Key Insights:

|

|

|

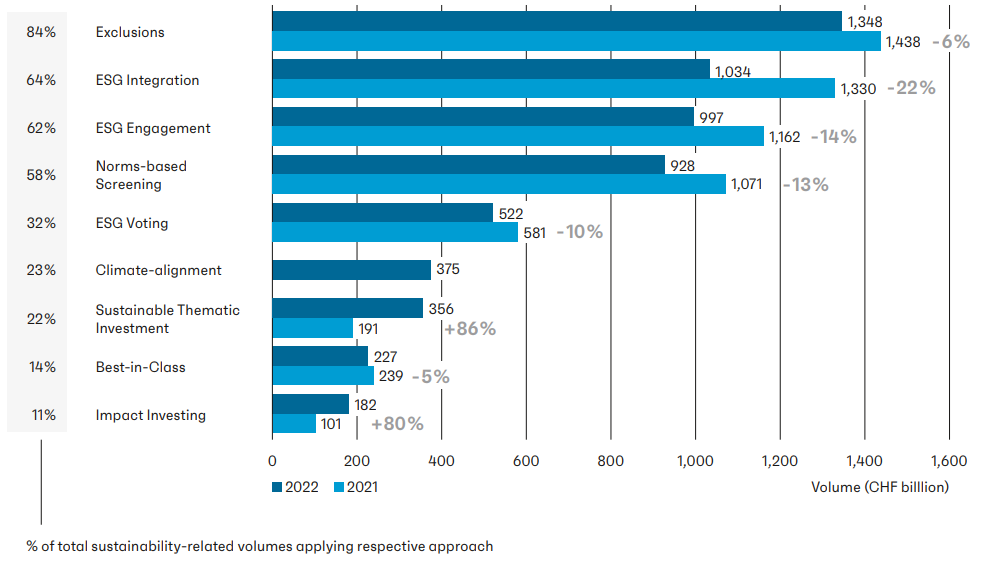

The last decade has seen a significant increase in the global uptake of stewardship codes, which outline practices for how investors should engage with their portfolio companies.1 Investors are undoubtedly focused on enhancing long-term company value. The important role of environmental, social, and corporate governance (ESG) factors in aligning the interests of investors, companies, and broader society,2 however, has also pushed more investors to engage with the companies in their portfolios through stewardship. As a sustainable investment approach, engagement ranks third in Switzerland and applies to 62% of all sustainability-related investments – where climate change risk management and reporting, as well as human rights are the main engagement themes (see Figure 1).3

Figure 1. Development of Sustainable Investment Approaches in the Swiss Market

Source: Swiss Sustainable Finance (2023). “Swiss Sustainable Investment Market Study 2023.” For informational purposes only.

The highly anticipated Swiss Stewardship Code, launched in October 2023 by Swiss Sustainable Finance (SSF) and the Asset Management Association (AMAS), aligns Switzerland with its global counterparts. Most stewardship codes, including Switzerland’s, echo the United Kingdom’s code, which is widely considered the gold standard4 due to its emphasis on sustainable long-term value creation, comprehensive integration of ESG issues into investment practices, and its focus on transparency and accountability. The U.K. stewardship code is set for a revision this year.

The guidance offered in this article, though centered on Switzerland, can serve as a blueprint for investors everywhere to promote impactful stewardship that emphasizes long-term value over short-term gains and strategically aligns engagement with value creation.

Insight One: Approach Regulatory Flexibility With Caution

Regulators worldwide have adopted various approaches to stewardship. The U.K.’s Financial Conduct Authority (FCA) introduced the Sustainability Disclosure Requirements (SDR) that has rules related to stewardship and product labelling. It initially proposed three sustainability-based investment labels, including stewardship, but in response to feedback, the FCA decoupled stewardship from asset improvement requirements.5 This contrasts with the European Union's imminent Sustainable Finance Disclosure Regulations (SFDR) reforms, which are expected to mandate minimum stewardship standards and reporting for qualifying funds.6

These recent developments influence how stewardship is practiced globally. The FCA's flexible stance acknowledges the varied forms stewardship can take and the challenges in proving investor impact.7 While the FCA may encourage the adoption of individualized stewardship approaches, this flexibility may potentially reduce the clarity and comparability of stewardship's role in sustainable investing. Differences in stewardship approaches can complicate transparency, accountability, and how asset owners evaluate managers' ESG efforts, including engagement.

