- European Supervisory Authorities create a “single rulebook” for SFDR and Taxonomy product disclosures.

- Taxonomy disclosure rules for financial products differ substantially from those for financial undertakings, leaving fund managers and other financial market participants to address two sets of rules to comply with.

- Investors need to produce Taxonomy alignment figures probably as of 1 July 2022 (rather than 1 January 2022), but this is yet to be confirmed.

A Single Rulebook

On 22 October 2021, the final draft rules for financial product disclosures under the Sustainable Finance Disclosure Regulation (SFDR) were published by the European Supervisory Authorities (ESAs) in their ‘Final Report on Draft Regulatory Technical Standards’ (final draft RTS). This final draft RTS aims to create a “single rulebook” for sustainability-related disclosures for SFDR pre-contractual and periodic product disclosures including Taxonomy-related product disclosures. They are the requirements for what have become known as SFDR Article 8 and Article 9 products, which are financial products with environmental or social characteristics (Article 8, sometimes called ‘light green products’) or sustainable investment objectives (Article 9, or ‘dark green products’).

The publication of these rules marks the end of a prolonged period of uncertainty in the market around final rules and timelines - assuming the RTS will be adopted as-is in a Delegated Act, which turns these rules into regulation. There are several noteworthy aspects to these rules, which we address from our perspective in this article.

Two Taxonomy KPIs for financial products

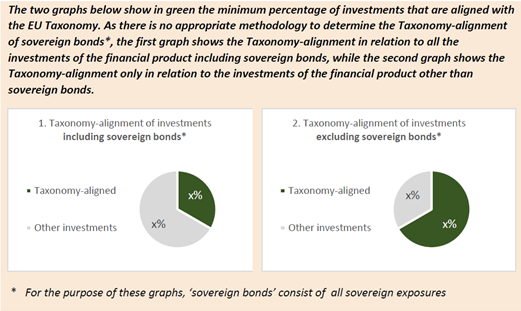

The ESAs dealt with the contentious issue of whether to include sovereign exposures in the calculation of the Taxonomy KPI – this has been rumored to be the main reason for the delay of this draft RTS – with the logical solution being to have two KPIs: one including sovereign exposures in the denominator and one excluding them (in both KPIs sovereign alignment is excluded from the numerator). This solves the issue that excluding sovereigns may inflate the Taxonomy figures of a fund while including them is not straightforward since there is no Taxonomy for countries at this point. The Taxonomy KPIs should be graphically depicted; see below figures taken from the disclosure templates in the RTS on what this should look like.

Pre-contractual figures should use turnover as its financial metric as a default unless CAPEX or OPEX are more representative of the product. In periodic reporting, all three metrics should be used, as can be seen below.

Figure 1: Graphical representation of Taxonomy alignment in pre-contractual product disclosures (source: Final Report on Draft Regulatory Technical Standards)

Figure 2: Graphical representation in periodic product disclosures of Taxonomy alignment (source: Final Report on Draft Regulatory Technical Standards)

Alongside these graphs, a number of other elements pertaining to Taxonomy alignment need to be disclosed, such as a breakdown of enabling and transitional activities of Taxonomy aligned investments and whether a third party audited the compliance with the Taxonomy. Also, the share of sustainable investments with an environmental objective other than the six Taxonomy objectives (so environmentally sustainable, but not Taxonomy aligned) and the allocation of socially sustainable investments must be provided (in the absence of a social Taxonomy for the time being).

Diverging Rules for Product and Entity-level Disclosures for Financial Undertakings

The rules for Taxonomy reporting for financial products are quite different from those for financial undertakings themselves. For the latter, the rules in the Delegated Act for Taxonomy Article 8 apply, and they differ from the product rules, particularly on the following aspects:

- Timelines. The Taxonomy-related product rules will likely apply from 1 July 2022 (see later section on timelines) and require reporting on Taxonomy alignment1 right away. In contrast, the entity-level rules require reporting on Taxonomy eligibility2 for 2022 and 2023 and on alignment only as of 2024. For products, this means the timing mismatch between when companies start disclosing and when financial products need to disclose has not been resolved (see also next section of this article).

- Treatment of non-EU companies and small and medium-sized enterprises (SMEs). The rules for entity-level disclosures for financial undertakings state that non-EU companies (or, more accurately, companies not in the scope of the NFRD)3 should not be included in the primary KPI. SMEs can’t be included at all until 2025, under the entity level rules. The new product disclosure rules make no mention of such limitations in scope. As such, in principle all investee companies held in a fund are in scope for product-level Taxonomy alignment reporting.

- Use of estimates. The Article 8 entity rules also effectively rule out the use of estimates for Taxonomy reporting, requiring the use of Taxonomy data reported by investee companies. However, the product level rules do allow for estimates. In case data not directly obtained from publicly disclosed information by companies is used for the fund disclosures, this should be made explicit but is not banned. Allowing for estimates is more than reasonable, given that financial products need to start disclosing Taxonomy KPIs 18 months before companies are required to do so. In this context, investors can only rely on estimates in that first period.

The Timelines

The ESAs note in their draft RTS that the EU Commission indicated to the EU Parliament and EU Council that the application date of the SFDR single rulebook is expected to be 1 July 2022, therefore it seems most likely that Taxonomy product disclosures need to start from that date (and not as of January 2022 as was the timeline until now). However, this is yet to be confirmed.

The below figure outlines the key regulatory timelines related to Taxonomy disclosures, highlighting the timing mismatch: companies need to start disclosing their Taxonomy eligibility in 2022 and their alignment from 2023, but financial products need to report their alignment in 2022 already, therefore before reported data will become available (with the exception of a handful of first-mover companies that have endeavored to do Taxonomy reporting already).

Figure 3: Key timelines for Taxonomy reporting (source: Sustainalytics)

The RTS will become official only when the EU Commission publishes a Delegated Act adopting these rules and once that Act passes the scrutiny of the European Parliament and Council.

Morningstar and Sustainalytics can support investors with EU regulations

The EU Sustainable Finance Action Plan is arguably the most comprehensive and detailed set of regulations affecting the field of ESG investing. To comply with the various regulatory deadlines, investors not only need a comprehensive suite of high-quality ESG research and data products and services, but also a trusted partner. Our knowledgeable team can show you how our robust data coverage and award-winning research can help.

Contact us today to begin your EU Action Plan compliance journey.

Definitions:

1. A business activity is aligned with the Taxonomy if it meets all the Taxonomy criteria.

2. A business activity is eligible to be Taxonomy aligned when it is included in the list of business activities covered by the Taxonomy. So this is before checking whether the activity meets the Taxonomy criteria.

3. NFRD is the Non-Financial Reporting Directive. Only undertakings in scope of the NFRD are required to disclose Taxonomy information.