Key Insights:

|

|

|

None of the Companies With SBTi Targets Assessed by Sustainalytics Has a Credible 1.5 C Aligned Transition Plan

Over 7,000 companies across various regions and industries have set emissions reduction targets grounded in climate science through the Science-Based Targets Initiative (SBTi). More companies are planning to set SBTi targets due to a combination of factors, including investor expectations, regulatory pressures, and simply the potential opportunities for cost savings, innovation and building resilience.

For their part, investors and financial institutions increasingly use SBTi targets to make capital allocation and lending decisions. Asset managers use these targets to track the decarbonization progress of portfolio companies, align their investments with a 1.5 C climate pathway, and engage with companies on decarbonization. SBTi targets also help managers identify companies leading the transition to a low-carbon economy. These companies may be included in thematic investment products, such as climate-transition funds.

Nevertheless, having science-based targets does not necessarily imply that a company is on the right track to achieving net zero by 2050, in line with the Paris Agreement. In fact, our analysis shows that within Sustainalytics’ coverage universe, no company with SBTi targets has a credible transition plan that is compliant with a 1.5-degree Celsius warming scenario. Moreover, the quality of the transition plans varies significantly across the universe of companies with SBTi targets.

In this article, we draw upon research from Sustainalytics’ Low Carbon Transition Ratings (LCTR) to assess the credibility of transition plans.

Assessing the Credibility of Transition Plans Towards SBTi Targets

The LCTR assesses companies’ transition plans and progress toward stated greenhouse gas (GHG) reduction commitments by evaluating the quality and ambition of the companies’ GHG reduction targets, along with existing trends of carbon emissions and forward-looking investment plans. Among other parameters, we analyze the adequacy of the companies’ governance structures to meet the set targets.

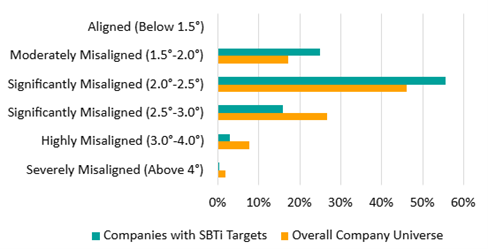

Out of the approximately 9,500 companies currently assessed by Sustainalytics, about 15% (1,450 companies) have validated SBTi targets. However, of these, we found none that have a transition plan aligned to a net zero pathway, limiting global warming to 1.5 C above preindustrial levels. In fact, no company in our research universe, with or without an SBTi target, has a transition plan aligned to a net zero pathway, as shown in Figure 1 below.

Meanwhile, according to our assessment, 25% of companies with SBTi targets are on a 1.5 C to 2.0 C pathway, which is only slightly better than the 17% of companies in our global research universe. The bulk (56%) of companies with SBTi targets are on a 2.0 C to 2.5 C pathway.

Figure 1. LCTR Distribution Across Assessed Companies with SBTi Targets Compared with All Companies in Sustainalytics’ Research Universe

Source: Morningstar Sustainalytics.

Note: Based on 1,450 companies with SBTi targets assessed by Morningstar Sustainalytics. The overall company universe includes 9,500 companies. Data as of January 2025. Companies with an ITR of 1.5 C or less are categorized as Aligned with the net zero target. Companies with an implied temperature rise (ITR) between 1.5 C and 2 C are considered Moderately Misaligned, while those with an ITR between 2 C and 3 C are Significantly Misaligned. Companies between 3 C and 4 C are Highly Misaligned and those above 4°C are Severely Misaligned.

The LCTR framework, with its Implied Temperature Rise (ITR) score, is designed to assess the actions companies are taking to reduce emissions, not just to assess their stated targets (including those set in accordance with the SBTi).

Over Half of Assessed Companies with SBTi Targets Have Strong Management Practices

One signal that investors can leverage to assess the actions that companies are taking to reduce their emissions and prepare for the transition is the LCTR management score. These company assessments are based on a pool of indicators, including ones evaluating how companies are aligning their governance and operational processes to meet low-carbon transition objectives. Other indicators evaluate the use of an internal carbon price in decision-making, management incentives to reduce emissions, and whether companies engage with suppliers and other stakeholders to support supply chain decarbonization.

On average, companies are assessed on 20 to 30 individual indicators. Each indicator is scored based on detailed assessment criteria, which give each company a set of raw indicator scores from 0 (weak) to 100 (strong). These raw indicator scores are then weighted according to the relative subindustry weightings and distribution of emissions by scope for each company. A management score above 55 means that the company demonstrates strong performance in managing climate risks and transforming its business to reduce its emissions. A management score between 45 and 55 is assessed as average, and a management score below 45 is weak.

