Key Insights:

|

|

|

|

Corporate governance is not only a core component of ESG, but a vital consideration in any investment decision: a material ESG issue (MEI).1 At its best, it is a mechanism for promoting alignment, transparency and trust between investors and management. At its worst, it can be the root cause behind the collapse of long-standing institutions. Its importance cannot be underestimated.

Morningstar Sustainalytics introduced significant enhancements to its ESG Risk Ratings as of May 2024, leading to an upgrade to the corporate governance baseline as a key element. Our new enhancements to the corporate governance MEI seek to reduce complexity within research, improve transparency, provide a global benchmark, and adjust for increasing expectations in specific areas.

Ensuring that the individuals responsible for overseeing companies are appropriately objective, have relevant experience and are properly rewarded for acting in investors’ interests are well-established principles. Similarly, treating all shareholders equally and allowing them to engage with the board on key matters is a well-recognized practice for asset owners.

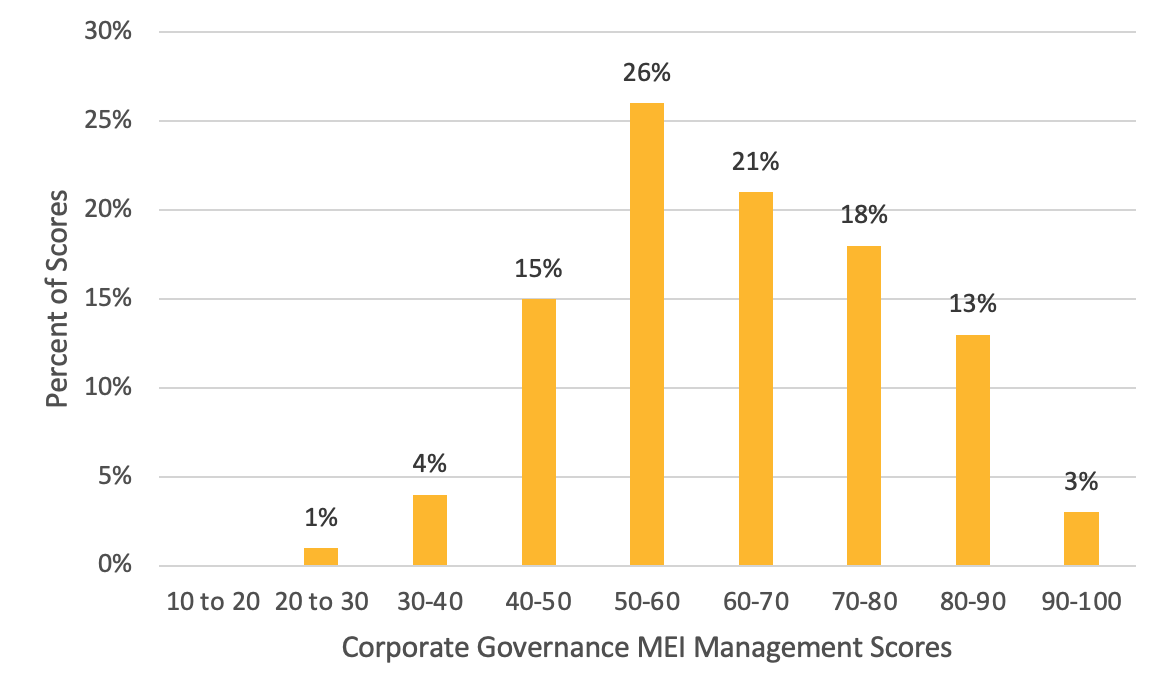

However, despite this, not all boards and companies adhere to best practices. Figure 1 draws on the enhanced corporate governance framework and highlights the varying practices across publicly listed companies.2 Specifically, we have plotted the distribution of corporate governance management scores for all companies covered in Sustainalytics’ ESG Risk Ratings universe. Management scores are an assessment of the company’s commitments, actions and outcomes that demonstrate how well the company is managing the ESG risks it is exposed to on a scale of 0-100, with a high score demonstrating positive practices. While overall, there is a positive leaning towards companies that have adopted good practices in the universe, there is room for improvement.

Figure 1. Distribution of Corporate Governance Management Scores in Sustainalytics’ ESG Risk Ratings Universe

Source: Morningstar Sustainalytics. For informational purposes only.

Source: Morningstar Sustainalytics. For informational purposes only.

