Investors are coming to realize that net-zero commitments and targets don’t necessarily result in effective action. Without committed investment dollars, clear transitions plans and solid governance policies, these commitments will not result in the magnitude of emissions reductions needed to meet global net-zero ambitions by 2050. Success will require not only a commitment to align to net-zero emissions, but also leadership buy-in, a sound strategy, and access to metrics based on science.

In short, company assessments need to go beyond emission pathways and reduction targets and give more weight to the actions and management practices companies are currently implementing. So, how can investors achieve this? In this article, we highlight some of the challenges investors face in assessing companies’ net-zero goals. We then outline various approaches to measuring alignment to net-zero emissions and their implications. Finally, we touch on the importance of assessing not only climate transition plans, but also their governance structures and implementation.

Corporate Commitments Require Wholesale Transformation

As the Earth continues to face an average global temperature increase of 2.5 degrees Celsius above pre-industrial levels by the end of the century,1 both companies and investors must act swiftly and boldly to correct this trajectory. When it comes to corporate promises to achieve net-zero emissions by 2050, ambitious commitments are one thing, and effective action is another. For many industries, successfully meeting science-based targets will call for considerable transformation of company strategy, supply chain management and product design, among other actions. Facilitating such a transformation will require the implementation of several strategic and governance-related processes. While companies work to understand the changes necessary to achieve net-zero emissions, investors grapple with a different set of challenges.

Investor Commitments Stand on Unstable Ground

Within the financial industry, there seem to be mixed signals when it comes to commitments to decarbonization and preventing global temperature rise. Some firms are withdrawing from industry-focused initiatives, while others are standing firm with their ambitious goals and public commitments. For example, Norges Bank Investment Management (NBIM) announced its net-zero strategy with a key goal for all of its portfolio companies to achieve net-zero emissions by 2050.2

For investors setting their own net-zero targets, it is becoming increasingly clear that looking at historic emissions performance and commitments to reduction targets is not enough considering the deep cuts to emissions needed to keep global temperature rise below 2 degrees Celsius. Assessments of company strategies should be forward looking, and must evaluate the extent to which companies are indeed turning the ship and whether they are likely to achieve their expressed emissions targets. Active engagement is another tool investors can employ to hold companies accountable. Whatever the approach, it’s clear that to meet their own decarbonization goals, investors will need to dig deeper when evaluating companies’ alignment to net-zero emissions and climate-related targets.3

Current Investing Commitments Aren’t Measuring Up

For companies, aligning activities with a net-zero scenario typically entails setting a science-based target through the Science Based Target Initiative (STBi). Although the SBTi has received criticism for its governance practices and the types of scenarios used in its methodology, it is generally accepted as a reliable approach for net-zero strategies.4

For investors on the other hand, the list of potential approaches to align their activities to net-zero scenarios is much longer. And for those that have received leadership buy-in to align to net-zero, a daunting next step awaits; developing a methodology that is both aligned with climate science and suits their asset allocation approach.