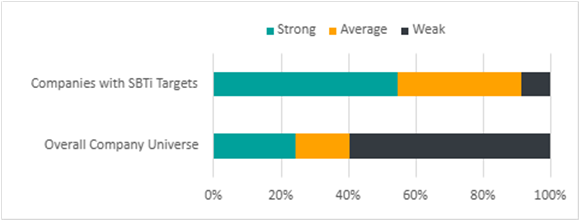

Looking at our sample of 1,450 companies with SBTi targets, we found that 55% have strong management practices. This number, which may be seen as relatively low, is more than double the proportion (24%) of companies in our global research universe that have strong management scores (see Figure 2).

Our analysis implies that companies that have set GHG reduction targets are more likely to act and have the right initiatives in place to reduce their carbon emissions. These companies are also, as a result, better prepared for the transition to a low-carbon economy.

Figure 2. Management Score - Comparing Companies with SBTi Targets to Companies in the Overall Universe

Source: Morningstar Sustainalytics.

Note: Data as of January 2025. Based on 1,450 companies with SBTi targets. The overall company universe includes 9,500 companies. Note that two companies with SBTi targets that had “Very Strong” management scores were grouped under “Strong”.

Examples of companies with SBTi targets that have strong management practices include US technology hardware and equipment company Apple, which has committed to reduce its absolute combined scope 1, 2 and 3 GHG emissions by 62% by 2030 from a 2019 base year. The company has an ITR of 2.1 C and a management score of 66 (out of 100). Among other aspects, we consider the fact that Apple has set an absolute GHG emission reduction target that covers all three scopes to be a positive signal. Also, the company engages with tier 1 suppliers and requires them to have their own GHG reduction targets. There is board-level responsibility for climate-related transition risk, and the company discloses how it engages with policy makers on pro-climate policy.

Similarly, Alstom, a French railroad transportation group, has committed to reduce its absolute scope 1 and 2 GHG emissions by 40% by 2030 from a 2021 base year. Alstom also aims to reduce part of its scope 3 GHG emissions by 2030. The company meets many of the same criteria as Apple and therefore exhibits strong management of low carbon transition readiness. The company’s ITR is 2.8 C and its management score is 62.

Among the companies best prepared for the transition to a low-carbon economy, we found Schneider Electric (1.7 C; 74), Storebrand (1.9 C; 73), and Hewlett Packard (1.9 C; 72). These are leading firms with some of the lowest ITRs and highest management scores. They score high on many of the management indicators we assess. For example, in addition to the initiatives previously mentioned, Schneider Electric discloses an internal carbon price, engages with suppliers to improve environmental performance, utilizes nature-based solutions for residual emissions, and issues green or transition bonds or loans.

About 45% of Assessed Companies with SBTi Targets Have Average or Weak Management Practices

Although, as mentioned, the proportion of assessed companies with SBTi targets and strong management practices compares favorably to the rest of the universe, 45% of assessed companies with SBTi targets still have average or weak management practices.

In fact, as much as 9% of companies with SBTi targets have weak management practices. For example, many of these companies do not use an internal carbon price in decision-making or do not have board-level remuneration linked to emissions reduction or wider climate-related targets. Some also do not have an investment forecast or engage with suppliers to reduce their emissions.

We consider these companies to be far from taking enough action to manage their transition risks and reduce their emissions to meet their net zero targets. In other words, these companies have non-credible transition plans.

One such example is Toyota Industries Corp., which has a management score of 44 and an ITR of 3.4 C. The company, a Japanese multinational that manufactures automobiles, industrial vehicles, and textile machinery, has committed to reducing its absolute scope 1 and 2 GHG emissions by 42% by 2031 from a 2022 base year. But the company discloses a limited number of initiatives to reduce its emissions and does not disclose a commitment to improve reporting over the next three years.

