Key Insights:

- European electrical equipment companies are managing their product governance risks much better than companies in other regions, with a higher percentage of European companies having strong management compared to other parts of the world.

- Likewise, European electrical equipment companies are also managing their carbon – products and services risks much better than their international competitors.

- When directly compared, the average management scores for electrical equipment companies in Europe and Asia-Pacific shows that European companies are managing both their carbon – products and services and product governance risks much better than companies in Asia.

The EU target to achieve at least 42.5% renewable energy by 20301 requires a massive investment in renewable energy across Europe. New European Commission (EC) legislation rewarding environmental, social and governance (ESG) factors could shift some renewable energy auction award winners to Europe from Asia if product governance or environmental sustainability are considered as non-price or prequalification criteria. Our research on the main players in the electrical equipment industry clearly shows that European companies are better equipped to benefit from wind and solar auctions launched in the EU. Firms with low ESG Risk Ratings that could be impacted include Vestas and Nordex.

The EU Renewable Energy Sector: Managing Competition and Maintaining Sovereignty

The widespread adoption of renewable energy is a boon to the environment; however, several European and US manufacturers have been decimated by pricing pressure from Asian exports of photovoltaic modules (e.g., solar panels) in the past decade.2 There was concern expressed at the 2024 Hannover Messe industrial trade show that this could happen to other green industries, such as batteries or wind turbines.3

With the cost of installed solar and wind capacities in the EU amounting to EUR 140 billion a year until 2030 and EUR 100 billion a year in the following decade,4 the stakes are high to win EU renewable energy auctions. Additionally, Russia’s invasion of Ukraine has made this not just a matter of meeting decarbonization goals, but also of securing the EU’s energy sovereignty.

The EU’s Renewable Energy Auction Process and Non-Price Criteria

Auctions to develop offshore wind, onshore wind or photovoltaic installations allow various bidders to compete for a site or project. Participants submit a bid that translates into the amount of public aid required per kilowatt-hour produced, with the lowest bid declared the auction winner.5 In a couple of countries, such as Germany, and for some offshore wind projects, several bidders have required zero subsidies. To break the tie, the country allowed negative bidding, whereby the bidders instead paid the government to develop the offshore project. This type of auction is unusual and viewed critically, as the consumers then bear the cost of electricity.6

Even though utility companies typically win government-led renewables auctions, electrical equipment companies, such as Siemens Gamesa,7 Nordex8 or Vestas,9 will work with utilities or other parties to validate the cost structure for the bids. Companies such as Prysmian SpA can also submit bids to connect the offshore wind project with the onshore electric grid.10

The EC makes clear that there should be momentum towards using non-price criteria because it conforms to European standards. With this pressure and early adoption from several EU Member States, we expect the use of non-price criteria to increase. According to Euractiv, the Netherlands, France and Germany are already using non-price criteria when awarding wind auction winners, and Belgium and Norway have plans to do the same.11 Utilities that win an auction may be subject to ecological sustainability criteria for the project site, but several EU countries have also implemented environmental sustainability requirements that pertain to wind turbines.12 The EC recommends that member states harmonize their auction design and make use of non-price criteria or prequalification criteria, such as sustainability, in auctions.

How EC Legislation Impacts the Entire Renewables Ecosystem

The Wind Power Action Plan and European Wind Charter

The Wind Power Action Plan, published in October 2023 and with immediate expectations for member states, applies to wind energy companies. But widening the aperture shows that governments may also hold auctions to install photovoltaics.13 Introducing award criteria could affect solar and wind energy companies’ ecosystem, including electrical equipment companies that Morningstar Sustainalytics covers, such as Schneider Electric, ABB, Eaton, Legrand, NIDEC and SMA Solar.

After the action plan, the European Wind Charter14 was published in December 2023, where EU Member States and wind sector representatives welcomed the action plan and committed to implementing the actions assigned to them. All EU member states, except Hungary, signed the charter. However, these signatures are non-binding.17

The Net-Zero Industry Act

The Net-Zero Industry Act15 advocates that EU Member States should use non-price criteria in auctions for the manufacture of clean technologies, including photovoltaic and wind technologies, heat pumps and batteries. The EU Wind Power Action Plan,16 which promotes the production and installation of wind turbines in Europe, also offers some potential for non-price or ESG criteria in member states’ auctions. Through the Net-Zero Industry Act, the EC establishes a playing field where non-price criteria could be a factor in auctions:

- Member states shall award a minimum weight of 5% per sustainability and resilience criterion, with a combined weight of between 15% and 30% of the award criteria.

