Key insights:

|

|

|

Climate change poses a significant threat to global water resources, impacting water’s availability, quality, and distribution. Altered precipitation patterns, glacier melt, and rising sea levels exacerbate water scarcity and pollution, necessitating urgent action from capital markets. Investors and financial strategists must incorporate these climate-related water risks into their decision-making processes to promote economic stability and sustainable growth. This is particularly crucial for the oil and gas industry, which relies heavily on water for everything from exploration to retail (Figure 1).

During exploration, water is essential for drilling and hydraulic fracturing. In production, water cools equipment and aids in extracting more oil and gas, with options for recycling or reinjection into the ground. Water is also used for testing pipelines and in the refining process to cool and transform crude oil into different products.

Figure 1. Water Usage in the Oil and Gas Industry

Source: Morningstar Sustainalytics. For informational purposes only.

Given its extensive use of water, the oil and gas industry faces a number of business risks. Physical risks, such as droughts, floods, and diminishing water supplies, can disrupt operations and supply chains, posing severe operational risks. Regulatory challenges, such as abrupt policy shifts or penalties for noncompliance, can directly affect financial outcomes and reflect on corporate governance. Community opposition – particularly from Indigenous groups for whom water is both a practical necessity and holds cultural significance – can also intensify reputational damage and operational disruptions.

As social and regulatory scrutiny over water issues increases, investors need to thoroughly understand water-related risks and their implications on business models. By comprehending these risks, investors can make informed decisions and advocate for sustainable business practices. Proactively addressing these urgent water challenges and advocating for effective risk management strategies can help investors safeguard investments and enhance the resilience of communities and ecosystems.

Acknowledging the growing significance of water issues, Morningstar Sustainalytics has changed the way we assess companies’ preparedness and management of water by enhancing the ESG Risk Ratings. In this article, we explain those changes and examine the challenges faced by the oil and gas industry in managing its water-related risks.

Assessing Water Risks: New Metrics for Better Risk Management

Previously, Sustainalytics included water management under the material ESG issue (MEI) of resource use. Now, we have introduced two new MEIs that focus on companies’ operational dependency on water and the availability of water for production.

- Water Use – Own Operations: This assesses a company’s water use in production and its risk management. Risks arise from operational water dependence, regional availability, and shared resource competition. Key areas of focus include risk assessments, identification of critical facilities, efficiency enhancements, and stakeholder engagement for catchment-level resilience.

- Water Use – Supply Chain: This assesses a company’s management of water stress risks within its supply chain. Risks primarily emerge from raw material dependence that demands significant freshwater for production. Emphasis is placed on: a) conducting water risk assessments to pinpoint suppliers in critical regions, and b) collaborating with them to enhance water efficiency and resilience.

Our assessment of exposure to water risk is anchored on two data points:

- Water dependency: This involves examining companies’ water intensity data derived from reported withdrawal and revenue, adjusted by the water consumption rate per water withdrawal; and

- Water availability: This is evaluated based on companies’ asset location data at the country level.

We use a comprehensive set of management indicators to assess companies' water-related practices, covering reporting scope, intensity, risk management, and sustainability commitments. These metrics offer essential insights into corporate water strategies, helping to gauge companies’ resilience and sustainability amid water scarcity and environmental challenges.

Balancing Water Use and Risk: A Deep Dive Into Oil and Gas Challenges

Our analysis reveals that companies within the oil and gas industry1 face significant water-related challenges compared to other industries in Sustainalytics’ universe. This underscores the substantial difficulties these companies encounter in managing, utilizing, and disposing of water in their operations. Figure 2 illustrates that higher water usage correlates with greater risk exposure. Water intensity measures the amount of water used per million dollars of revenue generated. Oil and gas producers exhibit higher water intensity compared to refiners, energy services, and the overall research universe, meaning they face higher risk exposure.

Figure 2. Correlation Between Median Water Intensity and Exposure Score by Oil and Gas Related Industries

Within the oil and gas industry, integrated oil and gas companies (those involved in all stages, from exploration to selling finished products) emerge as particularly vulnerable due to their heavy dependency on water for their operations. Refiners are scrutinized for similar reasons, sharing significant environmental and operational challenges related to water use. For example, excessive pumping of groundwater from aquifers and the exploitation of wetlands can threaten drinking water that serves local residents. This underlines the importance of comprehensive water risk management strategies in generating energy.

Examining the subindustries with the highest exposure to water, coal companies appear to be lagging other companies in the oil and gas industry in terms of management.2,3 Our research shows that there are some geographical differences, as European producers appear to lead the industry on overall water management performance, followed closely by North American producers.