Many of the issues highlighted by the latest research are echoed across the industry by asset owners, who are continuously demanding fairness and transparency. Results from an upcoming Voice of the Asset Owner Survey 2024, conducted by Morningstar Indexes and Sustainalytics, indicate that global institutional asset owners have a number of areas of concern across high profile companies: voting structures at Meta, board independence questions at Tesla, and a lawsuit with shareholders at ExxonMobil. Each of these are key areas of consideration in Morningstar Sustainalytics’ corporate governance assessment for ESG Risk Ratings.

The enhanced framework will continue to focus on the themes covered by the five existing key corporate governance pillars: board/management quality and integrity; board structure; ownership and shareholder rights; remuneration; and audit and financial reporting. However, the revised methodology will address these themes in a clearer and more concise way. One key change is that the benchmarks for good practice across the product are no longer relative to market practices. Instead, they are now based on Sustainalytics’ own definitions that draw on expectations globally.

In this article, we explore topical themes in more detail, including director independence and experience, board diversity, voting proportionality and remuneration programs. In addition, we provide examples of how the analysis of these key areas of corporate governance is applied to several companies, highlighting best practices and areas of improvement.

Board of Directors’ Independence and Experience

As guardians of shareholders’ interests, boards need to display an adequate level of independence to be able to exercise objective judgement and hold management accountable to ensure owners’ interests are represented. Minimum independence requirements may be established by stock exchanges, local legislation or codes, but they differ between regions. Therefore, board structures may reflect the particularities of the markets they are incorporated or listed in and can vary significantly between geographies.

For example, tenure is often considered a factor when assessing independence. This is because there is an increased risk of a director’s independence being compromised after serving for a prolonged period on the board. However, markets apply different standards. While countries such as Italy and France have adopted independence standards based on tenure, such standards are lacking in U.S. companies.

In markets where independence assessments or board refreshments are not driven by laws, regulations or corporate governance codes – but lie with the companies themselves – boards tend to include higher numbers of long-tenured directors. Sustainalytics research from 2023 showed that 55% of covered U.S. companies had at least a quarter of their board made up of long-tenured directors who have been on the boards for a minimum of 10 years. In contrast, just 29% of companies in Italy and 44% in France featured similar board compositions.

For a better comparison across markets, and to improve consistency and transparency, Sustainalytics has enhanced its framework to include tenure as a criterion for determining directors’ independence. Now, any director with a tenure of at least 10 years is classified as non-independent, regardless of the company’s classification or local laws and codes. This approach aligns with broader corporate governance trends, as companies are reducing overall director tenures and encouraging more frequent board refreshment.

Research shows that in the S&P 500, the average tenure of sitting directors declined from 8.9 years in 2018 to 8.3 years in 2023. For departing directors, the average tenure declined from 12.6 years in 2018 to 11.4 years in 2023. The decline is even more pronounced in the Russell 3000, where the average tenure of sitting directors fell from 8.6 in 2018 to 7.7 years in 2023.3

Limiting tenure is one mechanism to ensure that directors remain independent of thought, continue to challenge management, hold executives to account and reduce the risk of group-think. Although we acknowledge that experience and corporate knowledge are an asset, this should be balanced with novel perspectives and external points of view. Sustainalytics’ enhanced framework approach allows for this to happen.

Case Study: Apple, Inc.

Apple considers its long-tenured directors independent and has not yet adopted term limits. As such, the board is dominated by directors with long tenures ranging from 10 to 24 years. Under the enhanced framework, long-tenured directors have been reclassified by Sustainalytics as non-independent.

Apple’s board, therefore, has seen a decrease in our measure of independence from the 87.5% reported by the company earlier in 2024 to 37.5%. Four out of the seven nominally independent directors – including the board chairman and the chairs of the audit, remuneration and nomination committees – are now assessed as non-independent by Sustainalytics. The independence reclassification has also led to lower levels of committee independence, with the audit committee being only 50% independent, and the nomination and remuneration committees recording an independence level of 33.3%.

Furthermore, to effectively oversee the company’s financial reporting, Sustainalytics considers it essential that an audit committee consist of directors that are both independent and have solid financial expertise. With the re-classification of two directors as non-independent, we now consider there to be no independent directors with financial expertise on the audit committee.