- The criteria must apply to at least 30% of the auction volume per year, per member state or at least 6 gigawatt per year, per member state.

- A cost difference of more than 15% per auction is disproportionate, so member states are not obligated to use either the pre-qualification or non-price award criteria.

How Sustainalytics Measures Relevant Non-Price Criteria for Electrical Equipment Companies

Without knowing the environmental sustainability criteria from the Net-Zero Industry Act, we can still examine the high-level topics highlighted in the Wind Power Action Plan by way of Sustainalytics ESG Risk Ratings indicators for high-quality products and environmental sustainability. Human rights in the supply chain is also mentioned as a priority in the Wind Power Action Plan, but since it depends on the development of a European business conduct code and follows a different timetable, it is not covered below.

Since we do not know what sustainability criteria will be chosen, we can use proxies from Sustainalytics’ ESG Risk Rating and compare ratings by region. The criteria from the EU will most likely be technical in nature; however, the proxies below consider several aspects of environmental sustainability and high-quality products.

When Sustainalytics assesses electrical equipment companies, we include those directly involved in wind and solar energy, such as Nordex, Vestas, Sungrow and SMA Solar, as well as manufacturers that, in part, produce parts and provide services to support renewables.

Sustainalytics assesses electrical equipment companies against the following non-price themes: For high-quality products, Sustainalytics looks at product governance; for sustainability, we assess the material ESG issue carbon – products and services. These criteria are more relevant for electrical equipment companies compared with the utilities that may win a renewables auction, since it involves the products’ (i.e. wind turbines or cables) sustainability and reliability.

Looking at High-Quality Products Through Product Governance

For product governance, Sustainalytics looks at whether companies have implemented programs to ensure the safety and reliability of their products and services and whether they have implemented a quality management system in their operations. For example, Sustainalytics assesses whether a company conducts product or service safety risk assessments, conducts product or service safety training for employees, monitors product or service safety performance and conducts external product or service safety audits.

