the US Senate and House of Representatives - Forest Trends (forest-trends.org)