Disparities in the Landscape of Portfolio Alignment Metrics

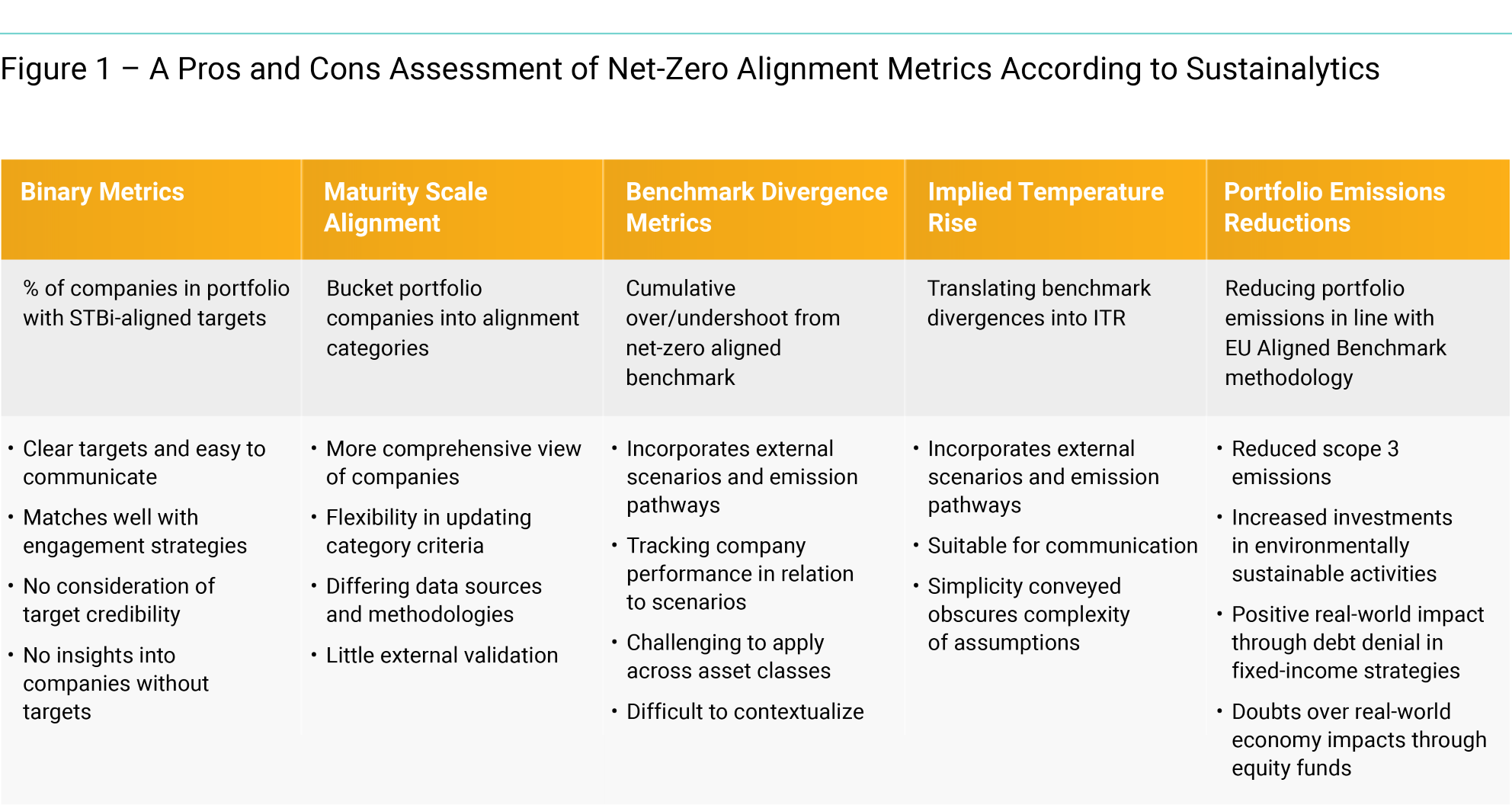

The Glasgow Financial Alliance for Net Zero (GFANZ) recently released a report outlining the metrics investors can use to manage and document their progress towards net-zero targets.5 The report highlights four approaches, each with considerable differences in terms of the impact on company investment strategies, and their potential effectiveness in transitioning the real economy. A deeper discussion of the benefits and drawbacks of each of these approaches merits a separate analysis, but for our purposes, we will cover Binary Metrics, the Maturity Scale Alignment, and our own addition of the category of Portfolio Emissions Reduction.

The Binary Metrics approach, in which goals are based on the percentage of portfolio companies with science-based targets, lends itself to having real world impacts if paired with active company engagement. However, the binary approach says very little about overall alignment of the portfolio to net zero when considering the extent of the negative impacts that companies without targets have. In addition companies can withdraw from initiatives, de-prioritize targets or simply not be transparent about their progress towards targets. For instance, our research shows that roughly 60% of assessed companies have not stated their commitment to report their progress on key climate-related milestones,6 leaving a sizeable information gap for investors attempting to assess the alignment of portfolio companies to net zero.