In Switzerland, regulatory oversight often relies on soft law — guidelines that are not legally enforceable — rather than on hard law like in the U.K. In 2022, the Swiss Pension Fund Association (ASIP) issued recommendations to its members that reflect the Swiss Stewardship Code’s principles regarding engagement disclosure and collaboration. Likewise, the Swiss Stewardship Code also offers a framework that supports investors in adhering to the voluntary Swiss Climate Scores, especially credible climate stewardship through detailed engagement and voting actions.

Insight Two: Develop an Outcomes-Based Stewardship Strategy to Achieve Real World Outcomes

While company engagement statistics are important metrics to track, measurement of outcomes is imperative.8 Stewardship efforts can focus on various real-world outcomes and dimensions of materiality, such as systemic risks (e.g., accelerated decarbonization efforts of companies across a sector) and global norms (e.g., Principles for Responsible Investment’s Advance initiative).9

In Switzerland, 9% of all sustainability-related investments have a demonstrated impact.10 Swiss institutional investors must provide evidence of their impact through setting targets for their engagement activities and reporting regularly, thereby enhancing transparency on investor contribution to actual outcomes.11

As it relates to climate, an implied temperature rise metric must be supplemented for achieving tangible results. It necessitates a deeper analysis of company actions, such as capital expenditures towards transition, robust target setting, and links to incentive structures. This approach offers a more meaningful view of a company's transition commitment and the broader goal of decarbonizing the economy rather than focusing on a select few metrics for portfolio decarbonization. Investors can prioritize tangible outcomes by advocating for stewardship instead of divestment, which has been deemed ineffective in reducing emissions.12

Insight Three: Ensure Alignment of Values Within the Investment Chain

There are exemplary partnerships between asset owners and their managers. For example, we’ve seen them working together to engage “climate laggards” across sectors; asset owners incentivizing managers to engage companies by offering a fee; and asset owners holding managers to account using engagement, assessment and reporting platforms. There remains, nonetheless, a growing misalignment of stewardship approaches between asset owners and managers.13

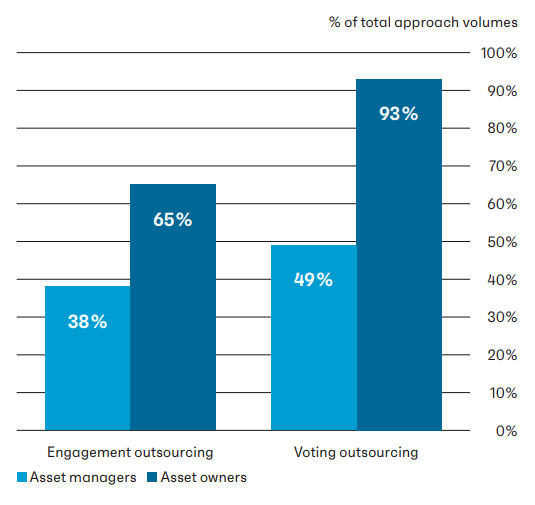

In Switzerland, since it is common to outsource stewardship activities (see Figure 2), clear communication of expectations is crucial. This requires a feedback loop that integrates ESG research, engagement, and voting with transparent reasoning. A clear escalation strategy to align objectives across the investment chain is also essential, which leads to the fourth and final insight.

Figure 2. Outsourcing of Engagement and Voting Activities

Source: Swiss Sustainable Finance (2023). “Swiss Sustainable Investment Market Study 2023.” For informational purposes only.

Insight Four: Prioritization and Escalation Are Key Pillars of Strategic Engagement

ShareAction’s14 escalation framework offers investors a best-practice model for engaging with companies. It starts with private dialogue and escalates to public measures and shareholder resolutions as needed, including voting against management and, ultimately, divestment. The framework emphasizes the importance of a transparent process for selecting companies for deep engagement, based on factors like holding size and material risk.15

While these tactics may be nothing new, managers' disclosures to their pension fund clients about these activities often lack detail. This may be due to their hesitations about damaging relationships with companies or facing negative media attention if certain actions are made public. To raise transparency around escalations, a more assertive approach is recommended. This has already been observed in the Swiss market, resulting in more alignment across the investment chain.16

Final Reflections

The Swiss Stewardship Code underscores Switzerland's commitment to fostering a sustainable future, leveraging stewardship as a powerful tool for positive and measurable change. To achieve tangible outcomes, harmonization of stewardship practices and clear articulation of objectives along the investment chain is essential, in addition to using appropriate metrics based on reliable data.

