[Note: This article was originally published on Morningstar.com]

As we settle into “COP season,” with the 2024 United Nations Biodiversity Conference of the Parties (COP16) recently completed and the United Nations Climate Change Conference or Conference of the Parties (COP29) convening this week, the first word that comes to my mind is climate. And if you add in the recent US general election results and we prepare to enter a new administration, the second word is uncertainty.

It’s hard to find a more uncertain element than climate. I think we can all agree, and now well understand, that the ferocious trends being unleashed on our world by global warming pose a growing risk not just to human beings but to their investment portfolios.

Just ask residents of the southern United States, who recently experienced the devastating impacts of the intense Hurricane Milton and Hurricane Helene in a period of less than two weeks. That is a difficult series of events to predict and an even harder one to prepare for.

The steady onset of global warming is creating disruption and change in how we live our lives. It’s also affecting the ability of investors to properly gauge the material financial risks—and opportunities—related to climate change.

Climate Change Causes Growing Physical Risks

Companies and investors are clearly underestimating or are simply unaware of the growing physical climate risks caused by climate change. Our Morningstar research shows that 83% of US-based issuers covered by our Physical Climate Risk Metrics data product have at least one real estate asset at high risk of physical risks in 2050. Our research also shows that 6.5% of US-based companies have over 10% of their real estate assets in high physical risk areas.

But how to get beyond scary statistics to identify and address physical climate risks in a way that is meaningful and actionable for investors? Here’s where it gets interesting, and also where I think we have an opportunity to flip the scary, often negative, script on climate change.

Investors and data providers are collaborating to find new ways to identify and potentially quantify physical climate risks to inform actionable investment approaches. I am the first to admit I am not an expert on the technical aspects of climate change and market data, so in this case I reached out to Jimmy Roberts in our Morningstar Sustainalytics physical climate risk data team to help with some examples. This team is doing interesting work to help our clients attach more-specific weather-related financial risk scenarios to their analyses.

