Key Insights:

|

|

|

What do pizza, chocolate, shampoo, and cosmetics have in common? If you look at the labels, you’re likely to find a recurring ingredient: palm oil. It’s used in almost 50% of supermarket products.1 It is also one of the world’s most widely used vegetable oils due to its versatile properties and high yield, producing over five times more oil per hectare than sunflower oil.2 But this versatility and high yield come at a price.

The palm oil industry has long faced criticism of its environmental and social impacts. NGOs, civil society groups, academics, investors, and other stakeholders have called out the sector for a variety of ESG issues including deforestation, biodiversity loss, land grabbing and poor labor conditions.3 Achieving sustainability in palm oil production requires robust management and strategies to address these risks across supply chains.

Gaining clarity on how these issues are evolving was the focus of my recent engagement trip to Malaysia earlier this year. As part of Morningstar Sustainalytics’ Stewardship Services team, I engaged with some of the key players in the palm oil sector on a wide range of ESG topics.

My engagement trip aimed to understand the leading practices and transition challenges facing companies in the palm oil industry – by meeting with four major global palm oil companies in Malaysia (see Table 1).

Table 1. Overview of the Palm Oil Companies Visited on Sustainalytics’ Stewardship Team Field Trip

| Company | Company Description | HQ | Total Employees | Market Cap (USD mil.) | Total Revenues (USD) |

| A | One of the world’s largest palm oil plantation owners and the largest palm oil refiner and biodiesel manufacturer in Indonesia and Malaysia. | Singapore | 100,000 | 14,357.99 | 67,155.26 |

| B | The largest listed palm oil company globally, based on plantation area and fresh fruit bunch production. | Malaysia | 84,000 | 6,535.23 | 3,997.37 |

| C | The world's second-largest palm oil plantation company. One of the world’s largest producers of crude palm oil (CPO). | Malaysia | 16,771 | 993.86 | 4,199.39 |

| D | A leading integrated and sustainable palm oil corporation across the globe, with plantation business and the downstream resource-based manufacturing business. | Malaysia | 28,010 | 5,083.37 | 2,478.35 |

To ensure I gathered a balanced perspective, I also met with the Roundtable on Sustainable Palm Oil (RSPO), which provides standards and certifications for sustainable palm oil, at its headquarters in Kuala Lumpur and the World Wildlife Fund (WWF) at its Singapore office. In this article, I summarize some of the key insights I gained from these engagements.

Understanding Malaysia’s Role in the Palm Oil Industry

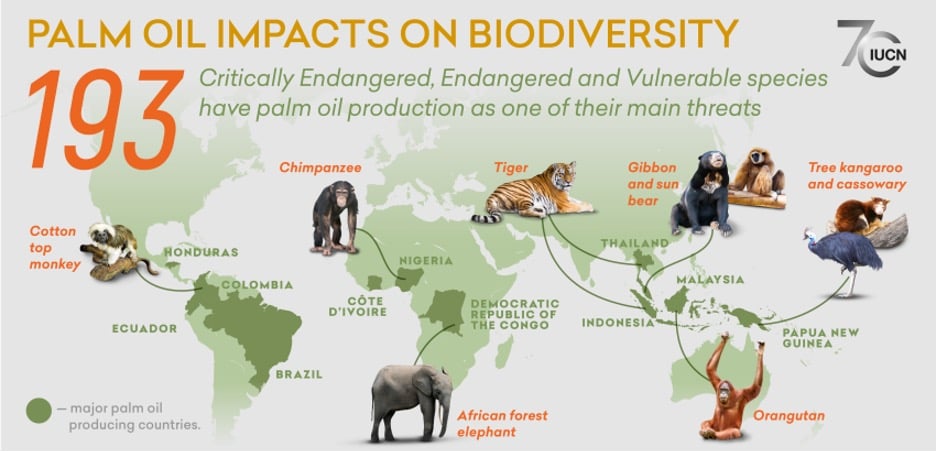

A briefing by the International Union for Conservation of Nature and Natural Resources (IUCN) reported that global palm oil production affects at least 193 threatened species, with potential impacts on 54% of all threatened mammals and 64% of all threatened birds (see Figure 1).4 Southeast Asia is one of the world’s most biodiverse terrestrial ecosystems, yet palm oil production is highly concentrated in this region, with Indonesia and Malaysia accounting for 85% of global production.5