The Maturity Scale Alignment approach provides a potential solution for these issues by allowing for the categorization of companies based on their alignment to a net-zero strategy (e.g., aligned, potential to align, not-compatible with low-carbon economy). It also considers more detailed company-level indicators and the existence of the governance structures needed to reach said targets. The method laid-forth by the Paris Aligned Investment Initiative follows the maturity scale alignment approach, and is one increasingly used by investors.

The Portfolio Emissions Reduction approach (i.e., reducing the carbon footprint of investment portfolios) is not included as an alignment metric by GFANZ, despite it being part of the EU Paris-Aligned Benchmarks methodology. The main argument against such an approach is that merely reducing portfolio emissions does not necessarily have a corresponding reduction in real-world emissions.7 In addition, company-level analysis based purely on historical company emissions says very little about where the company is heading in terms of any potential transition plan.

In Figure 1 we present a modification of the categories presented by GFANZ, with an additional category on Portfolio Emission Reductions, and our thoughts on the strengths and weaknesses of each.

Source: GFANZ and Morningstar Sustainalytics. For informational purposes only.

Changing Course to Achieve the Promises of Net Zero

Claims of positive climate impact and net-zero alignment should be carefully worded to accurately encompass the assumptions and limitations of the differing approaches. For investors looking to set net-zero targets, it will be important to understand both the nuances of the various methodologies and what impact they may have on investment strategies. With respect to the underlying emissions data, for any of the above approaches to work, investors will require assessments of companies’ transition plans because net-zero commitments and targets do not necessarily equal net-zero alignment. The same should apply for company assessments, where transition plans, green investments, and climate risk governance analysis should complement reduction targets and net-zero commitments.

In Sustainalytics’ Low Carbon Transition Rating, the research and analysis of over 85 company-level climate management indicators will be a cornerstone of the methodology, providing investors with comprehensive assessments of companies’ transition preparedness across all subindustries. Initial findings based on a test universe show that of the companies that have set 1.5 degree targets with the SBTi, only between 15%-20% have the governance structures in place to be likely to reach these goals.8 In a follow up blog, we’ll take a closer look at the importance of assessing how well companies are managing their net-zero transition plans.

Are you an asset manager trying to navigate the increasingly muddy waters of net-zero investment strategies? Get in touch to learn how Sustainalytics’ Low Carbon Transition Ratings and other Climate Solutions can help. Contact our team or your client advisor.

On-Demand Webinar

Discover how you can effectively respond to climate regulatory initiatives, advance engagement activities and support net-zero strategies, in our on-demand webinar The Net Zero Transition: Building Climate-Aware Investment Strategies. To access the recording, click here.

References

1 United Nations Framework Convention on Climate Change. 2022. “Nationally determined contributions under the Paris Agreement, Synthesis report by the secretariat.” October 26, 2022. https://unfccc.int/documents/619180.

2 Norges Bank Investment Management. 2022. “2025 Climate Action Plan: Driving our portfolio companies towards next zero 2050.” https://www.nbim.no/en/the-fund/responsible-investment/2025-climate-action-plan/#:~:text=We%20will%20set%20a%20net,acquisition%20and%20asset%20management%20practices.

3 Quinio, A. 2022. “Norwegian oil fund to vote against companies without net-zero targets.” Financial Times. December 7, 2022. https://www.ft.com/content/d681cabf-3189-442c-a9ed-2fd51b2f68fd.

4 Lo, J. 2022. “Science Bast Targets initiative accused of providing a ‘platform for greenwashing’.” Climate Home News. June 2, 2022. https://www.climatechangenews.com/2022/02/06/science-based-targets-initiative-accused-providing-platform-greenwashing/.

5 Glasgow Financial Alliance for Net Zero. 2022. “Measuring Portfolio Alignment.” August, 2022. https://assets.bbhub.io/company/sites/63/2022/07/GFANZ-Portfolio-Alignment-Measurement-August2022.pdf.

6 Based on test universe of 800 global companies.

7 2 Degree Investing Initiative. 2022. “Tracking real world emissions reductions.” September 2022. https://2degrees-investing.org/wp-content/uploads/2022/10/2DII_Real_final.pdf

8 Based on test universe of 800 global companies.