It is worth noting that the topic of long-serving directors at Apple has been a point of discussion with shareholders in the last few years and the company has made progress in renewing its board. Since 2021 the board has reduced the number of long-tenured directors and has added three new directors to its board.

Experience and Diversity of Board Members

The experience and diversity of board members also contributes to building an effective board. While it is important for each board member to possess a variety of skills, it is equally important for directors to have relevant industry experience. This allows them to make informed decisions and provide effective oversight of management. Our enhanced corporate governance framework now sets a higher bar for companies when assessing both the board and audit committee members’ relevant industry experience. For example, we expect boards to have at least two directors with relevant executive industry experience and two with non-executive industry experience.

Similarly, the ESG Risk Rating will continue to assess the levels of gender diversity on the board and the board’s gender diversity policy, including whether a company’s board diversity policy is in alignment with international standards.

Case Study: Danone SA

Danone is an example of a company that demonstrates good practices regarding board structure and composition. The practices meet the enhanced expectations under the new framework. The board is 88.9% independent, with no long-tenured directors. Half of the shareholder-elected independent directors have either executive or board experience gained from companies in sectors relevant to Danone’s operations. Furthermore, the chairman and the CEO roles are separated, with the chairman being an independent director. Finally, the board also maintains a good balance of gender representation, with 44.4% of the board comprising of women, in line with the country’s gender diversity requirements.

Voting Proportionality

Good corporate governance also ensures equal treatment of shareholders, with the adoption of the ‘one share, one vote’ principle considered best practice. Providing equal voting rights holds the board of directors accountable to all the shareholders. Sustainalytics assesses whether shareholders’ rights align with their economic investment, signaling deviations from this principle. The most common deviation from the principle is the adoption of a dual-class share structure.

Dual-class companies offer different classes of common stock with differential voting rights. Shares with superior voting power are typically held by the company owners or key insiders, allowing them to maintain control over the business. While some argue that dual-class structures protect against potential takeovers or market pressures and enable owners to focus on long-term growth, they may also pose risks. Minority shareholders have less influence on company strategy and director elections. Additionally, owners of supervoting shares can maintain control of the company without corresponding economic exposure. This disproportionate voting power, relative to economic investment, can lead to decisions that expose the company to greater risks. The Council for Institutional Investors recommends that dual-class structures include a mandatory sunset provision of seven years post-IPO, arguing that the valuation premium of these companies fades to a discount after this period.4

While dual-class structures are not common practice, they are still present in high-profile companies like Alphabet5 and Meta.6 According to the Council of Institutional Investors, 10% of U.S. companies have dual-class structures.7 Sustainalytics data supports this, revealing that 6% of companies assessed in 2023, regardless of their market of incorporation, deviated from the one share, one vote principle. Additionally, this trend is increasing. According to a report by the Investor Coalition for Equal Votes, nearly 40% of U.S. tech IPOs between 2020 and 2022 featured dual-class structures.8

Case Study: Meta Platforms, Inc. Versus Microsoft Corp.

Meta maintains a dual-class structure, with Class A shareholders being entitled to one vote per share, and Class B shareholders to 10 votes per share. The majority of the supervoting Class B shares are held by founder, CEO and chair Mark Zuckerberg. As reported in the company’s April 2024 Proxy Statement, he controls 61% of the total voting power despite holding less than 14% of the total Class A and Class B shares.9

This controlling stake allows Zuckerberg to dictate the strategy of the company, which may not always align with the expectations of minority shareholders. Zuckerberg can veto any shareholder proposals that do not align with his views or interests.

At the end of April 2024, the company announced increased capital expenditure for the full year to support its artificial intelligence roadmap, sending the shares tumbling 10%.10 Meta shareholders have asked for the removal of the dual-class structure, arguing that without equal voting rights, the shareholders cannot hold management accountable. The proposal was supported by 28% of the shareholders at the 2023 annual general meeting, despite the board’s recommendation for a vote against it.11

Conversely, Microsoft maintains a single class of shares, with each share entitled to one vote.12 Therefore, all shareholders have equal say in all voting items, including the election of directors. Microsoft does not limit the power of its shareholders and has a dispersed ownership structure.

Executive Remuneration

Good corporate governance also means transparent remuneration plans that align performance and pay. Transparent remuneration plans provide investors with information on how companies incentivize management by linking remuneration to the company’s short and long-term objectives.