Figure 1. Palm Oil Impacts on Biodiversity

In Malaysia, the palm oil industry is crucial for the population’s economic livelihood, occupying 18% of the country’s territory. The industry directly employs about 441,000 people and many more indirectly.6 Recent improvements in supply chain practices among Malaysian palm oil companies have been noted by organizations such as WWF,7 World Resources Institute (WRI)8 and Chain Reaction Research (CRR).9 These improvements include reduced deforestation due to stronger law enforcement, certification schemes and corporate commitments to zero deforestation.10

Additionally, from what Sustainalytics’ engagement programs have seen, companies are making the effort to enhance working conditions. For one company in our engagement program, efforts to improve working conditions are succeeding. Its products had previously been banned in the U.S. under a withhold release order (WRO), but with improvements to working conditions, the U.S. Customs and Border Protection lifted the WRO and allowed its palm oil products to re-enter the U.S. market. In a place that is full of potential to make an impact on biodiversity and local livelihood, we wanted to see the work and the people involved in sustainable palm oil production firsthand.

Key Takeaways

This engagement trip provided a comprehensive exploration of ESG topics for the palm oil industry, including labor conditions, community livelihood, nature conservation and climate initiatives. This section delves into the key strengths, challenges and opportunities that the industry faces.

Strengths: Standards as Catalysts for Corporate Commitments

Several key actors have advanced the sustainable transition of the palm oil industry in Malaysia, positively impacting the companies in our engagement.

RSPO: The RSPO has had profound impacts through its principles and criteria, providing certifications for compliant producers. The successful implementation of RSPO principles and criteria can also serve as a leading practice for other soft commodity industries to follow.

No Deforestation, No Peat and No Exploitation (NDPE) Commitment: The NDPE commitment, adopted by many growers, traders and downstream companies, helps reduce deforestation, preserve natural resources and protect workers’ and local communities’ rights.11

Government Support: The Malaysian government supports the sustainable transition through initiatives such as the Malaysia Sustainable Palm Oil (MSPO) Board and mandating the MSPO certification. In addition, the government has established legislation such as a plantation area cap in 2019 through to 2023 and the National Forestry Act enacted in 2022 to conserve forests from illegal loggers.12

Challenges: Traceability and Smallholder Management

While the industry’s sustainable transition is gaining momentum, there remain a couple of key challenges.

Traceability Issues: Achieving 100% traceability to the mill and plantation level remains challenging, especially for smallholders (i.e., small-scale farmers who are not linked to any particular company or mill). During an in-person meeting, one company mentioned that if smallholder farmers are to be a part of the supply chain, the company did not believe that 100% traceability at the plantation level could be achieved. The EU Deforestation Regulation (EUDR) requires this level of traceability, but many smallholders lack the resources to comply.

Smallholder Inclusion: Although efforts are being made to include and certify smallholder farmers, progress is slow. From our meeting with the RSPO, smallholders’ production currently accounts for 40% of total palm oil production in Malaysia. However, only 0.3% of smallholders in Malaysia are RSPO-certified as of the end of 2023. This may expose downstream buyers and financiers to higher risks of deforestation and other unsustainable practices within supply chains. Although some smallholders might follow sustainable production practices, due to resource constraints such as lack of documentation or substantial due diligence, they cannot meet the EUDR requirements. Considering the implementation of the EUDR by the end of 2024, it is undoubtedly challenging for smallholders to comply, leading to potential exclusion from the EU market.

Opportunities: Nature-Related Risk Management

Despite these challenges, there are still many opportunities and pathways we can learn from palm oil companies. These include:

High Conservation Value (HCV) and High Carbon Stock (HCS) Assessments: With the growing attention on nature conservation, other high-risk commodities (e.g., soy and cattle) and industries (e.g., forestry and mining) can learn from the practices of the palm oil industry, such as the implementation of HCV and HCS assessments before land development.

