In recent months, the Sustainable Finance Disclosure Regulation (SFDR) has been sparking almost as much debate as the EU Taxonomy – both cornerstone regulations of the EU Sustainable Finance Action Plan. With the SFDR set to redefine ESG disclosures and make a significant impact on financial market participants in Europe, the short timeline and ambiguity on several vital details are creating confusion and concern in the industry. The risk of organizations not being able to comply in time is still present, despite the announced delay in timelines for the technical standards, as is the risk of high financial and operational costs for the industry.

The SFDR requires all financial market participants in the EU to disclose on ESG issues, with additional requirements for products that promote ESG characteristics or that have sustainable investment objectives. This regulation aims to limit the risk of greenwashing by financial market participants while increasing transparency, making it easier for end investors to understand how ESG and sustainability factor into their investments. The SFDR is linked to the other cornerstone regulation of the Action Plan, the EU Taxonomy, in that it defines the product categories that need to disclose Taxonomy alignment in 2022 – the so-called article 8 and article 9 products. While the SFDR primary regulation (“Level 1”) was passed last year, the regulatory technical standards are still in development, and it is the proposal[i] for these standards as well as the timing that trigger questions and concerns.

Principle Adverse Impact indicators

An issue that we see clients grapple with is the Principle Adverse Impact (PAI) indicators. The proposal for the technical standards includes 50 PAI indicators, of which 34[ii] are mandatory. The indicators cover environmental, social and governance (ESG) issues, including a substantial number of indicators where many corporations may not currently present meaningful data; some report none at all, thus making it challenging to collect–even for ESG data providers. Although unconfirmed, we consider a ‘best-efforts approach’ to be most effective in cases where data is not available, or if modelling and estimations do not lead to meaningful outcomes. It is also possible to see a change in the approach, not requiring daily average ESG data during the reference period, but rather point-in-time ESG data.

The regulation text regarding the timing of the reporting requirements on these PAIs is topically complex, which is why we continue to see different interpretations in the market. In our purview, the requirement to report on the PAIs does not take effect until June 2022, with the first reference period over which must be reported starting in 2021. The regulators verbally confirmed this in their July public hearing where this question was raised more than once. However, it is unclear if this timing will be affected by the announced delay of the technical standards (see the next paragraph). It also remains unclear how financial market participants should assess PAIs for their investments in non-equity holdings such as physical property or derivatives.

Delay in the Application of Regulatory Technical Standards

The timing of the SFDR is a concern as there is limited time to prepare before the regulation comes into effect. Following broad-based criticism from the industry, the European Commission has confirmed[iii] that the regulatory technical standards (Level 2 regulation) which underpin the SFDR will be delayed. The revised compliance date for the Level 2 regulation is likely to be January 2022, although this is not confirmed. While the practicalities around implementation remain unclear, our understanding is that financial market participants still need to comply with the Level 1 regulation (the principles) for those articles that take effect in 2021 but without the technical standards. Clarity on those technical standards, following the close of the consultation phase on 1 September and the proposed presentational aspects[iv] of product templates later in September, might not come until March 2021.

Figure 1: summary timeline for entity-level requirements * It is unclear whether the announced delay to the regulatory technical standards affects the timelines of the reference period over which investment decisions must be recorded or the deadline of the PAI disclosures themselves.

Figure 1: summary timeline for entity-level requirements * It is unclear whether the announced delay to the regulatory technical standards affects the timelines of the reference period over which investment decisions must be recorded or the deadline of the PAI disclosures themselves.

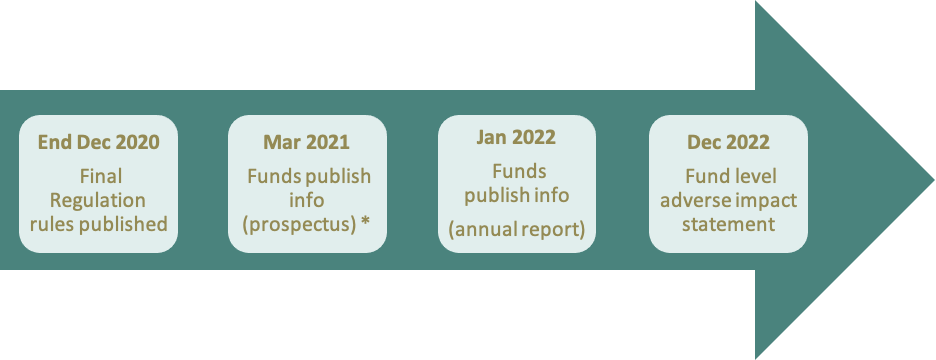

Figure 2: summary timeline for product-level requirements * Disclosure in March 2021 is on principles; from January 2022 on full Level 2 regulation.The Industry Consultation Response

Figure 2: summary timeline for product-level requirements * Disclosure in March 2021 is on principles; from January 2022 on full Level 2 regulation.The Industry Consultation Response

The industry response[v] to the consultation paper by the ESAs was mainly critical and not just on the timelines. Many respondents asked to reduce the number of Principle Adverse Impact indicators and take into account the lack of corporate reporting on a significant number of PAIs as it stands today. In our view, we agree with the general principles of this regulation, strongly supporting the need for greater transparency and comparability in ESG disclosures. Nonetheless, in our feedback[vi] to the regulators, we also suggest focusing on a targeted set of mandatory (negative impact) indicators to ensure that reporting to end investors is meaningful, comparable, and comprehensible.

A Partner to Navigate the Compliance Journey

Sustainalytics has recently published its ‘EU SFDR Mapping’, providing a full mapping of the PAIs against our Sustainalytics data, including universe coverage per indicator. Once there is more clarity on the regulation, we will update this mapping and work on making the relevant ESG data available to clients through data deliverables. Furthermore, Sustainalytics and Morningstar have published several materials on this topic, which can be found on our EU Action Plan Resource Centers[vii]. Also, we recently hosted an online event with detailed coverage of the SFDR. We are committed to supporting our clients with this regulation and others following from the EU Action Plan. Please reach out to your client advisor to find out how we can help with the SFDR, the EU Taxonomy or other EU sustainability regulations.

Sources:

[i] European Supervisory Authorities, “Joint ESA Consultation on ESG Disclosures” https://www.esma.europa.eu/press-news/consultations/joint-esa-consultation-esg-disclosures

[ii] Ibid

[iii] European Commission Letter to the European Supervisory Authorities on sustainability-related disclosures in the financial sector https://www.eiopa.europa.eu/content/letter-european-commission-esas-application-regulation-eu-20192088-sustainability-related

[iv] European Supervisory Authorities, “ESAs Launch Survey on Environmental and/or Social Financial Product Templates” https://www.esma.europa.eu/press-news/esma-news/esas-launch-survey-environmental-andor-social-financial-product-templates

[v] European Supervisory Authorities, Responses to “Joint ESA Consultation On ESG Disclosures” https://www.esma.europa.eu/press-news/consultations/joint-esa-consultation-esg-disclosures#TODO

[vi] Morningstar’s response to the consultation paper can be found in the list of consultation responses on ESMA’s website in the previous endnote.

[vii] https://www.sustainalytics.com/eu-sustainable-finance-action-plan-resource-center/ and https://www.morningstar.com/en-uk/lp/esg-policy-eu-action-plan