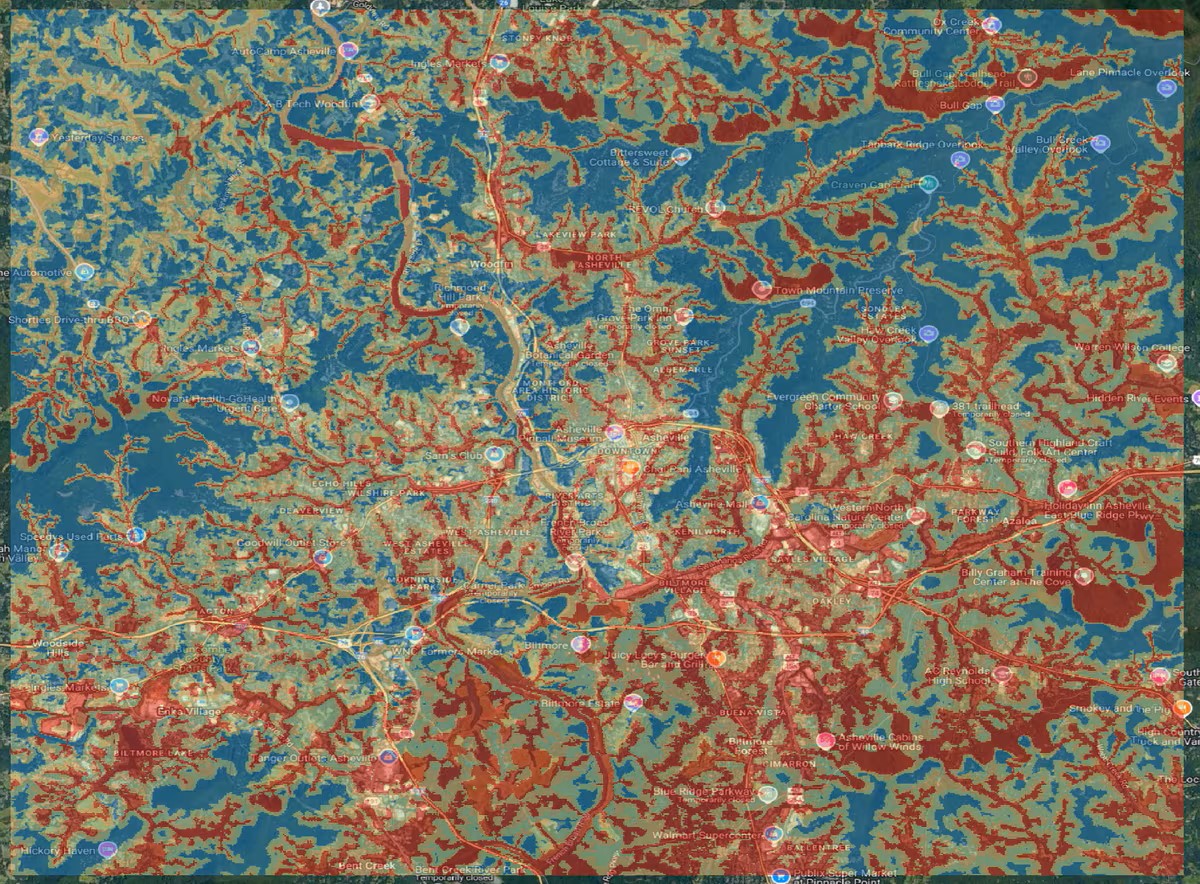

Consider the rainfall-related flood map of Asheville, North Carolina, which our team created to help identify—and better address—extreme weather-related risks.

Asheville tragically bore the brunt of Hurricane Helene, resulting in extensive property damage and loss of life. This map illustrates where high flood risk lies in Asheville. The yellow areas represent the low-lying regions most susceptible to the risk of flash floods. Notably, this is where most of the major transportation, residential, and commercial arteries lie.

Ashville, North Carolina, Flood Map

Imagine using these types of models for investment planning and risk modeling? Investors and organizations such as banks, manufacturers, and real estate developers can benefit greatly from this type of information if it is optimized. In this case, by using high-resolution flood models (30 x 30 meter pixel resolution), you can pinpoint the exact areas where water will accumulate in severe rainfall events like the one caused by Hurricane Helene. This information can then be used for enhanced mortgage underwriting, insurance underwriting, and corporate lending to ensure that risky loans are not concentrated in high-risk locations.

This approach can also be used more broadly to identify market sectors that may be at risk for investors due to the concentration of physical assets in high-risk locations. For example, southeastern US utility companies are especially exposed to coastal flood and extreme heat risk. Our research shows that Entergy ETR, which operates across the Southeastern United States, has a total loss ratio of 22% in 2050 for RCP 8.5. Total loss ratio is a ratio of its total direct and indirect losses relative to its cash flow, which means our categorization for this company is that it has Severe risk. Entergy’s leading Direct Hazard contributions are Coastal Inundation and Flooding, and its leading Indirect contributions are Coastal Inundation and Heat Stress.

Or consider Duke Energy DUK, which has operations concentrated across the Southeastern US, including North and South Carolina, where Hurricane Helene just caused devastating damage.

Duke Energy Power Plants and Battery Storage Sites

This example looks at flood risk, but the concept can be equally applied to other major climate event risks such as the risk of wildfires, major storms, or even extreme heat.

These innovative new tools can be used to protect investors—and communities—against the risk of investment loss but also to identify opportunities. We must respect the financial risks related to climate change and recognize the growing impact that major weather events can have on the markets and investors. But we can also learn from what’s happening and put these insights into better research, ratings, tools, and data. These tools can help investors better prepare for what is coming and to identify those companies that are modeling the right climate behavior.

Forward-looking climate data improves risk analysis, by allowing financial stakeholders to conduct asset-level analysis across different scenarios and return periods to understand what potential losses could be from severe but improbable events. We take a forward-looking approach when identifying companies, sectors, and markets for potential investment. Why not take a forward-looking approach to physical climate risk? This is how we flip the script on climate and lead with our front foot.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.