Wildlife Conservation: Palm oil companies are also familiar with the concept of wildlife conservation and the management of human-animal conflict. We observed some good practices from companies to conserve and support wildlife protection efforts such as funding wildlife rescue centers. Additionally, companies are setting standard operating procedures for plantation workers to raise awareness and achieve productive coexistence with wildlife. Amid increasing demands for companies to assess their nature-related impacts and dependencies and establish strategies to mitigate the risks as part of the recommendations of the Taskforce on Nature-related Financial Disclosure (TNFD), the palm oil industry has abundant experience and practices to share with other industries and influence other companies to work on their risk assessment and mitigation strategies.

Lessons for Responsible Investors

With growing global demand for palm oil due to its versatile properties and ubiquitous usage, the sector presents an intriguing investment opportunity. Two key insights we gained from our trip can aid in the sustainability transition process.

Collaborative Efforts Accelerate the Sustainable Transition: The sustainable transition in the palm oil industry results from collaborative efforts among investors, companies, governments, NGOs, certifiers (like the RSPO) and consumers. Despite ongoing challenges, multi-dimensional collaborations and communication are essential in navigating these challenges and accelerating the process to find win-win solutions.

In-Person Interaction as a Tool for Responsible Ownership: Direct interaction with companies allows investors to verify corporate sustainability commitments, understand current challenges, and better assess potential risks and outcomes. In-person engagement not only builds trust with companies, but also demonstrates that investors are genuinely concerned about the issues, further accelerating company actions to address them. In-person engagement also helps mitigate greenwashing claims by ensuring corporate disclosures align with on the ground practices.

The Biodiversity and Natural Capital Program is part of Sustainalytics’ Stewardship Services and addresses biodiversity loss head-on by leveraging the power of investors to engage directly with corporations and other stakeholders. Learn more about how you can leverage stewardship to gather valuable material ESG information and support the sustainable transition in the palm oil sector by downloading the brochure.

References

- World Wildlife Fund UK. “8 Things to Know About Palm Oil.” Accessed: July 31, 2024. https://www.wwf.org.uk/updates/8-things-know-about-palm-oil

- Ibid.

- Ibid.

- International Union for Conservation of Nature. Palm Oil and Biodiversity. June 2018. https://www.iucn.org/resources/issues-brief/palm-oil-and-biodiversity

- Meijaard, E. et al. (eds.). “Issues Brief: Oil Palm and Biodiversity.” June 2018. IUCN Oil Palm Task Force. https://www.iucn.org/resources/issues-brief/palm-oil-and-biodiversity

- Chang, F. K. “Palm Oil: Malaysian Economic Interests and Foreign Relations.” April 12, 2021. Foreign Policy Research Institute. https://www.fpri.org/article/2021/04/palm-oil-malaysian-economic-interests-and-foreign-relations/

- World Wildlife Fund. 2024. Palm Oil Scorecard. Accessed: July 31, 2024. https://palmoilscorecard.panda.org/

- Schneider, T., Vary, L., Tan, S. 2024. “Complex Supply Chains Are Still a Major Barrier to Ending Deforestation.” World Resources Institute. February 19, 2024. https://www.wri.org/insights/supply-chain-transparency-deforestation

- Jong, H. 2022. “Deforestation for Palm Oil Falls in Southeast Asia but Is It a Trend or a Blip?”. March 23, 2022. Mongbay. https://news.mongabay.com/2022/03/deforestation-for-palm-oil-falls-in-southeast-asia-but-is-it-a-trend-or-a-blip/

- The Sustainable Palm Oil Choice. Deforestation & Palm Oil. Accessed: May 15, 2024. https://www.sustainablepalmoilchoice.eu/deforestation-palm-oil/

- Economics Climate Environment. “Palm Oil Sustainability: NDPE.” March 2020. https://www.efeca.com/wp-content/uploads/2020/03/Certification-Scheme-NDPE-Infobriefing-5-Part-4-Final.pdf

- Weisse, M. et al. “How much forest was lost in 2022?” World Resources Institute | Global Forest Review. Accessed: April 30, 2024. https://research.wri.org/gfr/global-tree-cover-loss-data-2022