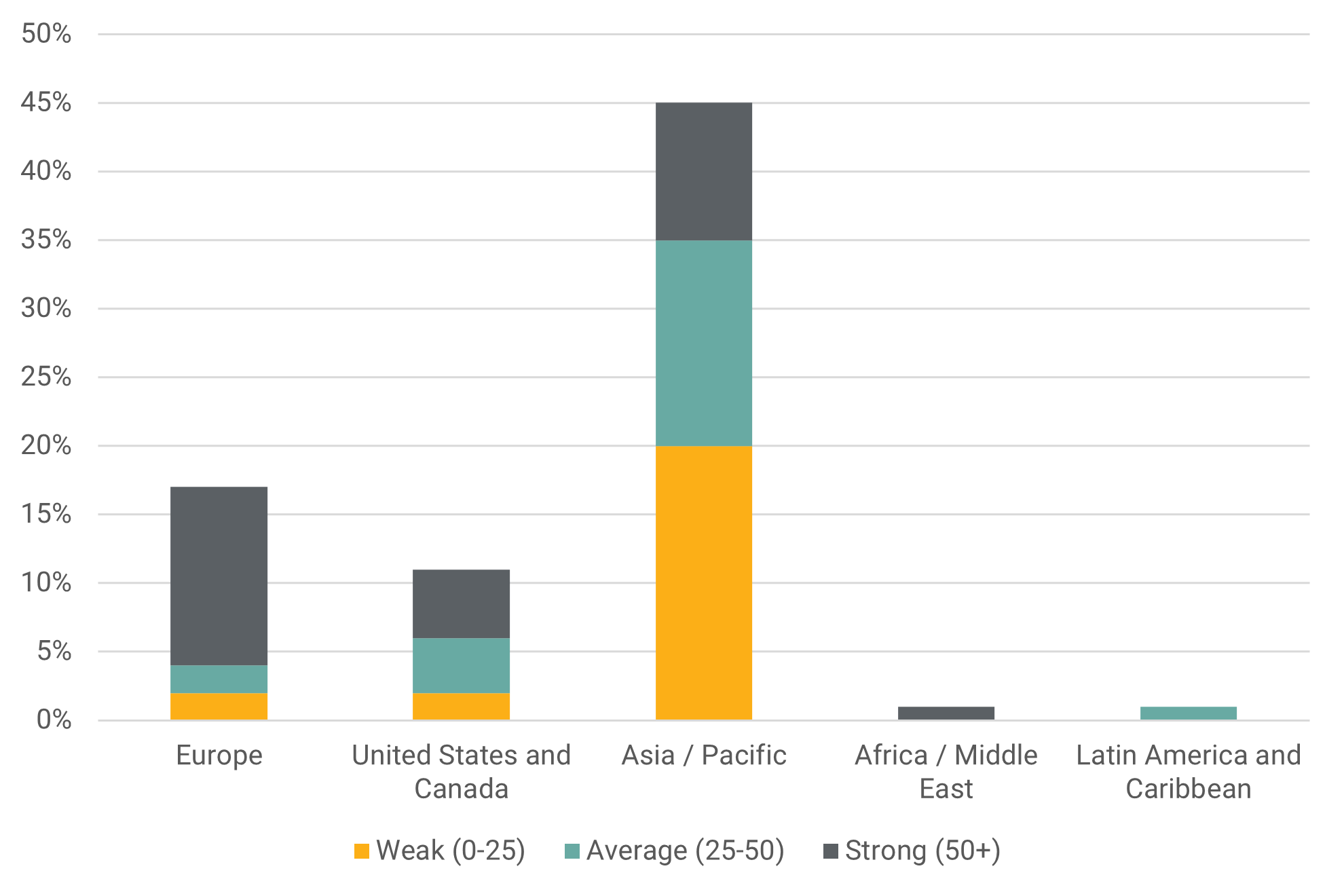

Figure 1 below shows that European electrical equipment companies are managing their product governance risks much better than companies in other regions. There is a much higher percentage of European companies with strong management compared with companies in other regions.

Figure 1. Electrical Equipment Companies’ Product Governance Management Scores by Region

Source: Morningstar Sustainalytics. For informational purposes only.

Note: Shows companies’ ESG Risk Rating scores for product governance management, with weak management scores seen more often in regions such as Asia-Pacific and strong management scores more often in Europe.

Looking at Sustainability Through Carbon – Products and Services

A utility company that wins an auction may be required to protect the environment where the offshore project is being developed. For electrical equipment companies, environmental sustainability can be assessed at the carbon – products and services level. Sustainalytics assesses whether the company considers the environment when designing its products, whether the company has an end-of-life product stewardship program and the percentage of the company’s revenue devoted to sustainable products and services. These topics are similar to those that the European Environment Bureau has proposed for improving auction design after the Wind Power Action Plan.18

In Figure 2 below, we can see that European electrical equipment companies are managing their carbon – products and services risks much better than companies in other regions. The figure shows a much higher percentage of European companies with strong management compared with other regions.

Figure 2. Electrical Equipment Companies’ Carbon Products and Services Management Scores by Region

Source: Morningstar Sustainalytics. For informational purposes only.

Note: Shows companies’ ESG Risk Rating scores for carbon – products and services management, with weak management scores seen more often in regions such as Asia-Pacific and strong management scores seen more often in Europe.

When taken together, we can see the average management scores for electrical equipment companies in Europe and Asia-Pacific. Figure 3 below shows that European companies are managing both their carbon – products and services and product governance risks much better than companies in Asia.

Figure 3. Electrical Equipment Companies’ Average Management Scores for Carbon – Products and Services and Product Governance in Asia-Pacific and Europe

Source: Morningstar Sustainalytics. For informational purposes only.

Note: Shows average ESG Risk Rating management scores for product governance and carbon – products and services, with average management scores seen more often in regions such as Asia-Pacific and strong management scores seen more often in Europe. As the name suggests, higher management scores reflect better managed ESG risks.

Future Considerations for Non-Price Criteria

The Net-Zero Industry Act states that in March 2025, the EC will further specify the sustainability criteria to be used in auctions. We therefore used proxies in this article that conform to the topics already named in the EU Wind Power Action Plan. When the sustainability criteria are further specified, Sustainalytics can reassess the topic with more granular comparisons or with reasonable proxies. However, the introduction of ESG non-price criteria could shift some renewables auction award winners to Europe from Asia if product governance or environmental sustainability are considered. Our research shows that European players are better equipped to benefit from wind and solar auctions launched in the EU.