Identifying Gaps in Transition Plans

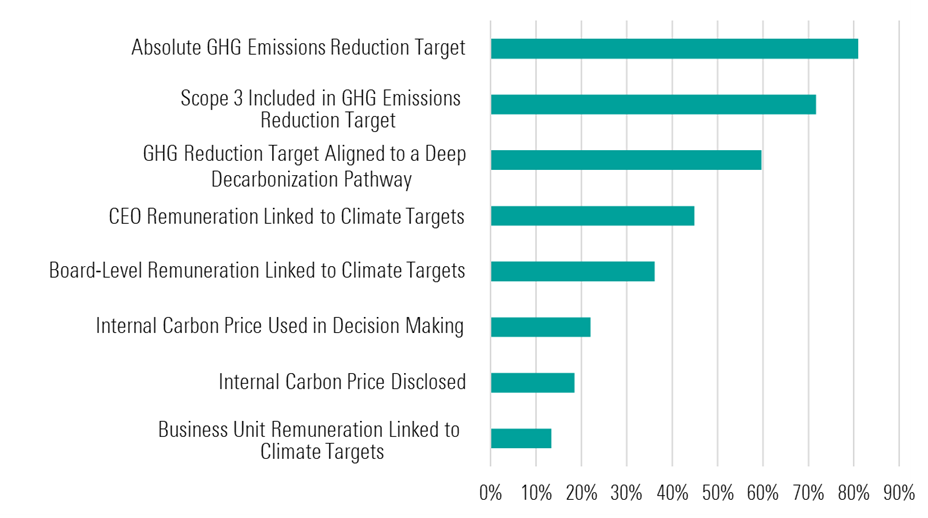

Using Sustainalytics’ LCTR management score and its underlying indicators, investors can identify gaps in companies’ reported transition plans. Looking at a selection of key management indicators, we found significant discrepancies, with some indicators better reported on than others.

For example, as Figure 3 shows, the vast majority (81%) of companies with SBTi targets have an absolute GHG emissions reduction target, but only 36% have linked board-level remuneration to emissions reduction or wider climate-related targets, and 18% disclose using an internal carbon price in decision-making. These indicators are relevant to all subindustries.

Figure 3. Frequency of Selected Key Performance Indicators Across Assessed Companies With SBTi Targets

Source: Morningstar Sustainalytics.

Note: KPIs applicable to all subindustries. Data as of January 2025. Based on 1,241 companies assessed by Morningstar Sustainalytics and with verified SBTi targets.

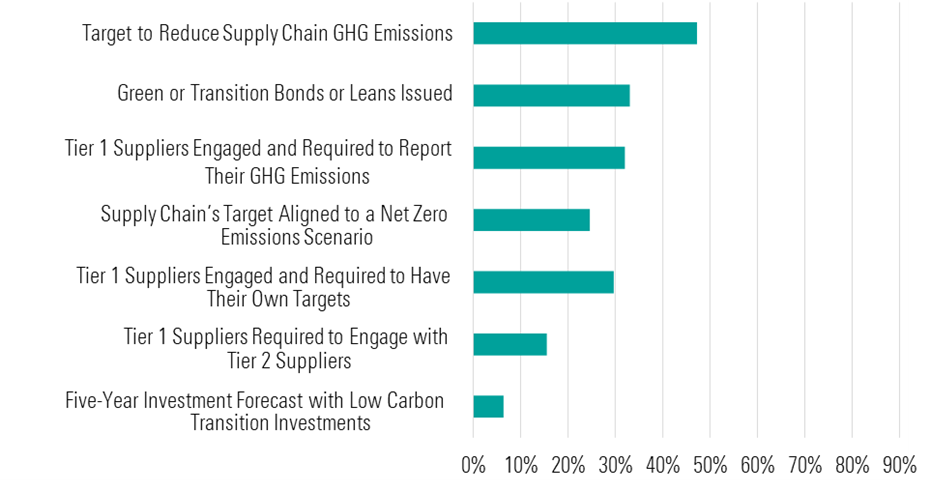

Looking at a set of key performance indicators (KPIs) applicable to certain subindustries for which these KPIs are relevant (Figure 4), we see that 47% of companies in subindustries such as textiles, automobiles, and consumer electronics, have targets to reduce their supply chain emissions, but only 16% engage with tier 1 suppliers and require them to have their own GHG emissions reduction targets. An even smaller number, 6%, have a five-year investment forecast incorporating low-carbon transition investments.

Figure 4. Frequency of Selected Key Performance Indicators Across Assessed Companies With SBTi Targets

Source: Morningstar Sustainalytics.

Note: KPIs applicable to certain subindustries only. Data as of January 2025. The number of subindustries and companies varies per indicator. For example, “Target to reduce supply chain GHG emissions” is applicable to 46 subindustries, including textiles, pharmaceuticals, construction materials, food retail, and household goods. Meanwhile, “Green or transition bonds or loans issued” and “Five-year investment forecast with low-carbon transition investments” are indicators applicable to 74 subindustries, including REITs, metals mining, utilities, and oil & gas.

In conclusion, our analysis shows that setting science-based targets is an essential step towards reducing GHG emissions, but it is far from being sufficient. It should also come with a series of wide-ranging measures that create strong incentives and evidence real actions. Key measures include strengthening governance structures, linking board and executive pay to emissions reduction targets, integrating carbon pricing, setting a long-term sustainable finance strategy, adopting green technology, and engaging with suppliers to set GHG reduction targets.

Through their engagement activities, asset managers, asset owners, and lenders can encourage companies to improve the credibility of their transition plans by implementing best practices.