At the core of this transformation is the concept of double materiality, which places equal importance on the impact of sustainability factors on a company and the company's impact on society and the environment.17 Despite its complexities, this principle is central to driving change. While it is rarely mentioned within the various stewardship codes from around the globe, a commitment to double materiality is essential to help ensure comparability, bring about greater transparency18 and achieve results. All of this can also enhance sustainable finance’s integrity, transparency and efforts to combat greenwashing.

A final note: the Swiss Stewardship Code and the broader Swiss market is shaped by “soft” regulation. However, with investors pulling out of initiatives like Climate Action 100+, the adequacy and effectiveness of voluntary, market-driven regulation remains undetermined. Despite this, stewardship codes should serve as an initial step in laying the foundation for robust stewardship policies that incorporate the four insights covered above and go beyond.

Learn more about Morningstar Sustainalytics’ Stewardship Services

Stewardship in partnership with a service provider is a proven and increasingly popular way for investors to enhance their share of voice, increase the number of engaged issuers, and complement existing internal stewardship expertise and capacity. Morningstar Sustainalytics’ comprehensive ESG Stewardship Offering represents over 130 clients and approximately USD 4.5 trillion (EUR 4.2 trillion) under engagement. Morningstar Sustainalytics is a signatory of the U.K. Stewardship Code. Connect with our team to learn more about how we can support the next evolution of your ESG activities.

References

- UNPRI. 2022. “An introduction to Responsible Investment: Stewardship.” https://www.unpri.org/download?ac=12686.

- Swiss Sustainable Finance. 2023. “Swiss Stewardship Code.” https://www.sustainablefinance.ch/api/rm/5A7ME29CD6M925N/2023-10-04-swiss-stewardship-code-final.pdf.

- Swiss Sustainable Finance. 2023. “Swiss Sustainable Investment Market Study 2023.” https://marketstudy2023.sustainablefinance.ch/wp-content/uploads/2023/06/SSF_2023_MarketStudy.pdf.

- Babington, M. 2022. “FRC lists successful signatories to UK Stewardship Code.” Financial Reporting Council Press Release. https://www.frc.org.uk/news-and-events/news/2022/09/frc-lists-successful-signatories-to-uk-stewardship-code-2/.

- Financial Conduct Authority. 2023. PS23/16: Sustainability Disclosure Requirements (SDR) and investment labels. https://www.fca.org.uk/publications/policy-statements/ps23-16-sustainability-disclosure-requirements-investment-labels.

- European Commission. 2023. “Platform Briefing on EC targeted consultation regarding SFDR Implementation.” https://finance.ec.europa.eu/system/files/2023-12/231215-sustainable-finance-platform-response-sfdr-consultation_en.pdf.

- Heeb, F., Kölbel, J. 2020. “The Investor's Guide to Impact.” https://www.csp.uzh.ch/dam/jcr:ab4d648c-92cd-4b6d-8fc8-5bc527b0c4d9/CSP_Investors%20Guide%20to%20Impact_21_10_2020_spreads.pdf.

- Hirt, H. 2023. “The future of stewardship.” Panorama (UBS Asset Management). June 22, 2023. https://www.ubs.com/ch/en/assetmanagement/insights/investment-outlook/panorama/panorama-mid-year-2023/articles/stewardship.htm.

- Ibid.

- Ibid. Swiss Sustainable Finance (2023). “Swiss Sustainable Investment Market Study 2023.”

- Ibid.

- Temple-West. P. 2021. “The ESG Investor’s Dilemma: To Engage or Divest?” January 26, 2021. Financial Times. https://www.ft.com/content/814cbd2c-00db-41b7-91af-28435301a8a2.

- Hoepner, A. 2023. “UK Asset Owner Stewardship Review 2023: Understanding the Degree & Distribution of Asset Manager Voting Alignment.” November 17, 2023. https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4643377.

- ShareAction. 2023. “Introducing a standardised framework for escalating engagement with companies.” https://shareaction.org/reports/rise-escalation.

- Ibid.

- Ibid.

- Wong, Simon C.Y. 2023. “Double materiality: Broadening corporate sustainability reporting to encompass societal and environmental impacts.” September 29, 2023. Cambridge Institute of Sustainability Leadership. https://www.cisl.cam.ac.uk/news/blog/double-materiality-corporate-sustainability-reporting-encompass-societal-and-environmental-impacts.

- Göttsche, M., Habermann, F., Kolb, M., Schiemann, F., Spandel, F., and Tetteroo, M. 2023. “Striking a balance: The importance of double materiality in sustainability reporting.” ECGI Blog. https://www.ecgi.global/blog/striking-balance-importance-double-materiality-sustainability-reporting.