Even though momentum for ESG non-price criteria in auctions seemed to be building in Europe, more conservative governments recently elected in the EU or elsewhere could stall momentum or reverse it.

References

- European Commission. Renewable energy targets. N.d. https://energy.ec.europa.eu/topics/renewable-energy/renewable-energy-directive-targets-and-rules/renewable-energy-targets_en.

- Beetz, B. 2022. The weekend read: EU solar manufacturing – The time is now. PV Magazine. March 12, 2022. https://www.pv-magazine.com/2022/03/12/the-weekend-read-eu-solar-manufacturing-the-time-is-now/.

- Author’s participation in online sessions of the trade show at https://www.hannovermesse.de/en/.

- Göke, L., Von Hirschhausen, C., Joshi, S., et al. 2023. European Power Sovereignty Through Renewables by 2030. Aquila Group. https://www.aquila-capital.de/fileadmin/user_upload/PDF_Files_Whitepaper-Insights/ExecutiveSummary_EU_Power_Sovereignty_through_Renewables_by_2023.pdf.

- Poupinha, C. 2021. Energy Auctions. YES Europe. October 19, 2021. https://yeseurope.org/energy-auctions/.

- Crampes, C., & Ambec, S. 2023. Auctions for offshore wind power. Toulouse School of Economics. September 12, 2023. https://www.tse-fr.eu/debate-auctions-offshore.

- Siemens Gamesa. 2020. Siemens Gamesa secures 184 MW at latest auction round in Poland to continue winning streak in country. April 20, 2020. https://www.siemensgamesa.com/global/en/home/press-releases/200420-siemens-gamesa-poland-auctions.html

- Nordex Group. 2023. Annual Report. https://www.nordex-online.com/wp-content/uploads/sites/2/2024/02/Annual-Report-2023_ENG.pdf.

- Vestas. 2020. Vestas secures 121 MW auction win and underlines market leadership in Poland. July 17, 2020. https://www.vestas.com/en/media/company-news/2020/vestas-secures-121-mw-auction-win-and-underlines-market-c3156109.

- Prysmian Group. 2023. “Prysmian selected as preferred bidder for BalWin1, BalWin2 and DC34." Power transmission cable projects in Germany.” August 22, 2023. https://www.prysmian.com/en/media/press-releases/prysmian-selected-as-preferred-bidder-for-balwin1-balwin2-dc34-in-germany.

- Panny, J., Gephart, M., Weckenbrock, P., et al. 2023. The growing role of non-price criteria in offshore wind auctions. Euractiv. December 8, 2023. https://www.euractiv.com/section/energy-environment/opinion/the-growing-role-of-non-price-criteria-in-offshore-wind-auctions/.

- Lundie, S., Van Der Hage, R., Donkin, R., et al. 2024. Offshore wind tenders: How renewables project developers can gain the edge with circularity. ERM. September 20, 2024. https://www.erm.com/insights/offshore-wind-tenders-how-developers-can-gain-the-edge-with-circularity/.

- SolarPower Europe. Recommendations on the design of renewable auctions. N.d. https://api.solarpowereurope.org/uploads/Solar_Power_Europe_Position_Paper_Recommendations_on_Auction_design_71505d115a.pdf?updated_at=2024-02-16T18:02:42.886Z.

- European Commission. 2023. European Wind Charter. December 19, 2023. https://energy.ec.europa.eu/system/files/2023-12/Charter_logos_final_02.pdf.

- European Parliament. 2024. Regulation (EU) 2024/1735 of the European Parliament and of the Council of 13 June 2024. June 13, 2024. https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX%3A32024R1735.

- European Commission. 2023. European Wind Power Action Plan. October 24, 2023. https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX%3A52023DC0669&qid=1702455143415.

- European Parliament. 2024. Regulation (EU) 2024/1735 of the European Parliament and of the Council of 13 June 2024. June 13, 2024.

- European Environmental Bureau. 2024. EEB’s response to the European Commission’s call for evidence: Design elements of renewable energy auctions (guidance). March 1, 2024. https://eeb.org/wp-content/uploads/2024/03/EEBs-response-on-RES-auction-design-criteria_20240301.pdf.