Sustainalytics has streamlined its approach to assessing executive remuneration by reducing the number of indicators, while maintaining coverage of the key themes, such as disclosure of short and long-term remuneration programs and the magnitude of CEO pay. Additionally, we will continue to assess whether shareholders are able to vote on the company's remuneration practices. The following case study highlights a series of good practices that are all captured under this enhanced framework.

Case Study: American Electric Power Co., Inc.

U.S. electric utility firm American Electric discloses transparent remuneration plans13 with metrics and pre-set targets, allowing shareholders to accurately assess the alignment between pay and performance. Notably, the company also includes ESG targets for both remuneration plans.

The short-term incentive plan is 60% based on financial performance, while 20% of the target award is based on safety and compliance metrics, and 20% on strategic initiatives.

The long-term incentive plan is 75% performance-based, with performance measured over a three-year period. Additionally, 90% of the plan is based on financial metrics, with the remainder being linked to an ESG metric, specifically three-year carbon-free generation capacity additions.

The company also discloses threshold, target, and maximum payout performance levels, offering shareholders a transparent view of its remuneration practices.

Conclusion

Assessing the strength of corporate governance practices is a key component of the investment decision process. With ongoing scrutiny from the market, shareholders, and other stakeholders, its importance is only growing. Sustainalytics’ enhanced assessment framework provides investors the necessary tools to make informed decisions, highlighting areas of concern which may increase investment risks.

References

- Material ESG issues are focused on a topic, or set of related topics, that require a common set of management initiatives or a similar type of oversight.

- Data is according to Morningstar Sustainalytics Ratings universe, which comprises approximately 5,000 large and medium market cap investable issuers in developed and emerging markets.

- Tonello, M. 2023. “Recent Trends in Board Composition and Refreshment in the Russel 3000 and S&P 500.” December 7, 2023. Harvard Law School Forum on Corporate Governance. https://corpgov.law.harvard.edu/2023/12/07/recent-trends-in-board-composition-and-refreshment-in-the-russell-3000-and-sp-500/

- Investor Coalition for Equal Votes. “Undermining the Shareholder Vote.” https://www.railpen.com/media/pmcil2eb/icev-report-2023-undermining-the-shareholder-voice.pdf

- Alphabet Inc. 2024. Alphabet Notice of 2024 Annual Meeting of Stockholders and Proxy Statement. April 26, 2024. https://abc.xyz/assets/b4/e1/141b66943c338236198ce76ee724/3a1a10373869afdd368fa7e2b27562ba.pdf

- Meta Platforms, Inc. 2024 Proxy statement. April 19, 2024. https://d18rn0p25nwr6d.cloudfront.net/CIK-0001326801/8c7f110d-9cc4-4034-b356-ece89d4cb1c5.pdf

- Council of Institutional Investors. “Dual-Class Stock.” Accessed: May 29, 2024. https://www.cii.org/dualclass_stock

- Investor Coalition for Equal Votes. 2023. “Undermining the Shareholder Voice: The Rise and Risks of Unequal Voting Rights.”November 30, 2023. https://www.railpen.com/media/pmcil2eb/icev-report-2023-undermining-the-shareholder-voice.pdf

- Meta. Annual Meeting and Proxy Statement. April 19, 2024. https://d18rn0p25nwr6d.cloudfront.net/CIK-0001326801/8c7f110d-9cc4-4034-b356-ece89d4cb1c5.pdf

- Coller, A. 2024. “Meta tumbles 10% on weak revenue forecast and Zuckerberg’s comments on spending.” April 25, 2024. CNBC https://www.cnbc.com/2024/04/25/meta-stock-down-15percent-on-weak-revenue-forecast.html

- Meta Platforms, Inc. 2023. Form 8-K. June 2, 2023. https://www.sec.gov/ix?doc=/Archives/edgar/data/0001326801/000132680123000083/meta-20230531.htm

- Microsoft Corp. 2023. Notice of Annual Shareholders Meeting and Proxy Statement 2023. December 7, 2023. https://microsoft.gcs-web.com/static-files/bca9acd8-406f-4318-915c-20f13ce4d060

- American Electric Power Co, Inc. 2024. Notice of Annual Meeting & Proxy Statement. March 13, 2024. https://d18rn0p25nwr6d.cloudfront.net/CIK-0000004904/66d142e7-11a1-4041-97d8-6ddb346dd2c3.pdf