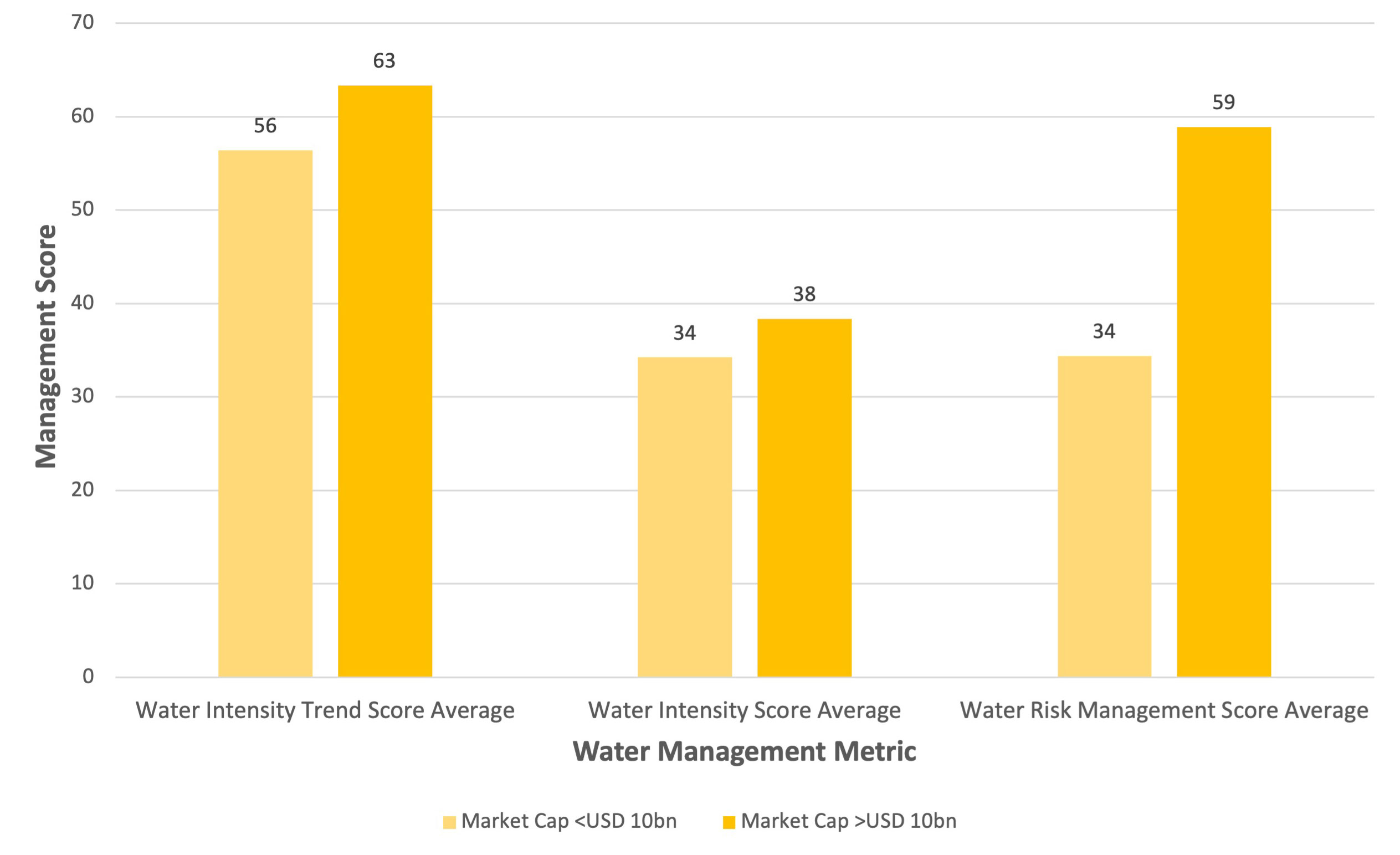

Figure 3 highlights how companies with different market capitalizations manage water usage and risks. The chart illustrates that companies with market caps greater than USD 10 billion generally perform better on the management indicators for water intensity trends, water intensity scores, and water risk management compared to companies with market caps below USD 10 billion.

Source: Morningstar Sustainalytics. For informational purposes only.

This suggests that due to their size and scope, larger corporations tend to have the resources, expertise, regulatory incentives, and risk awareness required to establish and execute successful water management initiatives.

Toward A Comprehensive Approach to Water Risk Management in Oil and Gas

Despite making some progress in managing and disclosing water issues, companies in the oil and gas industry continue to grapple with persistent challenges in water risk management, which remain a critical concern. Investors stand to benefit by understanding water risks and the associated operational, environmental, and regulatory complexities encountered in this industry. Recognizing and comprehensively understanding these challenges is paramount for investors, as it enables them to make more informed decisions that can foster long-term resilience and mitigate climate risks.

To aid this process, Sustainalytics has enhanced its ESG Risk Ratings to develop a comprehensive assessment framework for water use. This framework equips investors with the necessary insights to accurately evaluate the water risk profiles of oil and gas companies.

References

- The Oil & Gas Producers industry comprises three subindustries: integrated oil and gas, oil and gas exploration and production (E&P), and coal.

- Based on historical data gathered from the Resource Use MEI, which was not considered a material for the energy services subindustry prior to the Risk Rating enhancements introduced in June 2024.

- Due to similar environmental and operational challenges, the coal subindustry is also included among oil and gas producers.